1. Introduction

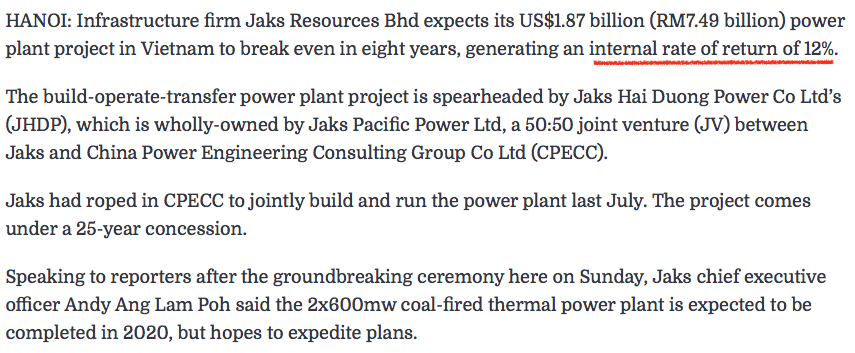

Jaks is closed to completing the Hai Duong power plant. So far, two major pieces of information attracted my attention : (1) expected net profit of at least RM200 mil p.a. for its 30% stake, and (2) Internal Rate of Return of 12% (IRR).

Can these two pieces of information be reconciled ? To find out, I built an IRR model to test things out. To my surprise, they fit each other very well, without even needing me to massage the figures.

2. Internal Rate of Return

For those not familiar with IRR, please refer to the following :

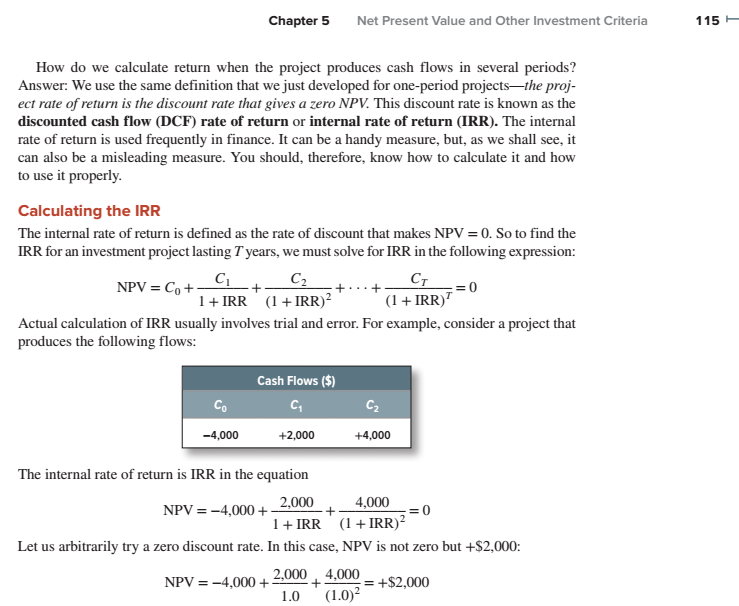

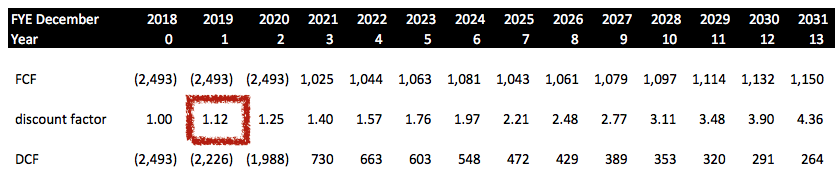

Net Present Value is the sum of the discounted free cash flow of a project over its expected lifespan. In the equation, Co will be the negative cashflow to be incurred by Hai Duong during the construction period. Based on construction cost of RM7.5 bil (USD1.87 bil and exchange rate of 4) and construction period of 3 years, Co will be RM2.493 bil per annum (for 3 years). C1 will be the free cash flow of Hai Duong in first year of operation (positive) while C2 will be the free cash flow for year 2 (positive), and so on (until year 25).

IRR is the discount rate that will lead NPV to become ZERO (Note : Co is a negative number while C1 to 25 is positive, so at certain discount rate, it is possible to cause the equation to end up with value of Zero).

For more information, please buy this Kindle Book and flip to page 115.

3. Principal Assumptions

Based on publicly available information and input and exchange of ideas from many i3 forum members, we know of the following (roughly) :

(Capex)

Total capex for the power plant is USD1.87 bil. Based on USD : RM exchange rate of 4 to 1, that is equivalent to RM7.5 bil.

(Loan)

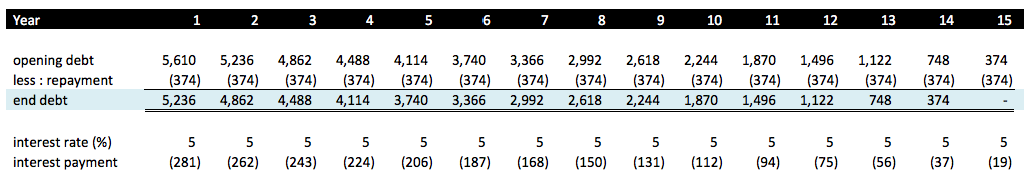

Assuming debt funding of 75%, total loan is RM5.6 bil.

Based on assumed interest rate of 5% (average) and repayment period of 15 years, the debt profile will look like this :

Key observations :

(a) based on 15 years repayment period, annual repayment is RM374 mil.

(b) in year 1, Hai Duang's interest payment is RM281 mil. However, as debt get progressively pared down, interest expenses also gradually decline. By year 15, it would have dropped to RM19 mil only.

The declining interest expense will of course have a positive impact on profitability.

(In real life, debt is likely to be repayed in tranches. But for discussion sake, we just stick to this simplistic straight line assumption and finetune later if necessary. My hunch is that the difference will not be material).

(Depreciation Charges)

Based

on depreciation period of 22 years (25 years concession, 3 years

construction, 22 years operation), annual depreciation charges is RM340

mil.

(Tax)

I was made to understand that the IPP is tax free for first 4 years, 5% for subsequent 9 years and 10% thereafter.

(Profit After Tax)

Many investors are expecting net profit of at least RM200 mil for Jaks' 30% stake in Hai Duong (ignore the anaylsts, they will start upgrading when Jaks share price goes to RM2.00).

Working backwards, Hai Duong's annual net profit would be RM667 mil (100% stake).

The PAT figure is not something plucked from the air. It is a consensus formed by investors after studying profitability figures of already completed Vietnam IPPs as well as projects in other countries such as MFCB and YTL Power in Laos and Jordan respectively.

I played with the IRR model by using PAT beginning from RM667 mil (translating into RM200 mil for 30% stake). It turns out that this level of profit will only generate IRR of approximately 8%. I gradually increase the profitability. Eventually at about RM1,060 mil, IRR becomes 12%. This translates into net profit of RM318 mil for Jaks' 30% stake.

4. Cashflow Projection (and Profit as well)

To derive the cashflow projection over next 22 years, we need to first figure out the EBITDA for year 1.

As mentioned in previous section, PAT and tax rate for year 1 is assumed to be RM1,060 mil and zero respectively. Hence, PBT is same as PAT (RM1,060 mil).

Meanwhile, interest expense and depreciation charges for year 1 is RM281 mil and RM340 mil respectivelty.

As such, EBITDA for year 1 = RM1,060 mil + RM281 mil + RM340 mil = RM1,681 mil (Reminder : this represents 100% equity interest)

How about year 2 onwards ? Well, since Hai Duong is an IPP backed by concession, EBITDA throughout the entire period should be more or less the same (in real life, inflation will have an impact, causing EBITDA to trend downwards at let's say, 3% per annum).

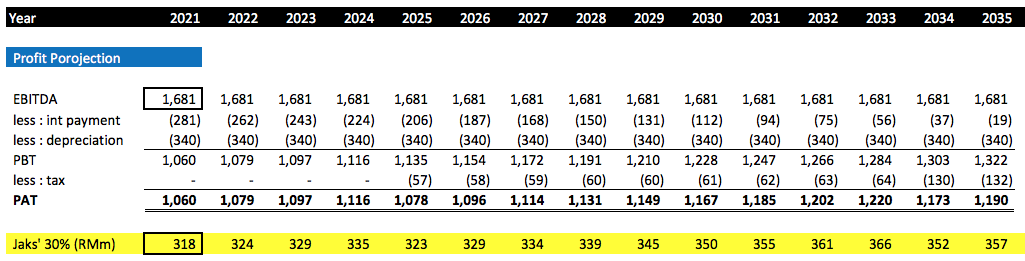

After factoring in all the above, the profit and cashflow projection will be as follows :

As shown in table above, Hai Duong's profit will be approximatelty RM1,060 mil per annum (translating into RM318 mil for Jaks' 30% stake). I am not interested in dwelling too much on the figures. The purpose of this article is to study the cashflow and IRR. As long as profit is approximately RM200 mil to RM300 mil for Jaks, I am happy already. So lets' just move on.

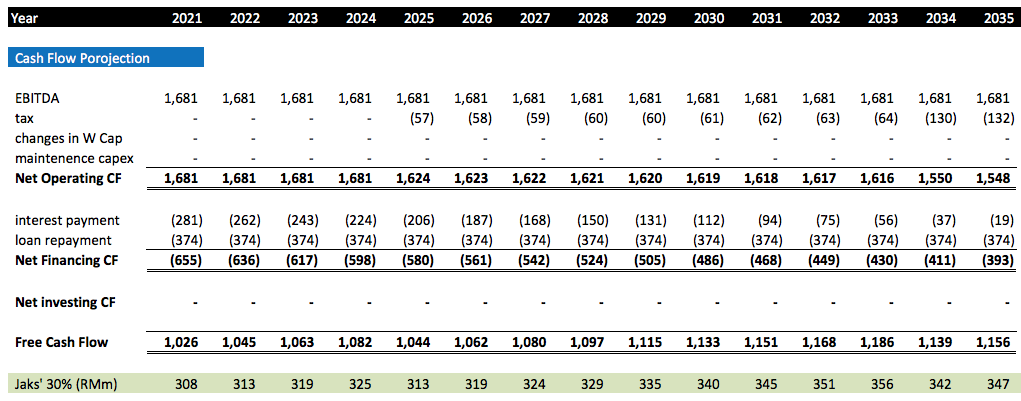

According to the table above, free cash flow is approximately RM1,000 mil per annum. This is not surprising. If profit is RM1,060 mil, the items that differentiate it from cashflow is depreciation charges and loan repayment. Since both figures are more or less the same (depreciaton charges is RM340 mil while loan repayment is RM374 mil), free cash flow will more or less be the same as net profit. (quick check !!)

5. IRR

The IRR model is as follows :

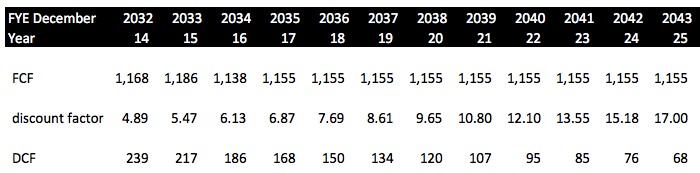

As shown above, after investing RM7.5 bil over 3 years, to generate IRR of 12%, Hai Duong's free cash flow per annum must be approximately RM1 bil per annum.

This will translate into net profit of approximately RM1 bil per annum (as explained above, depreciation and loan repayment related figures offset each other). Based on 30% stake, Jaks' portion will be approximately RM300 mil per annum (to be precise, RM318 mil in FY2021).

6. Concluding Remarks

My financial modeling shows that Jaks' 30% stake can potentially deliver net profit of RM318 mil per annum when both units are operational in FY2021. This level of net profit is truly impressive. But is it too good to be true ?

Not necessarily.

There are two possible reasons why the profitability of Hai Duong can be so strong.

First of all, Jaks initiated the Hai Duong project back in 2008. Vietnam was badly affected by the Global Financial Crisis then (I can remember Gamuda was heavily sold down because it has property projects in Vietnam). To attract investors, Vietnam could have offered relatively attractive terms to balance out the perceived risk.

Secondly, the Ringgit has depreciated substantilly in recent few years. When Jaks firmed up the concession agreement (in 2011 ?), the USD Ringgit exchange rate was 3.2. It has now declined to 4.2, a drop of 31%.

If you take RM318 mil and divide by 4.2, you will get USD75 mil. Based on exchange rate of 3.2 then, the profit attributable to Jaks' 30% is RM240 mil only (being USD75 mil x 3.2), a much lower level. The Vietnamese government was not as wasteful as it looked when come to awarding concession projects.

https://klse.i3investor.com/blogs/icon8888/2020-05-01-story-h1506818792-_Icon_Jaks_Resources_IRR_Model_Shows_That_RM300_mil_Net_Profit_p_a_For_.jsp