MALAKOF (5264) MALAKOFF CORP BHD - The research houses & EPF choices to park their funds

The Malakoff Corp Berhad is an investment holding company. The company’s subsidiaries engage in the design, construction, operation, and maintenance of a combined cycle power plant, generation and sale of electrical activity, and generating capacity of power plants. The group’s revenue is substantially derived from the generation and sale of electricity energy and generating capacity in Malaysia. These activities are governed by the Power Purchase Agreements and Power and Water Purchase Agreements. The Operation and Maintenance Agreements held by certain subsidiaries engage in the operation and maintenance associated with the specific Independent Power Producer within the group. The company generates the majority of its revenue in Malaysia.

Malakoff is a leading independent water and power producer based in

Malaysia with a world-class reputation. Our capability and experiences

include the following:

- Project Development

- Project Finance

- Project Management

- Commissioning

- Operation & Maintenance (O&M)

- Repair & Overhaul

- Asset & Risk Management

- Electricity Distribution & District Cooling

- Engineering Support

- Health, Safety & Environment

- Technical Training

- Plant Assessment Study & Technical Audit

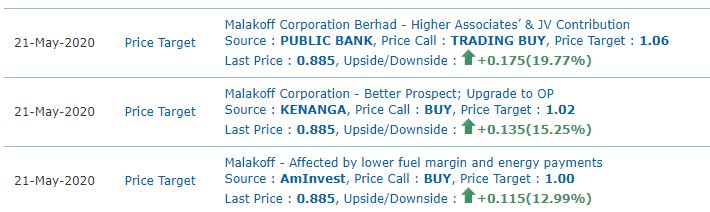

Research Houses Recent Target:

Public research : Malakoff reported a 33% increase in 1Q20 net profit to RM89.2m. The results were above our and consensus’ estimates, accounting for 32% of full year estimates respectively. The higher net profit was mainly due to the newly acquired Alam Flora and better-than-expected contribution from associates and joint venture following the acquisition of additional stake of 12% in Shuaibah and the absence of share of losses from Kapar Energy Ventures (KEV). There was no dividend declared for the period under review. We maintain our forecast for now, pending its analyst briefing. We retain our Trading Buy call on Malakoff with target price of RM1.06

Kenanga research : 1QFY20 net profit of RM89.2m beat expectations with maiden earnings from newly acquired assets coupled with the absence of KEV losses. With the zero asset value of KEV no longer in earnings equation, forward earnings volatility is fairly low. Thus, we are now positive on MALAKOF and raise the stock to OP with a revised TP of RM1.02. In addition, it also offers an attractive yield of >6%.

Aminvest research : We maintain BUY on Malakoff with an unchanged fair value of RM1.00/share (WACC: 7.6%) due to its decent dividend yield of 6.1% for FY20F. Malakoff is currently trading at FY20F PE of 17.1x and FY21F PE of 16.8x. We are keeping our gross DPS of 5.5 sen for Malakoff in FY20F (FY19: 6.5 sen) for now. The FY20F gross DPS of 5.5 sen translates into a decent yield of 6.1%. Recall that Malakoff was able to pay a higher gross DPS of 6.5 sen in FY19 due to the RM988mil disposal of its 50% stake in MacArthur Wind Farm, Australia.

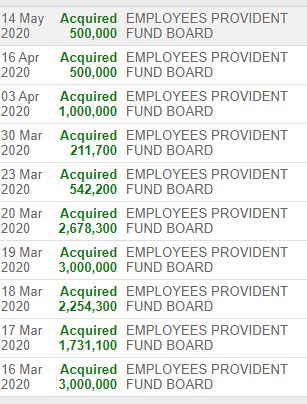

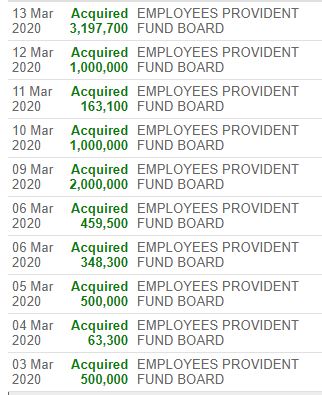

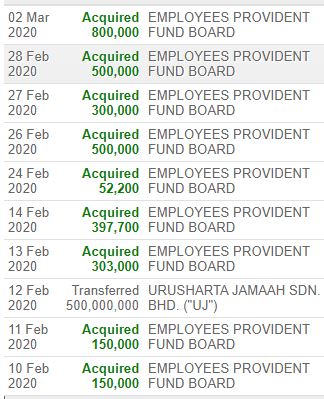

EPF aggressive purchase :

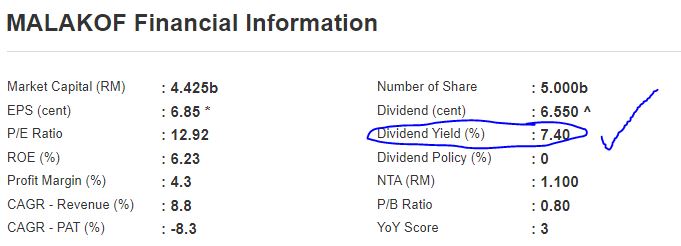

MALAKOF Financial Information

Malakof's price picking up with momentum

Summary

-Public research tp RM1.06, Kenanga : RM1.02 , Ambank : RM1

- EPF Aggressive buy

- Technical chart breakup at RM1

- our TP RM1.8

- Dividend Yield 7.4% , safe haven to park your money

DISCLAIMER : Investments involve risks, including possible loss of principle and other losses. This article is provided for information only and should not be construed as a solicition to buy or sell any of the instrument mentioned herein

https://klse.i3investor.com/blogs/megasun/2020-05-21-story-h1507777157-Malakof_The_research_houses_EPF_choices_to_park_their_funds.jsp