Pentamaster, the undiscovered Covid-19 thematic play

Covid-19 thematic stocks have seen a fantastic rally lately. Gloves, face masks, PPE, face shields, medical beds, ventilators, etc.. you name it.

One stock not known to many that has jumped on this ship is Pentamaster. It recently started making Ventilators like K-One Technology (K1).

Why do many not know about this? That’s because Penta has not made an announcement yet.

However, those who have stumbled upon Malaysian Investment Development Authority (MIDA) recently published Apr 2020 newsletter (https://www.mida.gov.my/home/e-newsletter/posts/) might have noticed this:

This is a very interesting development which could be a catalyst to Penta’s share price. Share price has been consolidating around RM4.00 level and looks ready for a breakout.

For those who are less familiar, Penta is no ordinary stock. In fact, it is a champion growth stock.

List of Awards from its 2019 annual report:

The Company was ranked in the top 200 in the Forbes 2019, 2018 & 2017 Best Under a Billion list of companies that are publicly listed in the Asia Pacific region. The Company was also awarded the Highest Return to Shareholders Over Three Years and the Highest Growth in Profit After Taxes Over Three Years for technology sector under The Edge Billion Ringgit Club 2019. Furthermore, the Company has also won Focus Malaysia Best Under Billion Awards 2018 for the Best Revenue Growth, Best Enterprise Value Growth and Overall Winner category; Focus Malaysia Best Under Billion Awards 2017 for the Best Return on Assets category; the Enterprise 50 Award 2002 organised by Accenture and SMIDEC; and Quality Management Excellence Award 2003 for the category of local company with annual sales turnover exceeding RM25 million to RM200 million at the Industry Excellence Award 2003 organised by Ministry of International Trade and Industry.

Growth from sensors

Penta’s strong growth has been driven by the growing usage of sensors in smartphones and cars. More sensors means more demand for Penta products.

In particular, 3D sensors will be a growth driver as they are now being used more & more in lower range phones. You can think of the growth as how higher range phones used to have 2-3 cameras, but now more and more lower range phones are having 2-3 cameras too. That was why HK-listed Sunny Optical did so well (A 9500% stock surge turns janitors into millionaires | https://www.chinadailyhk.com/articles/99/153/212/1528268255281.html). This is the same growth idea with Penta except instead of camera lenses it is sensors.

The global 3D sensor market forecast will be US$11,276.8 million by the 2026, rising at a rate of 28.0% CAGR, from US$1,464.6 million in 2018, according to a study conducted by Research Dive (https://www.openpr.com/news/2042085/why-is-3d-sensor-catching-on-faster-in-sensors-and-controls)

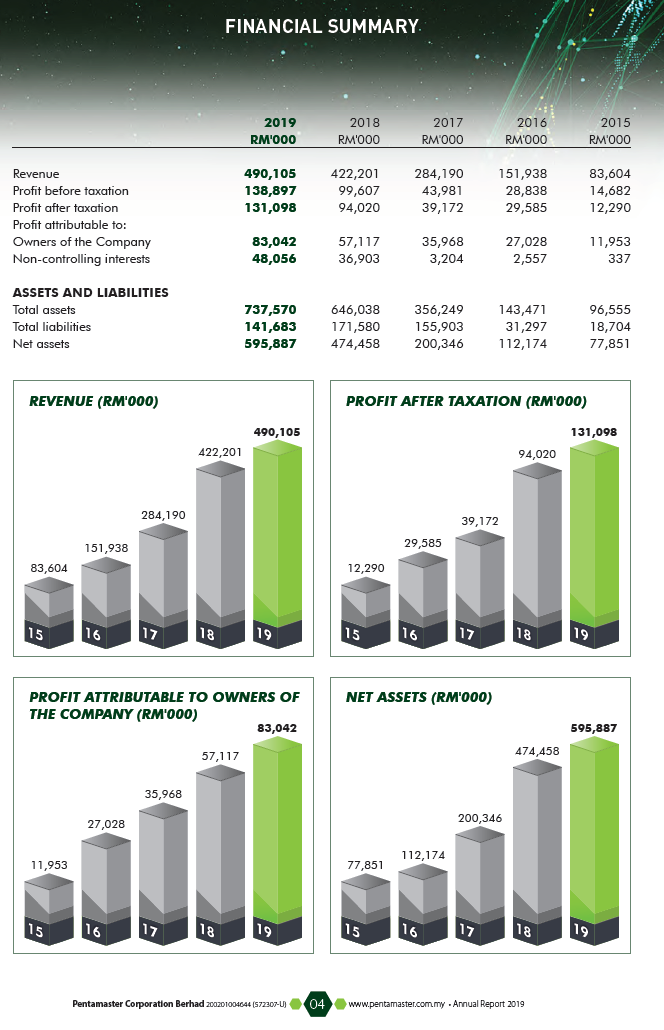

Financially, Penta has strong fundamentals. High net profit margin, high net cash, ROE, etc. Ticks all of the boxes.

Penta is one of CIMB’s top picks with target price of RM5.20.

https://klse.i3investor.com/blogs/dollardollarbill/2020-05-13-story-h1507029344-Pentamaster_the_undiscovered_Covid_19_thematic_play.jsp