Program Large Scale Solar By Malaysian Electricity Industry To Attract RE Investment

If you still looking at the COVID 19 theme in Bursa market now, you may be playing with the musical chair game now. This game is started with a chair then being removed and the process repeated until only one player remains. I hope you are not the last one will be stuck at the peak of the share price. This is what I told my student.

Do you know this Sunday 5/31/2020 will herald the largest PV procurement exercise ever held in Malaysia? The Ministry of Energy and Natural Resources (KeTSA) via the Energy Commission (EC) will open a competitive bidding process for Large Scale Solar (LSS) programme by Malaysia Electricity Industry to Attract Renewable Energy Investment (LSS@MenTARI) amounted RM4 billion.

Minister Datuk Dr Shamsul Anuar Nasarah said under LSS@MenTARI, some 1,000 megawatts (MW) of solar quota will be offered through the bidding process, and is open to fully-owned local companies or with at least 75 percent local shareholding for companies listed on Bursa Malaysia.

Source: https://www.theedgemarkets.com/article/ministry-offer-1000mw-solar-quota-under-lssmentari-programme

Which company will be awarded and benefited?

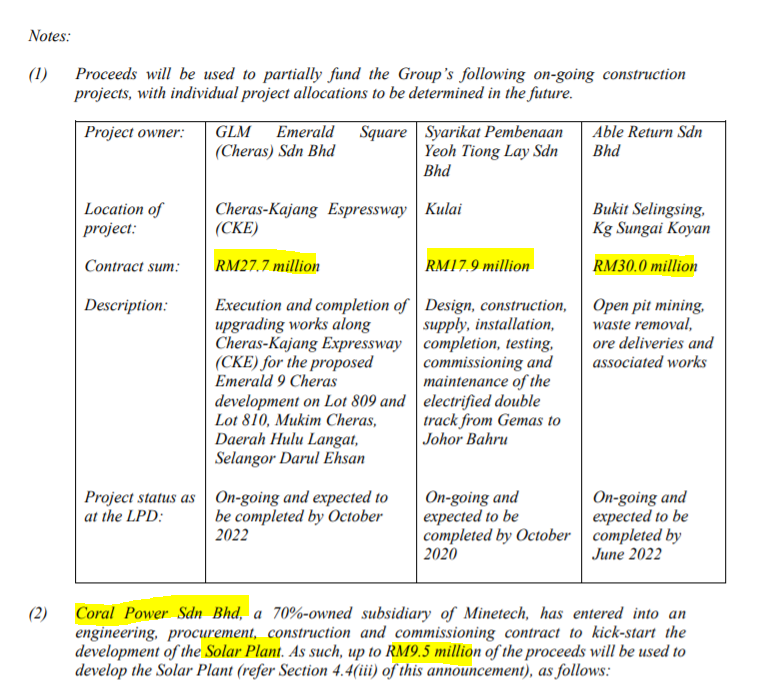

If you read the private placement announced on 12th of May 2020, you will know Minetech Resources Berhad (Minetech) is holding one Solar Plant Project. Below screenshot is taken from the announcement where you will notice Coral Power Sdn Bhd is one their subsidiaries. Will they bid another project this round for maximizing capacity utilization?

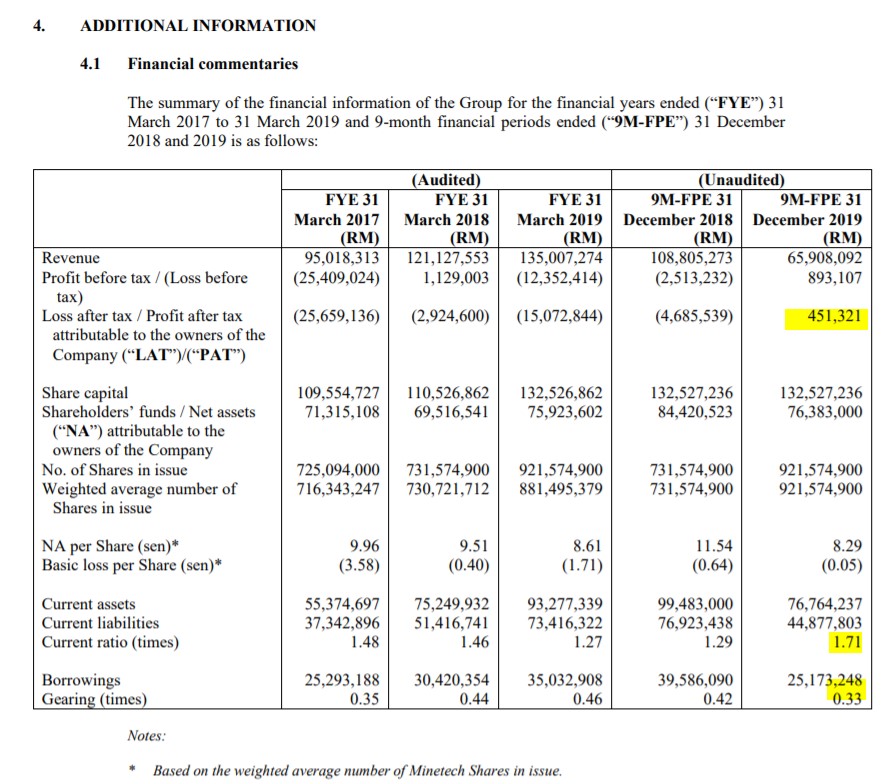

A turnaround in the FY2020.

Besides that,Minetech currently accepted a Letter of Award dated 12 May 2020 from Mutual Premium Sdn Bhd [Registration No. 199901006629 (481529-H)] appointing MCSB as a sub-contractor to undertake and complete the subcontract works in accordance to the Contract Drawings, Bill of Quantities and Specifications (including remedying of defects, if any) for “Pembinaan Sekolah Baharu 36 Bilik Darjah dan Lain-lain Kemudahan di SMK Pelangi Perdana, Parit Buntar, Perak Darul Ridzuan” at a contract value of RM30.395 million (“Project”). One thing we noticed that the company is aggressively tendering project despite MCO.

The Proposed Private Placement will enable the Group to raise funds to be used without incurring interest costs associated with bank borrowings. Despite the dilutive effects on the Group’s earnings per share (“EPS”) and the Company’s shareholders’ shareholdings, the Proposed Private Placement is expected to have a positive impact on the earnings of the Group when the benefits of the proceeds’ usage are realised, which will then directly enhance the Company’s shareholders’ value.

Insider move

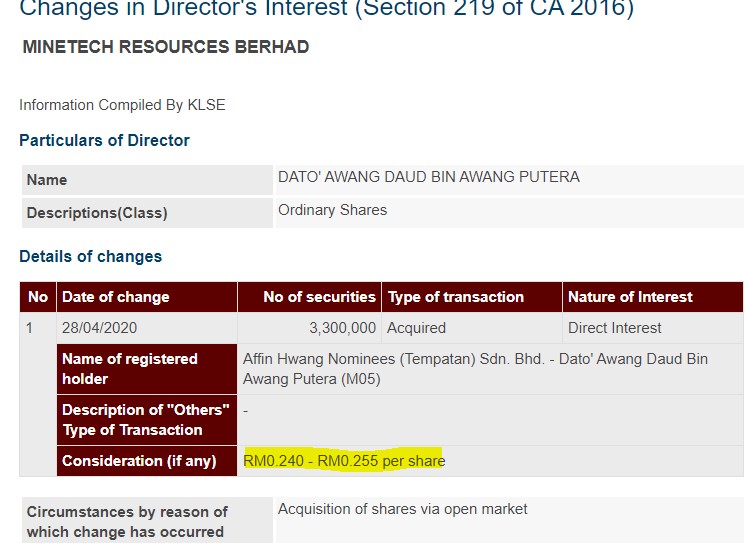

28/4/2020 Over at Minetech Resources Bhd, Dato Awang Daud Awang Putera acquired 28.8 million shares or a 3.13% stake in the quarry and construction outfit. Awang, who is the co-founder of oil and gas company Serba Dinamik Holdings Bhd, has been accumulating shares in Minetech since emerging as a substantial shareholder on Feb 11. He now controls a 21% stake in Minetech, and was appointed executive chairman of the group on March 31.

Two simple questions:

1. Did Serba Dinamik Holdings Bhd profitable under the management of Dato’ Awang?

2. Why Dato’ Awang keep on acquiring Minetech despite at high price? Ask yourself will you dare to buy more shares if you know the profit going to be suffered?

Smart Money

Our indicator is showing Smart Money is collecting aggressively despite chart consolidating. The price is only RM0.23 as of Friday (29/3/2020) closing.

Join our Telegram Channel for our latest stock discussion.

https://t.me/klseinsidertips

All the information is available online and I compile for readers reference, this is not a buy call or sell call.

https://klse.i3investor.com/blogs/MinetechResouces/2020-05-31-story-h1507923041-_Solar_Plant_Minetech_Benefits_from_On_Going_Program_Large_Scale_Solar.jsp