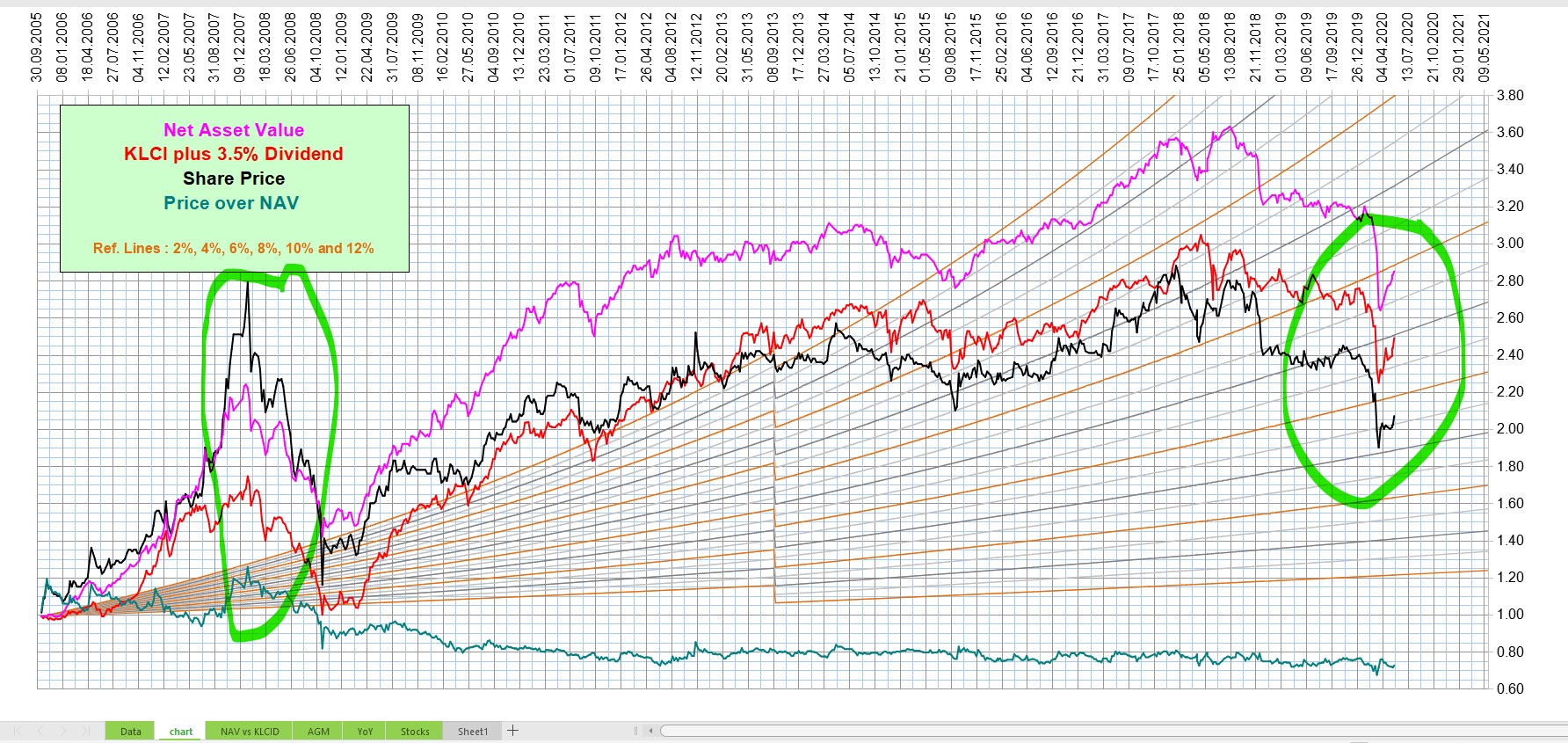

Look at the above chart.

The fund's NAV out perform KLCI (plus 3.5% dividend) for the early years, and trading at a premium to its NAV, it is logical.

But it is now trading at a big discount to its NAV.

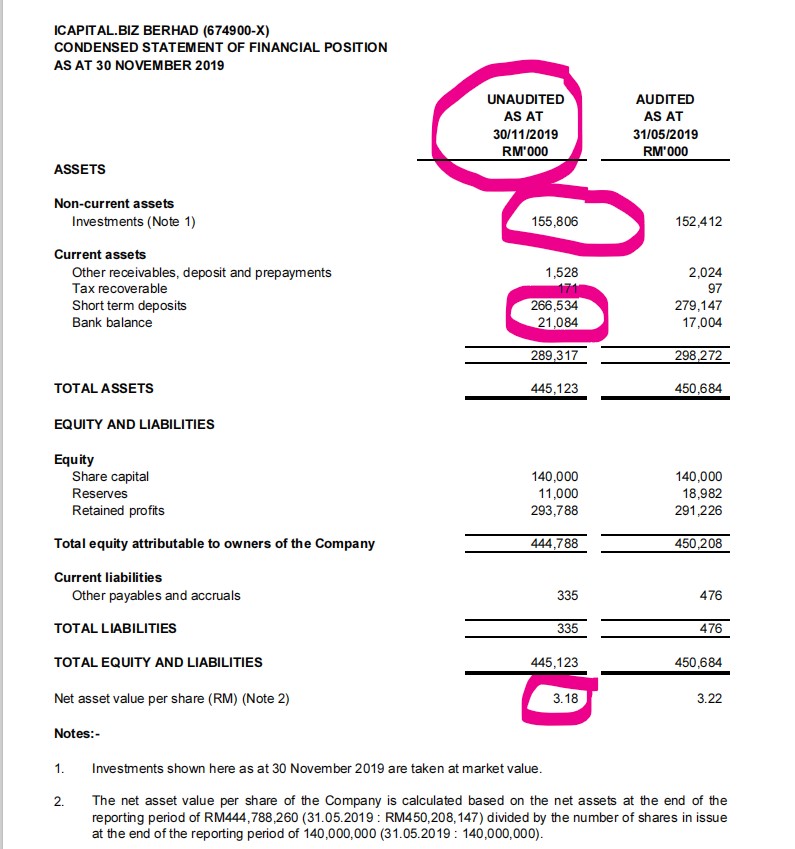

Look the above Quarterly Report, the balance sheet show that its NAV was RM3.18 on 30.11.2019.

The breakdown:

Investment (stocks) per unit = 156 / 140 = RM1.11

Cash and Deposit per unit = 289 / 140 = RM2.06

The latest announcement show that the NAV was RM2.85 on 20th May 2020.

I guess the Cash and Deposit is still the same at RM2.06,

But the investment (stocks) drop to RM0.79, due to bad market or whatever reason.

The 15th anniversary is in later part of Year 2020.

According to its propectus issued during listing in Year 2005, unit holders will vote / decide either:

1) To let ICAP continue to exist beyond its 15th anniversary, or

2) To liquidate ICAP and return the money to unit holders.

I bought ICAP at RM2.06, and hope for liquidation.

Suppose the NAV remain the same until liquidation, the investment part of RM0.79 may drop another 25% to RM0.60 due to liquidation process.

What we get will be 2.06 + 0.60 = RM2.66

Hope for a gain of 2.66 / 2.06 - 1 = 29%

https://klse.i3investor.com/blogs/gambler/2020-05-23-story-h1507806886-Speculate_Arbitrage_on_ICAP.jsp