ULICORP (7133) UNITED U-LI CORP BHD - RESUMPTION OF MEGA PROJECTS, A LOT OF CABLING, TRUNKING & ELECTRICAL REQUIRED !!!

Hi to all fellow investors and traders !

Today I would like to share my thoughts the following counter:

UNITED U-LI CORPORATION BERHAD or ULICORP (Code 7133, MAIN Market, Industrial Products & Services)

Some basic info on this company:

i. Number of shares float : 217.8 million

ii. Market Cap : RM 82.76 million

iii. Last closing price : 38c

iv. ULICORP is a diversified conglomerate with 7 subsidiaries involved in different businesses, namely:

a) United U-LI (M) Sdn. Bhd. : Manufacturing of and dealing in cable support systems, intergrated ceiling systems, steel proof battens and related industrial metal products

b) United U-LI Steel Service Centre Sdn. Bhd. : Provision of slitting and shearing services and trading of industrial hardware

c) Cable-Tray Industries (Malaysia) Sdn. Bhd. : Manufacturing of and dealing in all types of cable trunking and related industrial metal products

d) Gabung Mekar Sdn. Bhd. : Investment holding

e) United U-LI Building Materials Sdn. Bhd. : Manufacturing of and trading in integrated ceiling systems, steel roof battens and building materials

f) United U-LI Goodlite Sdn. Bhd. : Manufacturing of and trading in electrical lighting and fitting products

g) U-LI Goodlite Marketing Sdn. Bhd. : Trading in electrical lighting and fitting products

ULICORP - RESUMPTION OF MEGA PROJECTS, A LOT OF CABLING, TRUNKING & ELECTRICAL REQUIRED !!!

1. Government Allow Resumption of Mega Construction Projects - Surge in Demand for Cabling, Trunking and Electrical Fittings

Refer below news link. Basically government is allowing mega projects like ECRL, MRT2, LRT3 and few others to resume construction

Also, there is news from The Edge Weekly (refer image below) that KL-Singapore High Speed Rail (HSR) project which was suspended in mid-2018, might be revived soon as talks with Singapore like to commence soon.

Based on this, ULICORP shall be seeing demand very soon in its cabling, trunking & electrical fittings & lighting divisions, as these big projects span lengths of THOUSAND of KILOMETRES and require a lot of these products.

When news of HSR & other mega projects were hot during May 2019, that time ULICORP had hit a high price of 80c on the back of high trading volume. The current price of 38c is a very big discount compared to this 52 weeks high price of 80c.

2. Very Strong Balance Sheet - High Assets Versus Low Liabilities

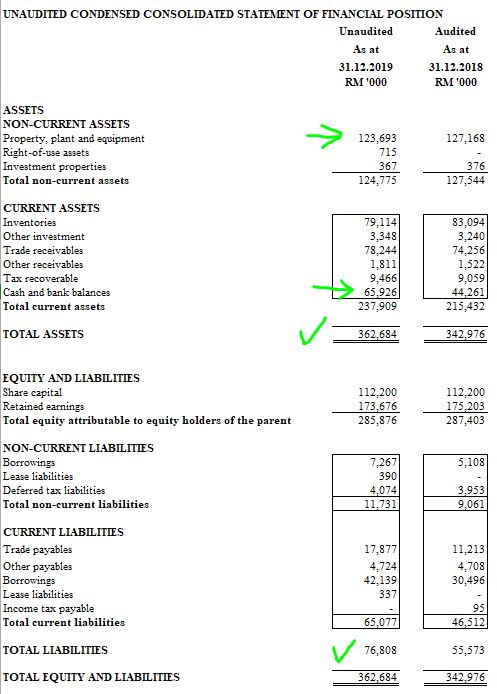

Take a look at ULICORP balance sheet as per the latest FEB2020 QR. A few key points to note:

i. Total NTA stood at RM 1.31

ii. Total cash position of RM 65.9 mil this year compared to RM 44.2 mil last year similar quarter. This translates to cash per share of 30c per share (current trading price is 38c per share which means cash position is 79%)

iii. Very high total assets of RM 362.7 million versus liabilities of RM 76.8 million. This comparison itself shows how strong the company asset is and right now is considered a NET CASH company.

Even as a takeover target by itself, would be very lucrative, as the new owner would be inheriting a lot more assets compared to liabilities of the company.

3. Many FUNDS Are Inside ULICORP Compared To Retailers - This Indicates A Long Term Confidence in the Company

Below the latest shareholdings as of latest Annual Report 2018. The 2019 report is still not yet out.

As we can see, there are more than 5 types of funds holding shares of ULICORP. To name some of the big ones:

i. Yeoman 3-Rights Value Asia Funds : 9.5 million shares (4.36%)

ii. Eastspring Investments Small Cap Fund : 6.988 million shares (3.21%)

iii. RHB Kidsave Trust : 4.396 million (2.02%)

and many more like EPF-PHEIM, RHB Private Fund - Series 3, KWAP, Tokio Marine.

With a variety of funds inside this counter, indicating that it is more of a value and long term investment equity. This also means, that there are less likely to be sellers when the price is trending upwards, as these funds tend to hold on to share even though price moved up, as compared to retailers.

Also, the biggest major shareholder is Tan Sri Dato' Wira Lee Yoon Wah with 87.4 million shares (40%) who is the Group MD/CEO.

4. TECHNICAL ANALYSIS - Homily Chart - Breakout Above the TE Line - Long Term Investors Adding Position

Let's take a look at the 60 minute chart of ULICORP using Homily software:

A few observations:

i. At Circle 1 - Price has broken above the trendline at 36c, indicating that bullish momentum is seen moving forward

ii. At Circle 2 - we can see that previously, there were no red chips in the counter. However, recently, red and yellow chips have increased while green chips reduced. This indicates that most of the weak sellers have exited and stronger buyers are taking over

iii. This price breakout is accompanied by increase in volume which means healthy trading momentum. Volume at closing of last Friday, 15/5 was 2.8 million shares

I would like to also highlight the monthly chart of ULICORP as below:

A few observations:

i. From Circle 1, it can be seen that ULICORP was trading at historical high of RM 4.57 in 2016, as their earnings per share was 21.5c at that year (20 X PE Ratio)

ii. As earnings continue to deteriorate, the share price tended to drift downwards for a few years, with the bottom hit recently in March 2020 at 23c, as the company recorded a slight loss

iii. From Circle 2, we can see super high volume trading in 2019 on the prospects of HSR and other mega projects. The price continued to go down as US-China trade war took a toll on global markets

iv. The COVID19 outbreak, another black swan event, had caused prices to hit low of 23c in March 2020. However, we notice that the volume of selling was not as high. From Circle 3, we see that volumes of buyers are starting to support the price to what it is now.

WILL WE SEE A LONG TERM UPTREND AGAIN IN THIS COUNTER? ONLY TIME WILL TELL. NO ONE KNOWS.

CONCLUSION

Based on my opinion, ULICORP should be given attention in coming weeks, based on below:

i Resumption of mega projects, to cause surge in ULICORP products namely cabling, trunking, electrical fittings and lighting

ii. Strong balance sheet, high NTA RM 1.31, high assets versus low liabilities

Thanks for reading and see you in the next post.

THE ABOVE IS NOT A BUY OR SELL CALL AND IS ONLY A PERSONAL OPINION ARTICLE AS A SHARING TO BSKL COMMUNITY MEMBERS.

Yours Truly,

INVESTHOR

https://klse.i3investor.com/blogs/InvesthorsHammer/2020-05-16-story-h1507062917-RESUMPTION_OF_MEGA_PROJECTS_A_LOT_OF_CABLING_TRUNKING_ELECTRICAL_REQUIR.jsp