Source from The Edge: https://www.theedgemarkets.com/article/brokerage-houses-tighten-margin-financing-glove-makers-stocks-amid-trading-madness

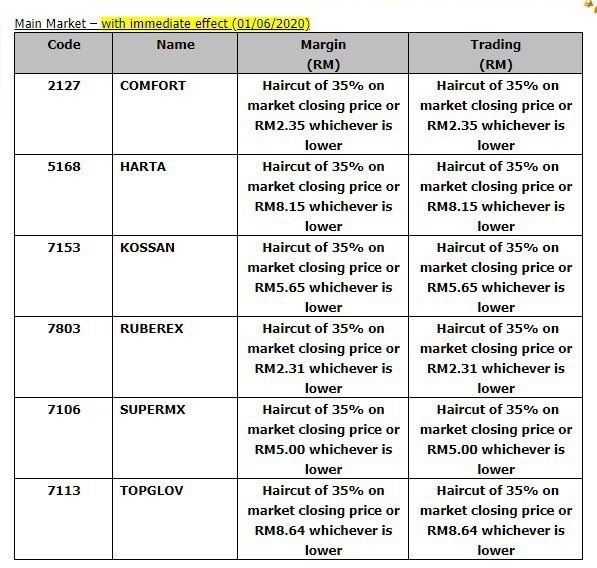

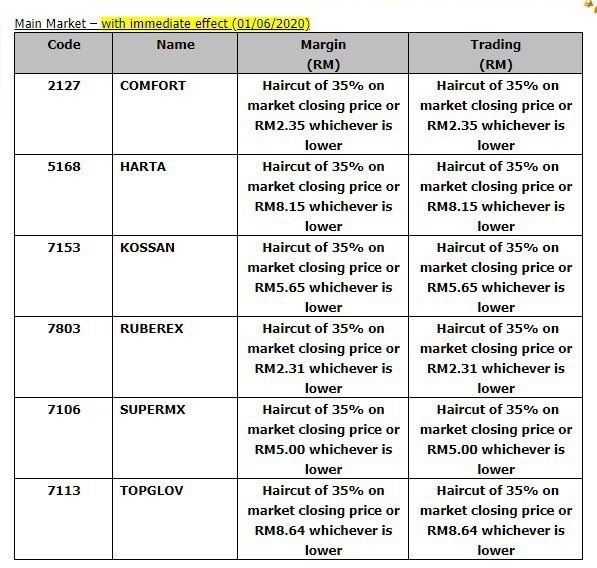

On June 2, both Maybank Investment Bank

Bhd and RHB Investment Bank Bhd have tightened their share margin

valuation on glove-related counters, starting today, following the

relentless craze for glove makers' stocks.

According to circulars issued by both

investment banks, margin financing curbs will be imposed on the trading

of shares in Hartalega Holdings Bhd, Top Glove Corp Bhd, Kossan Rubber

Industries Bhd, Supermax Corp Bhd, Rubberex Corp Bhd and Comfort Gloves

Bhd — at lower valuations compared to their current share prices.

*Haircut on glove sector by RHB Investment Bank Circular

Glove sector has been outperform other

sector during this COVID Pandemic due to demand surged. The lockdown of

the economy causing the oil price to dip to the lowest of 14 USD per

barrel, thus lower the raw material price for glove's makers. The

strengthening of USD against MYR also giving a plus to the glove

sectors. Glove's maker like Supermax has rose more than 600% YTD from

RM 1.3X to highest of RM 8.2X.

Why brokerage house and investment bank

will tighten their margin valuation at this time? Does it indirectly

telling investor that they feel that Glove Sectors are EXTREMELY

OVERPRICED?

DISCLAIMER: THE

ABOVE INFORMATION SOLELY BASED ON PERSONAL OPINION FOR RESEARCH,

DISCUSSION AND EDUCATIONAL PURPOSE ONLY. THE ABOVE INFORMATION IS NEVER

INTENDED TO BE A BUY/SELL CALL OPINION.

Stay tune and please follow our Telegram Channel for more latest information:-

Public Channel:

Public Group Chat:

https://klse.i3investor.com/blogs/babystockchannel/2020-06-02-story-h1507978747-Brokerage_House_Tighten_Margin_on_Topglove_Harta_Supermax_etc_means_Glo.jsp