ECOHLDS (0059) ECOBUILT HOLDINGS BERHAD THIS STOCK SHOULD BE RECATEGORIZED INTO CONSTRUCTION !!! EARNINGS QUADRUPLED IN LATEST QR !!!

THIS STOCK SHOULD BE RECATEGORIZED INTO CONSTRUCTION !!! EARNINGS QUADRUPLED IN LATEST QR !!!

Hello

to all readers out there. The CONSTRUCTION sector had been robust and

resilient as among the earliest sector allowed to operate by the

government under the MCO.

Having said the above, the stock which I'd like to talk about today which I feel was overlooked by the masses is ECOBUILT HOLDINGS BERHAD (ECOHLDS - Stock Code 0059, Main Market, Telco & Media)

BASIC INFORMATION ABOUT ECOHLDS

ECOHLDS core business:

i) Civil Engineering, Building Contracting and Construction

ii) Property Development

iii) Digital Content

Market Capitalization : RM 48.6 million

Shares Float : 313.56 million

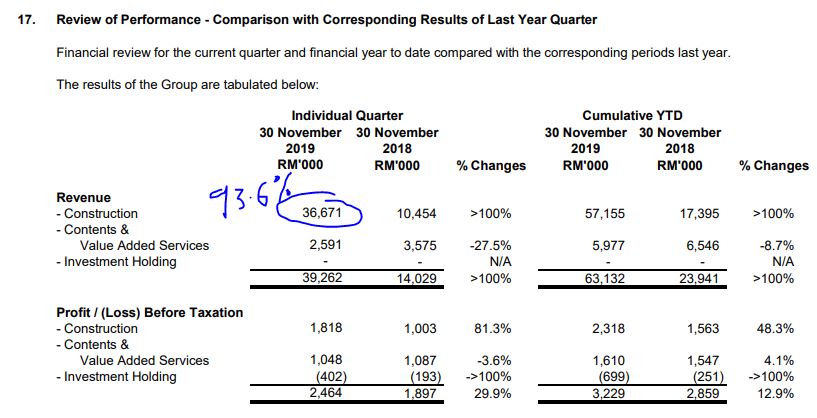

1. ECOHLDS SHOULD BE RECATEGORIZED INTO CONSTRUCTION AS IT CONTRIBUTED 93.4% TO TOTAL REVENUE

Refer below latest QR on the segmental information.

As

we can see, Construction sector recorded revenue of RM 36.67 mil

(93.4%) as compared to Digital sector with revenue RM 2.59 mil.

As such, I believe ECOHLDS should be looked at mainly as a CONSTRUCTION company, instead of a telco/media company.

I am amazed that no

MEDIA outlet has picked up on this matter and covered in the news. I

believe investors out there deserve to know more about this company

hence why I am taking the effort to do this write up and share my

findings.

2. ACQUISITION OF REXALLENT CONSTRUCTION SDN BHD (RCSB) VIA ISSUANCE OF SHARES AT 24.5 CENTS IN SEPTEMBER 2019

Refer

below news article by The Edge in April 2019. The acquisition of

construction arm was completed via cash & issuance of new shares of

102 million units priced at 24.5c per share to Kilau Makmur Sdn Bhd

(refer image below), which was completed in September 2019.

Since

then, due to the US-China trade war, our local political uncertainties,

oil price crash and COVID19 pandemic, the price of ECOHLDS has dropped

to a very attractive price.

Even

at the latest closing price of 15.5c, this is still 9c discount (36.7%

discount) to the price of the new major shareholders which took up

shares at 24.5c a piece.

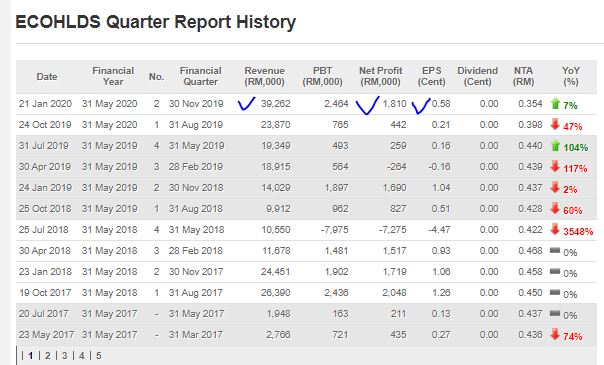

3. CONSTRUCTION ARM STARTING TO BEAR FRUITS - EARNINGS QUADRUPLED IN LATEST QR

Refer below QR summary for ECOHLDS. As we can see, in the latest QR, improvement as below:

i) Revenue Up to RM 39.26 mil from RM 23.87 mil (jump of RM 15.39 mil or 64.5% increase)

ii) Net Profit Up to RM 1.81 mil from RM 442k (jump of RM 1.368 mil or 309% increase)

This

shows how the acquistion of the CONSTRUCTION arm is starting to bear

fruits for ECOHLDS. I checked the latest news in 2020 and it seems that

no media outlet had written about this company's earnings improvement

and outlook.

I

urge my friends in The Edge, The Star, Focus Malaysia and other

financial news outlets, to sincerely take a look into this company and

provide some fair coverage for all the existing shareholders and also to

outside potential investors.

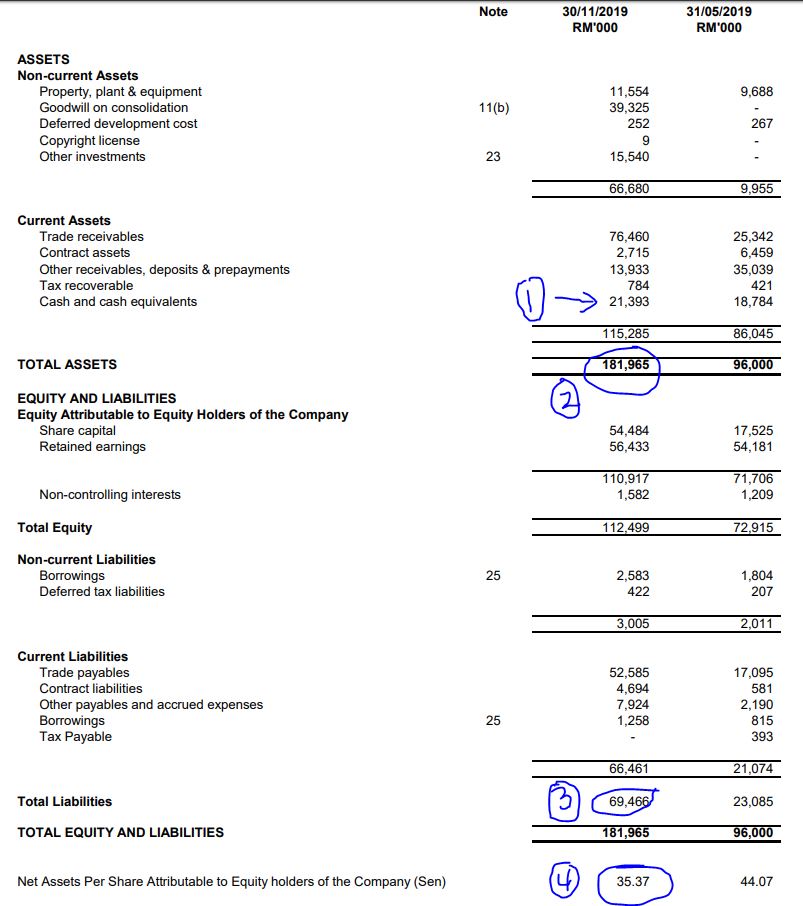

Also, if we look at the ASSETS VS LIABILITY summary below, we can see below notable points:

i) Total cash holdings at RM 21.4 mil, which is about 44% of the latest market cap

ii) Total Assets stood at RM 181.97 mil or 35.37c per share

iii) Total Liabilities stood at RM 69.47 mil

iv) Total Assets RM 181.97 mil versus Total Liabilities RM 69.47 mil (which means assets surplus of RM 112.5 mil)

4. TECHNICAL ANALYSIS - HIGH UPSIDE BASED ON MONTHLY CHART, BREAKOUT OF KEY EMAS ON DAILY CHART

Refer below the basic price and volume chart with key EMAs for ECOHLDS monthly chart :

A few observations on the monthly chart:

i. Refer Circlr 1, ECOHLDS hit a peak of 82c in 2014, before price trended downwards

ii. Refer Circle 2, price hit a low of 7.5c in March 2020, during COVID19 pandemic peak flash crash

iii.

Refer Circle 2 & 3, since hitting the low, price and volume started

to significantly improve with better trading interest seen in ECOHLDS

iv. Key EMA14 at 18c and EMA43 at 25c

v. Low downside is seen, and very high potential upside towards its historical high

Refer below the basic price and volume chart with key EMAs for ECOHLDS daily chart :

A few observations on the daily chart:

i.

When the price hit low of 7.5c in March 2020, the selling volume was

also very low (Refer Circle 1 & 2). This indicates no major

shareholders were exiting the company during this flash crash

ii.

After hitting the low, significant improvent was seen in the trading

volume, indicating buyers are rejecting low prices and keen to buy

upwards

iii.

The Price had broken key EMAs of EMA14 and EMA43 at 14c, and to test

the next EMA200 at 16.5c and EMA365 at 20c in the short to medium term

CONCLUSION

Considering all the above, I opine that current price for ECOHLDS is attractive due to below:

i) Miscategorization

of this stock in TELCO/MEDIA whereas it should be seen as CONSTRUCTION

as it contributed 93.4% of total revenue in latest QR

ii)

Acquisition of CONSTRUCTION ARM was done via issuance of cash & 104

million new shares to Kilau Makmur at price of 24.5c. Latest closing

price of 15.5c is still 9c discount to the issuance price

iii) In latest QR, earnings had quadrupled due to constribution from Construction arm

iv) Assets RM 181.97 mil versus Liabilities RM 69.47 mil (asset surplus of RM 112.5 mil)

v) Low downside and high upside potential on monthly chart, breakout of key EMAs on daily chart

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer

: The above opinion is never intended to be a BUY CALL whatsoever. I am

sharing my observations ONLY based on fundamental; past history;

current trading pattern; charts etc. Please make your own informed

decision before buying this share or whatever share for that matter.

BURSAMASTER

https://klse.i3investor.com/blogs/Bursa_Master/2020-06-07-story-h1508668865-THIS_STOCK_SHOULD_BE_RECATEGORIZED_INTO_CONSTRUCTION_EARNINGS_QUADRUPLE.jsp