Hi to all fellow investors and traders !

Today I would like to share my thoughts the following counter:

MATRIX CONCEPTS HOLDINGS BHD or MATRIX (Code 5236, MAIN Market, Property)

Some basic info on this company:

i. Number of shares float : 834.21 million

ii. Market Cap : RM 1.51 billion

iii. Last closing price : RM 1.81

iv. Website : https://www.mchb.com.my/

MATRIX - INVESTORS WOULD BE MAD NOT TO HOLD THIS GEM ! DIVIDENDS PAID QUARTERLY WITHOUT FAIL SINCE 2014 !!!

1. PROPERTY Sector Stimulated by PENJANA

Refer below news link. The PENJANA Economic Recovery plan announced by

government on 5th June 2020 is a boost to property sector due to below:

a) Revival of Home Ownership Campaign (HOC)

b) Real Property Gains Tax (RPGT) exemption for property sold between 1/6/2020 to 31/12/2021

c) stamp duty exemption for purchases

d) lifting of 70% margin of financin limit for third housing loan onwards

Based on all the above initiatives, I believe would benefit the

property sector overall, including MATRIX as one of the property

players.

2. Dividends Paid Quarterly Without Fail Since May 2014

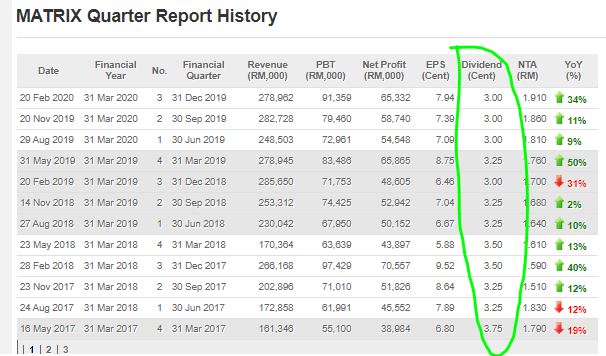

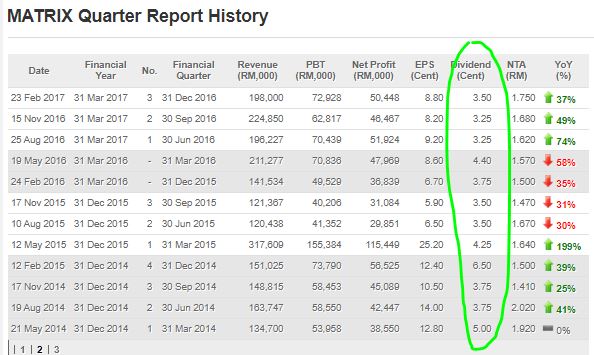

Refer below image for summary of QR since May 2014 till latest Feb 2020. As we can see, MATRIX has paid a dividend of between 3 - 6.5 cents per quarter without fail since 2014. Let me summarize the annual dividend below for ease of reading:

a) FY 31 DEC 2014 : 19c

b) FY 31 DEC 2015 : 11.25c

c) FY 31 MAC 2016 (6 months) : 8.15c

d) FY 31 MAC 2017 : 13.75c

e) FY 31 MAC 2018 : 13.5c

f) FY 31 MAC 2019 : 12.75c

g) FY 31 MAC 2020 (9 months) : 9c

Any investor or fund manager looking at decent quarterly dividend

payment would be mad not to buy and hold MATRIX into their portfolio. In

addition, we can see that their Earnings Per Share (EPS) allows the

dividend payment to be made, as their EPS usually falls in the range of 6

- 10c for the past 3 years.

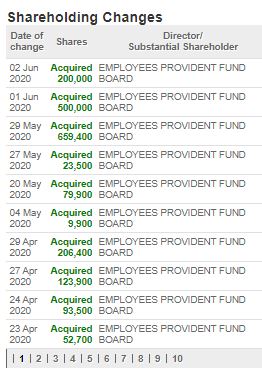

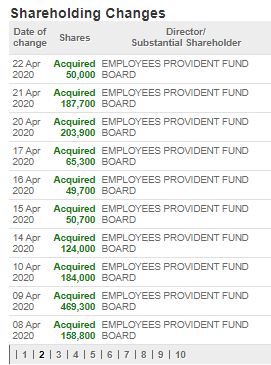

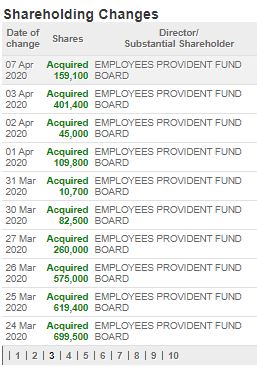

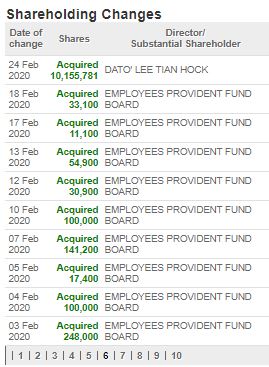

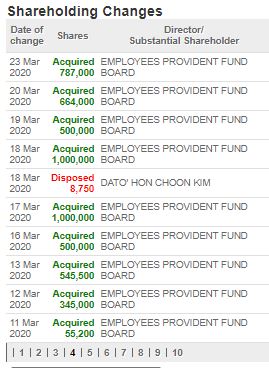

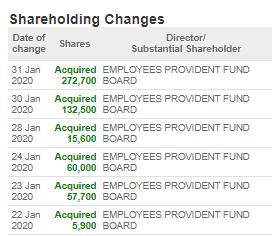

3. Since January 2020, EPF aggressively adding shares, roughly 13.26 million

Take a look at below summary of major shareholding change since Jan 2020. As we can see, EPF keeps buying shares of MATRIX since January 2020 and has added roughly 13.26 milion shares to take their total shareholding of MATRIX to 78.9 million shares (9.4%).

This shows us the EPF is valuing this stock as a longer term play as

they keep adding shares eventhough during the COVID19 flash crash

recently which brought this stock to a low of RM 1.24 on 17 March 2020.

3. MATRIX WARRANT A - A High Risk High Reward Entry - Low Price & Low Premium

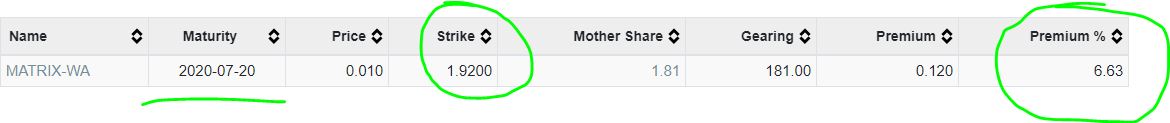

Below the profile of MATRIX WARRANTS A (MATRIX-WA):

Below my observations on this warrant:

i. Strike price of RM 1.92, translating to premium of 6.63% for the warrant

ii. Latest mother shares close at RM 1.81, which is only 11c below the strike price

iii. Maturity of 20th July 2020, which is about 1 and a half months to go

iv. Latest closing price of 1c, indicating very low risk should the mother shares expire below strike price

Should the price of mother

shares able to recover to Pre-COVID19 price of RM 1.90, I believe the

warrant should see some trading interest. Especially if the mother

breaks out above RM 1.92 strike price towards RM 2, then the warrant

will see big interest in trading volume.

Let's say worst case scenario that the mother shares price is below RM

1.92 when the warrant expires, all warrant holders will have chance to

convert the warrant into mother shares to avoid losing money on the

warrant.

Longer term prospect, the mother shares should be trending upwards, as

the PROPERTY market outlook improves and earnings will be boosted.

4. TECHNICAL ANALYSIS - Homily Chart - Breakout Above the TE Line - Long Term Investors Adding Position

Let's take a look at the 60 minutes chart of MATRIX using Homily software:

A few observations:

i. At Circle 1 - We see that red (bankers) chips are maximizing position into this counter with about 90% position taken up. This indicates long term or strong holders are buying and not short term/contra players

ii. At Circle 2 - We see that the price movement is strong above the pink trend line, indicating bullish momentum ahead

I would like to also highlight the daily chart of MATRIX as below:

A few observations:

i. From Circle 1, we can see that since March 2020, red (bankers) chips have been consistently adding position in this counter and taking up shares from green (weak) chips

ii. As of latest, red chips have taken up about 85% position, with balance of yellow 5%, and green 10%

iii. From Circle 2, we can see that the price has broken out above the pink trendline, indicating bullish momentum ahead as the PROPERTY sector is being stimulated by the PENJANA announcements

WILL WE SEE A LONG TERM UPTREND AGAIN IN THIS COUNTER? ONLY TIME WILL TELL.

CONCLUSION

Based on my opinion, MATRIX should be given attention in coming weeks, based on below:

i. PENJANA announcement by government to stimulate PROPERTY sector in the long run

ii. Strong balance sheet, high EPS and dividend paid quarterly without fail since FY2014

iii. EPF aggressively buying into this counter, 13.26 million shares added since January 2020

iv. Technical Analysis - HOMILY Chart indicating breakout above TE line, and long term investors adding position

Thanks for reading and see you in the next post.

THE ABOVE IS NOT A BUY OR SELL CALL AND IS ONLY A PERSONAL OPINION ARTICLE AS A SHARING TO BSKL COMMUNITY MEMBERS.

Yours Truly,

INVESTHOR

https://klse.i3investor.com/blogs/InvesthorsHammer/2020-06-07-story-h1508668933-INVESTORS_WOULD_BE_MAD_NOT_TO_HOLD_THIS_GEM_DIVIDENDS_PAID_QUARTERLY_WI.jsp