8 June 2020

When an investor buys a share, he expects to make profit from dividend yield and share price increase. All the listed companies in Malaysia give out less than 6% dividend per year. Investors always expect to make more money from the share price increase, provided they know how to select shares that can go up in price.

Among all the criteria such as NTA, cash flow, yield, debts, net cash etc the most important is EPS growth which is the most powerful catalyst to push up share price. Never buy based on NTA or net cash of the company because the company will not simply give out some of the company’s assets or cash to the shareholders.

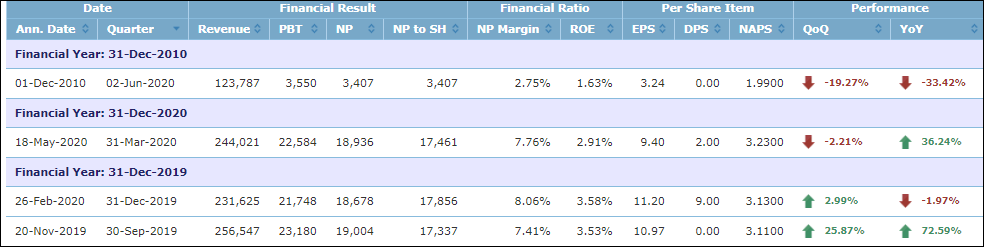

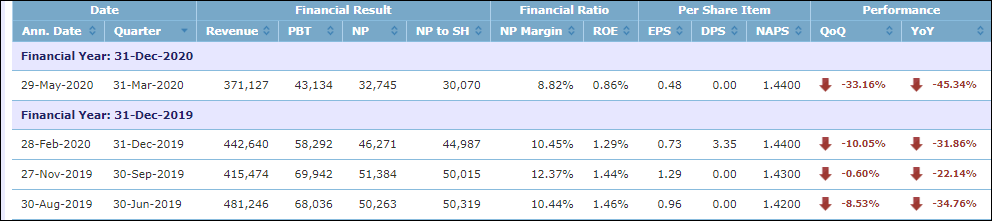

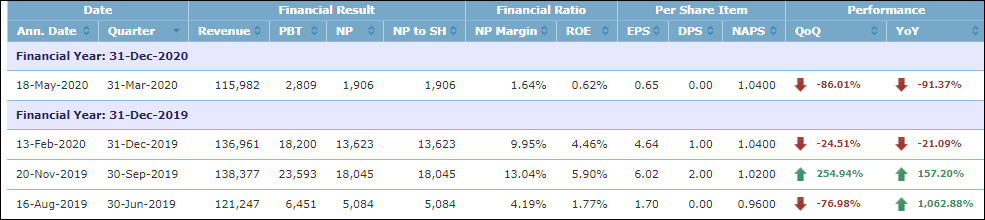

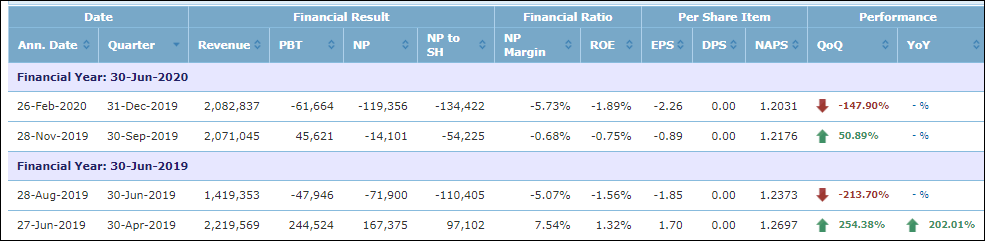

I have formulated my share selection golden rule. Never buy any share if it cannot report 2 quarters of increasing profit. The following companies namely MBMR, Master Pack, Deleum, Jaks, T Guan, Mah Sing, Teo Seng and Berjaya do not comply with my share selection golden rule which you should not buy.

Never buy any share because it has been dropping for a long time and you hope it will soon rebound. For example, all property counters will continue to drop for a long time because of oversupply.

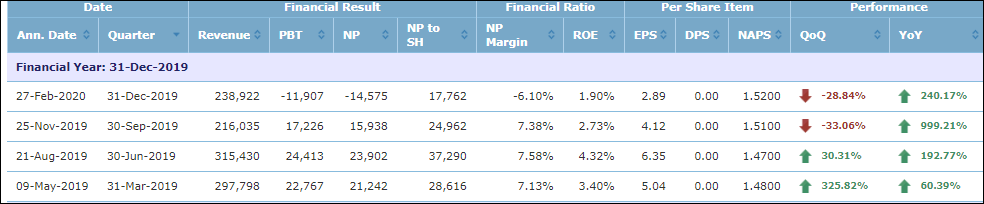

Never buy any share in anticipation that the company will soon make more profit. I am ashamed to admit my most expensive mistake in buying Jaks in anticipation of its future profit from its power generation plant in Vietnam and ignore its huge property investment holdings.

All investors should check their holdings to see if they comply with my golden rule.

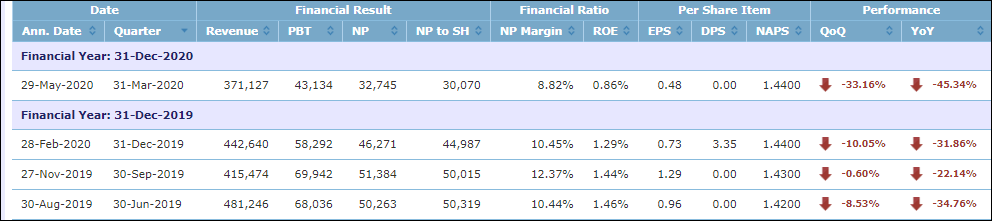

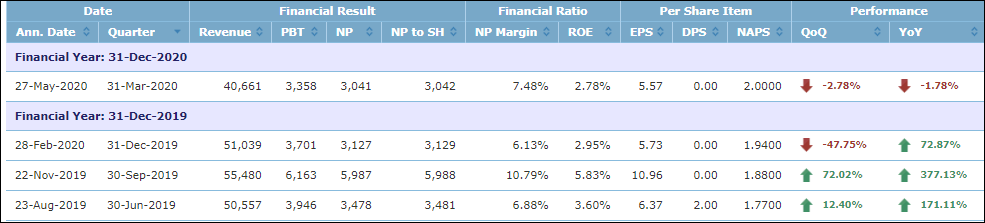

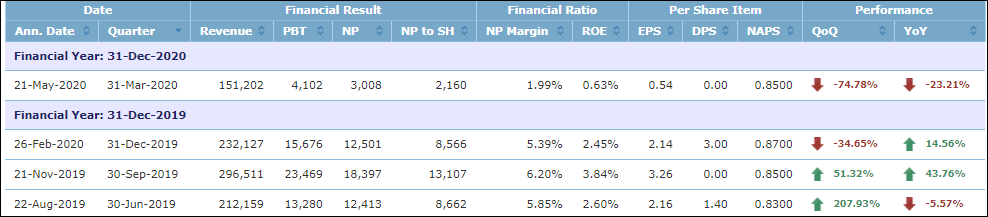

You can see the name of the company followed by its results for 4 quarters.

MBMR 4Q result

https://klse.i3investor.com/blogs/koonyewyinblog/2020-06-08-story-h1508671875-My_share_selection_golden_rule_Koon_Yew_Yin.jsp