SAUDEE (5157) SAUDEE GROUP BERHAD THIS DEPRESSED STOCK MIGHT BE A TAKEOVER TARGET OF OTHER BEHEMOTHS !!!

Hello

to all readers out there. Recently, I saw one stock that is undervalued

& did not get much attention from media & analysts alike. I

feel that it is unfair that this stock is not being analyzed properly.

Having said the above, the stock which I'd like to talk about today is SAUDEE GROUP BERHAD (SAUDEE - Stock Code 5157, Main Market, Consumer Products & Services - F&B)

BASIC INFORMATION ABOUT SAUDEE

SAUDEE

was founderd in 1985 and amongs the largest and most progressive

processed frozen food manufacturers in Malaysia, with a total workforce

of 500 personnel.

Their 2 main brands are SAUDI GOLD and FARM's GOLD.

SAUDEE core business :

i) Manufacturing & production of frozen foods thru FPP (Full Package Production)

ii)

Manufacturing & production of frozen foods via HORECA (Hotel,

Restaurant, Cafe) and OEM (Original Equipment Manufacturer)

iii) Trading of frozen foods

Market Capitalization : RM 27.13 million

Shares Float : 146.54 million

Website : https://www.saudee.com/

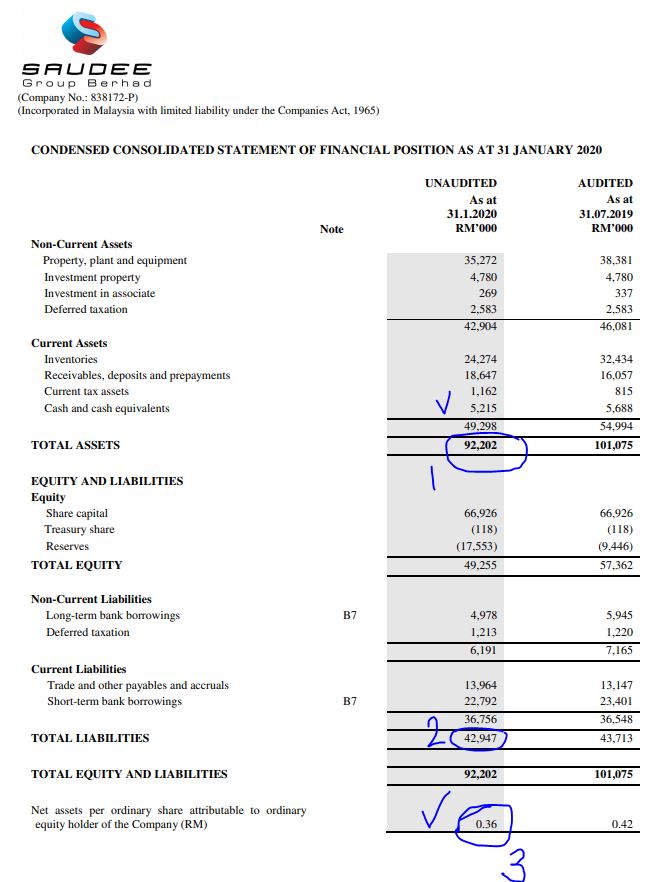

1. HIGH ASSETS OF RM 92.2 MIL VERSUS LOW LIABILITIES OF RM 42.9 MIL

Refer below SAUDEE latest Asset Versus Liability summary.

We can see from

Circle 1 & 3 that total assets equal to RM 92.2 mil or 36c per

share. Also, from Circle 2 it shows total liabilities amounting to RM

42.9 mil.

This means a

surplus of assets of RM 49.3 million (asset minus liabilities), which

indicates the company has a healthy balance sheet.

Also the latest

closing price of 18.5c, is half of the NTA, therefore indicating a big

discount in the open market which might be grabbed by potential players

looking at SAUDEE for Reverse Takeover (RTO) as a backdoor listing to

BURSA.

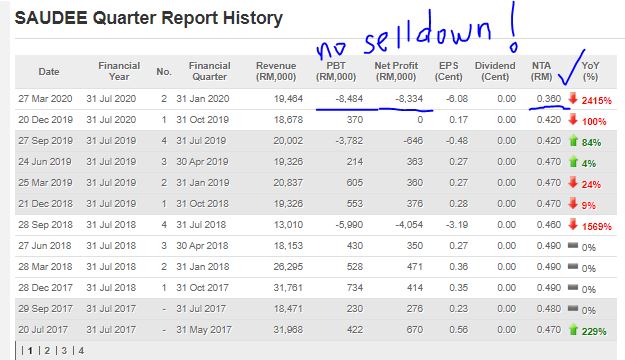

2. VERY LITTLE SELLDOWN DURING QR LOSS REPORT IN MARCH 2020 - AS

THE LOSSES WERE DUE TO IMPAIRMENT

Refer

below latest QR summary for SAUDEE. We see that the latest March 2020

had reported a loss of RM 8.3 million against revenue of RM 19.4

million.

However,

if we read at the comments section, it was mentioned that the loss was

mainly due to provision of allowance for slow moving inventories of RM 8

million and allowance for impairment loss on receivables of RM 1.14

million.

Therefore,

without this RM 9.14 million impairment, actually the company would be

in net profit of about RM 800k. I see this impairment as a healthy and

early declaration from the company, so that in upcoming quarter report

they can show earnings as they had already taken into consideration the

loss which they might be facing from the slow down of COVID19.

Finally,

it is worth to mention that one day after the QR was announced on 27th

March 2020, SAUDEE price had dropped but with very little volume of

559,500 units on 30th March 2020. After that within 2 weeks of the bad

result, there was little to no selling of this stock, after which we saw

buyers starting to take interest in this counter. This indicates to me,

that investors had already fully understood the impairment losses and

are holding on to this stock for its future prospects.

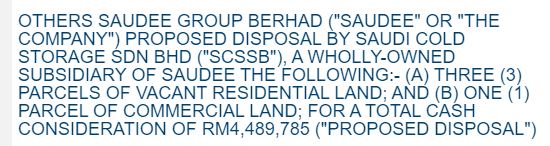

3. GAIN FROM DISPOSAL OF LAND WAS NOT COVERED BY ANY MEDIA - GAIN

OF RM 3.69 MILLION FROM ORIGINAL INVESTMENT OF RM 798K (362% GAIN

OR 2.5 CENTS PER SHARE)

Refer to below announcement link from BURSA website on SAUDEE disposal of land on 29th May 2020.

I

saw that no media or IB had reported the positive effects of this land

sale. I believe media/IBs has to be fair and also report on smaller cap

companies news.

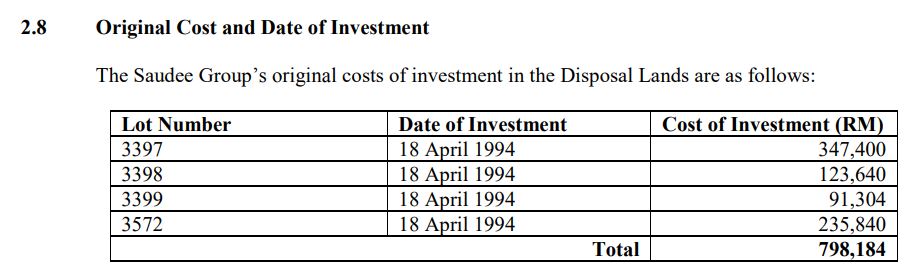

The disposal gain of land as below:

Original Investment = RM 798,184

Selling Price = RM 4,489,785

Gain on Disposal = RM 3,691,601 (gain of 362% or 2.5c per share)

I

believe the above disposal gain would be reflected in the coming 1 or 2

QRs and this would greatly boost up investors' confidence on the

financials, because for the past 3 years, SAUDEE has not yet reported

net profit above RM 1 million for any quarter.

4. TECHNICAL ANALYSIS - FORMING CUP AND HANDLE PATTERN, PENDING

BREAKOUT ABOVE 22 CENTS ON THE BACK OF IMPROVED TRADING

INTEREST IN THE STOCK

Refer below the basic price and volume chart with key EMAs for SAUDEE daily chart :

A few observations on the daily chart chart:

i.

Refer Circle 1 & 2, recently SAUDEE hit a historical low of 7c in

March 2020, however, the selling volume was not significant, indicating

only weak sellers were exiting the company at the time

ii.

Refer Circle 3 & 4, where the March 2020 QR loss was announced, but

very little volume selling was seen, indicating that strong holders are

still holding the stock as they had fully understood the impairment

provisions

iii. Refer Circle 5 & 6, where trading interest in SAUDEE had significantly improved, with volumes reaching year high

iv.

Refer Circle 7 & 8, after the recent retracement, it looks like

volumes of buyers are starting to take interest in this stock again and

coincidentally, the next EMA resistance of EMA200 at 22c is the point of

cup and handle breakout

v.

Refer pink line, where we see that SAUDEE is forming a cup and handle,

pattern, pending a breakout above 22c to confirm bullish trend upwards

CONCLUSION

Considering all the above, I opine that current price for SAUDEE is attractive due to below:

i) High Assets versus low liabilities

ii) Very little selldown during the March 2020 QR loss, as the losses were mainly due to impairment provisions

iii) Gain from disposal land of RM 3.69 (362% or 2.5c per share) to reflect very positively in the next upcoming QR

v) Chart is forming a cup and handle pattern, indicating a bullish trend once 22c level is broken out

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer

: The above opinion is never intended to be a BUY CALL whatsoever. I am

sharing my observations ONLY based on fundamental; past history;

current trading pattern; charts etc. Please make your own informed

decision before buying this share or whatever share for that matter.

BURSAMASTER

https://klse.i3investor.com/blogs/Bursa_Master/2020-06-20-story-h1508879418-THIS_DEPRESSED_STOCK_MIGHT_BE_A_TAKEOVER_TARGET_OF_OTHER_BEHEMOTHS.jsp