Make reference to the above screen shot.

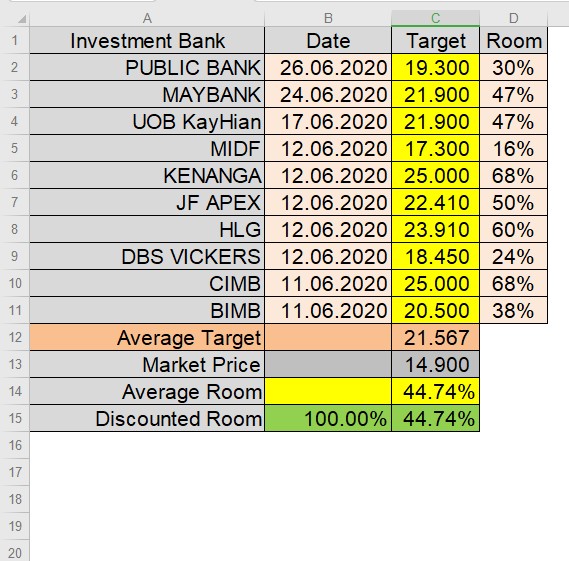

First we look at TOPGLOV target prices given by investment banks.

TOPGLOV released their latest quarterly result on 11th June 2020,

Therefore I capture only those target prices given on the same day or later,

Thanks to i3investor.com for the listing the target prices.

The average target price are sky high, an upside room of 44.74%, very rare for a blue chip.

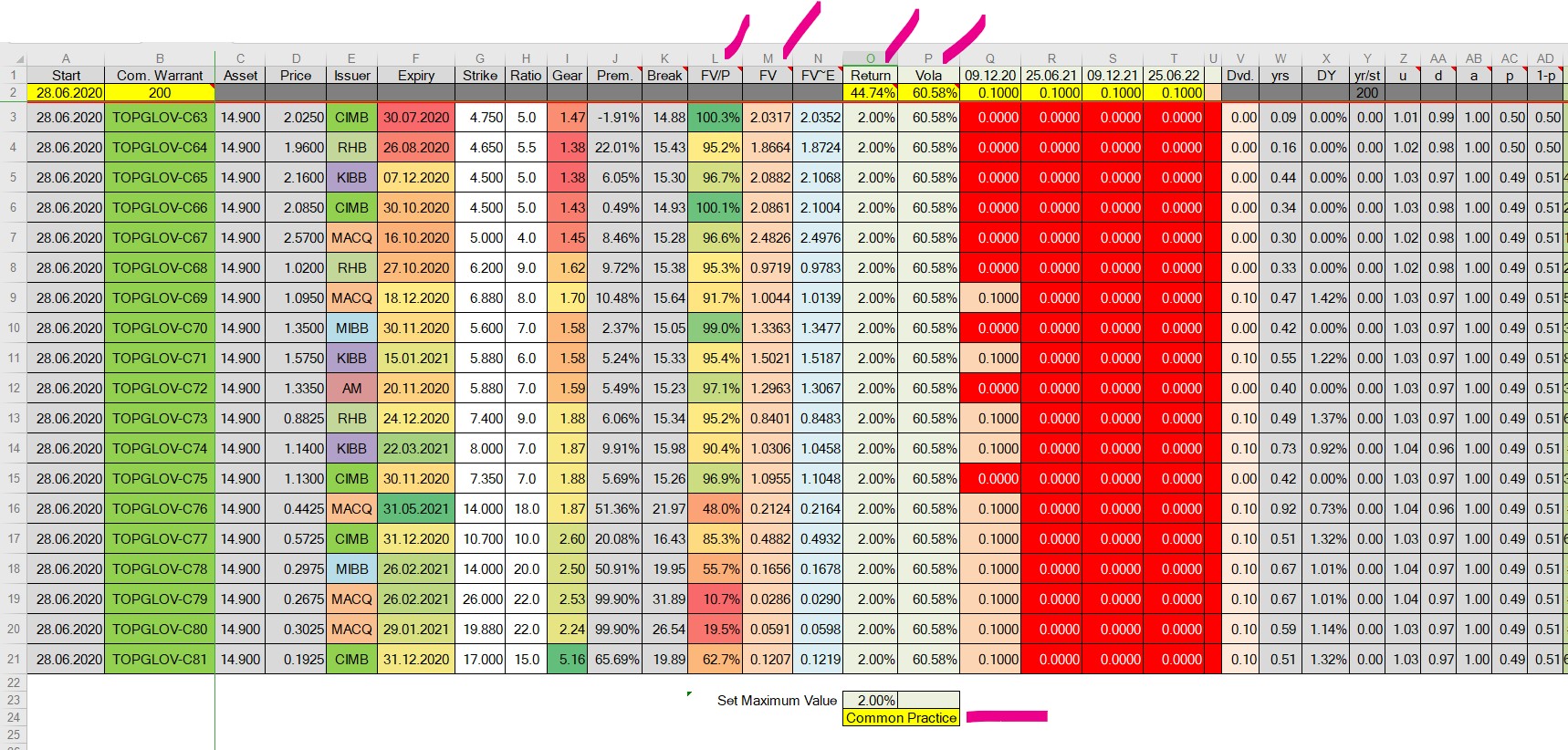

Now, to calculate the fair value of call warrants, we need inputs to the calculation, the two critical and arguable inputs are:

1) Interest:

Common practice:

Input the risk free interest rate, in our current case, should be around 2%

My preference:

50% of the upside room of 44.74%, equal to 22.37%, then plus the dividend yield, but subject to a maximum value of 8.00%.

2) Volatility:

Common Practice:

Calculate from the last 90 trading days, and assume same volatility will be maintained in coming months.

My preference:

Same calculation, but subject to a maximum value, in this case I choose 30%.

Make reference to the following two screen shots:

1) Column C:

The middle price at 4.30 pm on Friday, 26th June 2020.

2) Column M:

Fair values calculated using 200 steps binomial method.

3) Column L:

Fair Value over Market Price.

Discussion:

1) At a very unlikely chance, I could have put wrongly the expiry, exercise price or exercise ratio, so please double check at www.bursamalaysia.com if you want to trade any of call warrants.

2) Currently I do not have any TOPGLOV call warrant, and not like will buy any of them.

3) Trade at your own risk.

https://klse.i3investor.com/blogs/gambler/2020-06-28-story-h1509626058-TOPGLOV_Call_Warrants.jsp