Dear fellow readers,

Once

again, these writings are just my humble highlights (not

recommendation), feel free to have some intellectual discourse on this.

You can reach me at :

Telegram channel : https://telegram.me/tradeview101

Website / Blog : http://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/

or Email me to sign up as private exclusive subscriber : tradeview101@gmail.com

__________________________________________________________

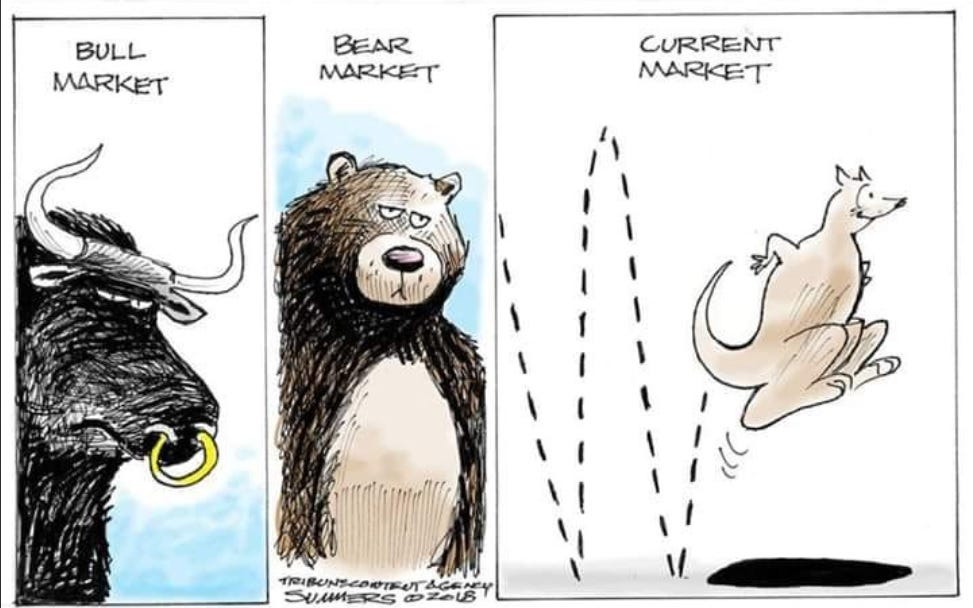

The

volatility in the recent markets is beyond what we have experienced

before. 1 day it can plunge 1800 points for Dow, another day it can

rebound almost 800 points and close at 500+ points. If we take into

consideration of the market sell off in March 2020, things are even

crazier. We do not have to look that far. FBMKLCI was down to 1210 in

middle of March, today it has rebounded back to 1513. Some say this is a

V shape rebound, others say W. Whatever letters that start to come out,

it would seem no one can truly grasp the market direction with

certainty. We managed to pick the bottom and called to buy with

conviction when the FBMKLCI hit 1210 level, but now with the market at

this level, we called to sell 2 weeks ago. Is this the right call? (Bear

with me, I will explain further later on at the bottom)

As

you can see from the above, FBMKLCI has rebounded strongly exceeding

Indonesia, Singapore, Hong Kong and Shanghai. My subscribers would know I

have been moving my funds heavily from Malaysia to Singapore and Hong

Kong markets due to the more attractive valuation there compared to

Malaysia since the rebound. During March selloff, I would say 80% of my

investments in equities are in Malaysia. Since then, especially when I

sold on strength upwards, I have been moving the funds to foreign

markets. I would say I am now about 55-45 (foreign vs local market

exposure). Of course the bulk of my investment in Singapore would be in

Riverstone Holdings and other stocks. Why did I take this drastic move?

There are 3 very simple reasons :

1. FBMKLCI valuation is toppish / expensive based on trailing PER without even considering future poor results earnings that has yet to be announced next QR. (Some argue it is the gloves that pushed the index up, true but not entirely. Ex : Airport 5014 is almost back to Pre-Covid level, does that even make sense?)

2. STI and Hang Seng are extremely cheap.

Just to give you some insights, the banks in both countries are trading

close to 0.3 / 0.4x PTBV whilst their real estate companies are trading

around 5x PER giving 4-5% Dividend Yield when land itself is the most

scare resource for both places.

3. Political risk. Singapore

is stable compared to Malaysia. The Government is very smart and

decided to call for elections in July to seek fresh mandate. Why now

when they could postpone? I believe they want to have a fresh mandate in

order to focus on rebuilding the economy and give confidence to foreign

investors to capture the capital flow. Hong Kong is undervalued due to

the ongoing protest, trade war and new security law, where the market

has been whacked down to a recent low. So when we look to invest, we

must always consider upside vs downside.

Coming

back to KLCI, many readers and investors still like KLCI because of

familiarity, funding and ease of access. Hence, that said, if you want

to continue investing in Malaysia, what can you do and how can you do

well?

1. Extend Your Investment Horizon

I

think most investors won't be able to sleep well if one keep tracking

the market daily. What if we extend our investment horizon and look

further beyond 9-12 months. Would we then be able to have clearer view

of the market? After all if you put your funds in FD, most would be

locked up for 6-12 months.

Now

it is clear that most of the recent QR that came out is atrocious. Ugly

in fact. However, did you all know the next one will be worse? The

current QR reporting is delayed from May to June. The results being

reported covered only January - March 31st. This means the results

included last 2 weeks of March where the lockdown begun on 18th March.

The next QR that reports will include April & May (full 2 months of

lockdown period).

The

worst of the QR isnt here yet. The share price rebounding from March

low, failed to take into account of the next QR is going to be very bad.

In short, the next QR will be reporting in August / September 2020 will

be worse than what you are seeing now. Therefore, it is not possible

that the shares can do well in the 3-6 months if it share price has

already has rebounded from March low. In order to decide whether to buy,

you need to extend your investment horizon to about 12 months before

you can expect any form of meaningful recovery in earnings followed by

share price.

2. Focus on Selected Stocks / Sectors That Have Shown Resilience During this Selldown

The

most straight forward sector that comes to mind is gloves sector. I

think by now, everyone walking on the street would have heard about the

stellar run. Is there still legs for glove sectors? My simple answer -

Yes. Now what else can we look at?

1. Ahealth, YSPSAH, (Pharmaceutical),

2. Hexza, Duopharma, (Medical / Chemical Supply),

3. RHB & Public Bank (Banking),

4. Allianz (Insurance),

5. Pentamaster, Genetec, (Tech / E&E)

6. MFCB (power plant & resources)

7. OCK, Digi, (telecommunications)

8. RCE Capital (Finance)

9. DKSH (Consumer Essentials)

10. Big 4 + Riverstone Holdings (Gloves)

11. Sunway, Oriental Holdings (Selected Conglomerates)

11. Sunway, Oriental Holdings (Selected Conglomerates)

These are just some ideas to let you have a picture.

3. Avoid Being Trapped in Stocks With Poor Fundamentals Especially NOW

This

is easier said that done. I noticed many are chasing stocks on news /

tips / rumours these days. Any penny stock with poor track record and

past failures announced an MOU, Agreement, LOI on any business remotely

related to Covid-19 has moved the share price up, some to ridiculous

levels. If I were to write down list of stocks to avoid, I think many

"diehard fans" or "syndicates" of these stocks would come for my head. I

shall not name it explicitly here but I can guide my fellow readers how

to distinguish. Avoid the stock if :

1.

It is an announcement of non-legally binding MOU / LOI with no specific

investment quantum or detailed plans of execution (quantity production,

estimated returns, project income etc)

2. Poor track records (strings of years of losses) or management has poor reputation (A leopard cannot change its spots)

3.

Sudden announcement of all kinds of JV, New Business Ventures etc. (It

is hard enough to run existing business in a bad economy, suddenly

starting a new venture with no past track record / capability /

synergistic advantage is suicide)

4.

Award of new Government Contract out of the blue (Please note the

Government is not stable and whatever award can be revoked or cancelled)

5.

Stocks which any Tom, Dick & Harry , Auntie, Uncle , Pak Cik or Mak

Cik recommend you to buy. (These are signs of speculative mania)

It

is never easy navigating the market in such torrid times especially

when there is lack of certainty, stability and continuity be it local or

foreign backdrop. I foresee the risk will get better in time and in the

longer term horizon but what matters will always be the fundamental of

the stocks you are buying. Do not let your hard earned money be trapped

in a lousy lost making penny stock that will take years to recover (or

worst, delisted).

_______________________________________________________________

Telegram channel : https://telegram.me/tradeview101

Website / Blog : http://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/or

Email me to sign up as private exclusive subscriber : tradeview101@gmail.com

Food for thought:

http://www.tradeview.my/2020/06/tradeview-2020-how-to-invest-or-trade.html

Telegram channel : https://telegram.me/tradeview101

Website / Blog : http://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/or

Email me to sign up as private exclusive subscriber : tradeview101@gmail.com

Food for thought: