What does the disposal means forn LIONIND (4235) Lion Industries' shareholders and what is happening in the regional steel industry?

Lion Industries Corp had disposed of its 100% equity interest in Antara Steel Mills Sdn Bhd for USD 128 million cash to Esteel Enterprise Pte Ltd. Antara Steel Mills owns a hot-briquetted iron (HBI) plant in Labuan.

For your information, Hot Briquetted Iron (HBI) is a relatively new product, developed in the past 25 years, as a supplement for pig iron and scrap in the electric furnace steel mill.

The transaction is priced at 5x the price to book ratio and 5.08x the P/E Ratio of FY 2019. This transaction is expected to increase the net asset per share by approx. 63.62 cents. If you are expecting a special dividend from Lion Industries, you are going to be disappointed. The proceeds of the disposal will be used as working capital and new investment opportunities. Also, Lion Industries has ceased declaring dividends since FY 2013. Even in the good years like FY 2017 or FY 2018, no dividends are declared.

[Outlook for Lion Industries remain bleak]

Lion Industries Corp had been undergoing a series of restructuring since 2018.

• In Jul 2018, Lion Industries acquired a flat steel manufacturing plant in Banting for RM 537.73 million

• In Jan 2019, Lion Industries disposed of its entire 50% stake in Singapore based company, Angkasa Amsteel to South Korea steel manufacturer, Daehan Steel for SGD 26.65 million.

We do not know what the company’s management is planning. The company has been selling some assets and acquiring some assets. No long term strategic plan has been discussed in its annual report too. When we look at Parkson Holdings Bhd, the company managed by the same management, it is very hard to believe that Lion Industries Corp can be turned around when the business environment is harsh and the management remains the same. Parkson Holdings Bhd's share price and gone all the way down in the past 10 years and its financial performances are deteriorating.

The share price performance of Lion Industries today has further proved that investors lack confidence in this company. Although the disposal will generate a huge disposal gain, the share price moves by a mere 4 cents (14%) today, still way below its NTA of more than RM 2.

In short, I will avoid companies like Lion Industries Corp Bhd. As a contrary, Ann Joo Bhd and Masteel are good examples of how management should convey their message to the public.

[Positive view for steel industry]

Looking at a broader landscape, we are quite bullish on the steel manufacturing industry. A few days back, Malaysia Finance Minister, Tengku Zafrul announced that there is so much monetary policy can do. The government will start implementing fiscal policy to revitalise the local economy. In layman term, it means the government had printed enough money and will start some mega project to jump-start the economy. This is definitely something positive for steel and cement counters.

[Consolidation wave among regional steel manufacturer]

Besides the local factor, we are also seeing a wave of consolidation among the region steel players.

The acquirer of Antara Steel Mill, Esteel Enterprise Pte Ltd (Esteel) is owned by 2 China nationality investors, You Zhen Hua and Liu Bin via their investment vehicle Advance Venture Investments Limited (80.1%) and Toptip Holding (19.9%)

In Sept 2017, Esteel made a mandatory general over to acquire Singapore listed BRC Asia Ltd at SGD 0.925 per share. BRC Asia is a company with more than 80 years history and is involved in manufacturing rebar, mesh wire and pre-fabricated iron cage. In July 2018. BRC Asia acquired another Singapore listed steel trading company, Lee Metal for SGD 200 million.

We believe more acquisition will come by in the near future and the regional steel industry will be shaped differently from the fragmented landscape today. Ann Joo Bhd and Southern Steel Bhd previous plan to merge is the best indicator to prove our theory. If you are looking to gain exposure in this industry, focus on the big players. Small players will be squeezed out from the market for sure.

[Useful Tools]

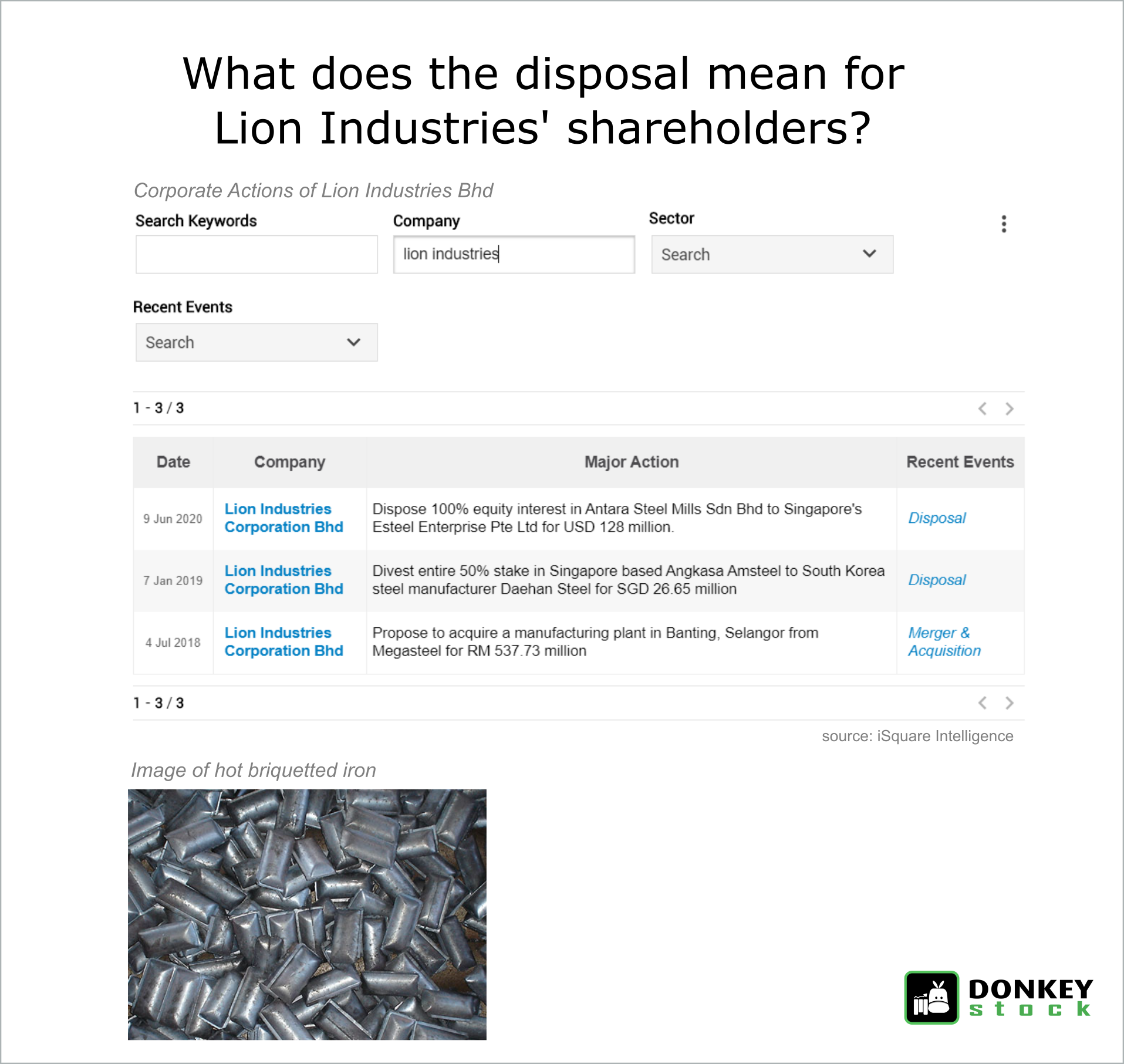

The image in this post is a screenshot from a tool developed by iSquare Intelligence. This tool helps investors to keep track the corporate events happening on Bursa Malaysia. Instead of spending hours to find that information from Bursa, we get this information within seconds. Here's the link to the tool.

Find out more insights from Donkey Stock here.

https://klse.i3investor.com/blogs/donkeystocks/2020-06-10-story-h1508727362-What_does_the_disposal_means_for_Lion_Industries_shareholders_and_what_.jsp