With the unexpected Covid-19 global pandemic, we have witnessed one of the most significant market fluctuations in the past decade. The global market has suffered a sell-down in the first six months of 2020. The Straits Times Index (STI) has seen a drop of 18% year-till-date. Singapore REITs were not spared as well; the sector has plunged by more than 34% to its lowest level in March.

Despite the heavy sell-down in the stock market including the REIT sector, there were five REITs that were performing exceptionally well in the past six months. The top three, Keppel DC REIT, Mapletree Logistics Trust and Mapletree Industrial Trust have seen double-digit price growth in 2020!

In this post, we will see which are the five REITs that have been outperforming and what they have in common.

1. Keppel DC REIT (SGX: AJBU)

Keppel DC REIT is the only pure data centre focused REIT listed on the Singapore Stock Exchange (SGX). Its current portfolio comprises 17 data centres strategically located across ten cities in eight countries in the Asia Pacific and Europe.

While the yield has been low (< 3%), Keppel DC REIT has been maintaining solid fundamentals with a low gearing of 30% and high-interest coverage of 13x. YTD June, its share price has been appreciated by more than 20%

2. Mapletree Logistics Trust (SGX: M44U)

Mapletree Logistics Trust is the first Asia-focused logistics REIT, with

a portfolio of 143 logistics assets in Singapore, Hong Kong, Japan, Australia, China, Malaysia, South Korea, and Vietnam. The REIT has been expanding its portfolio in key logistics hubs with direct access to the growing consumer markets.

During this Covid-19 period, the REIT management mentioned that most of its tenants in Hong Kong and Japan are operational and only 5% of its Singapore's tenant base is impacted. Among its tenant base, retail, hospitality and travel sector took the biggest hit. Fortunately, this group of tenants only account for 10% of its revenue.

The REIT is currently trading at 4% yield, with strong fundamentals of 37% gearing ratio, and more than 5x interest coverage ratio.

3. Mapletree Industrial Trust (SGX: ME8U)

Mapletree Industrial Trust is an industrial REIT with a portfolio of 87 industrial properties in Singapore and 17 data centres in North America.

The trust continues to deliver strong results with positive rental reversion. Besides, the management has a strong track record on enhancing its value through redevelopments. Telok Blangah cluster, 30A Kallang Place property on top of a car park were among the past successful redevelopment, which helps to drive upside in valuations and earnings.

YTD June, its share price has gone up by more than 12%. It is currently trading at 4% yield and high price-to-book ratio of 1.8.

4. Ascendas REIT (SGX: A17U)

Ascendas REIT was the second REIT listed on Singapore Stock Exchange in 2002. It is the biggest REIT with a focus on managing industrial properties. The REIT owns and operates a portfolio of industrial properties in Singapore, Australia, the United Kingdom and the United States.

The management guided that none of its properties were shut during the Covid-19 lockdowns. And no tenant has requested to pre-terminate in the near term. Rent collection remains healthy, however, 20% of the local tenants have enquired about rent waivers or relief packages. The good news is these group of tenants form less than 1% of its gross rental income.

The REIT remains resilient with more than 50% of its monthly gross revenue contributed by relatively more resilient industries such as financial services, government sectors, data centres and biomedical.

YTD June, its share price has gone up 9%. It is currently trading at 4.2% yield, with a low gearing ratio of 35%.

5. Parkway Life REIT (SGX: C2PU)

Parkway Life REIT is one of Asia’s largest listed healthcare REITs. Its portfolio comprises 53 healthcare properties in Singapore, Japan, and Malaysia. In Singapore, Parkway Life REIT operates the Mount Elizabeth Hospital, Gleneagles Hospital, and Parkway East Hospital.

With a gearing ratio of 38%, the REIT still have some debt headroom for future acquisition. With a portfolio of Japan assets, Parkway Life REIT has also hedged its JPY net income till 2024, to protect against any currency volatility. The long-term outlook of the healthcare industry continues to be bullish, driven by the ageing population and the increasing demand for better quality healthcare.

YTD June, its share price has gone up 3%. It is currently trading at 3.9% yield.

What is the common trait of these five REITs?

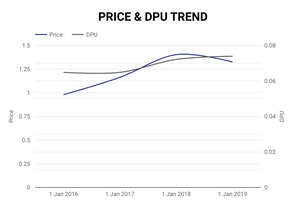

One of the key similarities is all the five REITs have been generating very consistent DPU growth in the past three to five years.

While the yields of the REITs are low (< 5%), but all of them have been delivering very consistent and growing DPU historically, which drives the share price in the past six months. Out of the 40 REITs listed on SGX, there are only 13 REITs that managed to maintain positive growth in DPU in the last 5 years.

Besides, their portfolio focus and tenant mix are the least impacted by the Covid-19 pandemic, which is favourable for risk-adverse investors during this crisis period.

How to quickly pick up the REITs with consistent DPU growth?

Using the REIT Numerical Scoring, you can quickly shortlist REITs with positive DPU growth over the previous 5 years.

Then, you can quickly use the REIT Deepdive to see the historical DPU trend. All the 5 REITs above has shown strong trends in their historical DPU.

Final Thoughts

While DPU consistency is a critical parameter to evaluate REIT performance, there are still other important parameters to pick the next winning REITs, including valuations, growth prospects, management, portfolio rebalancing etc.

https://www.reitscompass.com/post/5-top-performing-reits-in-2020-what-they-have-in-common