- Exclusive distributorship of Specialty Pharmaceutical products confers high margins and strong customer loyalty.

- Expansion into both online and offline retail sales channel such as Watson’s, Guardian, Lazada and RedMart will spur growth across product portfolio.

- Hyphens Pharma continues to establish its presence within the region with expansion of product portfolio through new product launches and footprint into various sales channels.

- Initiate coverage with ACCUMULATE rating and a target price of S$0.435.

Company Background

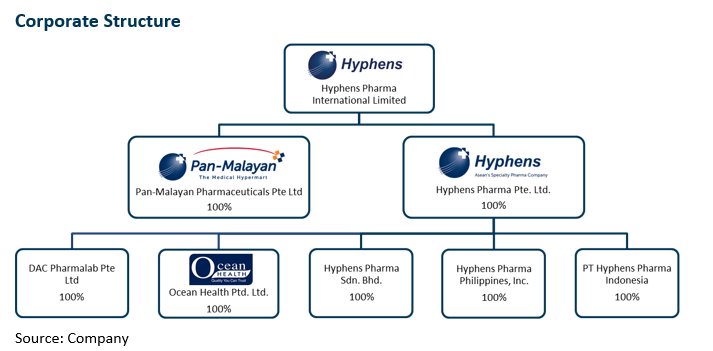

Hyphens Pharma International Limited (“Hyphens Pharma”) was founded in September 1998 by Chairman, Executive Director and CEO Mr. Lim See Wah when the Group made an investment in Pan-Malayan Pharmaceuticals (“Pan-Malayan”). Its principal business activities include the sales, marketing and distribution of pharmaceutical and healthcare-related products on behalf of its proprietary brands and renowned pharmaceutical principals such as Sofibel and Guerbet.

Today, Hyphens Pharma has expanded its business to include both B2B and B2C channels with direct presence across 5 countries (Singapore, Malaysia, Vietnam, Indonesia and the Philippines) and marketing and distribution network in 6 other markets (Bangladesh, Brunei, Cambodia, Hong Kong, Myanmar and Oman).

Investment Merits

- Exclusivity as regional product owner for proprietary brands and renowned brand principals from Europe and the United States.

- Expansion of sales into B2C channel in Singapore will increase retail presence of Hyphens Pharma’s product portfolio.

Apart from expanding into the physical retail space, Hyphens has also moved its products to e-commerce platforms such as Lazada, RedMart and Shopee. Hyphens will continue to enjoy top-line growth of its products as its footprint in the consumer sector grows.

- ‘Asset-light’ business model presents strong value creation.

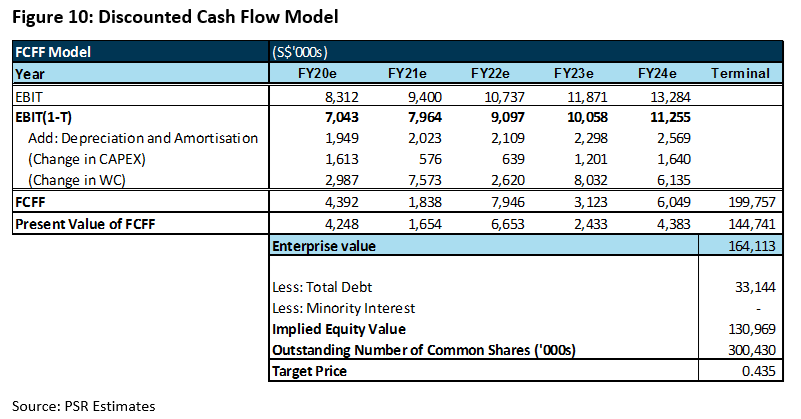

We initiate Hyphens Pharma with an ACCUMULATE rating. Our target price of S$0.435 derived from a discounted cash flow model with weighted average cost of capital (WACC) of 7.2% and terminal growth rate of 1.5% implies a total return of 6%.

Industry Overview

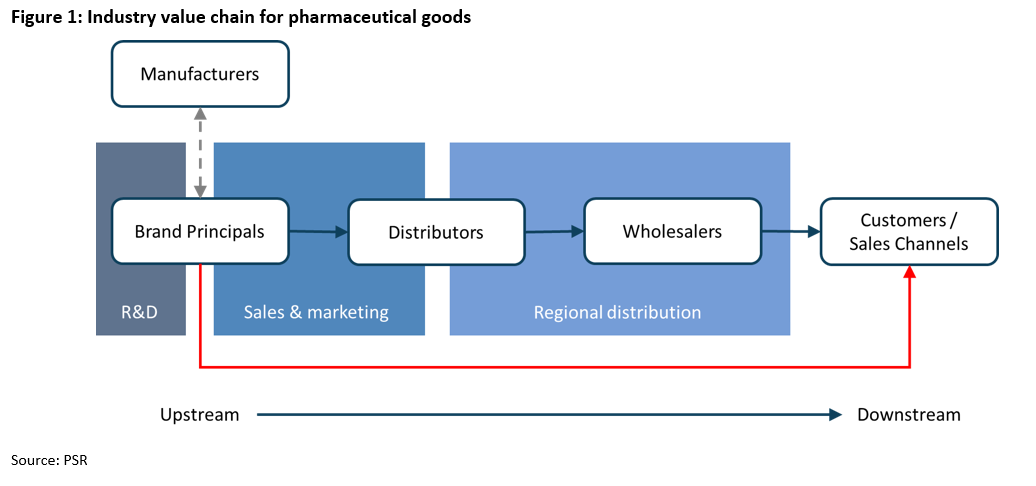

The pharmaceutical goods industry is a fragmented industry with each medical discipline (e.g. dermatology, orthopaedics etc.) comprising a sub-segment on its own. A pharmaceutical product often undergoes years of Research & Development (R&D) process involving application for patents to protect technologies and strict regulations and procedures around safety and testing.

Due to the long and arduous R&D activities, product value is often concentrated on upstream activities. The product owners, known as the brand principals, will then take the product to the market themselves or out-license the product to distributors who will be in charge of go-to market strategies, which require specific market knowledge.

Apart from understanding market demand, entering a market also involves understanding regulations across jurisdictions as pharmaceutical products need to be registered with the relevant authorities before they can be sold in the different markets in accordance with local regulatory guidelines.

The industry value chain from upstream to downstream is illustrated in figure 1.

While brand principals hold the most value within the value chain which typically translates to higher margins, the long lead time as well as the huge capital outlay to engage in R&D to create new products often limits the scale of brand principals.

Distributors on the other hand, with their specific market knowledge, are able source for potential brand principals to expand their product portfolio, and in return, operate on a larger scale within their market. Distributors also engage with medical practitioners to raise the profile of their product portfolio and seek potential sales prospects such as specialists, general practitioners (GPs), retail pharmacies and even hospitals.

Revenue

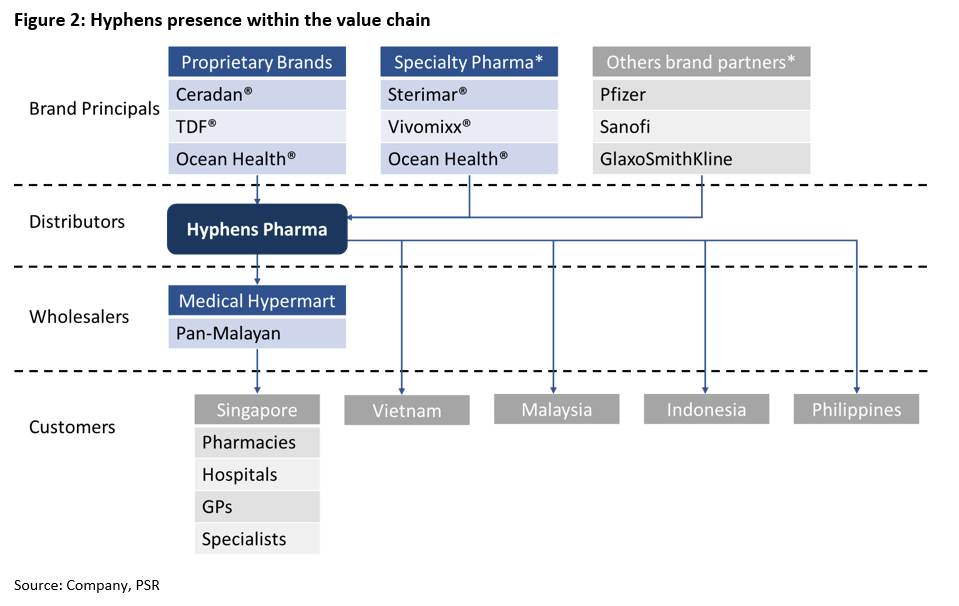

Hyphens Pharma operates three business segments – Specialty Pharma, Proprietary Brands as well as Medical Hypermart and Digital. Through its business segments, Hyphens Pharma has established itself within the value chain across various markets (Figure 2).

Business Segment

Specialty Pharmaceuticals Principals: the segment involves the management of the product portfolio that Hyphens Pharma owns through exclusive distributorship or licensing and supply agreement with pharmaceutical principals from Europe and the United State.

Currently, Hyphens Pharma has more than 30 products under its portfolio, including contrast media products (Figure 3) used in radiology from Guerbet S.A. and Stérimar® nasal sprays from Sofibel S.A.S. Business activities within the segment include product registration and marketing campaigns to educate medical professionals on product knowledge to generate demand for products.

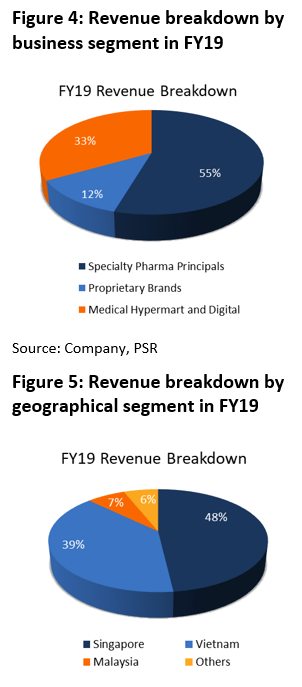

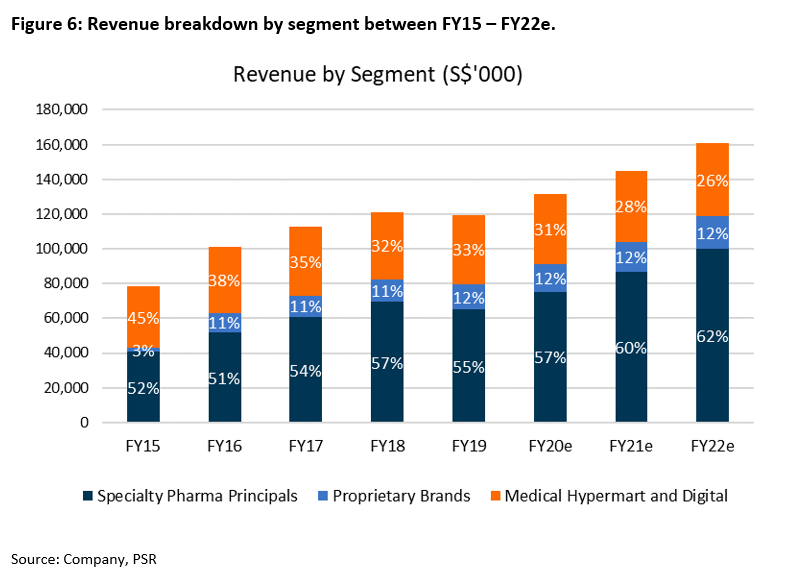

Having established its reputation of managing an extensive portfolio of pharmaceutical products within the region, Hyphens has enjoyed success through building long-term working relations with various brand principals. The segment has historically contributed more than half of the Group’s revenue, and experienced a CAGR of 10% over the past 5 years (Figure 5).

Proprietary Brands: Hyphens develops, and sells its own proprietary range of dermatological products as well as a suite of health supplement products. The segment saw contribution leapfrog from 3% in FY15 to 12% in FY19. This was largely due to the acquisition of Ocean Health® in 2016 which expanded its portfolio from Ceradan® to further include TDF® as well as Ocean Health® supplements.

Hyphens work with research partners such as A*STAR to conduct research and development (R&D) activities. Hyphens then bring its proprietary brands to the market regionally through its distribution network via a similar model undertaken for specialty pharma products.

Medical Hypermart and Digital: Hyphens Pharma conducts its online B2B business through Pan-Malayan. Carrying over 4,000 items from medical PPEs to pharmaceutical drugs, Hyphens undertakes the wholesale of medical supplies to more than 3,000 customers in Singapore ranging from specialists, GPs to hospitals and retail pharmacies.

Apart from specialty pharma brands and proprietary brands, the medical hypermart also carry trusted pharmaceutical drugs from Pfizer and Sanofi to provide customers with a one-stop shop for all their inventory needs. Hyphens also provides break-bulk services to customers by consolidating orders from customers and passing cost savings customers.

Revenues within the segment has remained relatively stable, with an average growth rate of 3% over the past 5 years and contributing 33% to Hyphens’ revenues in FY19.

For more information on Hyphens Pharma’s product portfolio, please refer to Appendix A.

Investment Thesis

i. High loyalty to specialty pharma products and proprietary brands. Hyphens Pharma is granted exclusive distributorship for products under the specialty pharma and proprietary brands segments. Apart from off-the-shelf health supplements under Ocean Health®, the products are generally sold to discerning medical practitioners. As such, Hyphens engage in extensive sales and marketing activities such as holding medical conventions and providing product knowledge training to doctors to prove the efficacy of its products for sales conversion.

The process of relationship-building with doctors builds trust for Hyphens and its product portfolio, which translates to customer loyalty. Customers are also deterred from switching products due to the inherent familiarity with existing products and a lack of substitutes products, especially for specialty products with niche uses.

ii. Expanding retail presence through online and offline channels. The acquisition of Ocean Health in 2016 allowed Hyphens to gain access to additional sales channels for its product portfolio that was largely B2B in nature. In the second half of 2019, the company brought three products, Stérimar®, Ceradan® and Vivomixx® to the retail market through retail pharmacies such as Guardian and Watson’s and saw robust growth in sales for these products.

The additional sales also came at minimal marketing and distribution costs as the company’s go-to strategy for bringing its product portfolio to these channels is to take products that have established its brands that have obtained doctor’s recognition before putting them out in the retail market. This means that retail consumers usually have brand recognition by way of prior prescriptions from doctors.

iii. Presence as a channel integrator promotes business longevity. Hyphens pharma is able to preserve business value by engaging in high-value functions within the value chain. This grants them with the ability to command higher margins while outsourcing manufacturing and logistics activities to third parties to ensure an asset-light business operation.

As of FY19, plant, property and equipment and right-of-use assets only make up 7.4% of Hyphens asset, allowing Hyphens to pursue growth strategies such as acquiring more brands to expand its product portfolio or downstream distributors to widen their footprint across different sales channels to generate more sales.

Financial Highlights and Forecasts

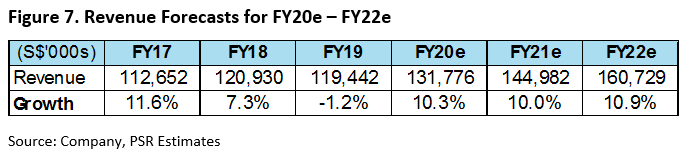

Revenue: Hyphens Pharma have seen revenues grow at a CAGR of 8.8% between FY15 – FY19, with a reversal observed in FY19 (-1.2% YoY) as a result of heightened sales in FY18 in anticipation of licensing renewals in anticipation of license renewals in FY19 for some of its specialty pharma products. We expect revenues to grow between 10 – 11% over the next 3 years, driven by both specialty pharma and proprietary brands segments. Expansion of product portfolio including the recent product launch of Ceradan® Gentle Cleanser and Ceradan® Hand Lotion Sanitiser, as well as deeper penetration of the retail market through both online and offline channels, will contribute to the robust revenue growth.

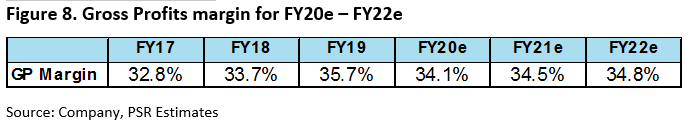

Margins: Gross profit margin improved from 32.8% in FY17 to 33.7% and 35.7% in FY18 and FY19 respectively. This was largely attributable to the increased contribution from the specialty pharma principals and proprietary brands segments, which command higher margins when compared to the medical hypermart and digital segment. We expect margins to stabilise around 34 – 35% moving ahead.

Balance Sheet: with strong cash position

Cash-flow: A strength of Hyphens’ business model is the minimal capital expenditure required in the business. PPE only make up only 7.4% of total assets in FY19. With minimal capex required for business activities, FCF yield in FY19 stands at 7.5% based on current prices. High FCF allow Hyphens to keep a lookout for potential acquisitions that can further expand its footprint within the value chain.

Dividends: Hyphens Pharma distributed dividends of one Singapore cent per share for FY19, representing a payout ratio of 46% in FY19. Moving forward, the Company intends to distribute dividends of at least 30% of the Group’s net profits attributable to shareholders. We believe the dividends of one Singapore cent per share will be sustainable, representing a modest yield of c.2 – 2.5%.

Risk and mitigations

Dependence on relationships with brand principals for specialty pharma portfolio. Licensing agreement with brand principals is key to the success within the segment, which contributes to more than 50% of its revenue historically. As such the loss of such agreements as a result of non-renewal or early termination may result in the loss of key revenue sources.

By establishing itself within the regional as a reputable distributor, Hyphens Pharma is able to maintain healthy and longstanding working relations with brand principals, allowing for the longevity of exclusive distributorship of products within the portfolio.

Loss of demand from delayed product registrations and renewals. Product registration with relevant authorities is required before products can be sold within the various markets. These licenses to sell within a market typically expire within two to three years and require renewals.

However, due to regulatory backlog at times, licenses registrations and renewals face the risks of non-timely renewals which may put product off the market while awaiting approvals. Hyphens Pharma mitigates the risks by working with downstream partners to sufficiently stock sales channels to and to ensure no loss of demand.

Competition with other brand principals for proprietary brands portfolio. While proprietary brands grant higher margins to Hyphens Pharma, there is strong competition within its product portfolio segments of health supplements and dermatology. As such, recognition of efficacy in products through granting of patents will be testament to quality and reliability of its product portfolio, especially amongst medical practitioners.

Valuation

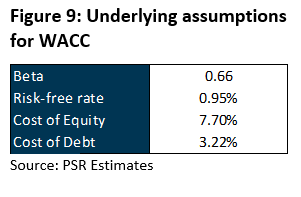

We initiate coverage on Hyphens Pharma with an ACCUMULATE rating and at a target price of S$0.435 derived from a discounted cash flow model with the following assumptions:

- Weighted Average Cost of Capital (WACC) of 7.2%

- Terminal growth rate of 1.5%

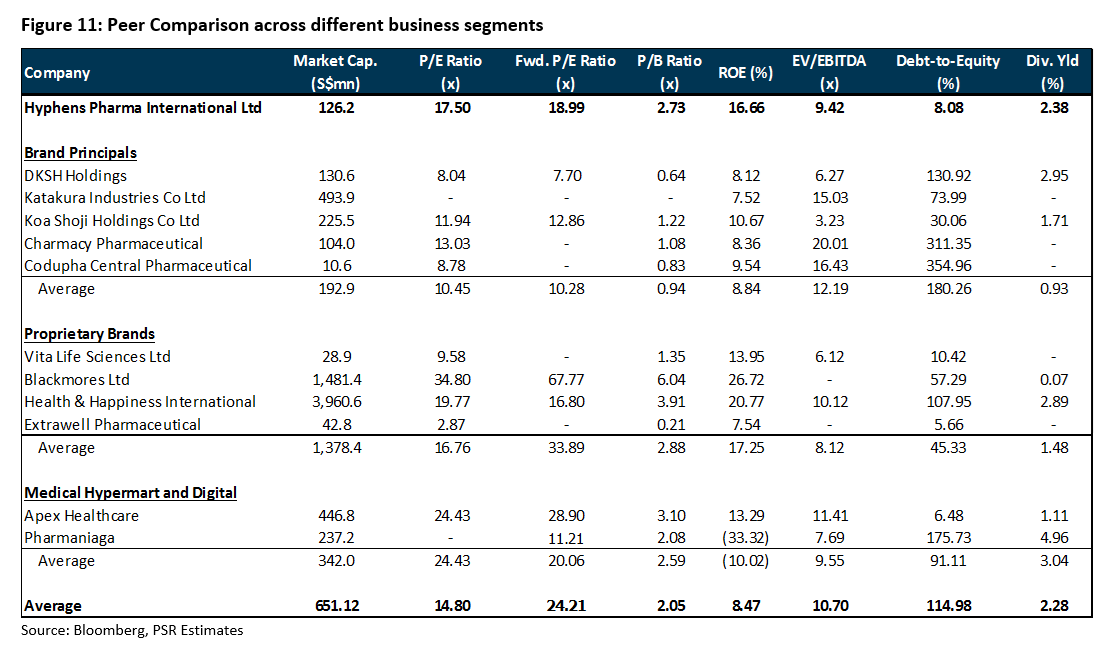

The target price of $0.435 suggests a forward PE ratio of 18.99x which is favourable when benchmarked against the industry average of 24.21x. Hyphens Pharma’s Return-on-Equity of 16.66% is also higher than the industry’s 8.47% with a comparable dividend yield of 2.38% to the industry’s 2.28% (Figure 11).

Source: Phillip Capital Research - 20 Jul 2020

https://sgx.i3investor.com/servlets/ptres/14408.jsp