LETS JOIN KIM'S STOCKWATCH GROUP?

Official Telegram : https://www.telegram.me/kimstock

Official Website : http://www.kimstockwatch.com/

DATE : 09 July 2020

(UPGRADED TP)

Current Price: RM11.32

Immediate Target: RM12.00 (This Week)

Target Price: TP1 = RM16 / TP2 = RM18

Last target : RM25 (Mac-2021 - Last target depend on COVID-19 situation)

WHAT THEY DO?

Kossan Rubber Industries Bhd is a public listed company which has been established since 1979 with primary business in glove manufacturing followed by technical rubber and cleanroom manufacturing expertise.

Kossan is one of the largest manufacturers of latex disposable gloves in the world with an annual production capacity of 28 billion pieces and the largest technical rubber products manufacturer in Malaysia with a total compounding capacity exceeding 10,000 mt.

More than 80% of its products are exported to over 130 countries with 350 active customers mostly located in developed nations such as United States, U.K., Scandinavian Countries, Europe, China, Korea & Japan.

Kossan manufactures and offers a wide range of products including highly technical input engineered rubber products used in automotive, infrastructure, marine, aviation, rail and mining industries through its Technical Rubber Product Division and latex disposable gloves through its Glove Division. The Group operates with 20 plants (19 in Malaysia, 1 in China) and has a total workforce to approximately 6,000 comprises both local and foreign nationals. Equipped with strong manufacturing capability,

Kossan has been the preferred OEM manufacturer and business partner by many renowned MNCs for the past 2 to 3 decades. The Company is recognized for its capability in bringing to its customers various innovative products with a fair price and consistent product quality, professional business dealings and robust financial track record.

KOSSAN PRODUTCS

Kossan have 3 segmen products :-

1. Technical Rubber Products

- Engineered Products

- EVA Products

- Extrusion Products

- Moulded Products

- Rollers & PU Products

2. Gloves

- Medical

- Professional

- Specialty

- Surgical Procedures

3. Cleanroom & Safety

- Cleanroom

- Industrial PPE

KIM INSIGHTS

All of us knew that Golve counters has move up a lot and why we still writing this blog to share with all of you? It is important for you not to miss this great opportunity to join the party for KOSSAN. We believe KOSSAN can move even higher as a lot of Investment Bank had just updated the TP to RM14. Believe it or not it will hit Kim's TP soon.

As Kim's mention on June 20 "You will not getting any cheap entry price for golve counters again on July".

As the chart pattern above show a skyrocket pattern and still no

stop!!! With the strong consolidation on previous resistance level that

generated strong breakout on this counter. Watch out!!!! It will hits

Kim's TP soon!!!

WHY WE WRITTEN KOSSAN?

- Among the rest of the Golve counters. KOSSAN is the lowest PE. Other counters had already taking about forward PE>80-100.

- The Management continue buying it share from the market.

- EPF also joining the party and keep buying this counter.

- The company is expanding its business.

- A lot of IB updated all golve counters TP to higher price. Imagine if Top Glove their thinking TP is RM30. What do you think about Kossan?

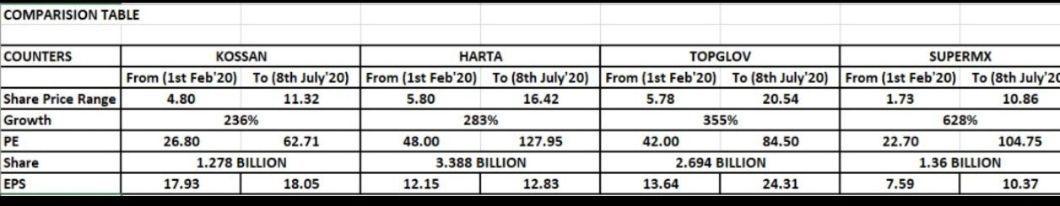

COMPARISON BIG-4

Please find the comparison data we had prepared for you and why we said so!!!

From the table above, do take note that

ONLY KOSSAN is laggard behind in term of percentage growth and the

lowest P/E still. Its should be P/E 80 - 100. If their P/E increased

between that range, we will see this KOSSAN trading at RM16 & RM18 which is my target price.

THE GLOVES VIEW

About a couple months ago, we have seen that Malaysian stocks are set to enter bull territory as glove makers extend their record rally. The country is home to the world’s biggest glove makers Top Glove and Hartalega , which have surged in recent months due to rising demand for protective equipment during the global coronavirus pandemic.

However, the hottest sector which is gloves had been warned and

distracted by some of local IB’s. As we know the margin capping has been

applied. I had asked my local broker house regarding this issue and the

answered I got, that is because the price moves too quickly. They don’t

want to have non-performing loan. So till now I am foreseen and agreed

some said the valuation of gloves at the peak and already price in

currently for all gloves mostly. But I am still intrested to see

incoming next quater results. I also hope the results for all gloves

excellent and superb.

For now, the return of the retail investor have been the major support

of the stock market rally. However, will they exit soon, as the market

currently seems to be consolidating. With more retail investors

participating in trading, we can expect volumes to stay, though expect

herd mentality. In the longer run, second half of this year would show

better prospects than first half. As I mentioned earlier a couple months

ago, this gloves sector has entered the defender territory sector. Due

the pandemic Covid-19 keep increasing global cases nowdays, especially

US and Brazil, my predicting 10 millions cases has been hit and US with 5

millions cases coming soon. My view on this sector, can be resume again

in a long-run after market consolidating finished in June.

Recently, Gloves stocks movement high volatility after margin capping

imposed by IB’s. I had wrote my view before, while I read some

newspapers had published an article with the title ” Malaysian banks

cheaper than glovemakers as mania continues”. Since that, people are

notified that glovemakers can go for long-term play investment. This my

another reason for me and I foresees this sector have a big potential

and still strong on demand supply.

So in my view glove stocks currently, It has been finished phase 3

consolidation and “They” are trying hard to push it down and flush all

the small players. ESPECIALLY the warrant traders. They had lose too

much in warrants because they are not expected too much rallies from

Glovemakers.

My short points of view now as follows :-

- If you targeted for long-term investment. I foresee and agree for those holding Big-Four Gloves ( Topglove, Harta, Kossan & Supermax) can keep it and hold till next quater result.

- Strong orders and demand are expected to continue for the next one or two years. This statement I agreed for what big-player said. Only who had received ordered from US and other countries, it can easily increase its selling price for gloves.

- Vaccine COVID-19 still ongoing test and taking long time-frame a year

- Demand for gloves will continue to exceed supply. So this is my points, why im pointing my finger to IB’s. I wont say there is a “game plan”. But it look like yes. As a result, glove price will continue to increase and all the glove manufacturers are making more money which should be reflected on their share prices.

- So those asking about the Future of Glove Stocks. I already answered it. You can make a good decision of yours.

KIM'S TARGET PRICE (latest)

STOCK 1 : TOP GLOVE CORPORATION BERHAD

Target Price : [ TP5: RM30 - TP6 RM35 ]

Last target : RM40 (Mac-2021 - Last target depend on COVID-19 situation)

* All target prices has been revised from 6.05 - 6.10 Buycall.( Old Target )

* My previous blogs :

01. TopGlov Kim01

02. TopGlov Kim02

03. TopGlov Kim03

04. TopGlov Kim04

STOCK 2 : HARTALEGA HOLDINGS BERHAD

Target Price : [ TP5: RM25 - TP6 RM30 ]

Last target : RM35 (Mac-2021 - Last target depend on COVID-19 situation)

* All target prices has been revised from 6.38 - 6.40 Buycall.( Old Target )

* My previous blogs :

02. Harta Kim02

03. Harta Kim03

04. Harta Kim04

STOCK 3 : KOSSAN RUBBER INDUSTRIES BERHAD

Target Price : [ TP5: RM16 - TP6 RM18 ]

STOCK 4 : SUPERMAX CORPORATION BERHAD

Target Price : [ TP5: RM12 - TP6 RM15 ]

Last target : RM20 (Mac-2021 - Last target depend on COVID-19 situation)

* My previous blogs :

* All target prices has been revised from 1.50 - 1.60 Buycall.( Old Target )

01. Supermx Kim01

02. Supermx Kim02

03. Supermx Kim03

04. Supermx Kim04

05. Supermx Kim05

06. Supermx Kim06

07. Supermx Kim07

08. Supermx Kim08

Lastly, don't forget to click on our telegram link above and join us. Let us give you the latest update on the stock market and our group development. We hope you enjoy reading our blogs and give us your support.

If you would like to know more about

Kim's Group Trader (KGT) and Kim's Investment Club (KIC). You may reach

out to us via link above.

Best Regards,

Disclaimers: The research, information and financial opinions expressed in this article are purely for information

and educational purpose only. We do not make any recommendation for the intention of trading purposes nor is it

an advice to trade. Although best efforts are made to ensure that all information is accurate and up to date,

occasionally errors and misprints may occur which are unintentional. It would help if you did not rely upon the

material and information. We will not be liable for any false, inaccurate, incomplete information and losses or

damages suffered from your action. It would be best if you did your own research to make your personal investment

decisions wisely or consult your investment advisor.

https://klse.i3investor.com/blogs/spartan/2020-07-09-story-h1509826040-MY_NEXT_GLOVES_COUNTER_TO_SKYROCKET.jsp