With NASDAQ reaching new high in the past few weeks, the technology

sectors seems to be making a comeback. With some of the tech stock

rallying to some of the new highs (even higher than before the plunge in

March), one of the stock has caught my attention.

*I'm just a newbie in this field and this is just my thoughts. My views are not a buy/sell call. This is just my 2 cents on this counter.

Presbhd: Looking back on what has occured in the past week

1) A new judicial commissioner - Datuk Seri Latifah has been appointed to hear the case (involving the cancellation of the SKIN Project, a RM732.86mil suit between Presbhd against Malaysia Government). The date has been fixed on Jan 21,22 2021.

2) Dr Abu Hassan Ismail (founder, president cum CEO of Presbhd) has subscribe to 79.58mil shares in Presbhd (15% stake) through a private placement exercise. The price per subscription is at 35 cents.

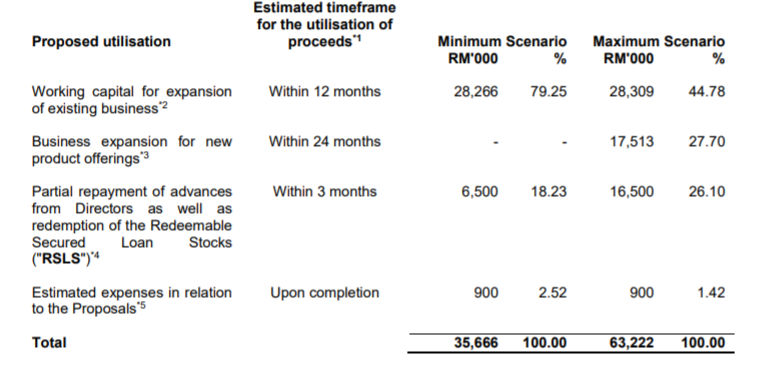

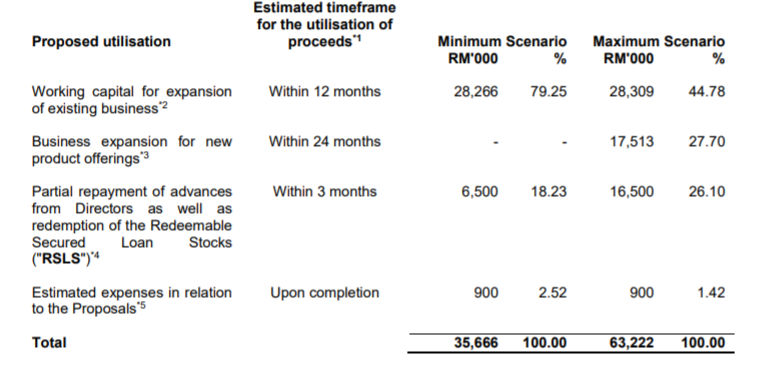

3) Presbhd has announced a rights issue exercuse. It is expected to raise RM35.57 million (or 176.84mil shares @ RM0.20). For every three Presbhd shares, shareholder is entitled to 1 rights share and 1 free warrant. The proceeds will be utilised in the following manner:

*Extracted from the announcement dated 23 July 2020.

4) Affinhwang Multi Asset Fund has been acquiring a total of 20mil shares in Presbhd (20 Jul - 22 Jul 2020), raising their direct interest to 11.31% (currently holding 60mil Presbhd shares).

What caught my attention

Many people told me that having a rights issue right now is like taking a suicidal pill. This is because the timing of having a rights issue right now would mean that the company is in deep trouble, having no alternative cash or cashflow to fund their business. As such, they seek to raise money from shareholders.

However, given the fact, the share price closes at RM0.505 on friday even though the rights issue were announced. This is a good sign.

On top of that, the owner of the company willingly subscribe to the shares at RM0.35. The rights issue provide an avenue for shareholders to subscribe it at RM0.20 with free warrant attached. Why would anyone pay for something more expensive and provide the shareholders to subscribe to something that is way cheaper? This makes no sense to me at all.

Technical Chart

Technical wise, the chart seems to be doing well. With friday closing price at RM0.505,

1) The price is above its 7,14, 200 Moving Average.

2) With the chart forming a double bottom, this is a good reversal trend, showing that the stock is bullish.

3) Bullish engulfing is formed.

Feel free to drop me a message/comment below for your input. Hopefully we can have a healthy discussion on this counter.

https://klse.i3investor.com/blogs/starringpresbhd/2020-07-26-story-h1510751236-Something_is_brewing_within.jsp

*I'm just a newbie in this field and this is just my thoughts. My views are not a buy/sell call. This is just my 2 cents on this counter.

Presbhd: Looking back on what has occured in the past week

1) A new judicial commissioner - Datuk Seri Latifah has been appointed to hear the case (involving the cancellation of the SKIN Project, a RM732.86mil suit between Presbhd against Malaysia Government). The date has been fixed on Jan 21,22 2021.

2) Dr Abu Hassan Ismail (founder, president cum CEO of Presbhd) has subscribe to 79.58mil shares in Presbhd (15% stake) through a private placement exercise. The price per subscription is at 35 cents.

3) Presbhd has announced a rights issue exercuse. It is expected to raise RM35.57 million (or 176.84mil shares @ RM0.20). For every three Presbhd shares, shareholder is entitled to 1 rights share and 1 free warrant. The proceeds will be utilised in the following manner:

*Extracted from the announcement dated 23 July 2020.

4) Affinhwang Multi Asset Fund has been acquiring a total of 20mil shares in Presbhd (20 Jul - 22 Jul 2020), raising their direct interest to 11.31% (currently holding 60mil Presbhd shares).

What caught my attention

Many people told me that having a rights issue right now is like taking a suicidal pill. This is because the timing of having a rights issue right now would mean that the company is in deep trouble, having no alternative cash or cashflow to fund their business. As such, they seek to raise money from shareholders.

However, given the fact, the share price closes at RM0.505 on friday even though the rights issue were announced. This is a good sign.

On top of that, the owner of the company willingly subscribe to the shares at RM0.35. The rights issue provide an avenue for shareholders to subscribe it at RM0.20 with free warrant attached. Why would anyone pay for something more expensive and provide the shareholders to subscribe to something that is way cheaper? This makes no sense to me at all.

Technical wise, the chart seems to be doing well. With friday closing price at RM0.505,

1) The price is above its 7,14, 200 Moving Average.

2) With the chart forming a double bottom, this is a good reversal trend, showing that the stock is bullish.

3) Bullish engulfing is formed.

Feel free to drop me a message/comment below for your input. Hopefully we can have a healthy discussion on this counter.

https://klse.i3investor.com/blogs/starringpresbhd/2020-07-26-story-h1510751236-Something_is_brewing_within.jsp