Join our Telegram Channel : https://t.me/TriumphinBursa

19 July 2020

Last two trading days, MARKET all heat up on Ancom Bhd, Ancom Logistics Bhd.

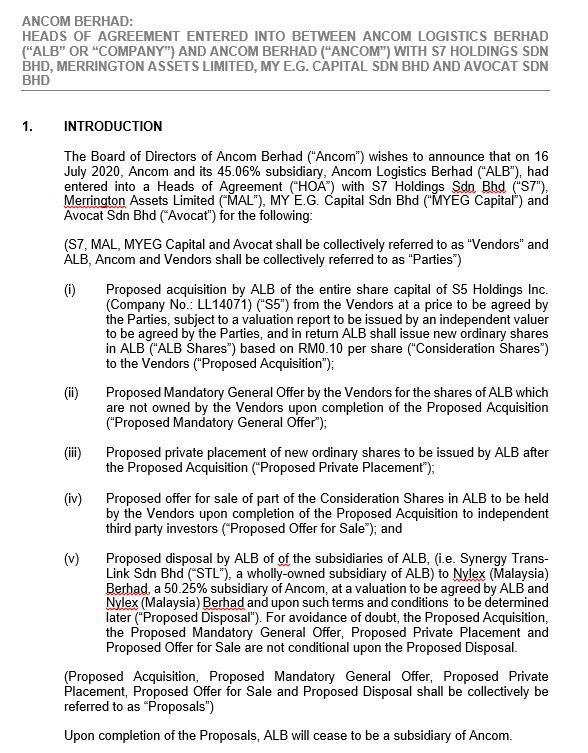

Source said that Ancom, AncomLB and Nylex (Malaysia) Bhd will undergo a restructuring exercise that will see the logistics business move to Nylex and the entry of immigration technology company S5 Holdings Inc into Ancom Logistics.

Who is S5? Background & Key Personnels

S5

is a private company which is mainly involved in the provision of

security technology, intellectual property as well as the development

and customisation of solutions and systems, consultancy and support in

all related information technology and security industries.

The

directors of S5 are Tuan Syed Mohammad Hafiz Syed Razlan, Aaron Loke

Khy-Min (Ex CFO of PRIVA), Kurian Thomas Jacob Thomas, Chan See Siang

and Effendi Ramli.

Syed

Mohammad Hafiz's father Syed Razlan Syed Putra Jamalullail is the

younger brother of Raja Perlis Tuanku Syed Sirajuddin Putra Jamalullail.

Syed Razlan was former Arau MP and he joined Bersatu from Umno on July

15, 2018.

Syed Mohammad Hafiz also owns a 0.42% stake in listed automobile leather seat designer Pecca Group Bhd. (PPE-Venturing : https://www.theedgemarkets.com/article/pecca-group-joins-list-bursalisted-firms-venturing-ppe-production)

S5 Financial INFO

Data #1

According to the latest filings, S5 Systems’ total assets stood at RM82.7 mil with revenue of RM116.8 mil and a profit-after-tax of RM68.3 mil for the financial year ended June 30, 2019.

https://focusmalaysia.my/mainstream/who-owns-this-company-vying-for-rm1-5-bil-immigration-system-tender/

Data #2

S5 has net assets amounting to RM21.7mil and registered a net profit of RM63.4mil for its financial year ended June 30,2019 (FY19), according data from the Companies Commission of Malaysia (SSM). https://www.klsescreener.com/v2/news/view/703983

https://www.thestar.com.my/business/business-news/2020/07/18/ancom-springs-a-surprise

Data #1

According to the latest filings, S5 Systems’ total assets stood at RM82.7 mil with revenue of RM116.8 mil and a profit-after-tax of RM68.3 mil for the financial year ended June 30, 2019.

https://focusmalaysia.my/mainstream/who-owns-this-company-vying-for-rm1-5-bil-immigration-system-tender/

Data #2

S5 has net assets amounting to RM21.7mil and registered a net profit of RM63.4mil for its financial year ended June 30,2019 (FY19), according data from the Companies Commission of Malaysia (SSM). https://www.klsescreener.com/v2/news/view/703983

https://www.thestar.com.my/business/business-news/2020/07/18/ancom-springs-a-surprise

FINANCIAL INFO FOR ANCOMLB

Let's do some maths. +-+-+-

With the super handsome PROFIT & REVENUE, the EPS super duper Handsome.

How much is S5 market value ?

"MyEG said the proposed RTO provides an avenue to unlock its initial investment — of RM90 million for a 10% stake in S5, thus roughly valuing the company at a whopping

RM900 million !!! "

https://www.theedgemarkets.com/article/myeg-disposes-stake-s5-ancom-logistics-five-weeks-after-announcing-purchase

FUTURE PROSPECT

National Integrated Immigration System (NIIS)

(To be announced on August 2020.)

(To be announced on August 2020.)

This is an RM1.5 bil project

expected to be awarded during the third quarter of this year. The

contract is for a total of 4.5 years including three years of

development, six months of monitoring and a final year of maintenance.

After that, there is another maintenance contract which would be around 15%-20% of the value of the project.

Who are the FRONTRUNNERS then?

Dsonic, HTPADU, MYEG, IRIS, SCICOM.

Who are the FRONTRUNNERS then?

Dsonic, HTPADU, MYEG, IRIS, SCICOM.

Then nothing related to S5 ????? RELAX lahhhhh.

https://www.theedgemarkets.com/article/deciphering-niis-bidding-war

1. MyEG–Heitech Padu–S5 consortium the frontrunner

Meanwhile, MyEG, which is acquiring a 10% stake in S5, is said to be

bidding for the contract with Heitech Padu. The latter currently

maintains the Malaysian Immigration System (myIMMS) through a three-year

contract signed with the Immigration Department in 2017.

2. WHOEVER WINS, S5 also WINS.

An interesting point to note is that S5

Systems Sdn Bhd is said to be involved in almost every bid. Industry

players say the company has put in bids as part of various consortia

with companies like MyEG, Iris and Heitech Padu.“S5 Systems approached almost all the bidders and offered them its biometric solutions as part of their bid,”

“Whoever wins the contract, S5 Systems [also] wins,”

“This company is going to be a big player in the country’s cyber security and information technology system industry, especially once it gets listed,”

It is not clear whether the tender allows for a company to put in bids through multiple consortia. However, one executive privy to the tender process says it would not be a problem if the company is just listed as a supplier.

So what's your thought now for S5?

How much does it worth in your opinion ?

Goreng Char Koay Teow lagi? Atau over-valued lahh?

(Side View :We collected MYEG & DSONIC also as we see potential on these two gov-link tech companies)

If you like our sharing,

Join our Telegram Channel:

https://t.me/TriumphinBursa

https://klse.i3investor.com/blogs/triumphinbursa/2020-07-19-story-h1510607142-S5_Whats_going_on_ANCOM_ANCOMLB_NYLEX_MYEG_Involved_By_TriumphinBursa.jsp