TYYAP ~ TOPGLOV (7113) TOP GLOVE CORPORATION BHD & HARTA (5168) HARTALEGA HOLDINGS BHD Analysis

2020年是医疗手套工业辉煌的一年,由于“新冠肺炎”传染疾病的全球高传染性而令全球市场医疗手套供应紧凑,医疗手套的销售量与价格都双双提高几倍。医疗手套业也是我国“马来西亚”的骄傲,暂居市场需求量的65%供应量,也是全世界制造医疗手套业最先进的国家,也是高品质的医疗手套业制造原产地。我本人投资在医疗手套业的上市公司,几乎令我可以一生衣食无忧~

T.Y.YAP

HOW LONG CAN GLOVE RUN?

SHOULD INVESTOR CONTINUE TO INVEST AT THE PRICE NOW?

SHOULD INVESTOR CONTINUE TO INVEST AT THE PRICE NOW?

- COVID-19 Pandemic

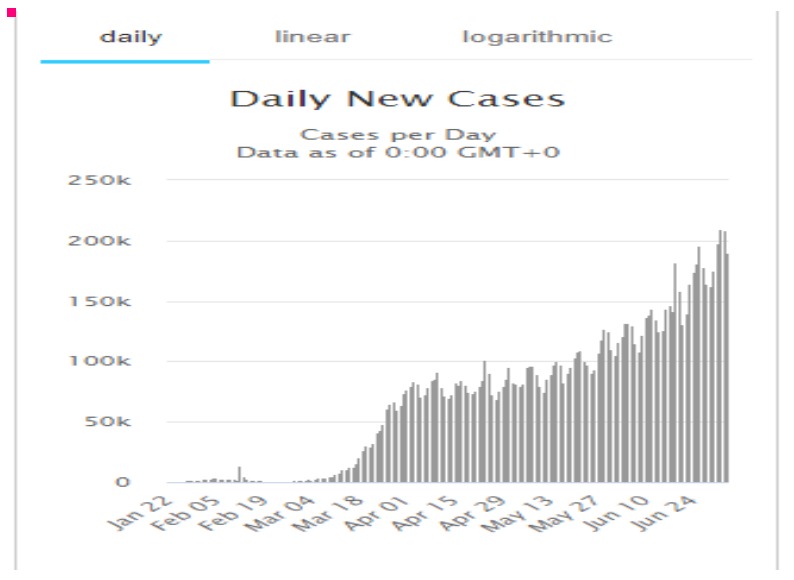

- Referring to the chart below, Covid-19 cases are still on the rise and there is no indication that it will slow down anytime soon.

- As of today dated 5th July 2020 the total number of cases is 11.39Million with USA, Brazil, Russia and EU being in the top of charts.

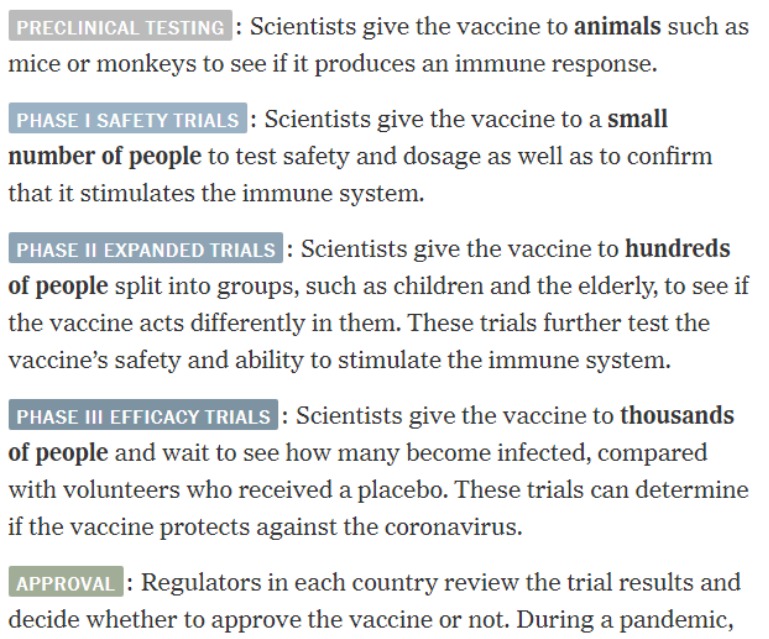

- Vaccine, to date, more than 145 vaccines are being developed and 21 are in human trials. Below are how Vaccine trial is being tested;

- A possibility of 2nd wave is already quite imminent with multiple country experiencing surge of cases and reactivation of partial lockdown in certain country. This coupled with the seasonal flu which usuallly start in September/October (Winter season) may exacerbate the situation further leading to a possible huge 2nd wave impact.

- As countries in the world are struggling in re-opening their economy they are also taking huge risk in further spreading the disease.

2. So what will this translate to the DEMAND for GLOVES ?

- There are already multiple report and analysis from local institutions (kenanga, macquarie, maybank etc) and overseas institutions (marketwatch, nikkei, financial times etc) which have noted and are well aware of the SUPER NORMAL DEMAND for rubber gloves in MEDICAL FIELD

- Not only in the medical field, it is also noted that other industries (F&B, Industrial, Services etc) are also pouring in requests for Nitrile gloves which are less allergenic compared to Latex gloves.

3.Malaysia Glove Industry Big 4 ( Hartalega, Topglove, Kossan, Supermax)

-

Malaysia

supplies more than 60% of the world demand, given this situation the

industry players especially the big 4 of the industries are well

positioned to gain ENORMOUS benefit from this demand as we noted the

below positive points :

-

CAPACITY INCREASE

- Topglov estimated annual production of 78billion gloves in 2020

- Hartalega estimated annual production of 40billlion gloves in 2020

- Kossan estimated annual production of 32billion gloves in 2020

- Supermax estimated annual production of 26.2billion gloves in 2020

-

AVERAGE SELLING PRICES

-

From our trusted internal sources

- Most company ASP are up by 5-15% month to month basis since May 2020

- Spot order price soars as much as USD170 per carton

-

From our trusted internal sources

-

TECHNOLOGY

- Malaysia glove industry are the world most advanced compared to other country piers, providing a consistent and reliable quality glove which have slated our industry players the major suppliers to USA and EU.

- EXISTING PRESENCE IN THE MARKET

-

CAPACITY INCREASE

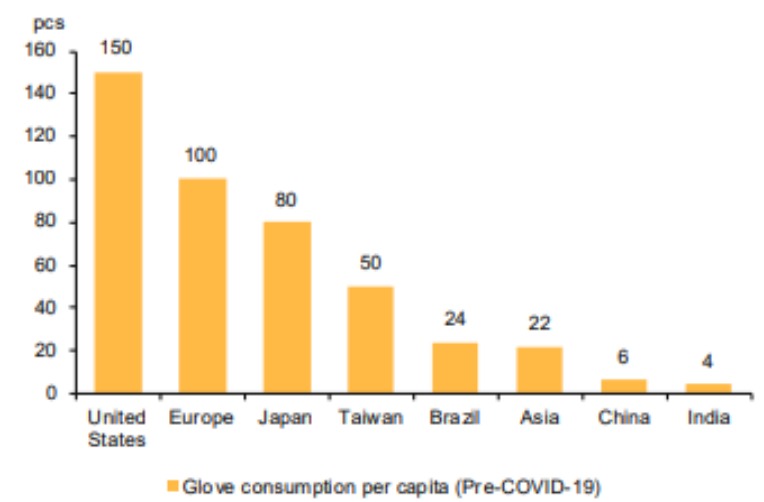

- As per research glove consumption has been on the rise in both developed and developing country as medical field continue to advance further.

- Figure below shows the pre-covid data on the top consumption of glove per capita of the country

3.)As our industry are already well established in USA and Europe, the surge in demand are well received by our glove makers

4.) What's the fair value then?

- Our top picks are still TOGLOVE & HARTALEGA,Why?

THE RELATIONSHIP BETWEEN AVERAGE SELLING PRICE (ASP) AND PROFIT MARGINS

- ASP is the single most important factor boosting the current glove industry into the next level.

- Many do not understand how this works, thus giving and example below :

Assuming

a company produce 1billion gloves and are able to generate a sales of

RM100 million (RM0.10 per glove ASP) and an average cost of RM90

million, the company will gain a net profit RM10 million (RM0.01 per

glove)

Just

by a mere increment of 30% ASP, the same company generating 1billion

gloves will then be able to generate a sales of RM130 million, however

the cost is still fixed at around RM90 million and giving the company a

net profit of RM40 million with is a tremendous 300% gain.

Knowing this, if the ASP continue to rise, can you imagine the impact to their financial bottom lines?

Knowing this, if the ASP continue to rise, can you imagine the impact to their financial bottom lines?

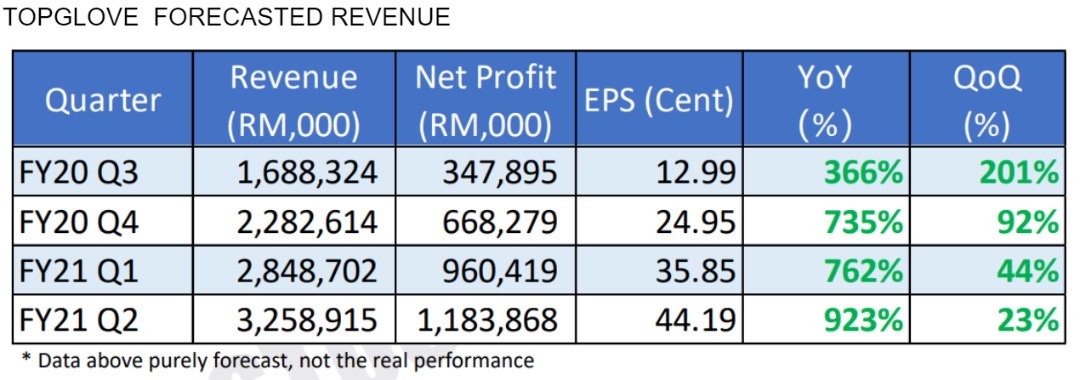

- According to information my group collected to date,

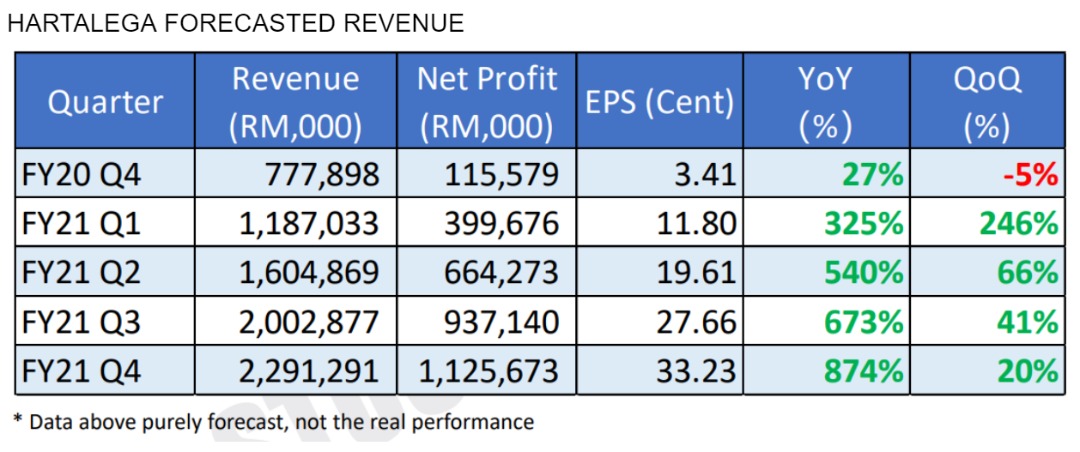

TOPGLOVE FORECASTED REVENUE

A possible full year EPS of RM1.18 coupled with :

- PE20 a possible share price of RM23.60

- PE25 a possible share price of RM29.50

- PE30 a possible share price of RM35.40

A possible full year EPS of RM0.92 coupled with :

- PE25 a possible share price of RM23.00

- PE30 a possible share price of RM27.60

- PE35 a possible share price of RM32.20

Despite

this it doesn’t means that we’re not interested in other glove

counters, it is however we had manage to receive more information on the

above 2 companies compared to others as such we are more keen in going

with what we CONFIRMED than speculations as we can see from other

smaller players which reported a somewhat under expected results.

We’re

quite sure the ASP of the above 2 companies is now already at least

100% or more since April 2020, and are still in the rise especially

since their orders have been confirmed till year 2021.

Vaccine

is still the major concern for the gloves industry as it may spell an

end to the COVID-19 pandemic however medical experts have already

informed that the earliest possibility of vaccine will be by next year.

Given this I strongly believe the trend of glove movement is still intact given the recent corrections in the chart and especially when all big 4 gloves companies have now entered into their newest high prices as per our prediction forming a new higher high for the uptrend patterns.

*Note : Im holding Supermx as well, I believe it will be the company with the largest share price increase in 2020

(The average selling price of Supermx is the highest in the industry)

(The average selling price of Supermx is the highest in the industry)

https://klse.i3investor.com/blogs/tyyapglove88/2020-07-05-story-h1509767134-TYYAP_Topglov_Harta_Analyst.jsp