BTM (7188) BTM RESOURCES BERHAD A STOCK WITH HUGE UPSIDE POTENTIAL & HIGHLY POSSIBLE TAKE-OVER TARGET !!!

A STOCK WITH HUGE POTENTIAL UPSIDE & HIGHLY POSSIBLE TAKE-OVER

TARGET !!!

Hello to all readers out there. Recently we saw many penny stocks rallying in BSKL, and some even hitting limit up.

Having said the above, the stock which I'd like to talk about today is BTM RESOURCES BERHAD (BTM - Stock Code 7188, Main Market, Industrial Products & Services)

BASIC INFORMATION ABOUT BTM

BTM was founderd in 1994 with core businesses in a few fields:

i) Logging

ii) Sawmilling

iii) Kiln Drying

iv) Moulding

Market Capitalization : RM 28.98 million

Shares Float : 141.34 million

Website : http://www.btmresources.com.my/

1. VENTURE INTO POWER PLANT BUSINESS TO GENERATE ADDITIONAL

REVENUE IN LONGER TERM

Refer

news link below. BTM announced in early July 2020 that it had obtained

approval to operate 10 mega-watt (MT) power plant in Chukai,

Terengganu.

It is expected that a power purchase agreement (PPA) will be signed with TNB in October 2020.

This would greatly contribute to future earnings of this company.

2. SMALL MARKET CAP & LOW FLOAT SHARES MAKES IT ATTRACTIVE AS A

TAKE-OVER TARGET

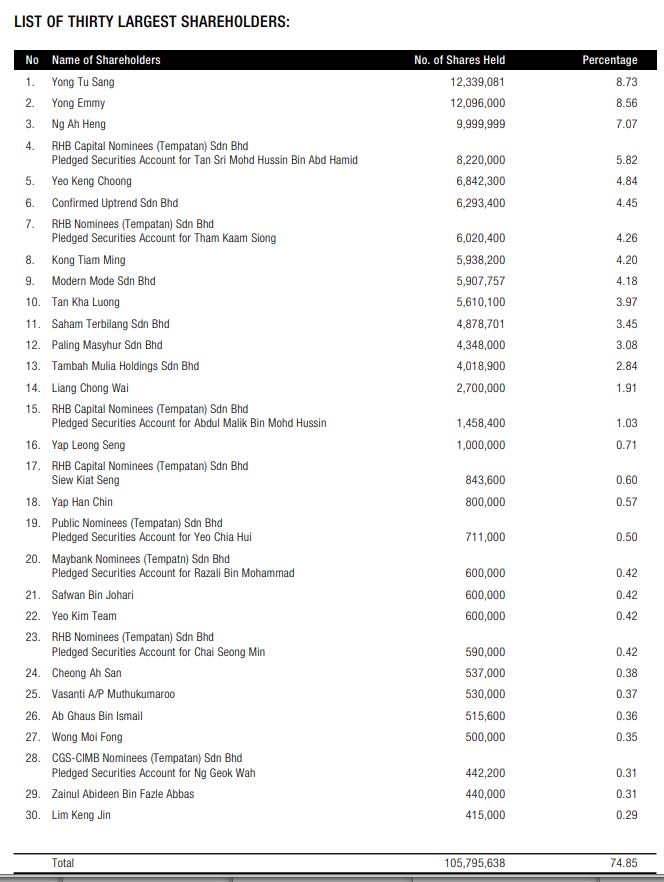

The

current market cap as at writing is RM 28.98 million with float shares

of about 141.34 million. Refer below the latest shareholding list as of

latest 2019 Annual Report.

It

shows that Top 30 shareholders are holding 74.85% of the company. This

means that the actual float in the market is very little should the top

30 shareholders be long term investors.

Also,

we do notice that none of the directors or major shareholders sold

shares during the recent COVID19 market crash, which indicates a good

and healthy sign that they are invested in the longer term prospect of

the company.

3. TECHNICAL ANALYSIS - BREAKOUT ON MONTHLY CHART, FURTHER

UPTEST TOWARDS NEXT RESISTANCES

Refer below the basic price and volume chart with key EMAs for BTM monthly chart :

A few observations on the monthly chart:

i. BTM has been downtrending since hitting a high of 45c in 2015

ii.

Since then, there had been a few attempts to breakout the downtrend,

however all ended up fail and resuming the downtrend pattern

iii. Refer to Circle 1, recently volumes had started to take interest in BTM, and price had shown a breakout of the downtrend

iv.

Refer to Circle 2, the downtrend breakout, would possibly be followed

by a test towards next resistances, which I had identified at 25c, 30c,

and 37c.

Refer below the basic price and volume chart with key EMAs for BTM daily chart :

A few observations on the daily chart:

i. Formed an inverted head and shoulders pattern (bullish pattern)

ii. Refer to Circle 1, volume is building up at the breakout zone

iii.

Refer to Circle 2, a solid MARUBOZU candle formed today. A breakout

above 20c price would mean next resistance to be tested around 25c and

next towards 30c and 37c

4. CHEAPER ENTRY INTO BTM VIA BTM WARRANT-B (BTM WB)

Following is the profile of BTM WB, for traders looking at lower cost entry into this stock. A few comments:

i. Maturity is October 2024, which means very ample time to hold on to before expired

ii. Premium of 57% is considered quite reasonable, with the amount of life left for this warrant

iii. Strike price of 20c, which is 1c from the latest mother shares closing price

iv. Very low gearing, indicating high sensitivity of this warrant relative to the mother shares movement

CONCLUSION

Considering all the above, I opine that current price for BTM is attractive due to below:

i) Venture into Power Plant in Terengganu to generate additional earnings in the longer term

ii) Small float shares and low market cap, making it an attractive target for take-over

iii) Monthly chart showing breakout of downtrend, and further uptest to the next resistances is possible

iv) Daily chart formed an inverted head and shoulders bullish pattern, with a solid marubozu candle formed today

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The

above opinion is never intended to be a BUY CALL whatsoever. I am

sharing my observations ONLY based on fundamental; past history; current

trading pattern; charts etc. Please make your own informed decision

before buying this share or whatever share for that matter.

BURSAMASTER

https://klse.i3investor.com/blogs/Bursa_Master/2020-08-10-story-h1511620935-A_STOCK_WITH_HUGE_UPSIDE_POTENTIAL_HIGHLY_POSSIBLE_TAKE_OVER_TARGET.jsp

https://klse.i3investor.com/blogs/Bursa_Master/2020-08-10-story-h1511620935-A_STOCK_WITH_HUGE_UPSIDE_POTENTIAL_HIGHLY_POSSIBLE_TAKE_OVER_TARGET.jsp