DYNACIA (5178) DYNACITE GROUP BERHAD - CLOSELY LOOK OUT FOR THIS EXPLOSIVE STOCK !!!

DYNACIA - CLOSELY LOOK OUT FOR THIS EXPLOSIVE STOCK !!!

Hello

to all readers out there. In the recent week, CONSTRUCTION stocks had

started to show some momentum in BURSA. Some sector leaders moving were

GAMUDA, IWCITY, EKOVEST, GADANG and many more.

Having said the above, the stock which I'd like to talk about today is DYNACITE GROUP BERHAD (DYNACIA - Stock Code 5178, MAIN Market, Industrial Products & Services)

BASIC INFORMATION ABOUT DYNACIA

DYNACIA was incorporated in May 2002 with core businesses in a few fields:

i) Construction, property development & property investment

ii) Steel

Market Capitalization : RM 64.91 million

Shares Float : 590.12 million

Website : https://dynaciate.com.my/

1. SHIFT FROM STEEL TO CONSTRUCTION BUSINESS

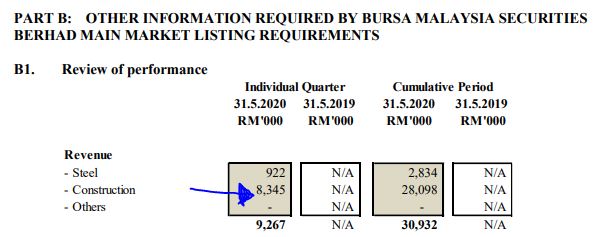

Refer

latest summary of segmental information from QR. We can see that as of

latest, nearly 90% of its revenue is derived from CONSTRUCTION segment.

Therefore, I believe that DYNACIA should be recategorized into

CONSTRUCTION sector instead of Industrial Products & Services.

On

9 November 2018, the emergence of Dynaciate Engineering Sdn. Bhd.

(“DESB”) as a new major shareholder together with the appointment of

Khoo Song Heng and Woon Kok Kee as executive Board members saw a change

in the fortune and direction of the Group. DESB (together with its group

of companies) is a well-known integrated service provider of

engineering, procurement, construction management, maintenance and

project management solutions for over 18 years in Malaysia as well as

Singapore.

Their

close association with DESB is cemented and they assumed the name of

Dynaciate Group Berhad on 20 February 2019. Through this close

association and injection of their wealth of experience and expertise,

the Group has managed to secure two (2) projects for the construction of

plants and facilities from two (2) reputable clients, namely, MIE

Industrial Sdn. Bhd. and Oncogen Pharma (Malaysia) Sdn. Bhd..

The

shareholders of the Company had approved the disposal of the Penang

Land and properties for a total cash consideration of RM41.00 million at

an EGM held on 21 January 2020 to Mgudang Sdn. Bhd., a wholly-owned

subsidiary of MMAG Holdings Berhad. The disposal represents an

opportunity for the Group to unlock and realise its value with the

proceeds raised are earmarked for the construction segment which still

requires substantial funding to complete ongoing and future projects.

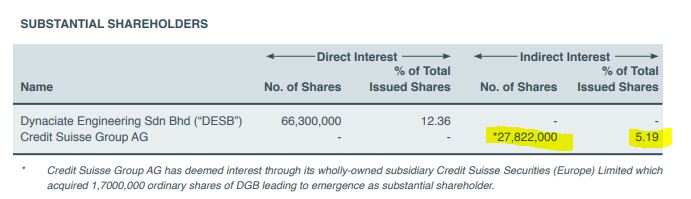

2. CREDIT SUISSE GROUP AG A MAJOR SHAREHOLDER WITH 5.19% STAKE

Refer

below list of major shareholders as at latest 2019 Annual Report. Aside

from DESB, which is the Construction arm of DYNACIA, we also see Credit

Suisse Group AG with a major shareholding of 5.19%.

As

such, there might be increased trading interest (local participant) in

this stock with the confidence of foreign investors in the company

business.

3. TECHNICAL ANALYSIS - BREAKOUT OF ACCUMULATION AREA WITH

STRONG VOLUME INTEREST, BREAKOUT OF ALL MAJOR EMAs

Refer below the basic price and volume chart with key EMAs for DYNACIA weekly chart :

A few observations on the weekly chart:

i.

Refer Circle 1, there were very little weak holders selling during the

COVID19 crash in March 2020, implying that the stock has more strong

holders compared to weak holders

ii.

Refer 2 & 3, DYNACIA had broken out above the accumulation area of

between 8-9c, and also broken out above all major EMAs including long

term EMA of EMA200 and EMA365

iii. Next resistances seen at R1 22-25c and R2 36-38c

CONCLUSION

Considering all the above, I opine that current price for DYNACIA is attractive due to below:

i) DYNACIA diversifying as a majority Construction company as compared to Steel

ii) Credit Suisse a major shareholder with 5.19% stake in the company

iii) Chart showing breakout of all key EMAs and accumulation zone, with significant volume interest

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer

: The above opinion is never intended to be a BUY CALL whatsoever. I am

sharing my observations ONLY based on fundamental; past history;

current trading pattern; charts etc. Please make your own informed

decision before buying this share or whatever share for that matter.

BURSAMASTER

https://klse.i3investor.com/blogs/Bursa_Master/2020-08-30-story-h1512603327-CLOSELY_LOOK_OUT_FOR_THIS_EXPLOSIVE_STOCK.jsp

https://klse.i3investor.com/blogs/Bursa_Master/2020-08-30-story-h1512603327-CLOSELY_LOOK_OUT_FOR_THIS_EXPLOSIVE_STOCK.jsp