There were so many views (click and read) on my previous post FINTEC-PA Fat Frog.

For comparison to my other post on 1st Aug, it was 16+ times.

This encourage me to write further on FINTEC derivatives.

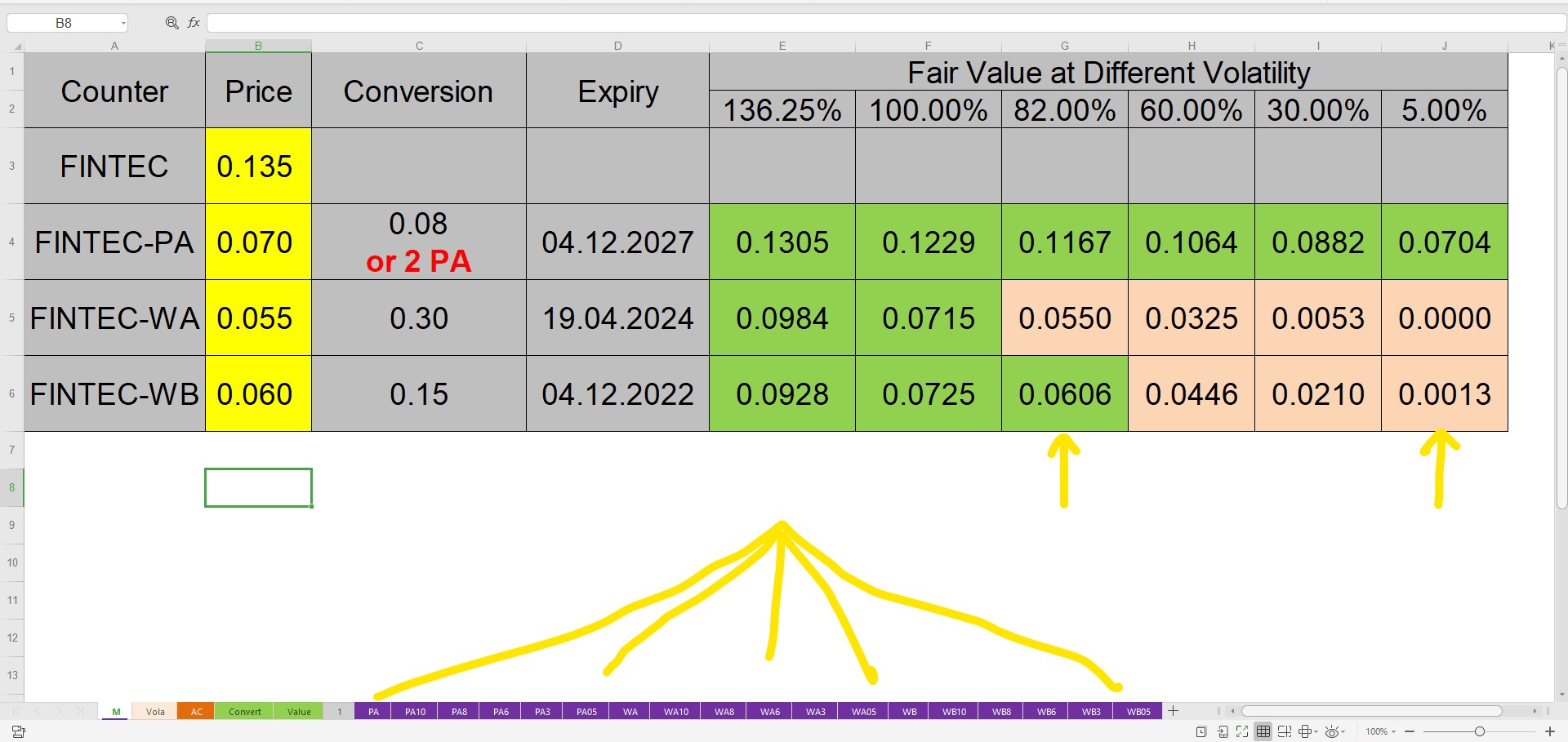

Today I include the following into my calculation:

1) FINTEC-WA and FINTEC-WB

2) What if the Future Volatity is different from the last 90 trading days? So I calculate also for 100%, 82%, 60%, 30% and 5%.

3) PA, WA and WB at 6 different Volatility, that need 3 x 6 = 18 sheets.

Discussion:

1) WA market price 0.055 was equal to 0.0550 (fair value if Volatility is 82%), WB market price 0.060 was closed to 0.0606 (fair value if Volatility is 82%). Meaning to say the Implied Volatility (IV) for WA and WB are both at 82%.

2) In another word, buyers/sellers of WA/WB "thought and accept" that FINTEC future Volatility should be around 82%, else they would not have bought/sold them at that market price.

3) What is the IV for PA? You can see from screen shot, it was 5%. The same logic apply, buyers/sellers of PA "thought and accept" that FINTEC future Volatility should be around 5%, else they would not have bought/sold at that market price.

4) Then, a big question is, the underlying asset is the same for WA, WB and PA which is FINTEC, how could the IVs are so much different? May be they thought and accept that the future Volatility from now to 2024 is going to be very high, and would come down to very low after 2024? However I think this does not make sense at all.

5) I think most probably the traders are just trading without any proper calculation!

6) Trade at your risk, at your own risk, and at your own risk.

https://klse.i3investor.com/blogs/gambler/2020-08-23-story-h1512482926-Fair_Value_of_FINTEC_PA_WA_and_WB_at_Different_Volatility.jsp