MINHO (5576) MINHO (M) BERHAD THIS STOCK WILL SPEED LIKE A LUMBERGHINI SOON !!!

MINHO - THIS STOCK WILL SPEED LIKE A LUMBERGHINI SOON !!!

Hello

to all readers out there. Recently I saw a spike in lumber prices as

economies reopen and infrastructure projects are resumed.

re

resumed. Refer below lumber future prices from investing.com, we see

that lumber is now at USD 681.40, up from a lot of USD 250 in April

2020. This indicates a gain of 173% for this commodity as of to date.

Having said the above, the stock which I'd like to talk about today is MINHO (M) BERHAD (MINHO - Stock Code 5576, Main Market, Industrial Products & Services - Wood & Wood Products)

BASIC INFORMATION ABOUT MINHO

MINHO was listed in BSKL in 1993 with core businesses in a few fields:

i) Manufacturing, exporting and dealing in timber products

ii) Kiln drying and chemical preservatice treatment

iii) Operation of fully integrated timber complex

Market Capitalization : RM 103.86 million

Shares Float : 340.54 million

Website : http://www.minhobhd.com

1. RECENTLY TURNED PROFITABLE, AND FUTURE QR EARNINGS TO GROW AS

LUMBER PRICES SOAR HIGH

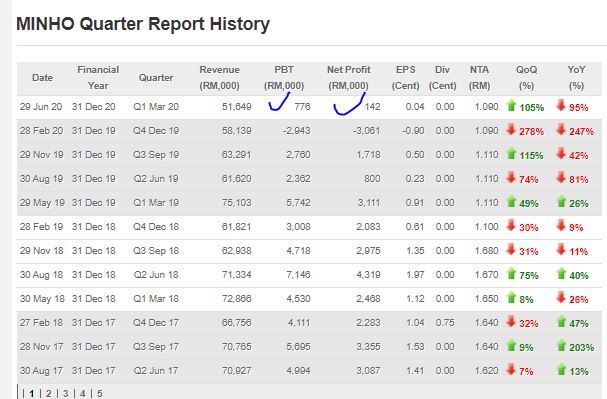

Refer

below image of the latest QR summary for MINHO. As we can see, MINHO

recently turned profitable after facing QR loss in February 2020.

As

lumber prices skyrocket from bottom in April 2020, I would expect that

earnings will be improving in the next quarter report due in August/Sept

2020.

2. TRADING AT HUGE DISCOUNT 72% TO NTA OF RM 1.09, AND HIGH ASSETS

VERSUS LOW LIABILITIES

Refer below the Assets VS Liability sheet for MINHO. A few key highlights : i

.

Total NTA is RM 1.09, versus latest closing price of 30.5c. This means a

total discount of 78.5c which means the share price is at a huge

discount to NTA (72% discount).

ii. Total cash position is RM 40.9 million, which has improved from last year same quarter of RM 32.7 million.

iii.

Total Assets at RM 504.2 million versus Liabilities of RM 94.2 million,

means a whopping surplus of RM 410 million in assets

3. TECHNICAL ANALYSIS - BREAKOUT CUP AND HANDLE PATTERN

Refer below the basic price and volume chart with key EMAs for MINHO daily chart :

A few observations on the daily chart:

i.

Refer Circle 1, very low selling during the COVID19 crash, indicates

strong holding by the major shareholders and investors in this company

ii.

Refer Circle 2 & 3, overall, the stock had formed a cup and handle

pattern, and made a strong breakout above the resistance, with

significant volumes entering the counter

iii. Next resistances appear to be at 34c and 39c

4. CHEAPER ENTRY INTO MINHO VIA MINHO WARRANT-C (MINHO WC)

Following is the profile of MINHO WC, for traders looking at lower cost entry into this stock. A few comments:

i. Maturity is August 2021, which means very ample time to hold on to before expired (about 12 months left)

ii. Premium of 28% is considered quite reasonable, with the amount of life left for this warrant

iii. Strike price of 32c, which is 1.5c from the latest mother shares closing price of 30.5c

iv. Very low gearing, indicating high sensitivity of this warrant relative to the mother shares movement

CONCLUSION

Considering all the above, I opine that current price for MINHO is attractive due to below:

i) Lumber prices skyrocket between April - August 2020 to contribute better earnings for MINHO

ii) Trading at 72% to NTA of RM 1.09, and Net Asset Versus Liability

iii) Breakout of Cup and Handle pattern in daily chart, moving towards next resistances 34c and 39c

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The

above opinion is never intended to be a BUY CALL whatsoever. I am

sharing my observations ONLY based on fundamental; past history; current

trading pattern; charts etc. Please make your own informed decision

before buying this share or whatever share for that matter.

BURSAMASTER

https://klse.i3investor.com/blogs/Bursa_Master/2020-08-12-story-h1511675871-THIS_STOCK_WILL_SPEED_LIKE_A_LUMBERGHINI_SOON.jsp