CiA.CONSORTIUM of INDEPENDANT ANALYST

@free@prob@wok@chief@dynasty@yfhew1

OBM -X

Supermax chose a business model of

differentiation by positioning itself as an OBM provider instead of OEM.

With this, their investment over the past 20 years has been focused on

establishing the delivery efficiency, distribution, and marketing. All

this with the aim of establishing brand loyalty and value. Their brand

equity would be synonymous to Louis Vuitton rather than Tesco.

With Covid. Supermax is able to be streamlined to OBM-X :

1.Xtra Customer base.

Supermax had captured many new and direct

customers (eg.major government bodies and agency) into their database

due to covid. These customers once captured will be long term customer

in future as Supermax will not lose out in terms of service and pricing

(who can win OBM interms of pricing. Not even china cheap gloves.) So

for those who keep worrying about new supply coming online should not

worry about supermax. Sometime its not only about pricing , Service and

Quality of product is of extreme importance. Likewise for other premium n

innovative glove product from malaysia.

No point for being able to produce good

gloves if one is unable to bring it to the market. Because they can

eXcel bringing their produce to the market and the right market that can

pay for the value.Hence, they have gained more customers than others.

2.Xtra Margin.

No brainer . Removal of middle man ,

agent and Big distributorhad completely overhauled the margin of

Supermax which permanently increase by 20-30% more. This increase is permanent

and even the ASP were to drop bak to precovid price (not likely due to

reasons stated in our previous article : VACCINE OR WITHOUT = GLOVE

STOCK RALLY!!!).

Super will be able to command a very high

net profit margin compared to precovid. No longer is the sub 10% margin

like in precovid.

Their brand equity and ability to market

this to the correct market which allows them to command a better margin

than others. In other words, their customers are also willing to pay

higher for it with satisfaction.

3.Xpanded Network.

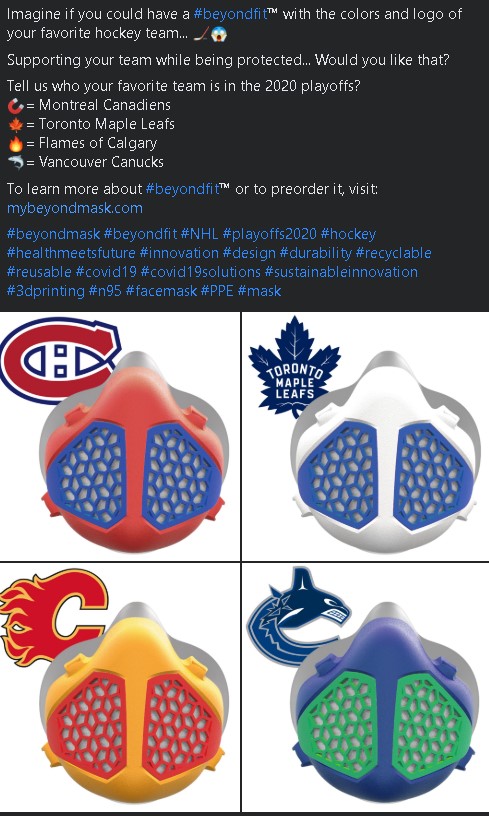

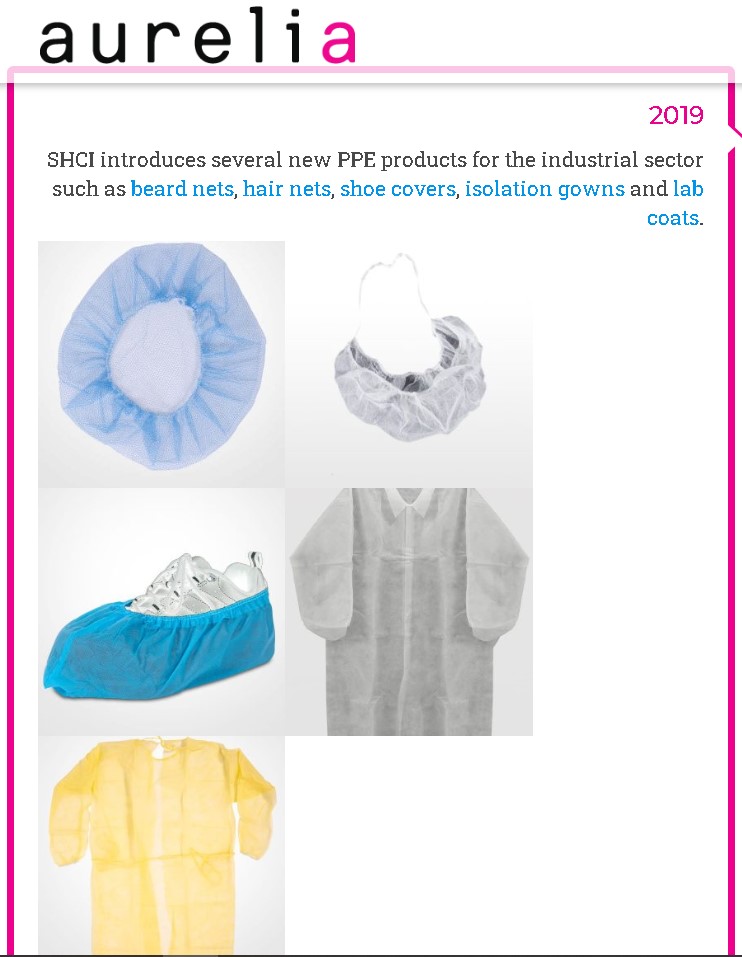

Due to this Covid. Supermax have

aggresively expanded into new distribution line such as more PPE like

mask,hand sanitizer, sanitary wipes and towels,faceshield,gown,

cost,hair net etc. The collaboration with Shapeshifter for worldwide

distribution of BEYONDMASK and Canada Government Mask Contract to be

annouced later. Korea distribution is expanding as well. We believe they

might acquire some of the largest distributor to become their

subsidiary. Aquisition of established distribution network is more

economical with a lot of potential.

Their contact lens had also improved by leaps n bound due to better publicity , advertising funding and network.

Don't be surprise in 2-3 yrs time, it will bring us the most explosive growth which other glove company doesn't enjoy.

Their knowhow and experience is an enabler for them to expand and reaching into new market segments faster than the others.

4. Xplosive Profit.

Needless to say. with pt 1 to 3 coupled with agressive capacity expansion equals explosive profit.This

permanent upgrade is unprecedented. Unlike previous outbreak. It is not

going back to precovid OBM margin and old customer base which is

controlled and squeezed by many middle man and big established

distributor.

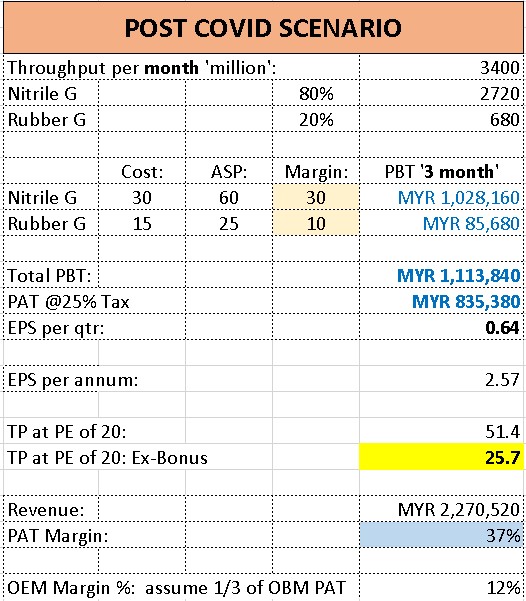

Here is a post covid scenario projection: (based on 48.4 million Caps @ 85% unitisialtion rate by end of 2022)

From the above conservative scenario projection. Super will still able to sustain high profit even it fall back to Precovid pricing with the OBM-X model.

The ascension from OBM to OBM-X should warrant a revaluation of Supermax since it is a structural and permanent upgrade.

The only weak point in supermax is

capacity. Now with explosive margin and profit. Supermax have planned to

double their capacity (highest % increase compared to peers) to 48.4

bil by 2022. Ranking after Topglove and on par with HARTA .

Actually this is not a weak point on

secoond thought. In fact even with lesser capacity, they already fare

far better than Harta and Kossan. It is which business model/strategy

they wish to position themselves in and how will they have executed it.

In this case, Super is A+ with OBM model.

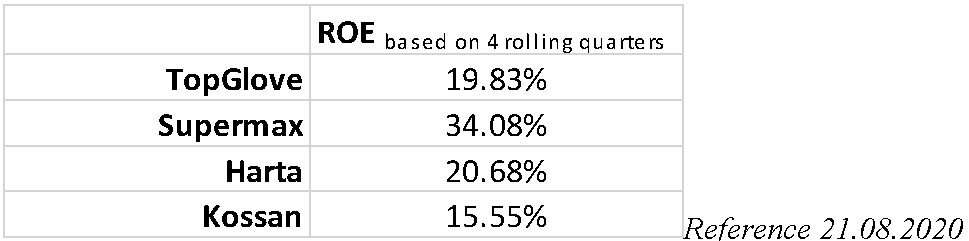

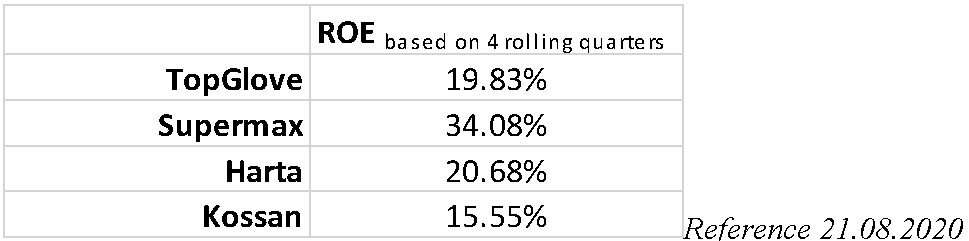

With OBM-X and 48.4 bil caps by 2022. The effect would be at least a 100 bil capacity in size. Remember Super is earning same profit as 100 bil capacity like Topglove while with only 48 bil COGS. ROE will be very attractive in that sense.

With OBM-X and 48.4 bil caps by 2022. The effect would be at least a 100 bil capacity in size. Remember Super is earning same profit as 100 bil capacity like Topglove while with only 48 bil COGS. ROE will be very attractive in that sense.

Every

RM Supermax makes now and reinvested on capacity expansion, would

generate 2-3 times more RM than PEERs. Market has not yet to realise

this explosive growth potential of Supermax. This is the hidden power of

OBM -X margin.

REVALUATION

Current Market Caps

SUPERMAX RM 21.40 = 29 BIL

HARTALEGA RM17.20 = 59BIL

TOPGLOVE RM 28.00 = 76 BIL

To fetch a higher market cap comparable to Topglove(39% now) and Harta(48% now),supermax need

1. Comparable proftabilty and margin to Topglove , Harta.(70% to 90%of their current profit)

Supermax latest QTR is 400m VS Harta 220M (182% )

1. Comparable proftabilty and margin to Topglove , Harta.(70% to 90%of their current profit)

Supermax latest QTR is 400m VS Harta 220M (182% )

Supermax latest QTR is 400m VS TopGlove 348 m (115%)

With the latest result. Super already met and exceeded the (70% to 90%) benchmark.

2. Comparable dividend payout policy.

2. Comparable dividend payout policy.

This one a bit lacking.but with better profitabilty it shld improve. But with the coming 45-1 share dividend and possible cash dividend in coming bumper quarter. Dividend policy should improve nevertheless.

3. Comparable liquidity.

SUPERMAX latet Bonus will increase it to 2.6 bil share from 1.3 bil. Comparable to Harta (3b) and Topglove (2.6b pre Bonus)

4. Comparable size and production capacity.

Super will close up the gap with Harta and Kossan in 2022 with plan to double expansion to 48.4 bil.

Expanding in caps turn aggressive after bumper qtr and years of obm network expansion.

5. Better appreciation of OBM-X advantage.

We see more attention and value appreciation in progress now.

All skepticism will be crushed with bumper profit of 800m - 1bil coming profit in QTR 1. Calculation here

https://klse.i3investor.com/blogs/freetospeak/2020-08-12-story-h1511646950-SUPERMAX_QTR_1_FORCAST.jsp

6. KLCI composite index.MSCI Global Index .Shariah index.

6. KLCI composite index.MSCI Global Index .Shariah index.

Being an index stock in the abovementioned indexes will command a higher PE and support from major local and foreign fund.

a) FTSE Bursa hijrah shariah index - Indexed on 30th June

b) MSCI Global Index - To be indexed on 30th Aug

c) KLCT index -Condition has been met and believe end of year will be indexed.

c) KLCT index -Condition has been met and believe end of year will be indexed.

We believe Supermax market caps with its

leading peers will be closing and be on par as the abovementioned

pointers being accomplished. Potentially reaching a 50 to 60 bilcaps as

compared to HARTA 59 bil and TG 76bil as of current valuation.

The

Consortium of Independent Analyst wish to express here is that there is

more future to Supermax for the coming quarters due to its OBM

advantage which allows them for dynamic pricing and super margin

capitalised in early period.

Appendix:

BEYONDFIT and BEYOND MASK https://www.facebook.com/AureliaGlovesCanada/

AVEO KOREA stocking up here:

Disclaimer…This is not an advice to buy or sell. It is just for education and sharing purpose.

CiA do not take accountability for any trading occurring from our information disseminated.

https://klse.i3investor.com/blogs/freetospeak/2020-08-21-story-h1512426349-SUPERMAX_OBM_X_REVALUATION_IMMINENT.jsp