SYCAL - COULD THIS STOCK BE ANOTHER TAKEOVER EPISODE ??

OR IS IT JUST A GUESSING GAME!!!!!

Hello

to all readers out there. In the recent week, CONSTRUCTION stocks had

started to show some momentum in BURSA. Some sector leaders moving were

GAMUDA, IWCITY, EKOVEST, GADANG and many more.

Having said the above, the stock which I'd like to talk about today is SYCAL VENTURES BERHAD (SYCAL - Stock Code 9717, MAIN Market, Construction)

Last Friday saw a significant increase in traded volume and share price of SYCAL which was caught under BURSAMASTER SCANNER WEB NET.

The volume spiked to 7.3 million, which was grossly in excess of the

daily average volume; and also witnessed a marked increased in its

price. SYCAL gained 6 cts to close Friday at 0.335, also its 52-Week high.

With the current hypes on TAKEOVERS and

spiralling share price movements for many super penny stocks which has

seen dizzying price run ups for such companies as Gunung,

Inix,SMTrack,GPA, Connect, Kwantas, ANCOMLB and many more.

Friday's price movement of SYCAL & spike in volume might signalled "something amissed" by any standards OR just PURE GORENG; yet to be seen.

If the momentum continues this Tuesday and subsequentl days, then, them most likely affirmative positive development should comes its way (most logical assumption).

LET'S SEE HOW THINGS UNFOLD IN THE COMING DAYS. I AM KEEPING A CLOSE WATCH ON THIS COUNTER.

Friday's price movement of SYCAL & spike in volume might signalled "something amissed" by any standards OR just PURE GORENG; yet to be seen.

If the momentum continues this Tuesday and subsequentl days, then, them most likely affirmative positive development should comes its way (most logical assumption).

LET'S SEE HOW THINGS UNFOLD IN THE COMING DAYS. I AM KEEPING A CLOSE WATCH ON THIS COUNTER.

BASIC INFORMATION ABOUT SYCAL

SYCAL was incorporated in 1980 with core businesses in a few fields:

i) Construction

ii) Property Development

Market Capitalization : RM 139.47 million

Shares Float : 416.32 million

Website : http://www.sycalberhad.com/

1. TRADING AT 50% DISCOUNT TO ITS NTA OF 67 CENTS

Refer latest summary of Assets versus Liability for SYCAL below taken from QR. As we can see the highlights below:

i. Total Assets RM 499.6 million (NTA 67c)

ii. Total Liabilities RM 217.7 million

iii. Net Assets Minus Liabilities RM 281.9 million

This

means SYCAL is now still trading at 50% discount to its NTA of 67c as

of latest closing price of 33.5c. Also to note that its Assets surplus

its liabilities by RM 281.9 million, which shows it as a strong and

healthy company.

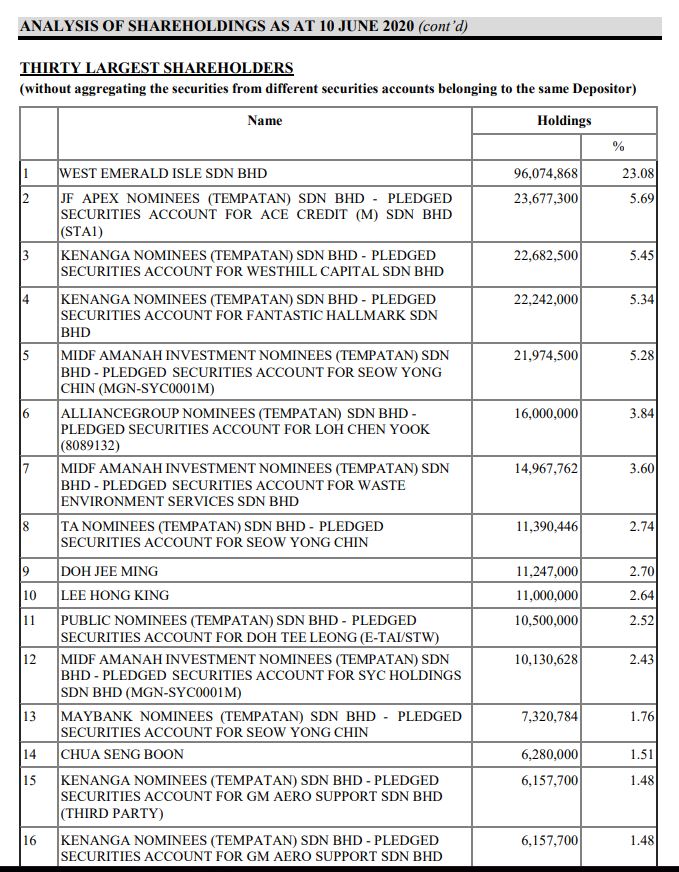

2. LOW PUBLIC FLOAT WHICH MEANS LESS RESISTANCE FOR THE PRICE TO MOVE UP

Refer

below list of top 30 shareholders as at June 2020. As we can see, the

top 30 shareholders are holding 82.95% stake in SYCAL. This means that

the total effective float (considering that the top 30 holders are

investors) is around 17.05%.

This would mean that any uptrend would be met with less resistance compared with companies with larger public float shares.

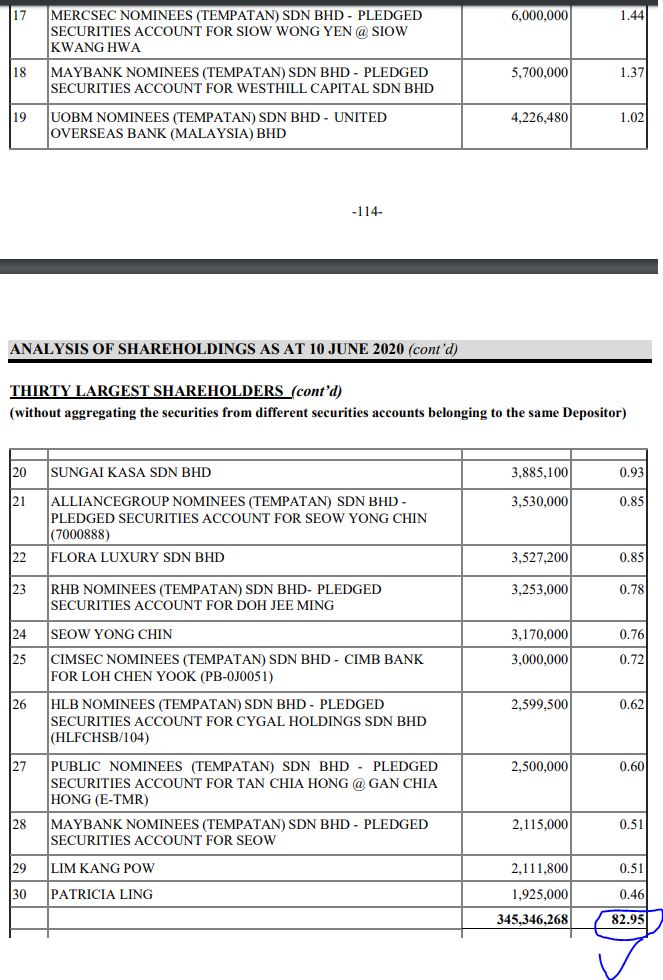

3. MANY INTERESTING PROJECTS NEWLY LAUNCHED

Refer

below image the list of newly launched projects under SYCAL. All these

projects would be contributing positively to earnings in future.

i. Klebang Perdana Phase 1A - Shop Office, Semi-D & Terrace Houses in Ipoh, Perak

ii. Klebang Perdana Phase 1B - Shop Office, Semi-D & Terrace Houses in Ipoh, Perak

iii. Marina Heights - Serviced Apartment in Lumut, Perak

iv. Ipoh Commercial Centre (ICC) - Fully furnished commercial suites in Ipoh, Perak

v. Sitiawan Commercial Centre - Shop Office, 2 & 3 storey semi D at Sitiawan, Perak

vi. Taiping Heights - Shop Office, Semi D and Bungalow in Taiping, Perak

vii. Manjung 2 @ Segari, Perak - Shop Lot, Terrace & Cluster House

viii. SYCAL Genting Park & Genting Sempah, Pahang - Commercial Suites

ix. Villa Taman Tun - 3 storey terrace at TTDI, KL

x. Villa Taman Tun - Condominium at TTDI KL

4. TECHNICAL ANALYSIS - BREAKOUT OF KEY EMAS WITH STRONG VOLUME

Refer below the basic price and volume chart with key EMAs for SYCAL weekly chart :

A few observations on the weekly chart:

i. Refer 1

& 2, SYCAL had recently broken out above all major EMAs including

long term EMA of EMA200 and EMA365, with strong volume buildup. This

indicates a bullish trend ahead

ii. Next resistances seen at R1 37-38c and R2 50-52c

CONCLUSION

Considering all the above, I opine that current price for SYCAL is attractive due to below:

i) Trading at 50% discount to its NTA of 67c

ii) Low public float of about 17% which means less resistance on its path upwards

iii) 10 interesting projects newly launched to contribute to future earnings

iv) Chart breakout above all key EMAs indicating bullish momentum ahead

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer

: The above opinion is never intended to be a BUY CALL whatsoever. I am

sharing my observations ONLY based on fundamental; past history;

current trading pattern; charts etc. Please make your own informed

decision before buying this share or whatever share for that matter.

BURSAMASTER

https://klse.i3investor.com/blogs/Bursa_Master/2020-08-31-story-h1512603328-COULD_THIS_STOCK_BE_ANOTHER_TAKEOVER_EPISODE_OR_IS_IT_JUST_A_GUESSING_G.jsp