CIA.CONSORTIUM of INDEPENDANT ANALYST

@free@prob@wok@chief@dynasty

The New Normal…..OBM Style!!

Just like Gangnam Style, OEM Style has always been the main topic amongst the big glove producers in Malaysia. However its business model effectiveness during this pandemic can be questioned if compared with the lesser appreciated OBM model.

Will OBM be the new normal in the glove sector?

In fact OBM business model is not new. It is in many case present within other business segments. Take Petrol retailers for example, they have a similar control over the entire value chain with outlets known as

(i) COCO company owned company operate

(ii) CODO company owned dealer operate

(iii) DODO dealer owned dealer operate.

How do we evaluate the revenue and gross margins for this the OBM business model?

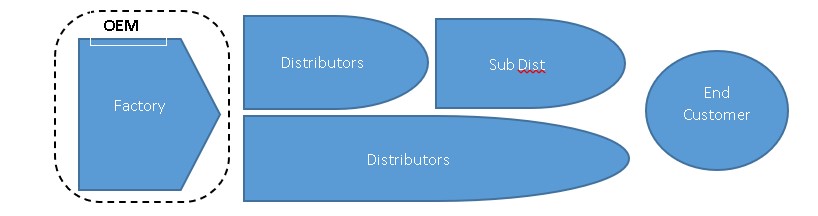

Here is an illustration of OEM Style

Using MYR 1.00 as an example, OEM style producers can only tap a gross profit from the selling price. For Manufacturing, say the Gross Margin i.e. Revenue less COGS to be around 60%. Therefore, the OEM Style producer can only a gross margin gain of MYR 0.60.

Its revenue estimate is straight forward and simple.

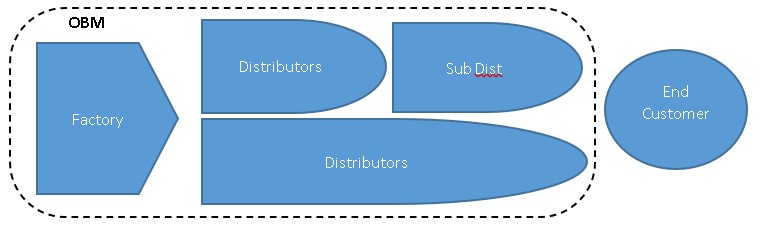

For illustration purposes, OBM Style would look something like this;

In this enterprise model, using MYR 1.00 as the selling price as an example, its business reap a gross profit of at least double.

Both these models have its pros and cons. Which company can execute the model well will benefit from it the most.

In the glove sector when prices and margins are thinner than our shoe string, to survive with an OEM enterprise model would require the economies of scale. In this case, the biggest volume producer will prevail.

Again in the glove industry, it is almost impossible to attain a Gross Margin as illustrated in the model above.

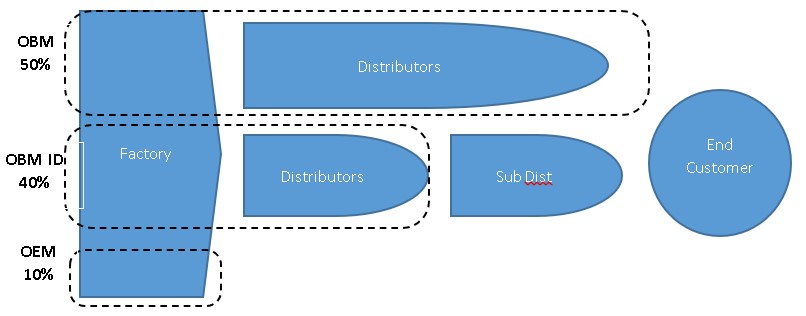

Supermax OBM business model comprise of OBM, OBM Independent Distributors and OEM. I would imagine their value chain can be illustrated as such;

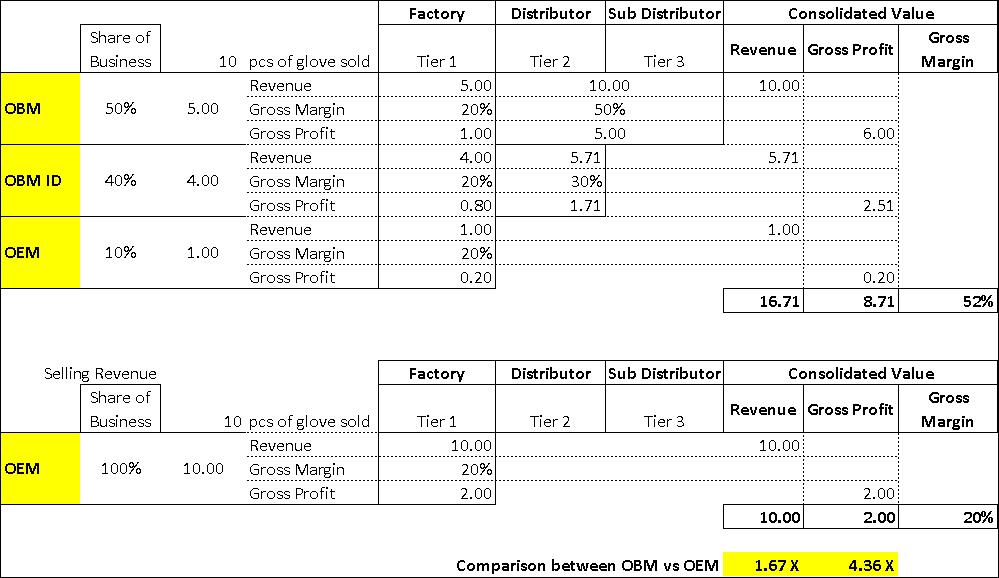

Assuming MYR 1.00 is OEM price piece of glove at FOB with 10pcs of glove being sold as an example, a comparison can be seen in the table below;

OBM model of business will be able to reap higher gains.

Well if the OBM enterprise is so lucrative, why not an OEM model transform into OBM and reap similar benefit? It won’t be so easy because

- The Brand mileage takes years to build

- The value chain of retailers, distribution outlets etc requires knowhow, requires plenty of time and resources to build

For those of you that is still wondering if an OEM player can price their ASP to be as high as OBM, think again in the following context…… can a Casio or Seiko watch be priced the same like a Rolex?

Happy investing!

The graph/table above provide can provide some illustration.

Disclaimer.

Bear in mind this is not exact representation of the real cause and we bear no responsibility.

https://klse.i3investor.com/blogs/freetospeak/2020-08-07-story-h1511586399-The_New_Normal_OBM_Style.jsp