VS INDUSTRY

A SOLID BENEFICIARY OF TRADE DIVERSION.

NEW-HIGH IN ORDER VOLUME SEEMS POSSIBLE.

- INTENSIFYING TRADE DIVERSION BENEFITS MALAYSIAN EMS PLAYERS, INCLUDING VS

- THE GLOBAL EMS MARKET SIZE COULD HIT USD 55 TRILLION IN 2024

- VS IS AN ESTABLISHED EMS PLAYER WITH STRONG TRACK RECORD

- WE BELIEVE VS IS POISED TO ACHIEVE A NEW-HIGH ORDER VALUE AMONGST THE INTENSIFYING TRADE DIVERSION

- WHICH EMS PLAYER IS BEST PREPARED TO CAPTURE TRADE DIVERSION OPPORTUNITIES? OUR VIEW: VS

- THE WORST IS OVER, BACK TO 100% OF PRE-MCO LEVELS

- GROWING CLIENTELE, LOOKING BUSY

- STRONG CASH FLOW, HUGE CASH PILE, NO ISSUES EXPANDING & DECLARING DIVIDENDS AT 40% PAYOUT

- BUSINESS RISKS MISSING OUT TRADE DIVERSION OPPORTUNITIES, UNDERPERFORMANCE

- A STRONG UPTREND STOCK – DIRECTORS ALSO BOUGHT 3.47 MILLION UNIT OF SHARES AT RM1.43-1.63 IN AUGUST, THERE IS STILL UPSIDE

- BASED ON OUR OWN TARGET PRICE OF RM2.50, AT RM1.63, VS OFFERS A 53.4% UPSIDE (WE COULD BE WRONG)

INTENSIFYING TRADE DIVERSION BENEFITS MALAYSIAN EMS PLAYERS, INCLUDING VS

US-China trade tension continues to worsen. Global tech players are relocating from US and China to Vietnam, Thailand and Malaysia to diversify their source of supply and stock up inventory in advance.

Furthermore, due to work-from-home practice and the New Normal, demand of electrical appliances have risen. This benefits EMS players and automated testing equipment (ATE) players.

THE GLOBAL EMS MARKET SIZE COULD HIT USD 55 TRILLION IN 2024

According to a New Research Analysis, The Global Electronics manufacturing services (EMS) market size is expected to grow at a CAGR of about 4.1% over the next five years and will reach USD 55 trillion USD in 2024, from USD 43 trillion in 2019.

Trade diversion would enable EMS players in Malaysia to take a larger pie of this huge, growing trillion-dollar market.

VS IS AN ESTABLISHED EMS PLAYER WITH STRONG TRACK RECORD

VS is the biggest EMS player in Malaysia with strong track record. Through contract manufacturing, VS manufactures plastic components and precision moulds. VS also sub-assembles electronic and electrical equipment.

WE BELIEVE VS IS POISED TO ACHIEVE A NEW-HIGH ORDER VALUE AMONGST THE INTENSIFYING TRADE DIVERSION

VS has been the front runner and apparent winner of the trade diversion among EMS peers (SKPRES, ATAIMS).

Case in point: With the Master Agreement signed with a renowned US floor care product manufacturer just a year ago, five models have been secured to date (revenue size: RM500m/year).

Most of the contract manufacturing jobs of this US player are being undertaken by two EMS players based in China (c.80%) and one in Mexico back then.

With VS now benefitting from the order fall-out from these EMS players, the potential could be enormous just based on a USD 800 million revenue size in 2017 (before acquisition in 2018 with another North America commercial vacuum brand).

As the biggest EMS player in Malaysia with strong track record, we believe VS is poised to achieve a new-high order value amongst the intensifying trade diversion.

Source: UOBKayHian

WHICH EMS PLAYER IS BEST PREPARED TO CAPTURE TRADE DIVERSION OPPORTUNITIES? OUR VIEW: VS

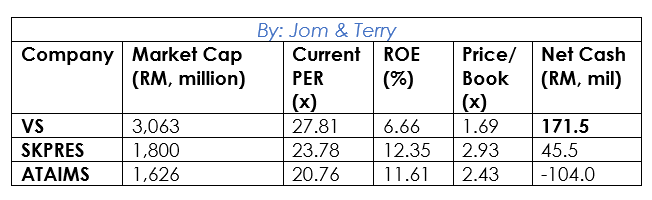

With a net cash of RM171.5 million, VS is able to expand their production lines or acquire new lands and facilities without the need to raise funds from the investors or financial institutions.The 3 EMS players in Malaysia are VS, Skpres and Ataims. Based on fundamental data, we believe that VS is best prepared to capture the trade diversion opportunities because it has the largest amount of cash on hand.

As the biggest EMS player in Malaysia with strong track record and a cash pile of RM171.5 million, we believe VS is poised to achieve a new-high order value amongst the intensifying trade diversion.

In fact, VS is also in discussions with a few prospective customers. While VS management has not provided any official number and guidance, we believe the new-higher order would translate into growing revenues and ultimately core earnings. This would lower VS’ PERx in subsequent quarters.

This could be one of the reasons why the market is willing to give VS a higher PER of 27.81x, as compared to Skpres and Ataims with PERs of 23.78x and 20.76x.

THE WORST IS OVER, BACK TO 100% OF PRE-MCO LEVELS

Due to MCO lockdown, EMS players experienced the worst quarters between March and May 2020. Fortunately, VS has fully captured the worst quarter with a core net loss of RM19.7 million. Since early-May, VS’ production has resumed to 100% of pre-MCO levels.

Source: UOBKayHian

GROWING CLIENTELE, LOOKING BUSY

In end-June 20, VS announced a new customer from the automotive industry that will contribute A good start and testimonial to VS’ capabilities.

As of 17 August 2020, VS is also in discussions with a few prospective customers. While VS management has not provided any official number and guidance, employees in VS seem pretty busy recently.

STRONG CASH FLOW, HUGE CASH PILE, NO ISSUES EXPANDING & DECLARING DIVIDENDS AT 40% PAYOUT

Despite MCO disruption, VS is able to generate strong cash flow (FY20-21 FCF of RM62m-RM260m).

Additionally, at a net cash position of RM147.4m, VS’ interest coverage stands at 16.6x, far higher than the normal threshold of 1.5x. VS is financially ready to capture market opportunities.

In terms of dividend payout, management noted that the CAPEX for FY20-21 will be minimal and they see no issue in paying a minimum dividend payout of 40% (at RM41m-RM61m).

Source: UOBKayHian

BUSINESS RISKS

VS may not capture certain opportunities offered by the intensifying trade diversion. VS may underperform, thereby eroding its profit margins.

VS, A STRONG UPTREND STOCK

VS has shown a strong uptrend. It has remained above MA10 since 1st July 2020. On last Friday, VS was able to close green even though most stocks dropped.

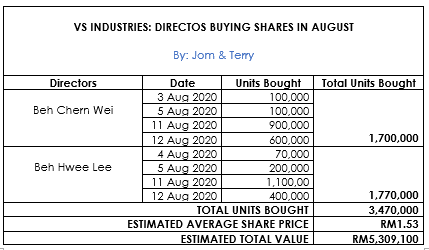

The buying interest is strong – even VS directors bought 3.47 million units of shares at RM1.43-RM1.63 in August 2020.

DIRECTORS BOUGHT 3.47 MILLION UNIT OF SHARES AT RM1.43-1.63 IN AUGUST

CONCLUSION

VS seems to have great prospects ahead.

Even though the share price has rallied from RM1.00 to RM1.63 in less than 2 months, the uptrend remains strong and we believe there is still upside. Even VS directors bought 3.47 million units of shares at RM1.43-RM1.63 in August 2020.

How much is the upside?

If VS does achieve new-high in their orders, their revenue and earnings could hit a new-high too. This could translate to a new-high in share price.

VS’ previous new-high was around RM2.50 in end-2017 and early-2018.

Based on our own target price of RM2.50, at RM1.63, VS offers a 53.4% upside.

DISCLAIMER

This article is produced based on our own study and analysis based on publicly available information, for sharing purpose only. Our views could be partial and/or inaccurate. There is no buy/sell recommendation.

https://t.me/jomnterry

https://t.me/jomnterry

https://t.me/jomnterry

https://klse.i3investor.com/blogs/jomnterry/2020-08-17-story-h1512364034-VS_INDUSTRY_A_SOLID_BENEFICIARY_OF_TRADE_DIVERSION_NEW_HIGH_ORDER_VOLUM.jsp