I have not been holding any glove stocks for the last 3 weeks. So I try to be objective here.

Fact 1: 29 May 2020, research report by Macquarie, Outperform TP RM13.10.

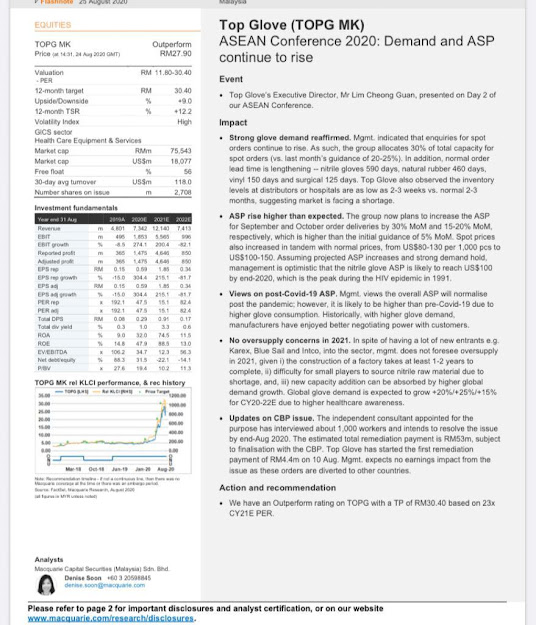

Fact 2: 25 August 2020, research report by Macquarie, Outperform 12 month target RM30.40.

Fact 3: 9 September 2020, research report by Macquarie Downgrade to TPRM5.40.

Fact 3: First two reports by Denise Soon. The downgrade report by Prem Jearajasingam.

Fact 4: Macquarie is one of the top covered warrants issuer in Malaysia.

Fact 5: Ex basis the RM30.40 would have been equaled to RM10.13. Which is to say the down grade wasn't just 10% or 20% in target price. The downgrade to RM5.40 was an astounding 46% cut in TP.

Fact 6: 46% cut in TP all in a matter of 15 days. Pray tell what were the variables and valuation dislocation that caused such a decision.

Bursa and SC need to look into this closely cause I am sure you have already received a lot of complaints. I guess you cannot have the same analyst do all 3 reports as that would have been tantamount to harakiri for the analyst. The change in analyst has to be questioned. Apparently, Prem is the Head of Research, and Denise has left her position. Still, Prem would have had to approve the previous reports.

The "new analyst" halved the TP on the basis that "ASP cannot sustain forever". What changed the analyst's forecast within this short 2 weeks? Did he suddenly talk to industry leaders worldwide to realise that ASP will not last forever?

Analysts/research heads have very little power as they do not bring in the big bucks. Before investors focus their ire on them, remember that. But this does not feel right. It leaves a very bad taste in our mouths. The integrity of the markets and the participants are at stake. We need answers and clarity.

THE FUNNIEST THING ... and its a big mistake by Macquarie... look at the table for projections. The first table was the upgrade to TPRM30.40. The estimated revenue for 2021 and 2022 were RM12.14bn and RM7.413bn respectively. Reported profit for 2021 and 2022 were RM4.646bn and RM850m respectively.

THE DOWNGRADE REPORT projected revenue for 2021 and 2022 to RM19.058bn and RM9.023bn respectively. The expected profit for 2021 and 2022 were RM10.259bn and RM2.022bn respectively.

How da-macha? The massive downgrade report had a substantive upgrade in revenue and profit. SUDDENLY the valuation parameters changed???

It is not even funny, when within 15 days one can revised the profit UPWARDS from 4.64bn to 10.259bn (+110%) for 2021 and from 850m to 2.022bn (+138%) for 2022 ... and at the same report downgrade the TP from RM10.13 to RM5.40 (-46%).

Please explain.

YAZ:

The way this particular report is laid out also isn't comprehensive.

The analyst showed his different assumptions for FYE20 - FYE22,

including all baseline figures (revenue, profit, et al). But then he gives his base case price target based on FY23 earnings, which is not stated in the report.

Kindly go kira yourself it seems! Then in an impressive of cover your

ass (CYA) mentality, he also outlines two other cases on page 2 of the

report. Bull case shows a price target of RM20.40 based on multiples of

FYe22 earnings! (FYE22, not FYE23!) Finally his bear case of RM2.80

shows the price target based on multiples of FYE21 earnings! Shenme the

f**k! Is he saying then his house is giving price targets of RM2.80,

RM20.40 and RM5.40, based on the estimated earnings for FYE21, FYE22,

and FYE23? Since there's a time lag dilation between expected

results and price movements (in a rational market), it's up to the

investor to use their own respective crystal balls to target their entry

points lah, based on the estimated price targets provided by this

house. The part that's amazing though, his main target price catalyst

(as shown on page 1 of this report) is: 12-month price target RM5.40

based on a PER methodology. And that PER methodology is based on FYE23

earnings! Holy sweet bejesus. You're ascribing a target based on

financial results for the year ending August 2023. Buy today because my

estimate for what is 3 full financial year results away starting from

after FY20 shows a downtrend. If one assumes glove stocks is going to

rebound (and it probably will with the upcoming results, albeit to what

extent up to the individual to figure out lah), he's going to have to

eat humble pie. And it really makes one wonder if there's really a

Chinese wall between the research side and the other divisions in his

house.

http://malaysiafinance.blogspot.com/2020/09/theres-company-research-downgrade-and.html