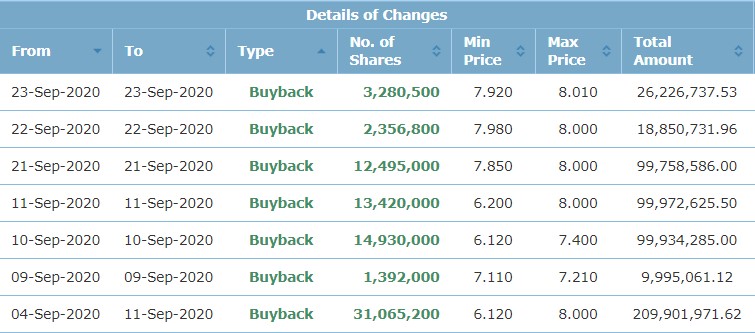

According to the announcement, Top Glove

spent around RM 564mil (RM 564,639,998.73) for Share Buyback in

September from 4th to 23th. The share buyback price is between 6.120 to

8.01. The total share buyback amount is almost 50% of its last QR net

profit (~RM 1.3bil).

There are some people said that Top Glove should not spend so much cash

to buy back its own shares. They should use the cash to expand their

business, give out as dividends to shareholders, pay bank loans, etc....

Instead of criticizing the share buyback action, we should think in another way round. Who knows Top Glove business better? -> Company director, market analyst or retailers? Why are they willing to spend so much cash to buy back stocks? What are the impacts of share buyback?

Over the past few weeks, there are a lot

members are asking about share buyback. We will write a report to

answer above questions and explain the share buyback action. This report

will be shared to the public members in our telegram channel during

this weekend. (Limited number of report)

Join our telegram channel to get the report !!!

https://klse.i3investor.com/blogs/bursatrade/2020-09-26-story-h1514324232-TOPGLOV_7113_Top_Glove_spent_RM_564_639_998_73_in_September_for_Share_B.jsp