For a copy with better formatting, go here, its alot easier on the eyes.

(CHOIVO CAPITAL) LCTITAN (5284) Five Magic Words - Rising ASP’s, Falling Costs, Hurricane (or is it Butadiene?)

========================================================================

In the last 1-2 weeks, I’ve been studying up on the convenience store sector. One thing led to another, and I found myself watching this video of a

guy eating delivery hot pot with friends.

The thing that surprised me the most, was the sheer number of plastic containers being used. Its utterly incredible. Every single piece of meat and vegetable had its own plastic containers.

Now, one of the things I’ve been thinking deeply about this crisis, is how consumer spending and behavior have changed.

During a crisis, certain trends pick up speed, and other trends may fall completely. And some of these trend changes may very well be permanent, and thus affect valuations of many companies very differently.

The one trend that i think this COVID19 crisis have helped gain serious momentum in, is the online food delivery trend.

Currently, more people are buying food via online deliveries, and even the older generation who often still uses Banking Cheques, have embraced the use of GrabFood and Foodpanda. And all these food deliveries use up a lot more plastics.

This is a trend that I think will persist in a positive upward trajectory over the next 10 - 20 years because it just works, and the convenience is something people will pay for. The only problem previously was gaining traction fast enough, which COVID19 just helped solve.

And so, I decided to study the plastics industry.

And I think I have found, what I consider to be a top tier short to mid-term trading opportunity. At current prices, I also think it also makes a decent investment.

Overview

So, the question here I’m sure many want to ask.

Why LCTITAN?

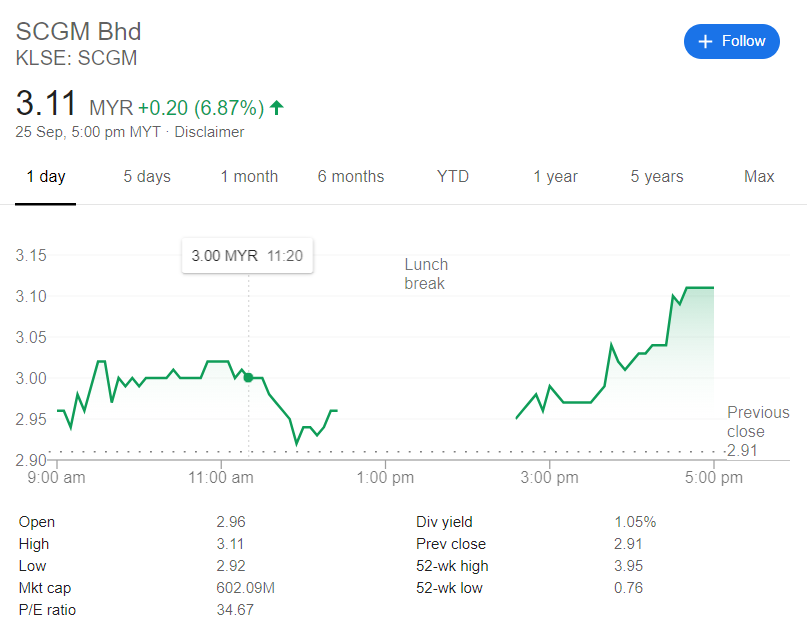

Why not a plastic packaging company like SCGM, SCIENTEX and DAIBOCHI etc?

Well, it’s simple.

SCGM and many of the plastics packaging companies have run up so far ahead, selling something like 30PE on record earnings, or all time high prices due to the strong demand in plastics.

And because of this, i don’t think they make that good investments or trading opportunity anymore as most of it is priced in.

However, unlike the plastic packaging industry, the plastics focused petrochemical refining industry did not.

In addition, for these industries, they have a far better catalyst.

Because in the case of LCTITAN especially, their raw material cost (Naphtha) has fallen significantly during this period.

In addition, like the previous refinery run, a hurricane has struck in the petrochemical refinery complexes in the US, decimating supply at a time when demand is rising very strongly.

PCHEM VS LCTITAN

In the Plastics/Resin Petrochemicals Refining market in Malaysia. They are only two real suppliers. PCHEM and LCTITAN.

Now, both have had their share prices beaten down severely during this COVID-19 pandemic.

So why LCTITAN?

They reason for it is this.

The first, is that in terms of Revenue, plastics contribute approximately to each respective company,

PCHEM: 60%

This is their “Olefins and Derivatives” segment, a large portion of it is plastic resins/polymers, but it also includes other Olefins and other basic and high-performance chemicals. Which means the real plastic resin/polymers contributions is significantly smaller than the stated 60%.

In addition, the main feedstock for PCHEM is Methane and Ethane (basically Natural Gas), whose prices have increased during the year, by about 5%.

LCTITAN: 80%

This is their “Polyolefin products” segment. It consists of ONLY plastic resin/polymers.

In addition, Unlike PCHEM whose feedstock cost have increased 5% this year, LCTITAN’s feedstock cost (which consist of more than 95% of their costs) which consists of Naphtha, which have FALLEN 34% since the start of the year. This reduces their cost very significantly.

What does Lotte Chemicals make?

Now, as said earlier, 80% of their revenue comes from “Polyolefin products”, which is basically “plastic”, and when it comes to “Plastics”, there are two main categories.

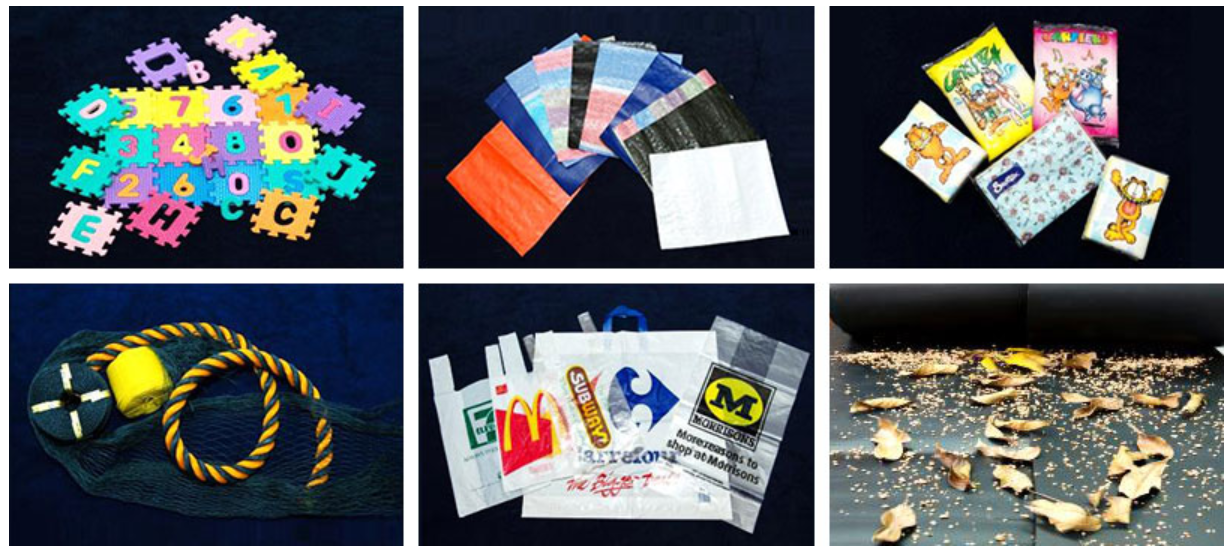

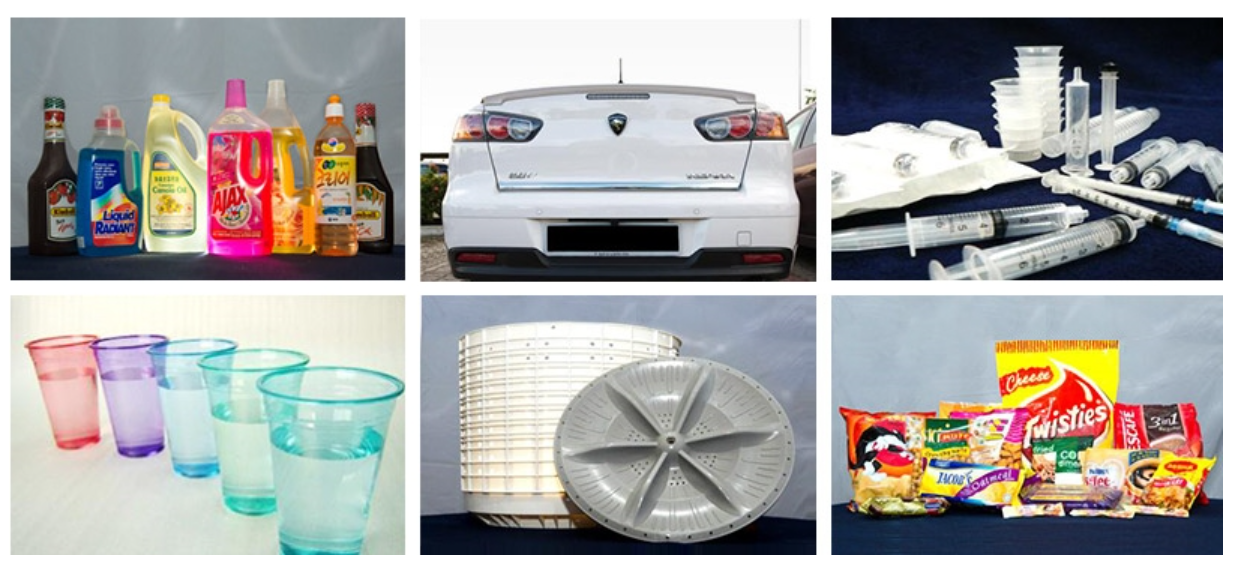

Polyethylene (“PE”)

There are 3 main categories for this that is produced by LCTITAN, these are HDPE, LDPE and LLDPE. What are these used for?

To put things simply, these are softer types of plastics, that is used mostly for plastic bags, packaging industry, food packaging etc

Polypropylene (“PP”)

To put simply, this is a harder kind of plastic with more structural integrity.

It is mainly used for plastic bottles, cups, car parts, solar panel covers, plastic spoons etc. Basically, any and everything else that uses plastics.

LCTITAN is the biggest (if not, the only) manufacturer of Butadiene in Malaysia with its 100,000 metric tonne production capacity and a supplier of Synthomer, the only manufacturer of Nitrile Butadiene Rubber in Malaysia.

Butadiene is the key ingredient in the production of nitrile gloves and prices of Butadiene have doubled since Q2 due to the strong demand of nitrile gloves worldwide.

![]()

For a more comprehensive picture, you can refer to this slide by LCTITAN.

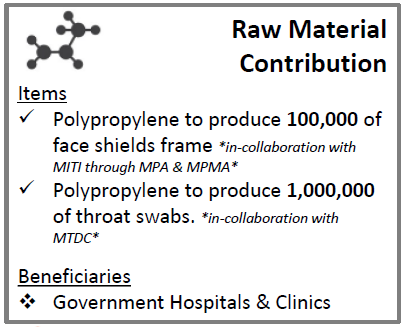

In addition, the increased usage of Face Shields, Throat Swabs, Personal Protection Equipment etc have also increased the usage of PE’s and PP’s globally.

As you see in the slide below, PP’s are a key raw material of these items.

Catalyst and Important Factors

Rising Average Selling Prices (ASP)’s.

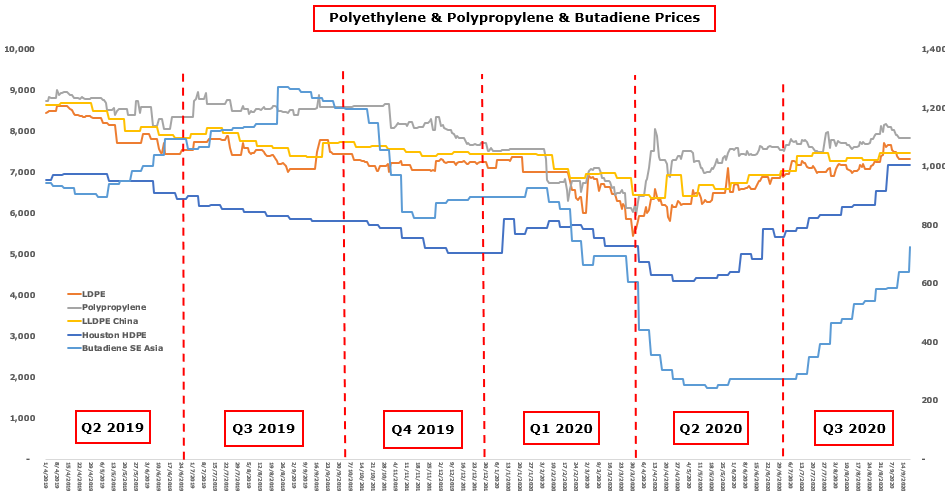

So, how have prices of Polyethelene (LDPE, HDPE, LLDPE) (“PE”), Polypropylene (“PP”) and Butadiene (“BD”) fared?

Well, it’s really difficult to find the prices of these items, as there are very little public charts on them, and when it’s available, you’d usually need to pay a subscription fee.

There are some public prices like this one from investing.com

This one shows to LLDP PE is back up to mid-2019 levels, but this is only one segment of PE and does not even include PP prices. And so, it is clearly not enough.

With some help from a friend access to a Bloomberg Terminal, we get the below.

And as we can see here, prices for all PE and PP items have increased versus 2019, and reached Q2 2019 prices, which was the high point in 2019.

As for Butadiene, South East Asian pricing have reached back to Pre-Covid levels due to the strong demand for nitrile gloves, whose factories are primarily located in South East Asia.

Now, for some of the items like PE-LLDPE and PE-HDPE, there isn’t a single price available, as it depends on the markets.

This is because refineries only exist in certain places/markets in the world, and their distance to consumers or feedstocks is different, resulting in somewhat different prices depending on the market.

And so, I picked the largest ones, China and Houston. And their price changes are as follows.

Polyethelene (LDPE): USD7,105mt to USD7,325mt (3% increase)

Polypropelene: USD751.5mt to USD784.6mt (4% increase)

Polyethelene (HDPE – Houston): USD705mt to USD1,005mt (43% increase)

Polyethelene (LDPE – China): USD744.0mt to USD747.3mt (0.4% increase)

As for Butadiene, prices have doubled since Q2, and is higher than Pre-Covid levels, which I’ve defined as Feb 2020.

Versus Q2 2020 - Butadiene (South East Asia): USD275mt to USD725mt (163.6% increase)

Versus Feb 2020 - Butadiene (South East Asia): USD665mt to USD725mt (9.0% increase)

So, what does this mean?

Well, as we can see from this chart, 2020 Q3 prices have basically recovered back to 2019 Q2/Q3 levels in just 3 short months, with HDPE increasing roughly 43% vs 2019.

And this pace is expected to continue due to strong demand increase, especially for Butadiene due to the strong demand for Nitrile Gloves.

And how does this matter, well in 2019 Q3 and 2019 Q4, given current prices for PP and PE LCTITAN could make at minimum roughly RM130m per quarter, or RM520m per year, except Naphtha cost is down 34% today.

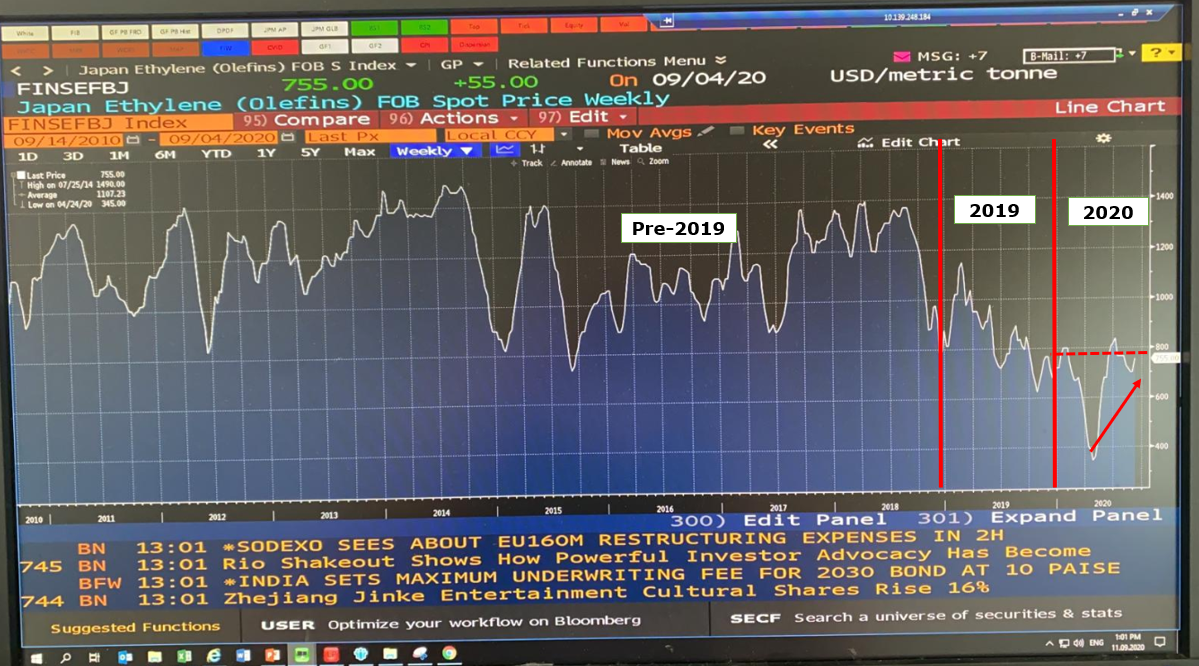

Now, I understand that a lot of the information here will not be available publicly, and so I also enclose here some screenshots from the Bloomberg terminal to prove its authenticity.

This is the price of Propylene (a chemical byproduct that is mainly used in producing PE and PP, and usually created from Naphtha by LCTITAN) in Japan.

This is the price of Ethylene (a chemical byproduct that is mainly used in producing PE and PP, and usually created from Naphtha by LCTITAN) from Japan as well.

These charts are 10 years in length, but as you can see, 2020 prices are back to 2019 levels.

And this is the price of Butadiene in South East Asia. Last week, prices jumped up 13% in a single week. You can also refer to this link for the sole Butadiene price chart i can find online.

By and large, PP, PE (and all their associated chemicals) and Butadiene have had their prices increase across the board in ALL Regions back to Q2 2019 levels or Pre-Covid Levels.

Falling Costs (Naphtha)

Now, LCTITAN only use one kind of feedstock.

Naphtha. That’s it.

Naphtha is produced primarily from crude oil (whose price and demand have fallen due to low economic activity and transportation) and is primarily used for 3 things.

- Dilution of Crude Oil for processing – Demand for this has naturally fallen as transportation (especially air) have fallen like a rock. Car Traffic is down 8% globally.

- Solvents and Fuel – The main use of Naphtha in the world, is as solvents (Items such as soap, cleaning fluid etc), and fuel, which includes Jet Fuel and in power plants.

Globally, the drive to reduce use of oil in products also means future use will reduce. Unilever plans to spend USD 1 Billion to eliminate the use of fossil fuel (basically Naphtha) from their cleaning products. And as the economy slows down right now, usage of these products will also naturally reduce.

- Plastics – Except due to natural gas prices being quite low historically since 2009, due to the increase in shale oil fields in the US (which produce Natural Gas), most plants in the US (a major supplier of plastics) using Natural Gas instead of Naphtha as feedstock. So, there isn’t much competition for Naphtha in this space either.

And with these things in mind, how does Naphtha prices look like today?

It is close to its all-time low (the all-time low is the peak of Covid-19 when it fell to USD130.44, before that it was the 2008 crisis when it fell to USD258.17) and has in fact fallen from USD536.17 to USD353.85 (Down 34% for the year).

Interestingly, due to the lower Naphtha prices, natural gas prices have increase due to the closing of shale rigs in the US reducing supply of natural gas in the US, LCTITAN now holds the cost advantage versus PCHEM in PP and PE, even though PCHEM signed a fixed cost contract for natural gas with PETRONAS in 2016.

Except that is not the end of it.

Hurricane Laura Decimating Petrochemical Refineries in USA

When it rains, it pours.

Just like the previous petroleum refinery trend in 2017-2018, a hurricane occurred two weeks ago in Louisiana, United States.

Hurricane Laura has hit and affected the petrochemical complexes in Lake Charles, Louisiana, and this is expected to further squeeze the already rising and high PE and PP prices.

From April to July, inventories of PE and PP in the US have already fallen by 756 million lb or 343,000 metric tonnes due to the increased demand, which resulted in the price increases you see above.

What this means, is that the impact of the hurricane has not yet been priced in yet into the prices of PE and PP.

Here are extracts of the reports

Supplies of PE and PP were tight even before Hurricane Laura made landfall, Pruett said.

Many of these plants escaped damage and are starting up.

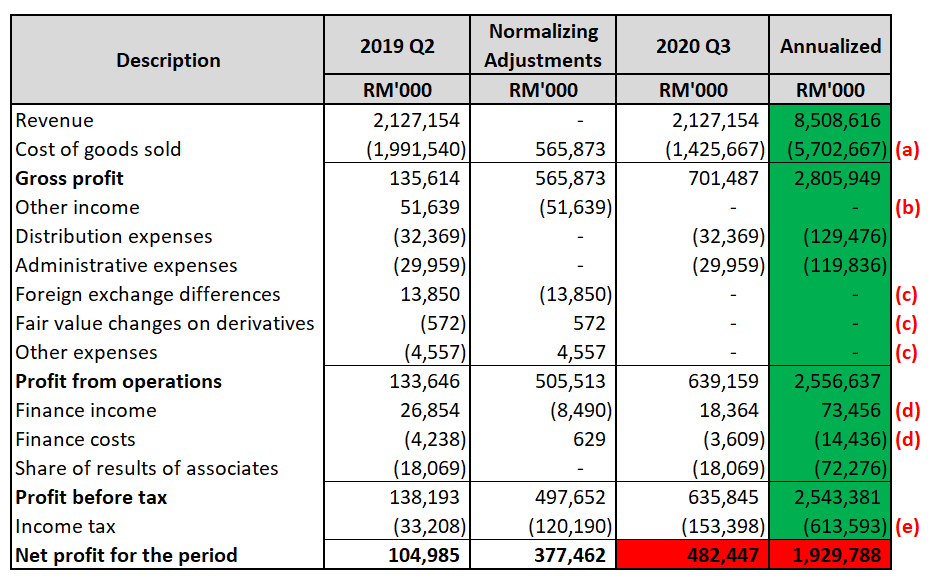

Million Dollar Question – What is the Projected Earnings?

Well, throughout the years, changes in Naphtha, PP and PE prices can be quite large.

And as LCTITAN does not really disclose average prices for all 3 for the year, it does not really make sense to project the earnings by year.

Therefore, to do our projection, I will use the quarter where PP and PE prices are quite like the amounts today (Naphtha prices is generally very volatile, as oil prices are also very volatile).

And this would be Q2 2019 as I previously explained in the “Rising ASP’s” section earlier.

(A) Cost of Goods Sold

The cost of goods sold includes item such as depreciation and staff cost which is fixed. To identify and isolate the 34% drop in naphtha costs, I deducted the 2020 Q2 latest depreciation number, and the staff cost of RM50m a quarter, and that amount is multiplied by 34%. This gives you the savings to be had from lower naphtha cost.

Do note, for staff cost the total amount for the whole company is RM50m a quarter, or RM200m a year. But some of this amount needs to be allocated to Distribution and Administration expenses.

However, as I did not have the breakdown, I just allocated the entire amount to the Cost of Goods sold.

The right amount of savings should be higher.

(B) Cost of Goods Sold

For other income, this is due to write back of inventory in Q2 2019. For 2020, there is already a write back in Q2, (due to the steep fall of PE and PP prices in Q1 which have since increased). So, I don’t think this is relevant. Its also to be more conservative.

(C) Miscellenous Items

I have no idea what the numbers for these are going to be next quarter or next year. But they are typically quite small. And since the net impact to Q2 2019 Income Statement is positive, to be conservative, I will remove it.

(D) Finance Income and Costs

Fall in interest rates mean lower finance income and finance costs. I’ve therefore changed it to the finance income and costs in Q2 2020.

(E) Income tax

Tax is adjusted to 24% of the projected profit.

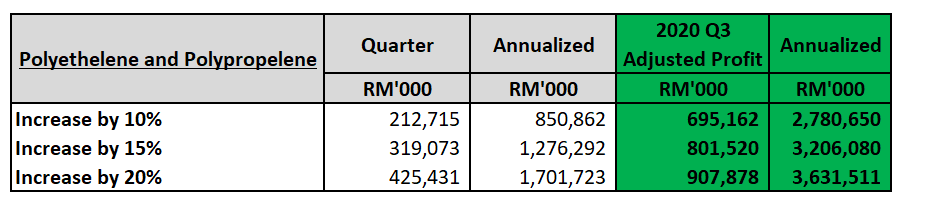

And so, just from the decrease in naphtha costs, and not even including the potential profits from the higher ASP due to margin squeeze from the hurricane.

LCTITAN is projected to make roughly RM483.4m for Q3. Giving an annualized profit of RM1.9 billion.

Now, knowing my readers, many people would naturally be a little skeptical.

These numbers do seem quite high, and so we have to ask ourselves, what other things can we use to support these assumptions?

As many would be able to deduce by now, the crux of the much higher projected profitability is the low price of Naphtha.

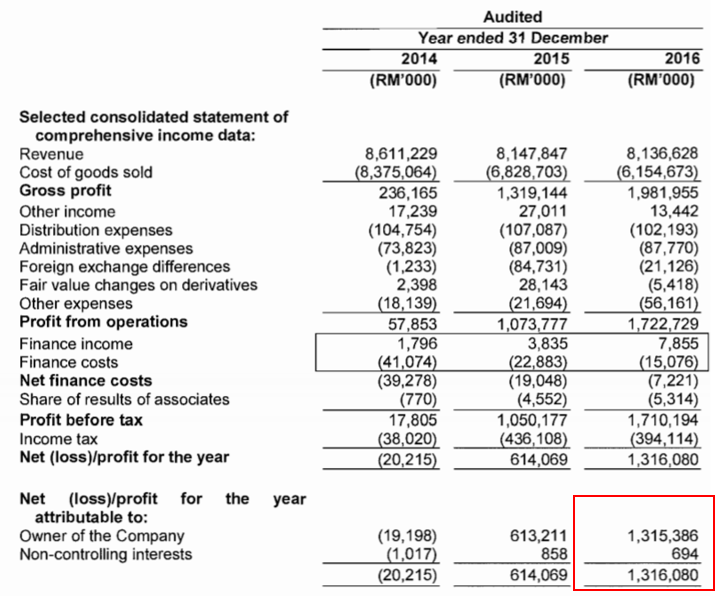

Now referring to the chart below,

The last time Naptha prices were around these levels is in 2016 (Naptha prices was in fact still significantly higher then) during the oil price crash.

What was LCTITAN’s profit’s in 2016 like?

All time high.

Now, what if we include the higher PP and PE prices, from both long-term trends in the increased usage of PP and PE, as well as the impact of the hurricane?

Quarterly profit increases to RM695m to RM908 million. Giving rise to annualized numbers of RM2.8Bil to RM3.6bil

Now, to be fair, since its already 13 September 2020, 2020 Q3 numbers will be nowhere near that, instead it will be more like RM520m. So, these will be more towards Q4 numbers, and depends on how much capacity the hurricane removed and how long it will take for plants to come back etc.

Still, it does not change the fact that plastic demand has gone through the roof in the last few months due to additional production of PPE, Masks, Online Deliveries, coupled with the low outputs in US refineries due to the shutdown of shale wells in the US resulting in lower gas supplies.

Current Valuation

And so, how much is LCTITAN valued today?

In terms of market capitalization, it is at RM4.4bil. This is a zero-debt company that also holds,

![]()

RM3.9 bil in cash and cash equivalents (This is for the LINE PP and PE plant in Indonesia, where the country does not have their own PP and PE refinery and therefore need to import these products).

This basically means, you buy the company for the cash it has in there, and you get for free, a business making at minimum RM483m per quarter or RM1.9bil a year, that has the potential to make RM908mil a quarter or RM3.6bil a year (if all the stars lined up).

Quite the deal.

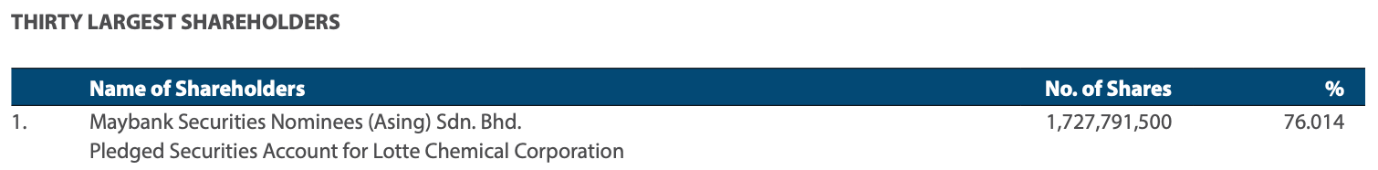

Public Share Float

Now, one of the questions I’m sure is on everybody’s mind after this is,

“Yes, can go up, but LCTITAN is so big and heavy, how to go up?”

Well, the current market cap in LCTITAN is RM4 billion.

However, 76% of the shares are held by the ultimate holding company, Lotte Chemical Corporation. And they cannot sell it if they want to maintain basically the right to do whatever they want including changing the Articles of Association etc (which is why when they listed, they only sold 25%).

So, the publicly traded shares only amount to RM1.1bil.

In addition, as people start to read this article, I’m sure many of those who were previously “Stuck” (like many in Supermax before this) would now think to themselves,

“Maybe I should hold or even buy more as I think price will go up”

Resulting in the previously ample supply of stock from people who are stuck and want to sell, now drying up instantly, as they decide they want to keep and make more money or maybe even buy more.

Liquidity is dynamic after all.

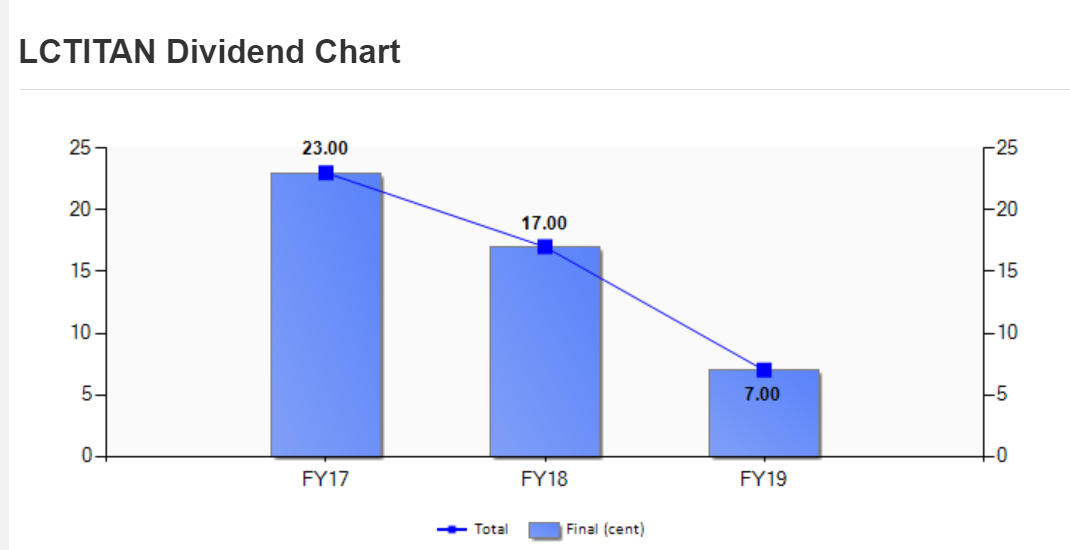

50% Dividend Payout Policy

One of the problems with Hengyuan previously, and even today, is that it is owned by a Chinese company and is therefore unlikely to pay out much dividends etc.

LCTITAN is different.

It is owned by Lotte Chemical Corporation and therefore to move money back to the holding co, they need to constantly pay out dividends.

Historically they have paid out dividends every year.

And the only reason for the reducing dividends was lower earnings due to PE and PP prices falling in 2019 (due to the ban on plastics import from the US by china, resulting in flow of supply to Asia) and most importantly, high Naphtha prices in previous years.

As you can see here, they lowered the dividend payments because earnings fell when Naphtha prices increased to almost USD725 in 2018.

In addition, there was also the fall in PE and PP prices in 2019 due to the ban on plastics imports from the US by China, resulting in the flow of US supplies to Asia.

As Naphtha prices is much lower today, while PP and PE prices have recovered to Q2 2020 levels and expected to go up further from the hurricane, I expect earnings to increase very explosively in Q3 and Q4 2020.

Which given history, should result in a large dividend, something that was also stated by their CEO, who confirmed a 50% dividend policy in a recent SinChew interview.

Risk Factors

Industry Risk

On a fundamental level, this industry is supposed to enter an oversupply situation in 2021 and 2022.

However, given the sudden surge in demand, which is likely to be structural and permanent, this situation should resolve itself mostly.

In addition, capex cuts by many petrochemical companies around the world (most refineries do other items including PP and PE, few are as focused as LCTITAN), there may be an undersupply situation in the foreseeable future instead.

Most affected refineries from the hurricane is expected to be restarted by October.

However, this is still hurricane season in the US, so you never know. The current impact in US is due to Hurricane Laura, but let’s not forget Hurricane Sally which may hit Louisiana as well.

However, even if everything goes back to normal, I expect LCTITAN to make RM482m in Q3 and more in Q4 as Naphtha prices are expected to remain depressed for some time due to the low economic demand as we are still in recession.

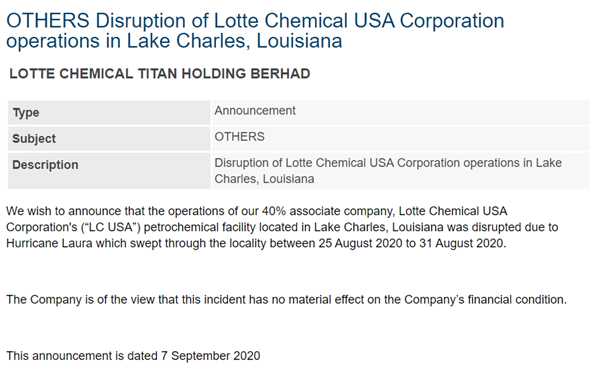

Lotte Chemical USA Corporation

LCTITAN owns a 40% share in an ethane cracker and monoethylene glycol (“MEG”) plant in the USA.

This plant was started up in September 2019 and primarily used to make ethylene from ethane. And MEG from ethylene.

Hurricane Laura also affected that plant as you see here.

However, here is why this information matters little.

This plant was only opened in September 2019, after running for 6 months, they basically cut production severely in Q2 2020. Coupled with the low ethylene prices in the US then, it recorded a loss of RM18 million.

This amount is included in my target price estimate, even though it is running and contributing to profit for a full 2 months, and with ethylene prices increasing strongly from July to September 2020.

The more important question is this, how much did this US Plant make back when it was first opened and running at full capacity?

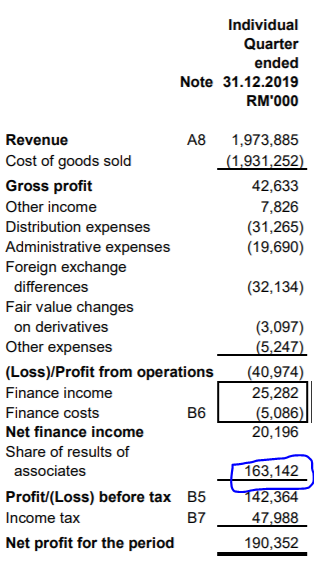

Profit of RM163m in ONE QUARTER (Q4 2019).

How much do you think it will contribute for Q3 2020, when ethylene prices are higher than it was in Q4 2019?

If anything, they contribute a similar amount this year for Q3 2020.

Do note my target price does not incorporate this. Earnings may be up to 30% higher than the RM483.4m projected just for Q3.

In addition, in the statement, LCTITAN states that the impact will not be material.

In “Audit” terms, this means it should affect less than 5% of revenue, or in this case 10% of profit.

Increase in Naptha Prices

As we can see in my thesis above, the increase in profitability hinges mainly on Naptha prices staying low.

As Naptha is primarily produced from Crude Oil, for prices of Naphtha to stay low, crude oil prices need to stay low.

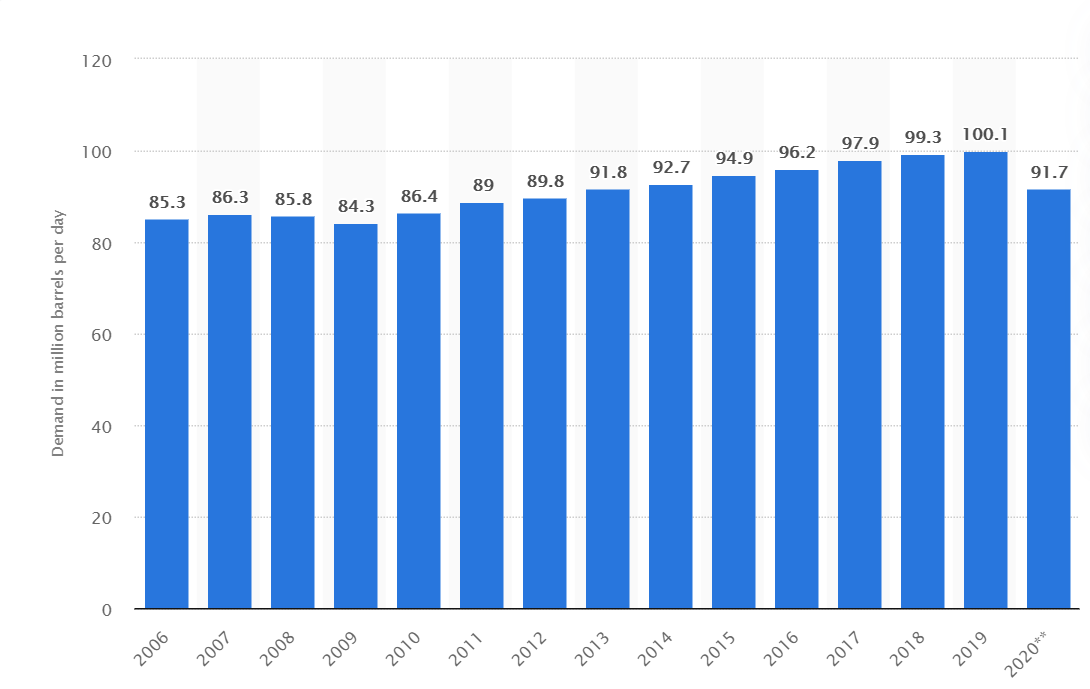

To start thinking about Crude Oil prices, we need to think about the supply and demand of crude oil.

Here is an interesting statistic.

As per Statista, from the previous financial crisis in 2009 to 2019, oil consumption have only grown by a CAGR of 1.73%.

And if we take the last 5 years from 2015 to 2019, it only has a CAGR of 1.07%.

This is an incredibly low rate of growth.

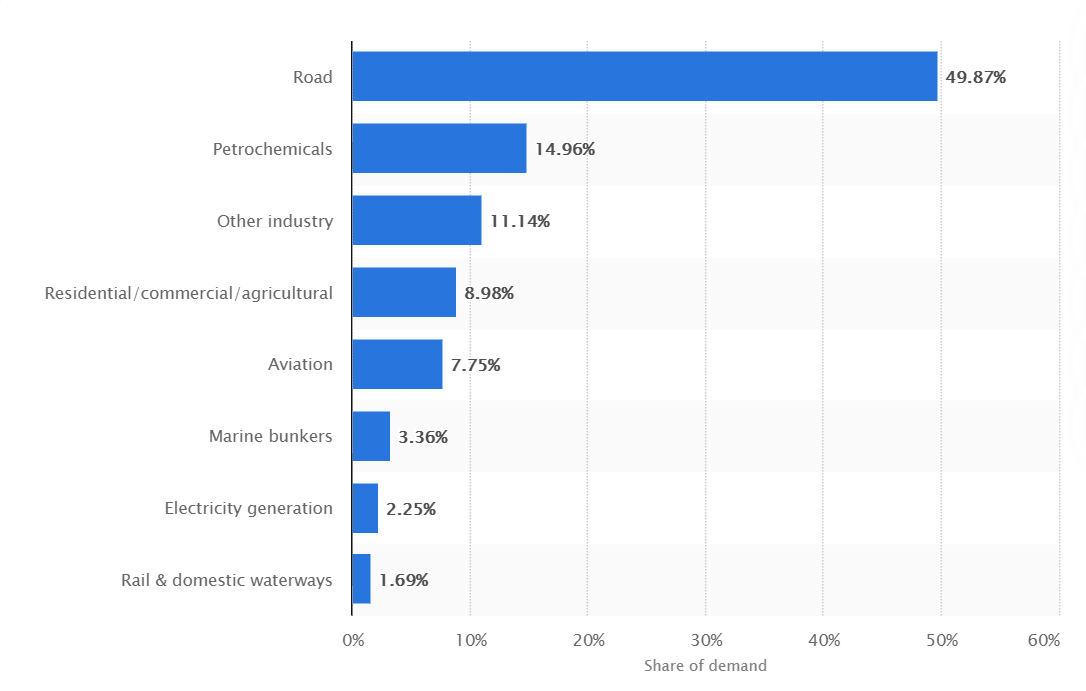

Now, in terms of %, oil is mainly used for,

Road Transportation.

Now, according to friends who work in highways in Malaysia, in terms of KM travelled, road transportation has fallen by about 8% compared to 2019 when comparing the latest month in 2020.

Meanwhile, for Aviation, it has basically fallen to zero.

This basically meant that about 12% of oil demand have been lost, with the 4% (from road transportation 8% X 50% = 4%) likely structural (due to work from home habits being built) and will need to be regained slowly.

And when it comes to air travel, I doubt international travel will be allowed any time soon.

Make no mistake, governments around the world are all itching to allow it again, but they just don’t have a good enough reason to do so yet.

To be honest, i think international travel will only be allowed after a vaccine is released and most of the key risk groups the population is vaccinated.

This is likely to happen in Q2 2021 earliest.

And even if international travel was allowed, I doubt it will recover previous levels, because business air travel (which previously consisted of 30% of all air travel) just does not make much sense these days when you can just work or meet remotely via video conferencing, and this is a habit every company in the world have now cultivated.

And because of this demand for oil is likely to fall back to 2014-2015 levels, while supply will not be reducing, as most shale wells in the US is expected to be restarted come end of September 2020, putting further pressure on crude oil and thus Naptha prices.

In addition, countries like Iran, Kuwait, Iraq who are already facing severe liquidity crisis due to most of their country’s revenue coming from the sale of crude oil, will likely be increase production in desperation.

Supply is likely to exceed demand in the short term (3-6 months) resulting in the current Naphtha prices to continue being depressed in the foreseeable future.

And, One More thing

With all the information above, we need to ask ourselves one very fundamental question.

Is it priced in?

Has anybody fried this share up so far?

This stock is

more virgin than extra virgin olive oil.

Other than the brief pop back in April-May 2020, which affected all stocks, it has only gone down since then and is way below its Dec 2020 closing price of RM2.4, despite being projected to make more money in Q3 2020.

Clearly the market still thinks this is some random petrochemical company that is going to suffer for the next 1 – 2 years due to reduced demand.

None of the facts I have written above have been priced into the stock at all.

When you are reading this, prices is likely to be a bit higher as much of this information is likely to be public from a summary i will publish beforehand, and this may move prices upwards a little.

Also, there was an interview with the MD in Sinchew, which spiked up the price a bit at first.

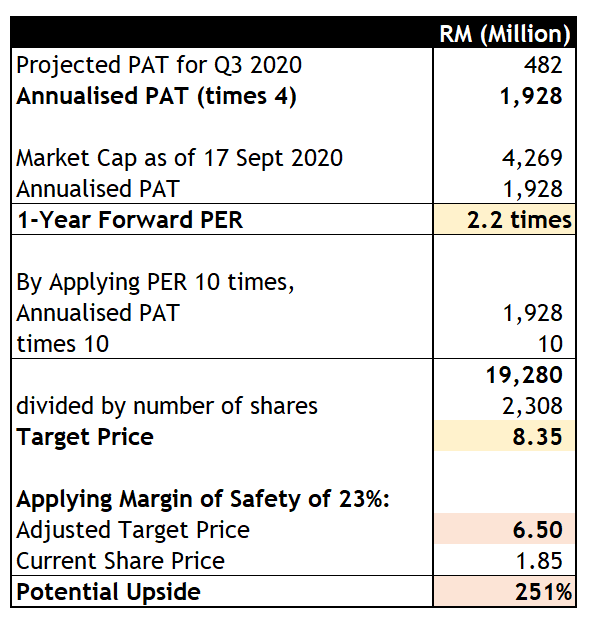

Target Price

And so, the second million-dollar question, what is the target price?

For me, the target price is dynamic.

When this article releases, and PP, PE and Butadiene prices shoot through the roof, it should increase to somewhere around RM2 to RM2.5 by 31 October 2020 as market now anticipate the strong projected profits.

I’m being conservative on this one, as there are quite a few fund managers who have been traumatized by this company and want to get out. This amount may be higher, if the telegram groups start promoting.

Personally, I’m projecting around RM550m or more for Q3, which is an all-time high quarterly profit.

But to be conservative, let’s say I’m wrong on this one, and its only RM350m.

Well, currently the market is pricing this company on a price to book basis, with the company not being worth much more than its cash, as most people still think this is some random petrochemical company that will suffer during this COVID, instead of one that will make record profits.

The results will surprise most of the people and result in an increase in share price, but as the market may still think the profit may not be sustainable, it may only increase to RM3-RM4 post Q3 results, as people want more proof.

Now, im certain Q4 will also be at least RM400m-RM550m in profits.

When this happens, suddenly, in the mind of the public, this company’s survival will no longer be in doubt, instead people will be thinking about all the expansion plans this company has.

They will think about the US associate contributing RM150m a quarter.

They will think about the Indonesia PP and PE plant which will grow revenue to RM25bil etc.

And then, suddenly, they would want to price in the growth and maybe push it up higher to 10PE.

This is where it will go up to RM6.5 or more.

The most lucrative investment is one where people go from thinking the company dying (and thus valuing it on Price to Book Basis), to thinking it will now be making supernormal profits with strong potential for growth, and thus valuing it on a Price to Earnings Basis.

And I think LCTITAN is one of these stocks with a lot of catalyst upcoming.

Needless to say, quite a few things have to line up very well in order to hit the RM6.5 target price, but I think the odds are pretty decent.

Buy and sell it at your own discretion. This is my target price, set your own based on your own observation and understanding of the situation.

As always, all the best and good luck.

=====================================

Disclaimers: Refer here.

====================================================================

Facebook: Choivo Capital

Website: www.choivocapital.com

Email: choivocapital@gmail.com

Telegram: https://t.me/philipcapitalmanagement (This is Phillips Telegram Chat, but i consider it the best telegram to follow for Malaysia Markets period. Its amazing how we got here given our history. He's one of the few with whom where i find myself more wrong than right whenever we argue/discuss)

Whatsapp: Email me, for Whatsapp, i can only accept up to 256 people (unlike telegram where the limit is 20k). So i try to be more selective for this.

https://klse.i3investor.com/blogs/PilosopoCapital/2020-09-26-story-h1514324256-_CHOIVO_CAPITAL_LCTITAN_5284_Five_Magic_Words_Rising_ASP_s_Falling_Cost.jsp