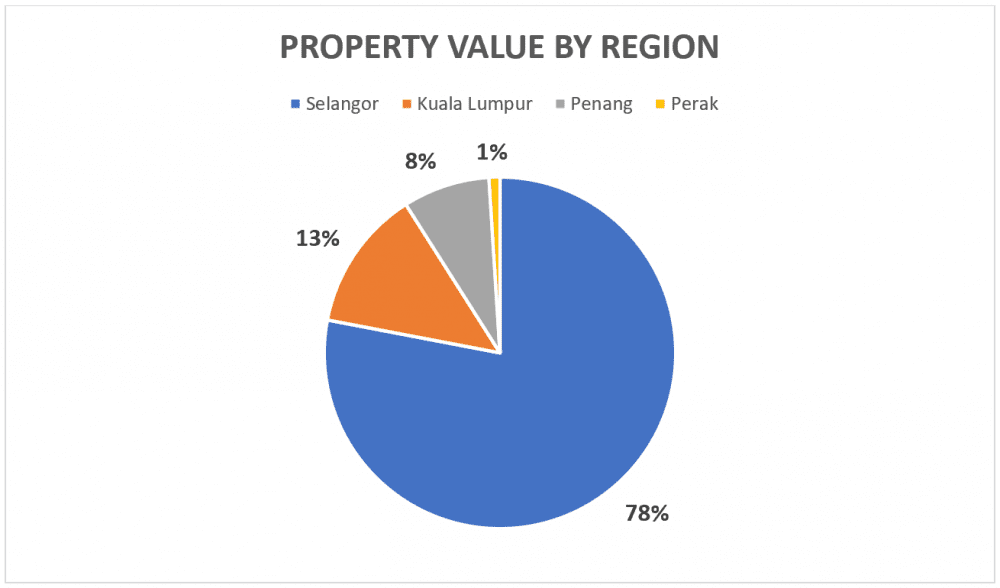

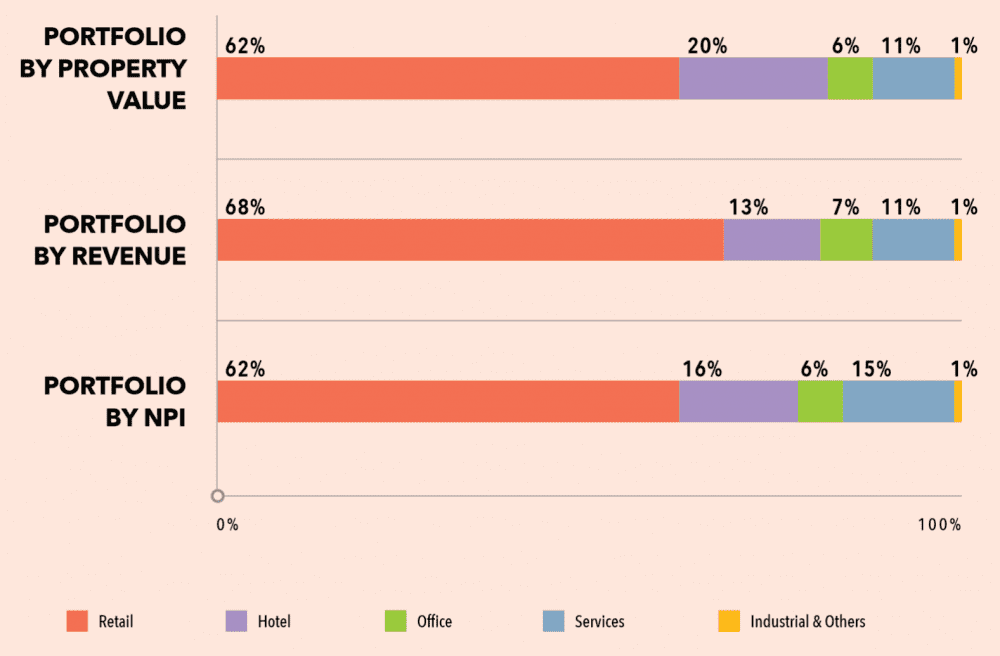

Sunway REIT is a diversified REIT with a focus on retail malls. It owns 17 assets from the retail, hotel, office, services, and industrial sectors in Klang Valley, Penang, and Perak. The majority of its assets are concentrated in Sunway City in Selangor.

Its total property value stood at RM8.0 billion as of June 2020. It aims to grow its property value to between RM13 and RM15 billion by 2025 in line with its TRANSCEND 2025 strategy by acquiring and growing its services and industrial properties.

Here are five things I learned from the 2020 Sunway REIT AGM and EGM.

1. In 2020, the REIT’s retail and hotel properties, its two largest segments contributed to about 80% of the REIT’s revenue. Revenue from the retail segment dropped 14.5% to RM364.7 million year-on-year because of lower rental and carpark income in the second half of financial year 2020. In August 2020, footfall and retail sales recovered by at least 60% and 70% year-on-year. They are expected to recover by 80% and 90% year-on-year by the end of the year. However, these estimates are uncertain as Klang Valley fell into another conditional movement control order (CMCO) period in October.

Revenue from the REIT’s hotels slid by 12.8% to RM68.5 million year-on-year. The management offered two of its hotels as quarantine centres for overseas returnees to mitigate the decline in its revenue. They took the opportunity to refurbish Sunway Resort Hotel by 2022 to rejuvenate the asset for the longer term. The phased refurbishment will cost more than RM220 million. The short-term outlook of the hotel segment remains soft as borders are closed to international tourists until the end of 2020. Domestic tourisms continue to be lacklustre as COVID-19 cases resurged in Malaysia.

Rental support was granted to retail tenants and hotel lessees whose businesses were affected by COVID-19 during the MCO period.

Occupancy rates of the REIT’s office properties increased from 74.5% in 2019 to 79.0% in 2020. The REIT’s services and industrial properties saw positive rental reversion and the services segment benefited from the full-year income contribution from Sunway university & college campus.

A number of strategies were adopted to conserve cash including:

- Change of distribution from quarterly to half-yearly

- Revision of distribution payout from 100% to 90%

- Deferment of non-essential spending

- Establishment of a distribution reinvestment scheme

2. Sunway REIT sought to raise up to RM710 million from a private placement to acquire The Pinnacle Sunway and expand Sunway Carnival Shopping Mall. The Pinnacle Sunway is an office building located in Sunway City. This building will be acquired at RM450 million using debt in addition to proceeds from the private placement. The acquisition is scheduled to be completed by 2021 and the building is currently fully occupied. The expansion of the mall is ongoing and will have 350,000 square feet of net lettable area upon completion in 2021. The development cost is estimated to be about RM353 million.

This private placement will boost distribution per unit (DPU) from 7.33 sen to 7.59 sen and reduce the REIT’s gearing ratio from 40.7% to 37.6%. If perpetual notes are included in the calculation, the gearing ratio would be 41.3% after the private placement.

Based on a DPU of 7.59 sen and its closing share price as of 29 October 2020, Sunway REIT’s distribution yield is 5.3%. However, we may see downward pressure on Sunway REIT’s DPU due to the impact of COVID-19.

3. CEO Dato’ Jeffrey Ng Tiong Lip stated the REIT’s interest to acquire data centres. Given the growth in the number of online users and connected devices, the management believes data centres are defensive assets that will continue to do well during the pandemic and in the future. Data centres typically house critical servers that operate 24/7 to support business operations. The acquisition of data centres is aligned with the REIT’s TRANSCEND 2025 strategy to increase the total asset value from the services and industrial segments to 25%.

4. The CEO said that the REIT’s operations will still largely be confined to Malaysia given the tax-friendly structure here. Sunway REIT will be exposed to different risks if it acquires overseas assets.

5. TF Value-Mart has replaced the operator of Giant hypermarket chain to be the sole tenant of SunCity Ipoh Hypermarket in Ipoh, Perak. TF Value-Mart is a supermarket chain that owns 35 outlets in secondary cities and towns nationwide. Just a side note, the owner of this supermarket chain was looking to sell the entire business for at least RM1 billion.

https://fifthperson.com/2020-sunway-reit-agm-and-egm/