Started covering the soybean price trend when it is still trading at $8.2 per bushel, it is now trading at $10.2 per bushel, 25% rise in just 6 months’ time. Although the three months starting from September to November are harvesting seasons for the Northern Hemisphere, we do not see any selling pressure from farmers this year.

Besides, there are many more reasons to be bullish on soybean:

1) Data from USDA shows that inventory is 46% lesser compared to last year

2) Crop yield per hectare declines slightly in this planting season

3) Soybean prices just breakout from a 3 years resistance and is holding well above the price level

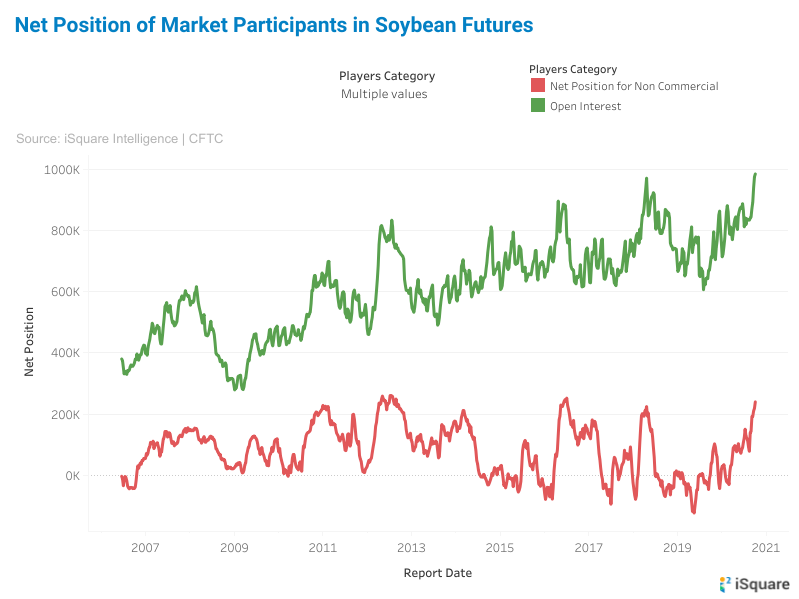

4) From the data compiled from CFTC, the open interest for soybean futures remained high and is still increasing. (Open interest is an indicator for the market participation in this product, a higher open interest means more money is trading this product)

5) Non-commercial trader, who are mainly made up of hedge funds or financial institutions have been increasing their long position since 2019. Their positions are still increasing and no signs of reversal yet.

In short, I remain bullish on the outlook of soybean prices.

https://klse.i3investor.com/blogs/isquare/2020-10-05-story-h1514475140-Bullish_Outlook_for_soybean.jsp