KPS (stock code: 5843) - A RM1bil [EMS] company in disguise? [$$bill dollardollarbill]

Kumpulan Perangsang Selangor (KPS)

The recent water cuts made me revisit KPS since it once owned 30% of Syarikat Pengeluar Air Sungai Selangor Sdn Bhd (SPLASH) and currently owns Aqua-Flo and Smartpipe Technology which sells goods to Air Selangor (see pg. 278 of 2019 annual report).

Many expect KPS to benefit from Air Selangor now that the government should become very serious about water issues (water pipe leakages, pollution) in Klang Valley, given how furious the public has become.

But water is not my purpose for writing this post. There’s way more to KPS than that…

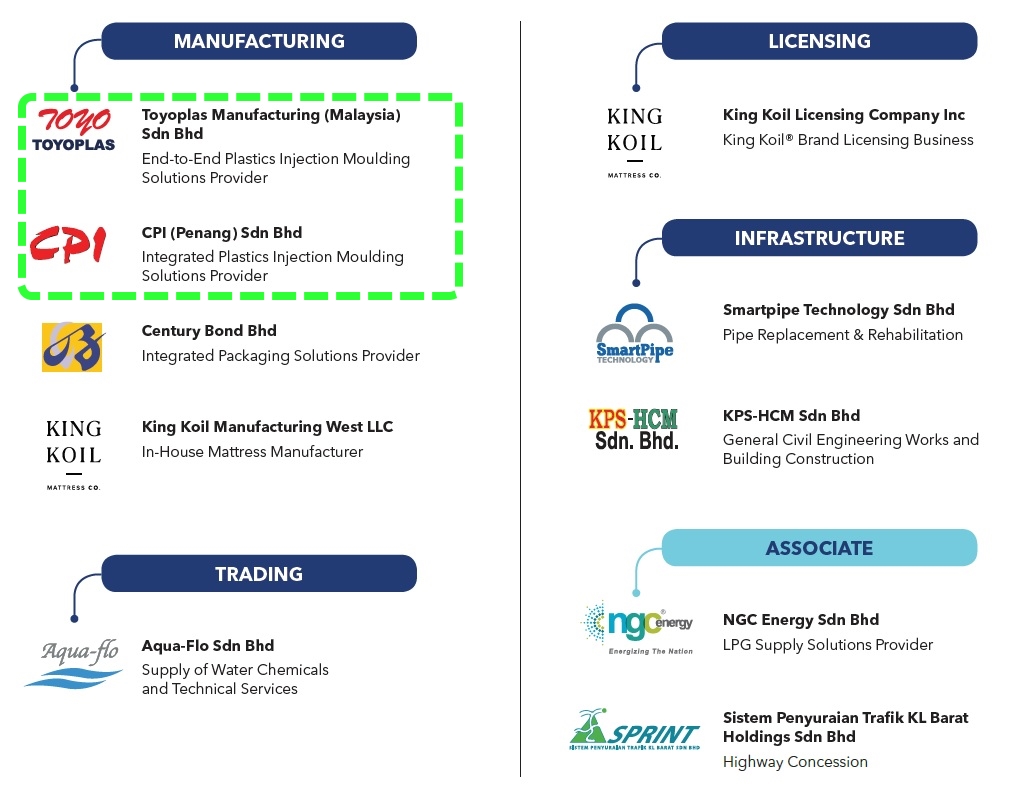

As I read up more, I realised that KPS is actually more into manufacturing, which is mostly from plastic injection moulding/EMS like SKP, VS, ATA IMS, HIL and Luster.

I believe KPS makes a good proxy to plastic injection moulding/EMS players which have been quite bullish (see stock charts at bottom). Luster for example has been strongly rallying over the last 2 days.

I discovered that KPS is actually attractively undervalued as a plastic injection moulding/EMS proxy and here’s why:

KPS has two 100%-owned integrated plastic injection moulding companies:

1. Toyoplas Manufacturing (Malaysia) Sdn Bhd - acquired in Aug 2019

2. CPI (Penang) Sdn Bhd - acquired in Mar 2018

To know the net profit of these 2 companies, we need to dig deeper in the annual report.

Toyoplas recorded revenue of RM398.2mil and net profit of RM38.1mil (net profit margin 9.6%) in 2019 (pg. 195 of 2019 annual report).

CPI recorded revenue of RM169.3mil and net profit of RM26.8mil (NP margin 15.8%) in 2018 (pg. 201 of 2019 annual report).

When CPI was acquired, there was a net profit guarantee of RM25mil in 2018, and RM26mil in 2019. In 2019, CPI registered revenue of RM180.4mil. Although net profit was not openly disclosed, I believe 2019 net profit should be about RM27.0mil (assuming 15% NP margin, and considering the profit guarantee).

So in total, 2019 net profit of Toyoplas and CPI should be about RM38.1mil + RM27.0mil = RM65.1mil (12 sen EPS).

If we peg a P/E multiple of 15x to that RM65mil net profit, it will give KPS a market cap of RM975mil. With shares outstanding of 537.4 mil, that translates to about RM1.80 per share! How undervalued is KPS with its shares now trading at 75 sen? Current market cap is just RM403mil.

Just with only the net profits of both Toyoplas and CPI, KPS is trading at 6x P/E at the current share price.

Compare this to the P/E of some plastic injection moulding stocks, taken from a CIMB analyst report dated 14 Oct 2020:

VS, ATA IMS and SKP are trading at current year P/E of more than 20x, and forward P/E of 17x on average.

I think it’s fair to say that Toyoplas and CPI can recover and grow their earnings in 2021. This is expected from the likes of VS, ATA IMS, etc.

Another plus point is Toyoplas and CPI has high profit margins when compared to its peers.

KPS has made it well known that there will be synergies with Toyoplas and CPI. The plan is for the two companies to leverage on each other’s expertise, resulting in higher operational efficiency from economies of scale and integration. This would result in better capacity utilisation and ultimately higher revenue, as stated in their annual report.

Source: Annual Report 2019

It is worthy to note that in addition to CPI and Toyoplas, KPS has other good income generating businesses like Century Bond and King Koil.

Balance sheet wise, KPS gearing appears manageable. As of 30 June 2020, it had cash of RM251.4mil and total borrowings of RM563.7. Shareholders’ equity (book value/NTA) stood at RM956.2mil or RM1.78 per share.

Gearing should improve over time…

KPS has a 20% stake in SPRINT expressway (worth RM870mil) which is pending disposal. The 20% stake is worth RM174mil. (http://bernamamrem.com/viewsm.php?idm=34812)

From the sale of SPLASH in 2018 for RM765mil, KPS received RM570mil in cash and will be receiving additional RM195mil in nine annual instalments (equivalent to RM21.7mil per year) (pg. 34 annual report 2018).

Given all this, it is in my personal opinion (not a recommendation to buy or sell) that KPS should be worth at least double its current share price. Personally, I feel it should be trading at a market cap of RM1bil. Perhaps it will be as more people discover the qualities of this stock.

Here’s a look at the BULLISH stock charts of plastic injection moulding/EMS players:

Will KPS rocket up soon as well?

Join my Telegram channel for random updates @worthystocks

#KPS (5843)

https://klse.i3investor.com/blogs/dollardollarbill/2020-10-20-story-h1534735929-KPS_code_5843_A_RM1bil_EMS_company_in_disguise_bill_dollardollarbill.jsp