POS

(4634)

RECOVERY IN SIGHT?

YOU JUDGE.

#jntstudynotes

Preview

If you noticed, share price of POS surged last week. This surged caught our attention. Curious and interested, we dived into POS study.

We think that dismissing POS as a potential stock simply because it has gone up a lot, is unwise. Instead, fundamental investors look for stocks based on fundamental analysis, instead of feeling whether a share price is ‘too high’ or ‘too low’.

Below are our study notes on POS.

LATEST NORM: BUYING THINGS ONLINE, NOT JUST BECAUSE WE WANT TO,

BUT ALSO BECAUSE WE NEED TO

“Based on EMIR Research's poll for the third quarter, respondents agreed that Covid-19 has resulted in the emergence of an economy that is reliant on technology.

A respondent said: "Now it seems that in the surrounding suburban areas, with the onset of Covid-19, we see a lot of these kind of businesses; suddenly many entrepreneurs have appeared. This means that (COVID-19) has created an economic opportunity and we now see a lot of online businesses and these online businesses are doing very well."

Source: New Straits Times

POS RUNS 4 BUSINESSES

- POSTAL (Core) – Courier and mail. 75% revenue contribution, largest business segment.

- LOGISTICS (Core) – Freight management and local automotive. 12% revenue contribution.

- AVIATION (Non-core) – Cargo and ground-handling business. 8% revenue contribution.

- OTHERS (Non-core) – Printing, digital certificates and Islamic collateral bonds. 5% revenue contribution.

|

Business Segment |

Revenue (RM, ‘000) 6 months ended Jun 30, 2020 |

Revenue Contribution |

|

Postal |

867,398 |

75% |

|

Logistics |

142,204 |

12% |

|

Aviation |

94,141 |

8% |

|

Others |

60,865 |

5% |

|

Total |

1,164,068 |

100% |

POSTAL and LOGISTICS are POS’ core businesses. They make up more than 85% of POS revenue.

CORE POSTAL BUSINESSES (75% REVENUE): GROWING AND EXPANDING

Courier service experiences strong demand from e-commerce arising from the New Normal – COVID-19, MCO, CMCO (and potentially EMCO), plus the already-ongoing global digitalisation.

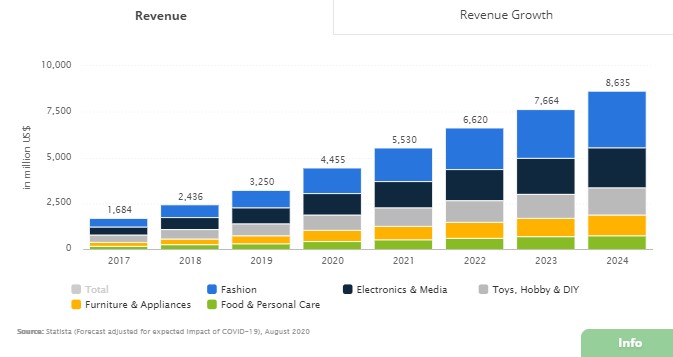

Malaysia's eCommerce market is growing at a high annual growth rate of 18.0%. Estimated user penetration in 2020 40.5% and it is expected to hit 51.4% by 2024.

Source: Statista

The two biggest eCommerce sites in Malaysia are Shopee and Lazada. Both of them partner with POS (and also J&T Express) for delivery.

If you shopped on Shopee or Lazada recently, you may recall.

On the other hand: below are the updates from POS:

- Parcel doubles. POS expects heightened demand to continue post-MCO. In August 2020, POS had experienced a drastic surge in the volume of parcels to be processed and delivered, ranging from 600,000 to 800,000 parcels a day from its capacity of only 300,000 to 400,000 parcels a day. POS expects this trend to continue throughout the rest of the year. POS is also seeing higher than usual courier volume even after the easing of movement restrictions.

- SendParcel, encouraging traction, 60% and 176% increase q-o-q. This online shipping platform for parcel delivery helps business and individual customers manage bulk deliveries and find the best rates, instant pricing quotes and other services. The MCO boosted demand SendParcel’s services. Registered users of SendParcel have increased by 60% while average daily parcel shipment has increased by 176% over the previous quarter.

-

IPC, 77% capacity expansion. POS’

Integrated Parcel Centres (IPC) in Shah Alam and newly completed

facility in KLIA has increased its processing capacity by 77% from

300,000 to 530,000 parcels per day, which will allow it to deal with the surge in demand from the e-commerce sector.

-

More fulfilment centres, guaranteeing 24-hour delivery. To

improve the efficiency of its parcel delivery services, POS is

developing more fully automated integrated fulfilment centres across the

country. A fulfilment centre Senai Airport in Johor will be completed

next year. Over the next two years, POS will be spending RM300 million to develop new fulfilment centres in

the northern region, east coast, Sabah and Sarawak, to complement its

central integrated processing facilities in Shah Alam and Kuala Lumpur

International Airport. Once all these facilities are up and running, POS

will be able to guarantee delivery within 24 hours to all locations across Peninsular Malaysia.

-

Pos Laju Ezibox. POS has widened its network of parcel lockers to 255 locations in Malaysia and working with over 700 retail partners so customers can pick up and drop off parcels for collection at those locations.

-

POS Entrepreneurship and Rider Programme. POS

workers become its business partners in the sorting and delivery of

parcels and mails, and receives a commission for each parcel delivered.

POS has also increased the number of delivery agents to increase the capacity for parcel deliveries to the recipients. Partnering with individuals to provide the last-mile delivery, POS could better manage its fixed costs.’

- 1300 new part-time personnel. POS has increased its workforce by adding 1,300 part-time personnel to speed up parcel processing in its centres across the country.

On the other hand, mail service experiences higher revenue due to nationwide postage revision effective Feb 1, 2020 (The last postage revision was in 2010). Sales volumes are lower, though.

- Non-commercial mail postage: RM0.20 à RM2.40.

- Commercial mail postage: RM0.90 à RM3.10

- Commercial private letterboxes: RM150/year à RM200/year

- Commercial stamp rates: RM0.70 à RM1.30 (more than double)

LOGISTICS BUSINESS: WOULD BE PROFITABLE WITHOUT RECEIVABLE IMPAIRMENTS

Logistics segment revenue is mainly from freight management business (especially from freight forwarding and haulage) and automotive business (largely from the local automotive production volume).

However, this segment was loss-making in the latest quarter due to impairment of certain receivables.

POS is having undergoing a transformation plan. Operational efficiency (which includes collecting receivables, we believe) is one of their focus. If the receivables collection can be made more efficient, POS would recover the logistics segment’s profitability.

COULD X50’S STRONG ORDER BENEFIT POS’ AUTOMATIVE LOGISTICS BUSINESS?

X50 is a local automotive. Even before launch debut, X50 appears to be a popular choice among car buyers, with over 20,000 bookings received in just two weeks after the order books were opened on Malaysia Day (Sep 16).

Source: Paultan.org

The current Covid-19 situation is not affecting car sales, thanks to the government’s sales tax holiday which ends on Dec 31. Many car companies are also throwing in rebates and discounts on top of the tax holiday introduced by the government to stimulate the local automobile industry.

Source: The Star, Oct 12, 2020

DRBHICOM owns 53.5% POS and 50.1% PROTON. Would DRHICOM award POS the automotive logistics business for X50? Would POS automotive logistic business benefit from X50’s strong order volume?

NON-PERFORMING, NON-CORE BUSINESS: KISSING GOODBYE, TO RECOVER PROFITABILITY

POS is proactively divesting its non-performing, non-core businesses to recover profitability.

- Divested loss-making WCA. On Aug 19, POS proposed to dispose of 51% stake in World Cargo Airline Sdn Bhd (WCA) to Asia Cargo Network Sdn Bhd (ACN) for a cash consideration of RM40 million. That said, WCA will continue serving POS’ needs for air freight cargo services between Peninsular Malaysia and Sabah and Sarawak

- Divested loss-making Pos Engineering Services. POS also divested a 49% stake in Pos Aviation Engineering Services Sdn Bhd to SIA Engineering Co Ltd for a cash consideration of RM10.09 million in February 2020.

- Likely to divest non-core aviation business. POS’s aviation business involves ground handling, aircraft handling, maintenance, repair and overhaul of aircraft, as well as inflight catering services. These businesses are non-core, not profitable and likely to be divested.

CEO: TURNAROUND IN SIGHT, A YEAR EARLIER THAN EXPECTED

POS has been reporting huge losses and has been in the red in the past seven quarters. POS Malaysia’s three main business segments – postal, logistics and aviation – were all loss-making.

In 2019, POS launched its 3-Year Transformation Plan.

- In 2020, POS aims to gain strong foothold in eCommerce and achieved efficient parcel professing and distribution network. Catalysed by the New Normal and aggressive execution, POS seems to have achieved these.

- In 2021, POS aims to achieve margin improvement by focus on core business and becoming a ‘parcel-first’ operator. 2020 now – time will tell.

- In 2022, POS aims to achieve sustainable growth by becoming the undisputed #1 courier of choice for eCommerce business. 2020 now – time will tell.

POS CEO Syed Md Najib Syed Md Noor says the group’s original plan to break even by the end of FY2021 has been expedited by a year owing to COVID-19. If the trend of increased demand for e-commerce continues, POS is hopeful of reaching this target.

Source: TheEdge

NO NEW COURIER PLAYERS ALLOWED UNTIL 2022: A BONUS FOR POS TURNAROUND

On October 26, MCMC imposed a two-year moratorium on the issuance of courier service license, effective from September 14, 2020 until September 15, 2022.

During the enforcement period of the moratorium, MCMC will not accept any new license application for all categories of courier servics.

This moratorium would provide opportunities for the government, together with the postal and courier industries to formulate new plans for the sector which faces challenges from technological changes and market trends.

This is a positive news for POS.

CONCLUSION: POS SEEMS TO BE WORKING TOWARDS TRANSFORMATION, LET’S SEE HOW WELL THEY CAN PERFORM MOVING FORWARD

|

Business Segment |

Business Status |

Transformation Strategy |

A Strategic Move? (Our view) |

|

Postal |

Core (75% revenue) |

Expand, optimise |

Yes, POS seems to be delivering early results (and catalysed by the New Normal) |

|

Logistics |

Core (12% revenue) |

Keep |

Unsure – Great if POS can collect receivables efficiently in future. May benefit from X50's strong orders. |

|

Aviation |

Non-core (8% revenue) |

Divest |

Yes, to recover profitability. |

|

Others |

Non-core (5% revenue) |

Keep |

Yes, good to keep profitable business. |

- POS is actively expanding and optimising its core, growing postal and logistic businesses via a series of strategies to capture rising demand in the New Normal. Looks like a good move for the core business that contributes to around 75% revenue.

- POS keeps logistics business and may continue to recover its efficiency and profit margins. We are unsure whether this is a good move, unless POS can collect receivables efficiently in future. That said, this segment may benefit from X50’s strong orders.

- POS divests its non-core aviation business. Good move to recover profitability.

-

POS keeps its non-core yet profitable OTHER segment. Looks good to keep this segment, as it’s profitable.

-

POS is positioned in a high-growth industry, catalysed by the New Normal - COVID-19, MCO, CMO (and potentially EMCO), plus the already-ongoing global digitisation.

- BONUS for POS: Benefit from MCMC's decision that stops issuances of new courier operating license until September 15, 2022.

BUSINESS RISKS

Business risks of POS include decline in mail volume declines, courier pricing competition, logistic businesses and higher than expected operating costs. POS’ Transformation may or may not succeed at the end of the day.

TECHNICAL PERSPECTIVE

When POS was profitable in 2017 and 2018, its share price stood between RM4-6.

After 8 loss-making quarters, POS dropped to a low of around 78 sen.

- This week, last week showed a surge of share price from 78 sen to more than 90 sen with considerable buying volume.

- POS had bullishly crossed the MA100 resistance.

- POS tried to cross the significant MA200 on Oct 21 but failed.

- Now, POS is taking a breather, hovering between MA100 and MA200.

Overall, POS is showing some early technical trend reversal signals.

As share price moves in advance of actual performance, could this be the sign of POS’ early turnaround success?

If successful, how much should its share price worth?

Moving forward, how would POS’ share price move?

Time and Mr. Market will tell.

DISCLAIMER

Our views are for sharing purpose only. They could be inaccurate. Valuation perspective is beyond scope. There is no BUY/SELL recommendation.

#jntstudynotes

https://klse.i3investor.com/blogs/jomnterry/2020-10-26-story-h1535454942-POS_4364_TURNAROUND_IN_SIGHT_YOU_JUDGE.jsp