Wong Engineering Corporation Berhad is engaged in

manufacturing of metal stamped parts, sheet metals and turned metal

components, trading, marketing and retailing of industrial and consumer

products and design, manufacturing and supplying of welded frame

structures, related modules and systems.

It produces metal parts, such as couplings, housing, plungers and utilizes engineering alloys.

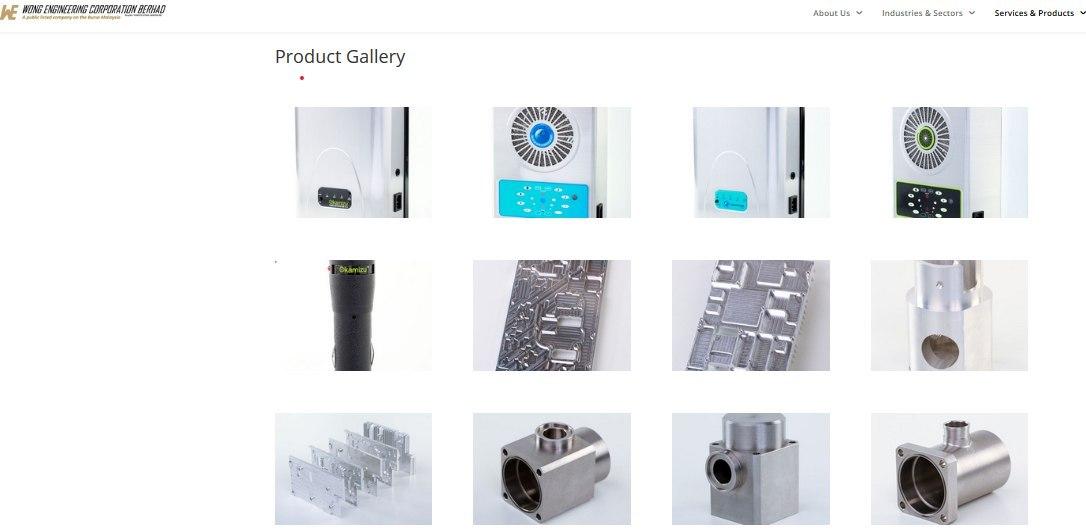

Its services and products include sheet metal fabrication, metal

fabrication, surface treatment and finishing, semi-modular and final

assembly, and product gallery.

Its manufacturing activities are in Malaysia and sales are in two geographical areas: Asia and Europe.

Its cater the industries in power, oil and gas, test instrument,

telecommunication, printing and imaging, and consumer products.

WONG ENGINEERNG (7050) – A Potential UWC and JHM in the making .

It is very thinly traded share with only 112 mil shares issued with a forward PE 12 valuation of 110 Sen to 132 Sen.

A low profile company worth to watch or take position around 90

Sen level depending on your risk appetite with its turnaround

performance.

Management confidence in its share price is reflected by the share

buybacks and purchase of shares by controlling shareholders in recent

months.

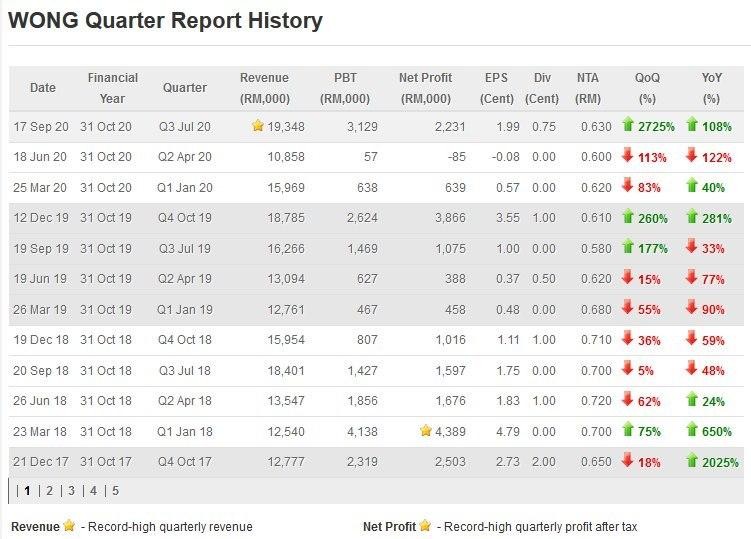

Based on Q3 EPS of 1.99 Sen achieved despite being affected by

MCO, we estimated the 12 mths EPS in the region of 9 Sen to 11 Sen.

Using the estimated EPS range of 9 Sen to 11 Sen, with a

prudent forward PE 10 to PE 12, its valuation could range from 90 Sen to

108 Sen ( if next 12 mths EPS is 9 Sen) and 110 Sen to 132 Sen (if EPS

is 11 Sen) respectively.

I am incline to use PE 12 with a valuation range 110 to 132 Sen.

A turnaround story before Mr. Market notice it.

Wong would be conducting investor briefing to investors and analysts in KL in due course.

The Co wants to send a strong statement of intend that it wants to

shine like other Penang Technology Supply Chain Players and asking

investors to put Wong on their radar. The Co focus would be on the

manufacturing sector and continue its pursuit of business in

construction.

![]() FINANCIAL :-

FINANCIAL :-

- In recent its Q3 announcement for the quarter ended 31 July, the Co reported a revenue of RM19.3 mil (9 mths YTD RM46.2 mil) with a PBT of RM3.1 mil (9 mths YTD RM3.8 mil) and net profit attributable to shareholders of RM 2.2 mil (9 mths YTD RM2.8 mil) .

- The EPS for Q3 was 1.99 Sen and 9 mths YTD EPS was 2.49 sen. The Co also declared an interim dividend of 0.75 Sen and the ex-date for Dividend entitlement is 1 Oct. The dividend yield is 2.1%. The Co has been paying dividend for the last 3 years since the changed in shareholders.

- At 31 July, its net gearing is nil with a cash balance of RM27. 8 mil which is about 24.9 Sen per share compared to its net asset per share of 63 Sen.

![]() PROSPECT STATEMENT :-

PROSPECT STATEMENT :-

- Amidst a difficult business environment brought about by the COVID-19 pandemic, the Group continue to focus on our core business and cost efficiency in order to maintain competitiveness.

- The Group is making efforts to expand into higher value-added manufacturing activities besides aiming to grow export sales and exploring diversification to support customers from various other industries

- As work resumed for the Kuchai Lama project, the Group seeks out new projects and opportunities for expansion and growth in this segment to further enhance and maximize shareholders’ value on top of striving to meet the targeted completion date. Premised on the above and barring any unforeseen circumstances, the Board is cautiously optimistic that the Group’s prospect shall remain favourable for the financial year ending 31 Oct.

- We are impressed as the above quantum leap improvement in top and bottom line which were achieved despite May MCO period.

- We were guided that going forward, the Q3 performance could be consistently achieved with improvements given the few 5G MNC customers which the Co is supporting.

- The Co is currently supplying to MNC clients like J, K, and T (due to confidentiality, we are not disclosing the names) and others. These are the common customers with UWC.

Let us observe Wong for the next 2 qtrly performance as One Swallow does not make a summer.

Thank you

BursaGemAnalysis Team

Please Join us at Telegram channel - https://t.me/BursaGemAnalysis

Disclaimers:

The views are my own as of this date and subject to change, for

educational and informational purposes only. No further distribution is

allowed without prior written consent. I make no recommendation, offer

or invitation to transact in any securities, futures contracts or other

instruments. Please make your independent evaluation, consider your own

investment objectives and financial situation, and consult your own

professional advisers before participating in any transaction. Shall

Anyone here try soliciting business like buy call, mutual fund forex,

will be kick out by admin.

Thank you and enjoy investing.

https://klse.i3investor.com/blogs/WongEngineering/2020-10-18-story-h1534706237-WONG_ENGINEERNG_A_potential_UWC_JHM_in_the_making.jsp