Focus Point (0157) – A strong recovery stock riding on the success of FamilyMart and MORE

Most people think Focus Point (FocusP) is a boring stock with an optical business. They’re wrong…

FocusP is the next F&B growth stock to keep an eye on.

FocusP F&B business can be categorised into two divisions:

1. Komugi bakery outlets

2. Komugi corporate sales

Investors need to focus on Komugi corporate sales division as this will be the growth driver.

FocusP struck gold after its Komugi central kitchen was certified Halal in Jan 2018. Since then, it has scored big with corporate customers like FamilyMart. And there will be more big corporate customers soon once the new central kitchen starts in Dec 2020.

Many are unaware that several hot selling delicious goodies on FamilyMart’s shelves are made and supplied by Komugi.

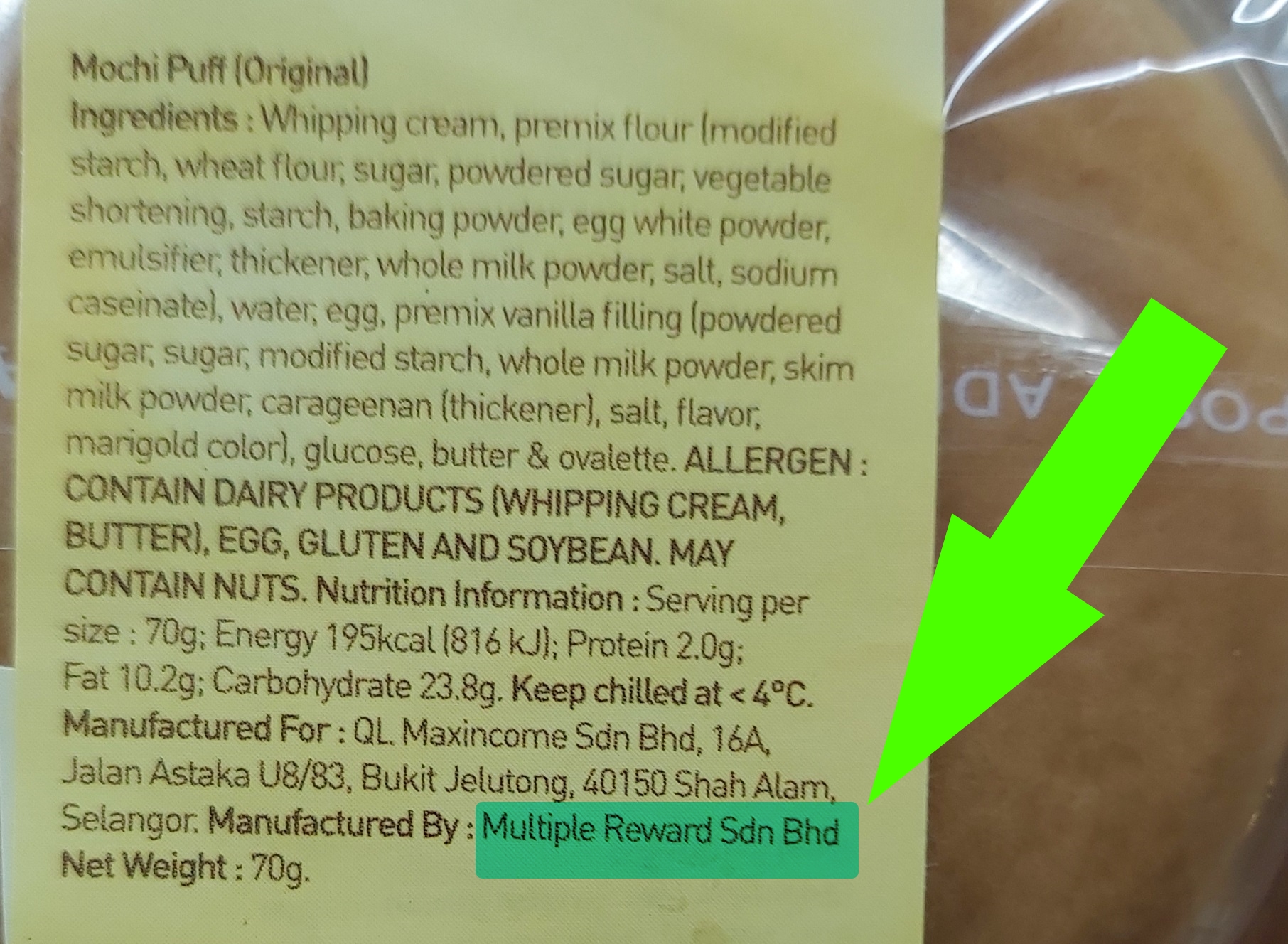

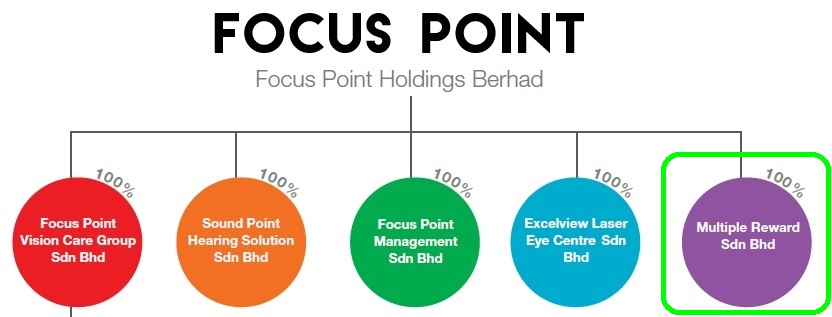

Just check the label and you will see that they are manufactured by Multiple Reward Sdn Bhd (which is 100% owned by Focus Point).

Sales to FamilyMart have been surging. Sales per month is now RM1.2mil (vs. RM300k a year ago). Sales to FamilyMart is expected to reach about RM2mil per month in 1Q2021.

Sales will continue to grow as FamilyMart rolls out more Komugi products to more of its stores.

FamilyMart currently has around 200 stores in Malaysia (the opening of the first store in Penang in July 2020 marked the 200th outlet).

QL Resources, which owns FamilyMart, targets to open 300 outlets by 2022 and is eyeing for 1,000 outlets by 2025.

Just imagine the amount of sales FocusP would generate when FamilyMart has 1,000 outlets...

New central kitchen - the earnings kicker

The first Komugi central kitchen (CK1) can generate about RM2mil sales per month or RM24mil a year.

A new central kitchen (CK2) next to the existing one is scheduled to start operating next month in Dec 2020. CK2 can generate sales of RM4mil a month or RM48mil a year.

FocusP probably built CK2 knowing the capacity will be fully taken up by its new corporate customers.

An article by The Edge last week said FocusP recently signed a supply agreement with a major café chain. FocusP is also in talks with a Japanese retailer and a convenience store chain in Singapore.

CK1 + CK2 = RM72mil sales a year. Assuming 11% net profit margin, that’s about RM8mil net profit a year.

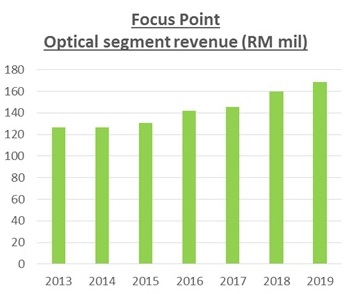

Optical division – steady pom pi pi

Focus Point is Malaysia's leading optical player. The optical division posted profit before tax of about RM14mil in 2019 (vs. RM11mil in 2018). I would safely assume this division to generate RM10mil net profit a year with decent growth.

The market for eyewear and contact lenses will probably grow as nearsightedness (myopia) is rising fast due to increasing digital screen time (computers, smart phones & tablets).

Nearly 50% of the world’s population is projected to be affected by myopia in 2050! (https://www.healio.com/news/ophthalmology/20201124/increasing-myopia-a-growing-public-health-concern).

Conclusion

(A) CK1 + CK2 could contribute RM8mil net profit

(B) Optical segment could contribute RM10mil net profit

(C) Komugi bakeries and other businesses - RM2mil net profit.

(A) + (B) + (C) totals to an annual net profit of RM20mil, which I’m assuming to happen in FY22 (to be conservative). The stock market is forward looking, so it could be as early as 1Q21 when FocusP stock reflects its future earnings of FY22.

If we peg a 18x PE (justifiable given strong growth prospects from F&B), FocusP could potentially be trading at a market cap of RM360mil or RM1.64 per share (about 140% upside to the current share price of 68.5 sen).

I believe FocusP will see a strong rerating once more investors find out about Komugi's relationship with FamilyMart, as well as the growth from new corporate customers.

FocusP just announced a stellar set of 3Q20 results with a net profit of RM5.35mil (annualized RM21.4mil).

4Q20 should be even stronger because 4Q is seasonally the strongest quarter for FocusP.

Join my Telegram channel for random updates @worthystocks

#FOCUSP

Disclaimer: All information here reflects the author’s personal views/thoughts and should not be considered as investment advice.

https://klse.i3investor.com/blogs/dollardollarbill/2020-11-26-story-h1536615587-Focus_Point_0157_A_good_recovery_stock_riding_on_the_success_of_FamilyM.jsp

————————————-

Kudos to dollardollarbill for the in-depth on-the-ground research on Focus Point (0157)

Summary

1. FocusP is the next F&B growth stock to keep an eye on. QL Resources, which owns FamilyMart, targets to open 300 outlets by 2022 and is eyeing for 1,000 outlets by 2025.

Just imagine the amount of sales FocusP would generate when FamilyMart has 1,000 outlets...

2. More new customers coming onboard with potentially another 300 outlet? Major cafe chain and convenience store chain in Singapore should have few hundreds stores. An article by The Edge last week said FocusP recently signed a supply agreement with a major café chain. FocusP is also in talks with a Japanese retailer and a convenience store chain in Singapore.

FocusP probably built CK2 knowing the capacity will be fully taken up by its new corporate customers.

CK1 + CK2 = RM72mil sales a year. Assuming 11% net profit margin, that’s about RM8mil net profit a year.

3. An undercovered gem! Current market cap is only RM150mil and only covered by one broker. If we peg a 18x PE (justifiable given strong growth prospects from F&B), FocusP could potentially be trading at a market cap of RM360mil or RM1.64 per share (about 140% upside to the current share price of 68.5 sen).

FocusP just announced a stellar set of 3Q20 results with a net profit of RM5.35mil (annualized RM21.4mil).

4Q20 should be even stronger because 4Q is seasonally the strongest quarter for FocusP.

https://klse.i3investor.com/blogs/Chongkh888/2020-11-29-story-h1537301740-AN_UNDISCOVERED_GEM_WITH_8X_GROWTH_POTENTIAL_TRADING_AT_BARGAIN_PRICE.jsp