Dear

all, many have emailed me with the concerns on the potential impact of

the iSinar programme expansion allowing 8 million members to withdraw

RM10,000 from the "sacred EPF Account 1" announced by Tengku Zafrul

recently over the week. Largely, I can segregate the gist of questions

to these 4 points :

1. Should EPF savers still leave their money in EPF or withdraw to the maximum allowable limit?

2. Will the dividend for EPF next year still be good?

3.

If the EPF is financially sound, why did the CEO of EPF said there is a

need to liquidate the assets to meet surge in withdrawal demands and

shortfall?

4. If EPF liquidate assets, would the KLCI Bursa stock market be impacted?

I

shall answer the questions point by point and try to avoid any comments

on politics but solely focus on the economics behind this issue.

On Question 1 :

I

think it comes down to individual financial circumstances to make this

decision. For the longest time, I have always held on the belief that

EPF money shouldn't be touched until the very last resort. It is the

savings for your old age so that you do not need to work in McDonald's

when you are 70 or 80 years old when your savings run dry and normal

employment opportunities are no longer available to you. Allowing

withdrawal now is also in expense of savers, who maintain good

discipline and fiscal responsibility over the years to enjoy the fruits

of their labour in the twilight years.

However,

the counter argument is the Covid-19 pandemic has brought many

households which may suffer from loss of jobs, pay cuts or business

closure to their knees. If one cannot survive today, there is no future

to talk about. This is especially true for the B40 & M40 segment.

Near my office, there used to be only 1 Nasi Lemak seller by the

roadside. Today, there are 3 Nasi Lemak and 1 Chee Cheong Fun sellers

within 5 mins walking distance. It is such observations that made me

understand the plight of others better.

My

view would be to only withdraw if you already have absolutely no where

else to turn to as the final resort. If you are intending to withdraw to

buy a new car, upgrade your house or spend on a new iPhone, this would

be grossly wrong. As for savers, EPF by law is required to give a min

2.5% return per annum to members and at this rate of return, it is still

higher than all Fixed Deposit rate given by commercial banks today due

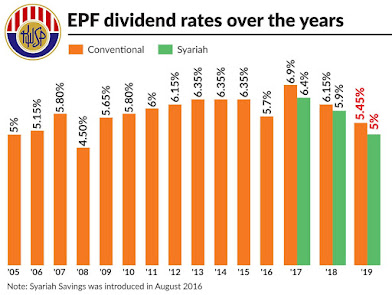

to the 100 basis points OPR rate cut through the year by BNM. If look at

the chart above of EPF dividend performance for the past 15 years, the

worst performance was in 2008 during the Global Financial Crisis. Even

then EPF declared 4.5% dividend yield then.

Additionally,

I conducted an internal poll with my private group subscribers. 79%

would leave their EPF funds in Account 1, 15% would withdraw the maximum

allowable limit and 6% would leave half and withdraw half subject to

eligibility.

On Question 2 :

Prior

to iSinar initiative, I was still rather confident that the dividend to

be declared next year would be quite good, if not better than last

year's performance as the stock market did very well this year

especially when compared to regional peers. The stock market has rallied

from a low of 1208 during the "March Plunge" on 19th March to a high of

1607 as at last Friday. This is despite the strong headwinds of a

pandemic driven economic recession. Even domestic bond markets are

performing well with large inflow due to attractive yield compared

global bond market low yield. After the iLestari and now iSinar

initiative, in addition lower EPF contribution inflow as many members

has either loss their jobs, suffered pay cut or companies have closed

down, the net inflow vs outflow gap widens significantly and likely it

will be in negative territory for EPF this year. This would mean the

potential dividend return next year would probably be lower than last

year. In the event it matches last year's performance, the full impact

will be felt in the years down the road. This is in line with what CEO

of EPF, Tunku Alizakri Raja Muhammad Alias said "There

is no such thing as a free lunch" in reference to the need to sell off

assets to make funds available to depositors withdrawing from their EPF

Account 1 & 2.

On Question 3 :

I

believe many have a misconception when it comes to the CEO statement on

liquidation of assets. EPF like any other funds, have to be invested in

the equity, bond, real estate or money market instruments. Cash / dry

powder cannot be the the bulk of the holdings as EPF mandate is to

deliver returns to members. To do so, the cash on hand cannot go stale.

However, this does not imply that EPF is lacking in cash allocated for

yearly withdrawal. In fact,

it is because this year is an exception / anomaly as a result of the

pandemic driven economic recession and policies made by the Government

which caught EPF asset allocation practice off guard. Hence, it cannot

be business as usual as "something's gotta give".

EPF

will need to liquidate assets or some of their existing position in

bonds, equities or money market instruments to meet the urgent demand

and need for withdrawal of members especially since Account 1 is now

accessible.

A

simple example : Imagine you who invest in the stock market actively,

suddenly with very short notice, your wife or husband tells you that

there is emergency need for funds, hence you need to pull out money

from the equities market now. What will you do? Will you sell your

profitable positions which you believe can do better if you continue

holding or will you sell the loss making position which you believe can

rebound? Either way your investment plan is affected. This is especially

bad for long term value investors who makes exponential returns in

later stage of the investment horizon. EPF in essence is a long term

investor. This would mean EPF will be impacted one way or another from

the liquidation of assets / position.

On Question 4 :

This

is the one which most investors in the stock market are concerned

about, it is important to understand the vast investment holdings of EPF

extends beyond local stock market. EPF would have options to sell

foreign equities, bonds in global markets outside of Malaysia equities.

If they opt to sell local equities more than the others, it would

definitely cause a sell down in the KLCI Bursa. I believe EPF wouldn't

do that but only embark on selective profit taking in sectors that have

done well this year. Hypothetically, if I am the decision maker, selling

foreign stocks which has ran up to record high would be a quicker and

better option without causing systemic risk to the local financial

markets. Bonds market where yields are less attractive though would be

an issue in terms of the price of sale.

In

addition, if members of EPF withdraws funds from Account 1 and put it

back into the equities market, spurring another retail rally, there may

be some net-off effects. Hence I am of the view the risk of large self

off in local markets is not high at this moment although there will be

some selling pressure unless foreign funds make a comeback with a bang.

We must remember it is local funds that has supported the KLCI Bursa

stock market with retail investors filling the void as foreign funds

sold stocks in Bursa to the tune of RM 23 billion to date in 2020.

Conclusion :

The

intent of this article is to alleviate some concern of readers and

assist one in better understanding the situation with EPF moving forward

in the near term. My humble view, if at all, the government should not

be asking people to dip into their own future savings to save themselves

but should use government internal funds to support these community.

Funds allocated for select new infrastructure projects, repairs or

upgrading of building work can be postponed as it is not of the utmost

priority now compared to the livelihood. The increased allocation for

controversial issues such as PMO, JASA departments can also be reduced

to compensate for the shortfall. My fear is this allowance for

withdrawal will set a precedent for the future and open the floodgates.

After all, EPF is one of the last few bastion of our country's esteemed

institutions that have yet to be exploited at the expense of the Rakyat.

_______________________________________________________________

Telegram channel : https://telegram.me/tradeview101

Website / Blog : https://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/or

Email me to sign up as private exclusive subscriber : tradeview101@gmail.com

Food for thought:

https://klse.i3investor.com/blogs/tradeview/2020-11-28-story-h1537297962-_Tradeview_2020_EPF_iSinar_Withdrawal_Programme_The_Stock_Market.jsp