VIVOCOM (0069) VIVOCOM INTL HOLDINGS BHD : End of Day Report (30 Nov 2020)

Vivocom: End of Day Report

Market Report on Vivocom. Close RM1.14 with volume 113.9m.

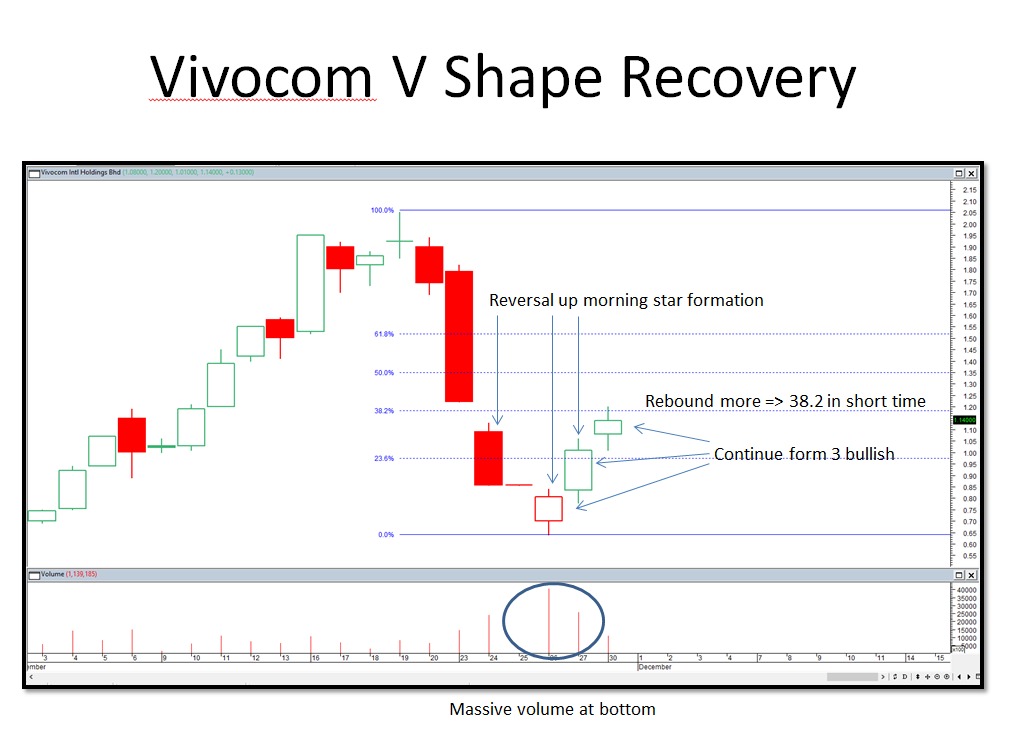

For this end of day report I would like to spend more emphasis on the V- Shape Recovery OF Vivocom’s shares.

There’s not two buts about it. It’s a terrific & astounding V -Shape Recovery.

V, U or L shape recovery on Vivocom? To me it is clearly and categorically a V Shape recovery in progress!

I have gone through in detail the technical analysis & also studied other financial asset which had encountered similar massive sell down, and later experienced a V Shape recovery.

Vivocom indeed fulfilled the criteria set out below.

1. US Major index vs VIVOCOM V shape recovery

A.Massive volume traded at the bottoming, such as buying sizzling.

B.Formed morning star candle stick pattern, triggered buy signal as it broke away from the formation neckline

C.Continue formed 3 bullish candle/3 white candle/solders

D.Rebound more => 38.2% of the sell down without any retracement.

V

V

V

2. How to capitalize on the V shape recovery on Vivocom (I will share with you guys my personal trading plan)

A.I will buy when it break out away from resistance and trigger morning star reversal signal or

B.I will buy if retracement fibo 23.6/38.2% or

C.I will buy at support when retracement happen on support level.

D.I will stop loss if break below RM1.00.

F. I will buy back if support show at RM0.900/RM0.860

3. Support/Resistance/Target

A. Support RM1.10/RM1.00/RM0.90

B. Resistance RM1.22/RM1.40/RM1.70

C.Target RM1.34/RM1.50/RM1.71/RM2.05

In closing I wish to point out that this is the third day of the V-Shape rebound- recovery and the steady and calm trading conditions suggests that this upward adjustment would persist in days to come.

I maintain my point of view that this upward cycle would stay strong and continue with its upward trend and should remain robust and re-visit all the high-points established during the last rally that took prices to a high of 2.05 levels.

I therefore reproduce the closing prices of the relevant week below for your study :-

9 Nov Vol 20M CL RM1.02

10 Nov Vol 65M CL RM1.19

11 Nov Vol 112M CL RM1.39

12 Nov Vol 77M CL RM1.44

13 Nov Vol 69M CL RM1.50

Will the patterns or trends be replicated, only time will tell.

V shape V shape V shape Recovery confirmed.

I’m confidently bullish about VIVOCOM, and as can be seen in the past three days of robust trading activities, the Bulls are Dominant and Surging Upwards again.

Viva la Vivocom. Long Live The SuperBull!!!

https://klse.i3investor.com/blogs/see/2020-11-30-story-h1537328838-VIVOCOM_End_of_Day_Report_30_Nov_2020.jsp