Stock code: 5025 NWP

16 December, Wednesday

Note: after part 1 of the Q&A was

published 12pm today, NWP announced during noon break that it has

signed an MOU with Hoong Li Development Sdn Bhd, to explore engaging NWP

for project management services for a light industrial development

project. This validates my reported updates yesterday and is consistent

with market info thus far.

Private Investor Brief by Senior Management

[ Part 2 ]

Q1:

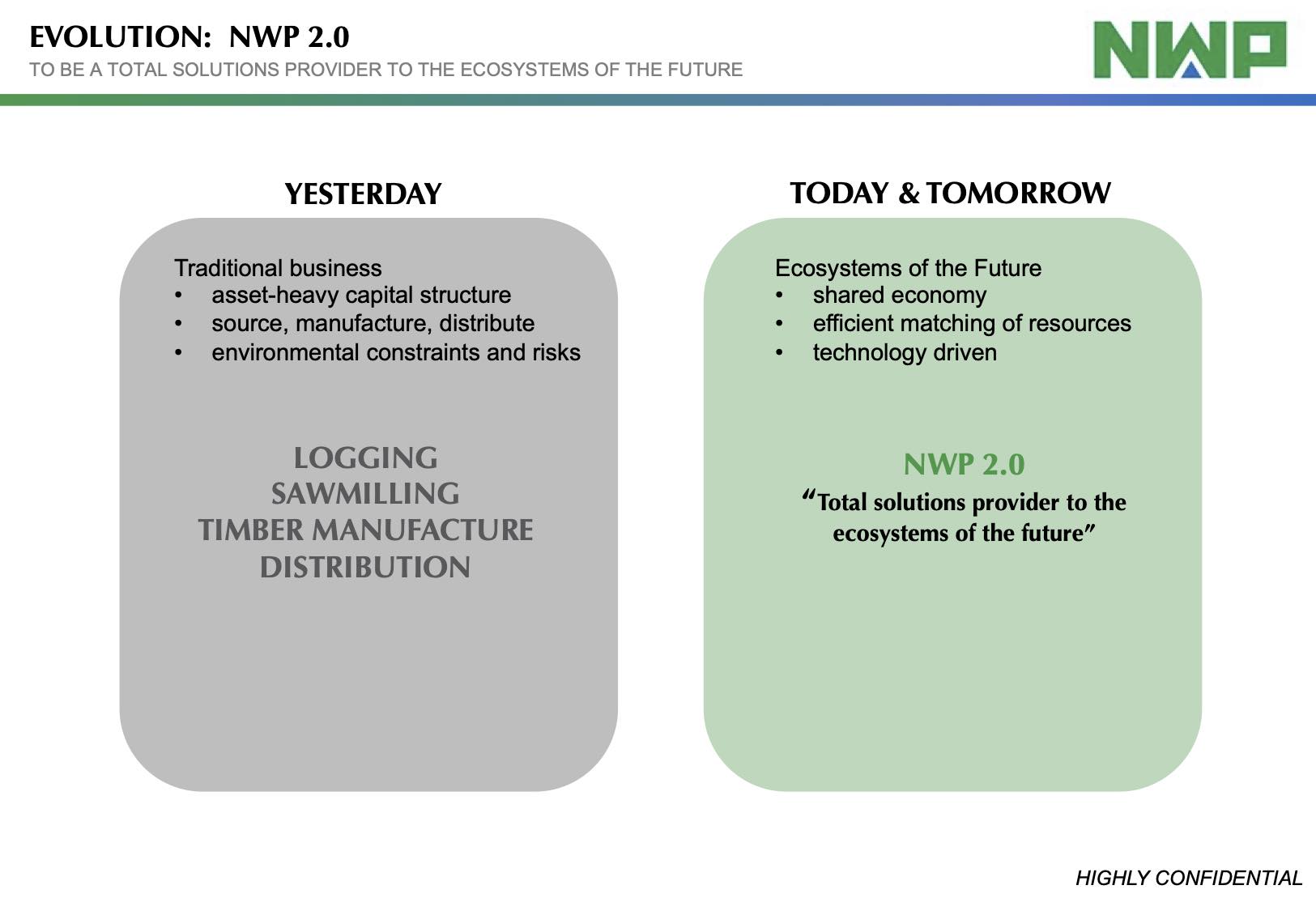

In his first media conference after re-joining as Group CEO, apart from

property, DS Nelson did mention a new automotive business venture,

possibly a tie-up with a “well-known food delivery service provider”.

This got everyone curious and excited. And also a little concerned

because this is a totally new business for NWP. I will put it bluntly:

can do or cannot do?

A: Hahaha this is the

most important question for today right? I get that the market is

excited and curious at the same time. We ourselves were a little

surprised that a brief sharing by our CEO got reported and now it is the

talk of the town. This really shows how powerful media reporting can

be!

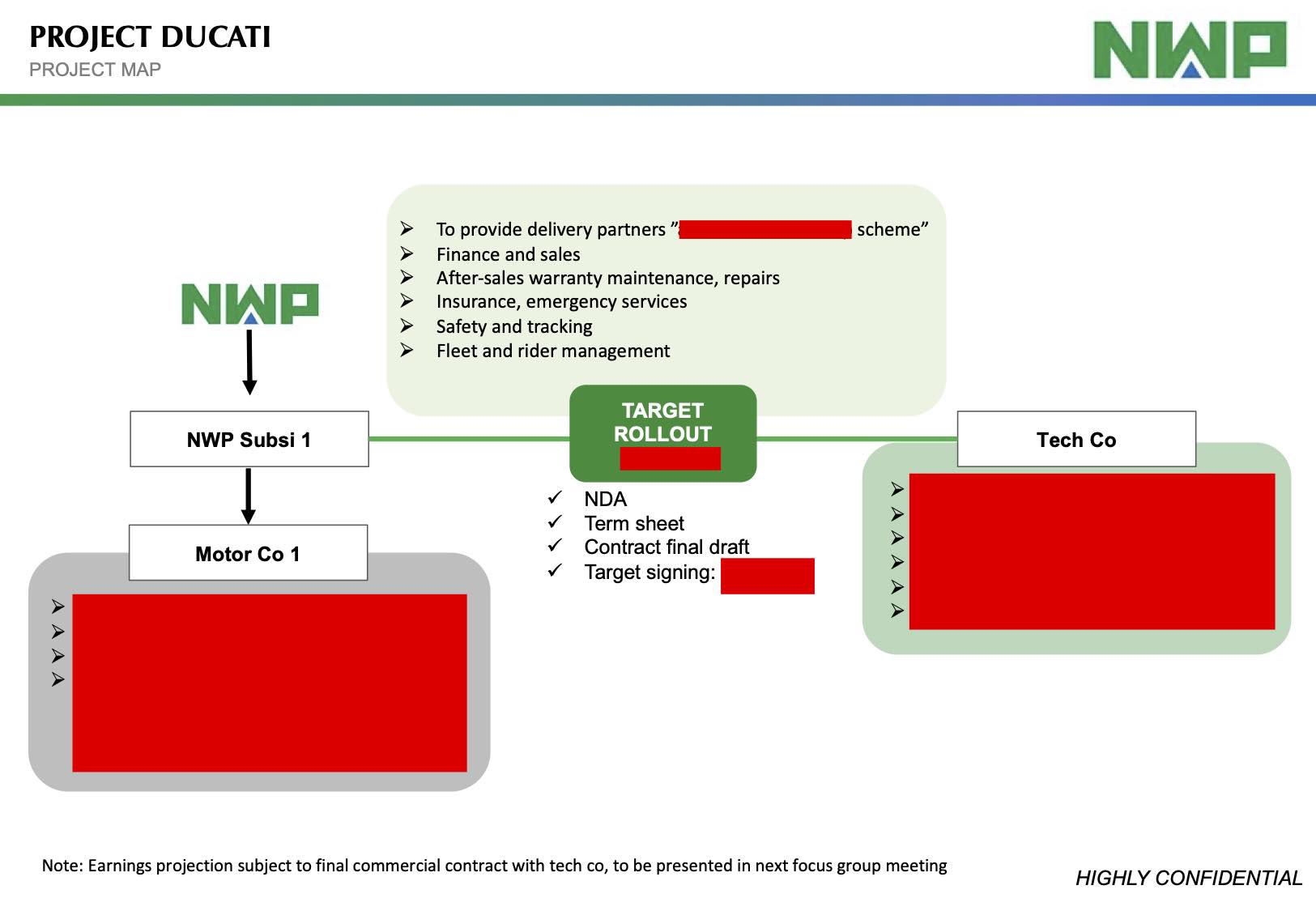

Back to your question, this venture has been in the works since the start of this year and Covid did delay the progress a fair bit. The initial plan was to launch by Q3. All the preparatory work is done. We are about to go live anytime now. To get to where we are today in terms of this project is already remarkable, so is just about execution from now on.

Q2: You

did not answer directly but I take it as a ‘can do’ because my

impression from your tone is that it is not about whether the project is

on or not, but rather how to get it off the ground and execute the

operation side of things.

A: You would not be

wrong to think so. Well, we have to be extra careful with what we say

now, taking a lesson from Datuk Seri’s media coverage last weekend haha

Q3:

Assuming everything goes to plan, how much can this automotive business

contribute in terms of financial numbers and profitability?

A: We do have a rough

estimate, or guess-timate, because this project is the first of its kind

ever. The projections have a wide variance depending on many factors.

But I will try to put it into perspective.

Assuming, if, we partner the ‘fastest-growing delivery provider’, and assuming we capture just half the number of riders, a defensive statement would be profits in the low double-digit millions.

Put it this way, if it were just a single-digit million profit project,

I do not think my bosses would even care to start! They would say

"don't waste my time"!

[Throughout the discussion, NWP Manager 1 was kind enough to update with reference to slides on his laptop. I thicken my skin for a second and requested a pdf copy, and sought his permission to share to investors. Voila! He said ok, provided some sensitive info is covered until after any official announcements by the company.]

It was a fruitful sharing over breakfast and coffee for almost 2 hours. Will digest all the info and looking forward to attend tomorrow’s virtual EGM before updating my analysis on NWP.

Thank you.

Best regards,

Alpha7 Research

https://klse.i3investor.com/blogs/alpha7research/2020-12-16-story-h1538250464-16_December_NWP_Investor_Brief_PART_2.jsp