For a the original copy with high resolution pictures, better formatting and additional details.

Go here.

(CHOIVO CAPITAL) WCE (3565) – When the roads align. 562% Upside.

========================================================================

When the roads align. 562% Upside.

Brief Overview

WCE is one company I’ve had some history with, and written 2 articles, both of which have different conclusions.

11 March 2019: A brief analysis and valuation of WCE Holdings Berhad (WCEHB).

28 July 2020: Why Highways are a Gruesome Industry – WCE Holdings Berhad (3565)

Since my last article, one thing kept bugging me.

Despite being conservative to the utmost extreme in my assumptions for the discounted cashflow projections. The fair value of WCE that I calculated then still ended up to be around RM0.25 per share.

Now why does this matter?

Well, the thing about discounted cashflow projections, is that there exists a “Hubble Telescope Problem” within each them.

"Discounted Cashflow to us is sort of like the Hubble Telescope—you turn it a fraction of an inch and you're in different galaxy." – Curtis Jenses – Third Avenue Management

Any small changes in growth estimates, cost of capital, and terminal growth rates in a discounted cashflow calculation can result in wildly different outcomes, much less a 50 year one which I did for WCE Holdings Berhad in the article above.

And since long term discounted cashflows are compounding/exponential in nature, if I was overly conservative by just 10-15% (which I have no doubt I was), the true intrinsic value of the company could very well be 5-10 times higher.

Since the day I’ve written that article, I’ve also read the rebuttals by Felicity of “Intellectpoint”

And have mulled over the above for some time.

With the above in mind, I set about studying WCE again, and well, I think I was erroneous on a few counts, and WCE is worth magnitudes more than what it is priced today. After reading the summary below, you may find it interesting to read the above articles for some context as well.

WCE Berhad - A Background

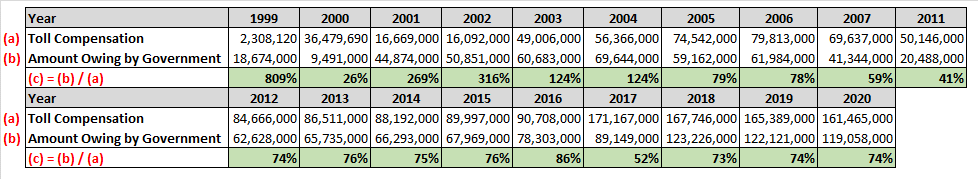

WCEHB main business is that of a 80% owner of West Coast Expressway Sdn Bhd, which is contracted to build and operate the 233km highway from Banting in Selangor to Taiping in Perak, with the remaining 20% held by IJM via Road Builder Sdn Bhd (who also happens to be the largest shareholder in WCEHB.

WCEHB also have a property business via its 40% stake in its associate Bandar Rimbayu (contributes around RM30-RM40 mil in earnings a year). Construction of WCE was initially expected to be completed early 2019. However, over the last 2 -3 years, the completion date of have pushed back mainly due to:

1) Land Acquisition problems which resulted in;

2) Alignment Changes; and

3) Higher than expected land acquisition costs.

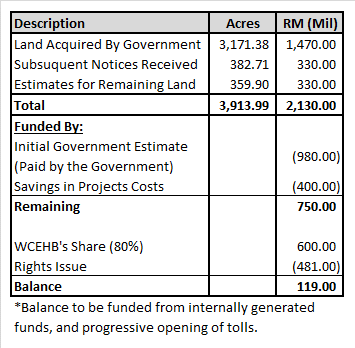

The land acquisition cost of the 3,913.99 acres of land need for the highway was initially expected to be RM980 million, with the full amount to be borne by the government.

However, on 16 October 2018, they received notice that the government have completed the acquisition of 3,171.38 acres of land out of the total 3,913.99 acres of land, for a total of RM1.47 billion. Out of the remaining unacquired land, they also received notice that the remaining 382.71 acres of land would cost another RM0.33 billion. As for the remaining 359.90 acres of land, WCEHB estimated it to cost another RM0.33 billion.

To cover this shortfall, they first decided to identify savings and efficiencies that can be done on the project. The construction is done by IJM via Road Builders Berhad, who have completed multiple highways like NPE, Besraya and LEKAS all within budget. Both NPE and Besraya are profitable, while LEKAS is in the process of building up the necessary traffic. The CEO (Dato Neoh) is also a 30-year highway engineer, project manager and CEO who used to work in NPE, Besraya and Lekas.

This delay, coupled with the right issue required, the current economic & highway industry climate, as well as, the general investing public’s misconception/lack of understanding the real economic reality versus the current accounting numbers for concession companies have resulted in a drastic fall in the share price, and the opportunity we have today.

To buy shares in the WCE Project/Company for far lower than the price paid by the major shareholders who invested in the company and the WCE project.

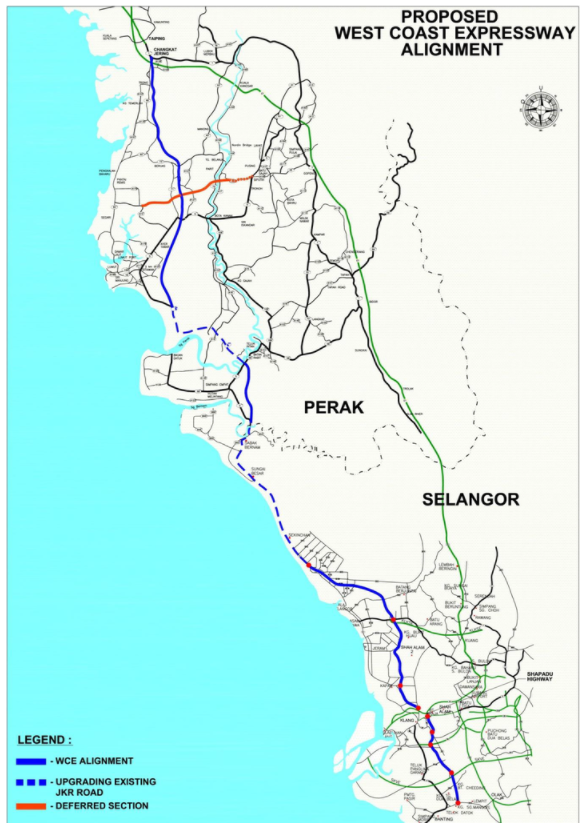

For reference, here is an illustration of the West Coast Expressway Alignment.

As we can see here, WCE mainly caters to the parts of Selangor not covered by the NSE and provides a direct route from Port Klang to Lumut Port and right up to Penang Port.

As the WCE route contains significant non-tolled roads, and a smoother gradient compared to NSE, and shorter distances when it comes to commercial travel, there is likely to be good demand from commercial vehicles (who are cost and time sensitive) and public vehicles (who are mostly time sensitive. Who actually knows what the toll rate per km for each highway in Malaysia and do price comparisons before travelling? You just set your Google Maps, decide if you want to pay toll or not and go.)

Catalyst 1: Cancellation of PLUS’s 18%

Discount/Toll Restructuring

On 17 January 2020, the previous Pakatan Harapan government announced that starting February 2020, PLUS will give an 18% discount for Class 1, 4 and 5 Vehicles (Non-Commercial) with no toll rate increase till the end of the concession, in exchange for an additional 20 year concession period, and a likely RM7.5 bil buyout from its current shareholders of EPF and Khazanah.

(The article does not specifically state a buyout, but why else do you need to securitize and raise RM7.5bil from the markets then?)

WCE lenders and bondholders instantly started worrying about how this will impact the future traffic for WCE. (It does not impact WCE traffic much as there is no 18% discount for commercial traffic, and public traffic is generally price inelastic, but time elastic due to Google Maps)

However, since then we have had a change in government, and till today there is no news on the completion of the toll restructuring of PLUS. Judging from the current situation, I think it is very likely that the toll restructuring will likely fall through due to,

- Different governments have different policy.

During the Pakatan Harapan government, many would have noticed the constantly differing signals by government leaders on the toll restructuring.

Mahathir, Azmin and Baru Bian will talk about the selling the highways to a private bidder.

However, Lim Guan Eng, Tony Phua and Anthony Loke will constantly reiterate their refusal to sell the company to a private seller and plan to restructure it to be held by the government instead.

Lim Guan Eng and Tony Phua will announce the purchase of highways from Gamuda, while Mahathir and Azmin will deny a decision has been made, and it is pending cabinet approval.

And till today, there is no news on the toll restructuring of PLUS Highway Concessions, while it appears Gamuda’s sale of highways have fallen through.

It has since been almost one year since the announcement with no news. The way things are looking,and considering the differing perspective of the new government in charge, it seems very likely the sale/restructuring will fall through, and sooner rather than later.

- Covid 19 and the Lack of Money

This COVID 19 pandemic have also like resulted in a lack of money for both the Malaysian Government and PLUS Malaysia.

For the Government, all of their COVID related stimulus items have resulted in Budget 2021 to be the largest ever at RM322.5 bil, when the nations income is at an all time low, and the deficit this year expected to exceed RM100bil.

This deficit will need to be funded by a record issuance of bonds by the government, which will likely be subscribed by the number one buyer of Malaysian bonds, EPF and the Malaysian Banks and Insurance companies.

Except, with the government allowing EPF members to withdraw from their EPF Account 1 as well, which is likely to result in outflow amounting to RM15 billion, there is quite simply very little additional liquidity available for the government to issue the relevant government guaranteed bonds amounting to RM7.5bil for the restructuring for PLUS Malaysia. Especially given the lack of political will.

As for PLUS Malaysia, given their previous year toll collection of RM3.5bil or so, the 18% toll discount coupled with record low traffic numbers due to COVID 19 Is likely to have resulted in a revenue loss of at least RM1bil or more.

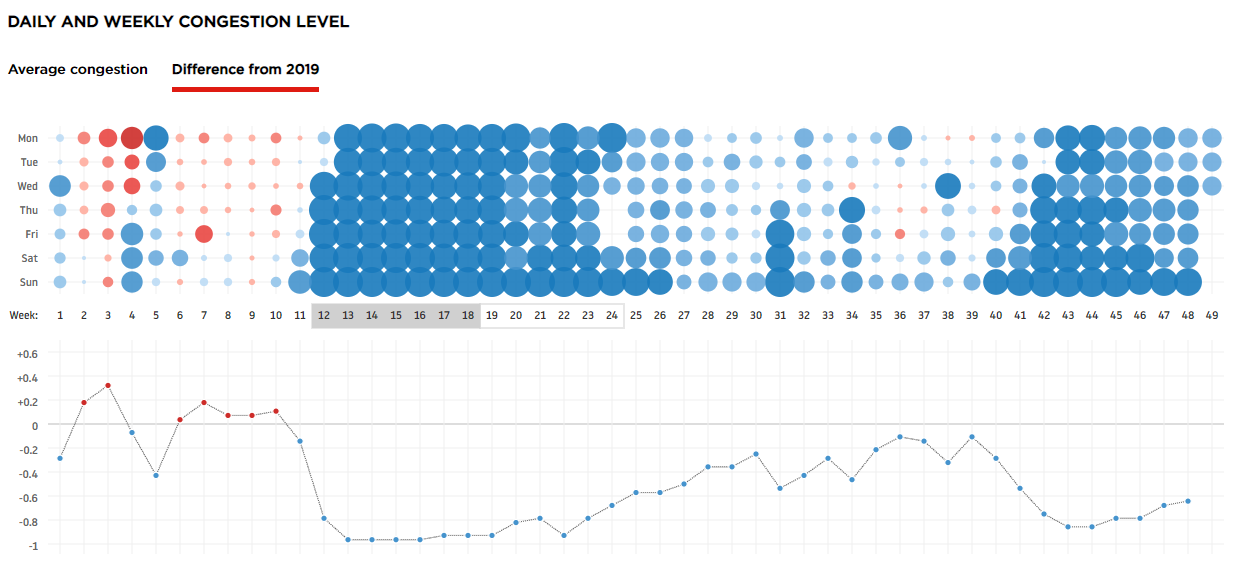

Averaged out, the above chart shows a reduction in traffic volume of around 30-40%.

Given their net debt of RM26 billion (RM30 billion in Debt, RM4 billion in Cash as per 2019 audited report) and yearly financial repayments of RM1.8bil (with an escalating instalment structure), the revenue loss above may result PLUS getting uncomfortable close to the minimum requirements of the sukuk covenants in the not so far future, especially if the current traffic trends continue into next year. There is a reason why MARC placed their bonds on rating watch (Still AAA though).

Due to the reasons stated above, I think it is very likely that the 18% toll discount forced upon PLUS by the Malaysian government will be lifted soon.

In August 2020, the government have already stated that the 18% discount on PLUS Highway will be reviewed, and an update is expected to I think there is a good chance the information will come after the budget is finalized around February 2021.

Catalyst 2: Highway Trusts

Why February 2021?

The current flavour of the day for the government to solve this highway issue, is the creation of a trust to hold all the highways, and the decision is likely to be made 6 months from the end of August 2020, or February 2021. They did raise it in parliament again just this November 2020.

Which is actually a very good thing, as this would mean the government takes over the entire highway at the cost of construction and clear all debt and amount owing related to the highway.

Currently, WCE is trading at a 70% discount to its book value. An instant 100-200% upside.

Catalyst 3: Land Acqusition Mostly

Solved, No More Right Issues

As explained earlier, in 2019, WCE have finalized most of their land acquisition matters, and a right issue was undertaken to fund this.

This right issue was fully taken up by all the major shareholders, IJM, MWE (Tan Sri Surin Upatkoon) and United Frontiers (The Mamee Family)

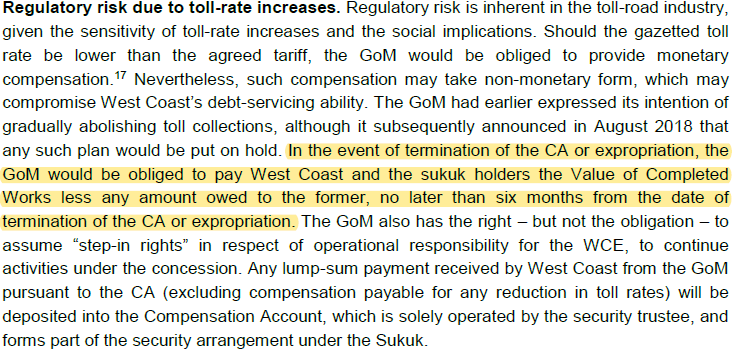

As the land acquisition issues are mostly settled, a few sections have opened, and the rest are too be opened based on the schedule below.

And from what I know according to people working in WCE, for the sections that have already opened, actual traffic is very close or equal to the projected traffic, if not for the COVID 19 pandemic, they would have exceeded expectations.

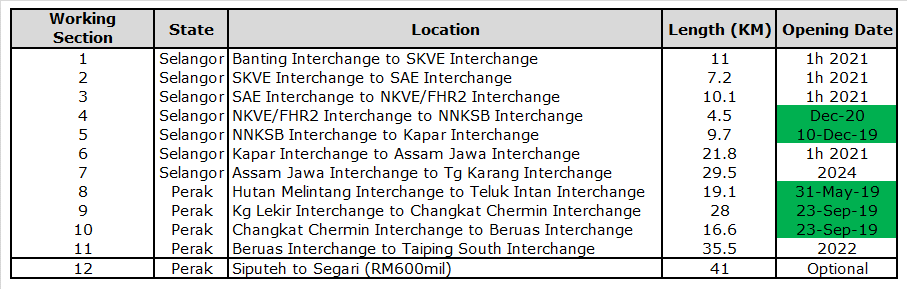

And here, based on our own observation of the traffic camera’s in WCE.

All things considered, we can see that traffic is quite good, especially when having considered the current Conditional Movement Control Order, which currently ban interstate travel.

In addition, the sections have not yet been fully connected to the other sections and interchanges which are linked to other highways and developed areas, which should further improve traffic numbers.

As for the right issues,

“The worst is over for us. The land acquisitions are about 95% completed and we have commenced construction works for Sections 7 and 11 – the last two sections, which is estimated to be completed by 2022” Dato Neoh Soon Hiong

As a result, it is highly unlikely for WCE to have another cash call in the near future.”

Risks : Delays in Toll Compensations

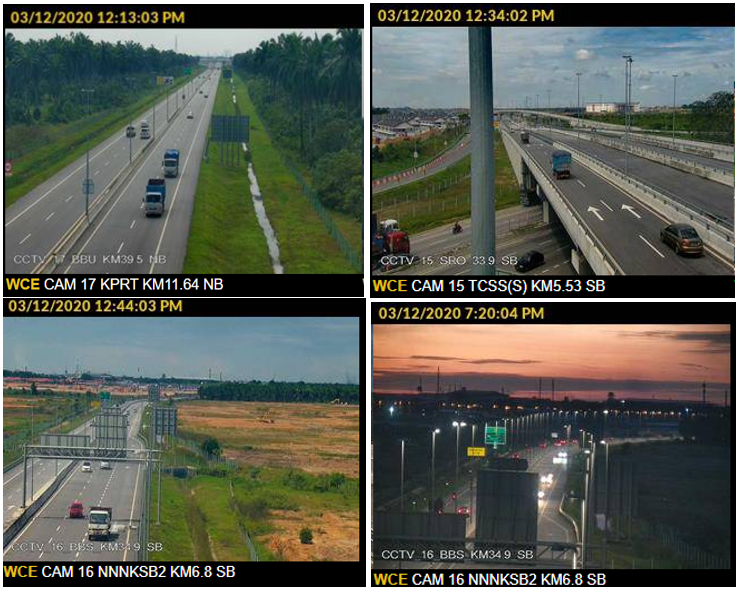

Reading PLUS Malaysia’s annual reports and bond rating reports, I noted the ever-burgeoning toll compensation owing by the government, which translates to slow repayment.

After some discussion with industry players, this situation appears to be mainly unique to PLUS, which is a GLC, that is owned by EPF and Khazanah. And since it’s a right hand to left hand kind of deal in that case, they are naturally subject to certain delays.

However, when looking at the accounts of private companies such as LITRAK,

I noticed that delays in toll compensations is not really an issue, and generally less than a year’s worth of the compensation is held in the books, which indicate that advances were also paid.

In addition, unlike PLUS who appear to have to agree to whatever suggested by the government, despite the government’s previous exhortations to implement peak/off-peak toll rates for LDP, this has not yet been implemented due to Gamuda and the Government having not yet agreed on the basis of the compensation, or the acquisition deal going through.

Cashflow Projection / Intrinsic Value

of WCEHB

When thinking about investment in projects/companies, especially one like a highway concession (or even power concessions like MFCB), where there is a long gestational period as construction is ongoing, and time is required to reach economies of scale.

We need to think about cashflows over the lifetime of the project, and the best way to go about this is via a Discounted Cash-Flow forecast (“DCF”), where all future cash inflows and outflows of the project, is discounted to present value (a bird in hand is worth more than a bird in the bush)

This natural require a lot of educated assumptions, with which we target to be as conservative than not. Its better to undervalue a company than to overvalue one.

A summary of my assumptions is as follows.

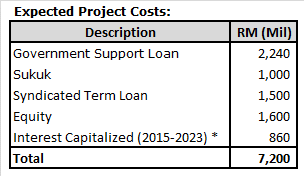

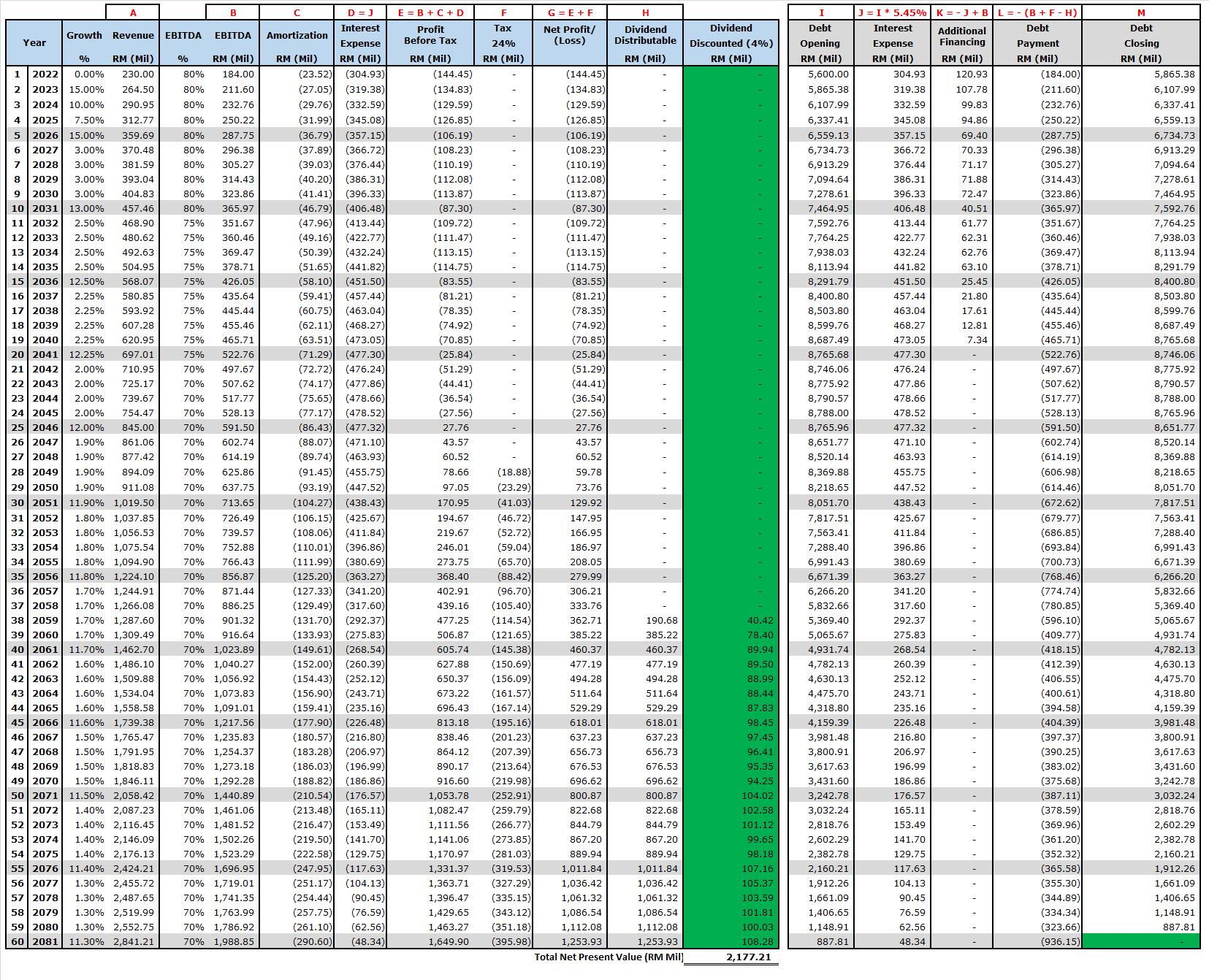

(A) Cashflow Projection: Opening Debt

The interest capitalized is around 4% of the entire project cost from 2015 to 2023. This is about half of the current interest rate, as the loan is progressively drawn down, and parts of the loan attributable to each section is no longer capitalized when that tolling begins for that section. To date about RM550 million have been capitalized in the Infrastructure Development Expenditure.

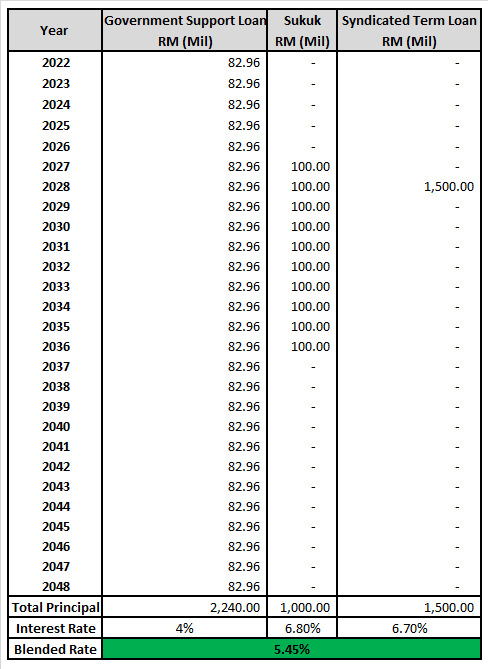

(B) Cashflow Projection: Interest Expense

By the time the highway is completed, WCE would have used borrowing facilities totalling RM4.74 billion.

This consist of 3 kinds of loans,

- RM2.24 bil Government Soft Loan (“GSL”) at 4% per annum. Repayment starts 6 years from first drawdown, in 108 equal quarterly installments. First Drawdown was in 2016. Therefore first repayment will be in 2022.

- RM1.00 bil Sukuk issued in 2015. Interest rate is around 6.8%. Repayment starts 12 years from first drawdown, in 10 equal yearly installments.

- RM1.50 bil Syndicated Term Loan. Interest is around 6.7%. Repayment is in 2028 bullet style.

This translates to the table below and a blended rate of 5.45%

To simplify things, in our DCF, we will ignore the schedule above, and assume that all excess cash would go to interest and principal payments (after accounting for a reasonable dividend policy) and that any lumps in the cash-flow will be handled while refinancing.

In any event, the repayment schedule used by my cashflow model is more conservative.

(C) Cashflow Projection: Expected Operating Costs (EBITDA%)

Depending on the type of highway, geographic profile, the kind of maintenance agreed in the concession agreement, the age of the highway as well as the efficiency of management involved, the cost of operating a highway when translated to EBITDA is usually around 60-90%.

For WCEHB, it is an Intrastate highway, which means that they usually have higher maintenance cost due to lower economies of scale (a long highway means a more mobilization and demobilization costs related to the machinery needed for maintenance).

In addition, Intrastate highways tend to have a higher (Class 2 and 3 – Lorries and Trucks) demographic from long distance shipping.

Despite these two classes being around 20% of the traffic, they contribute to around 80% of damage done to the pavement due to overloading for these lorries and trucks.

Having said that, a young highway is also cheaper to maintain than an old one.

Now, the operators of Interstate Highways in Malaysia are Anih Berhad and PLUS Berhad, the highways are relatively old (20 – 40 years old), and they record EBITDA of around 60-70%.

For reference, top Urban Highways such as DUKE, KESAS etc can record EBITDA of 80-90% relatively easily.

For WCE, we will assume 80% of the first 10 years, 75% for the next 10 years, and 70% till the end of concession.

This is somewhere in higher end as the other two highways usually use small subcontractors to maintain their highways.

IJM/Road Builders Sdn Bhd should be able to get the cost slightly lower in view of their deep expertise in construction and road maintenance.

(D) Cashflow Projection: Discount Rate

Discount Rate of 4% is used. This is the current 30-year MGS (not sure if it changed with).

It may seem low. However, it is sufficient as I’m already adjusting in the margin of safety via all the other assumptions.

In addition, if necessary a discount can be directly applied to the per-share intrinsic value.

(E) Cashflow Projection: Starting Toll Revenue Base

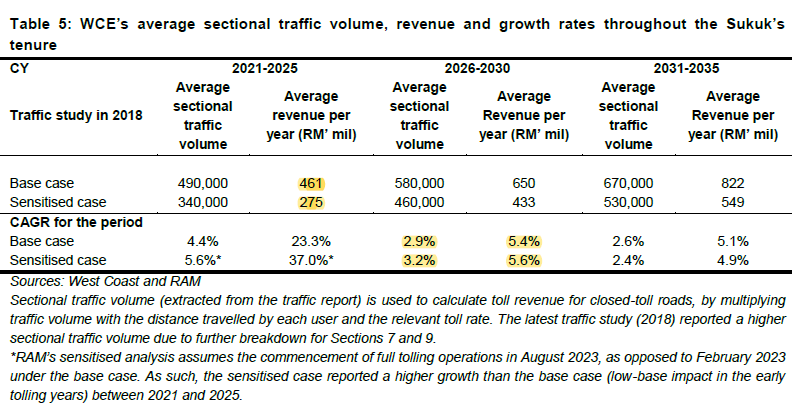

According to the RAM Rating report, the base case starting revenue is around RM461m, while the sensitized (Rating Agent Speak for “Worst Case”) scenario is around RM275m.

For our case, to be more conservative, “Best Case” will be RM461m, “Base Case” will be RM275m and “Worst Case” will be RM230m.

Our worst case will be significantly lower than RAM Ratings own “Worst Case” scenario, to account for any additional delays in opening new sections.

For more information on how I obtained these numbers, refer to the article reference in the “Overview”.

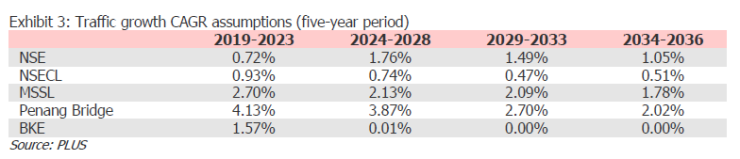

(F) Cashflow Projection: Toll Rate

In the typical highway concession, the toll rate increases at 10% every 5 years.

This appears to be the case here as well, as the revenue growth for the 5 year period is about double that of projected traffic growth in the table above (5.6% vs 3.2%), which is likely due to toll rate increase.

(G) Cashflow Projection: Growth Rate

For these, I will be using the traffic of a standard inter/intra-state highway like NSE and Anih, along with the typical traffic growth of a new highway.

This is the current projected traffic growth rates as per their MARC Rating Report. As it is significantly lower than that of WCE’s, we will be using this especially when projecting the growth rate of WCE, when it becomes a matured highway 20 – 25 years down the line.

The “Best”, “Base” and “Worse” case are based on the North South Expressways, Central and Northern traffic growth over the last few years.

The same growth rate is used across all scenarios, as looking at projected traffic reports, the different scenarios are often merely just 0.1% different up/down every other year, for a 50-year projection.

As all projections will always be wrong, but one would want to err on the side of caution, I just made more conservative assumptions and applied them across the board.

For more information on how I obtained these numbers, refer to the article reference in the “Overview”.

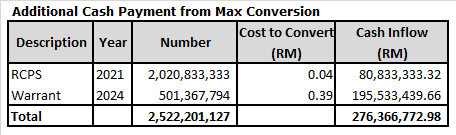

(H) Cashflow Projection: Number of Shares - (Maximum Dilution from RCPS and Warrant)

The key to identifying the intrinsic value of this investment, is to identify the NPV per share. The higher the number of shares, the lower the intrinsic value per share. For this, we will go the most conservative route and assume maximum dilution from the RCPS and Warrants.

According to the Rights Issue prospectus, under the maximum scenario, the maximum number of shares is ~3,509,575,000 shares.

This assumes that all RCPS currently held by shareholders will be fully converted to new WCE Holdings Berhad shares, by surrendering one RCPS together with the required cash payment, for one new share of WCE Holdings Berhad.

It also assumes that the Warrants currently held by the shareholders will be fully exercised in the First Exercise Period at RM0.39 per warrant.

This expands the number of shares to ~3,509,575,000 shares from the current 1,325,298,970 shares.

This expands the number of shares by around 171%. Dropping our estimated intrinsic value by that amount and increasing our margin of safety.

(I) Cashflow Projection: Cashflow from Maximum Dilution from RCPS and Warrant

The conversion of the RCPS and Warrants result in a cash inflow, which we will include in our intrinsic value calculation. The amount is included in the table above.

(J) Cashflow Projection: Others

Dividends: As West Coast Expressways Sdn Bhd’s capital structure consist of only ordinary shares, dividends would only be able to paid out when it has positive retained earnings. Most highways would not have this during the initial years, and so no dividends are paid until the cumulative retained earnings become positive. Subsequently, a 100% dividend pay-out policy is assumed.

Initial Losses: For our “Worst Case” and “Base Case”, the first few years are likely to be losses. This is likely to be the case in the real world as well, as the highway is opened section by section and will only reach the first phase of full economy of scale when it is fully opened. The initial losses are assumed to be financed via additional drawdown of finance facilities (if required).

Income Tax: Income Tax of 24% (current corporate income tax) is applied throughout the concession period. No adjustment is made for deferred taxes. Current tax laws of allowing loss allowance to be brought forward for only 7 years is applied throughout the concession.

Borrowings: Debt payment is “EBITDA less Dividends (if any). Borrowings must be zero by the end of the concession period.

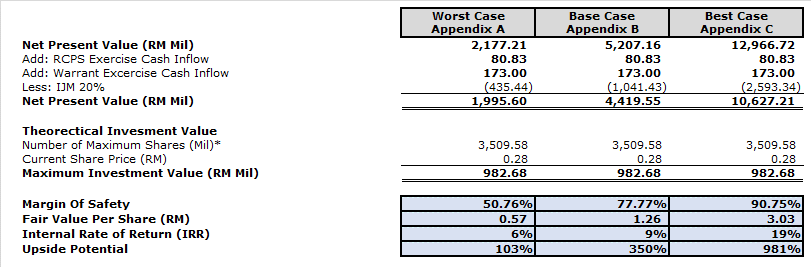

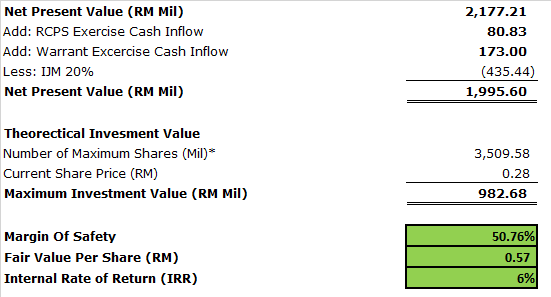

Now, with all the above in mind, what does our “Worst Case”, “Base Case” and “Best Case” look like in this case?

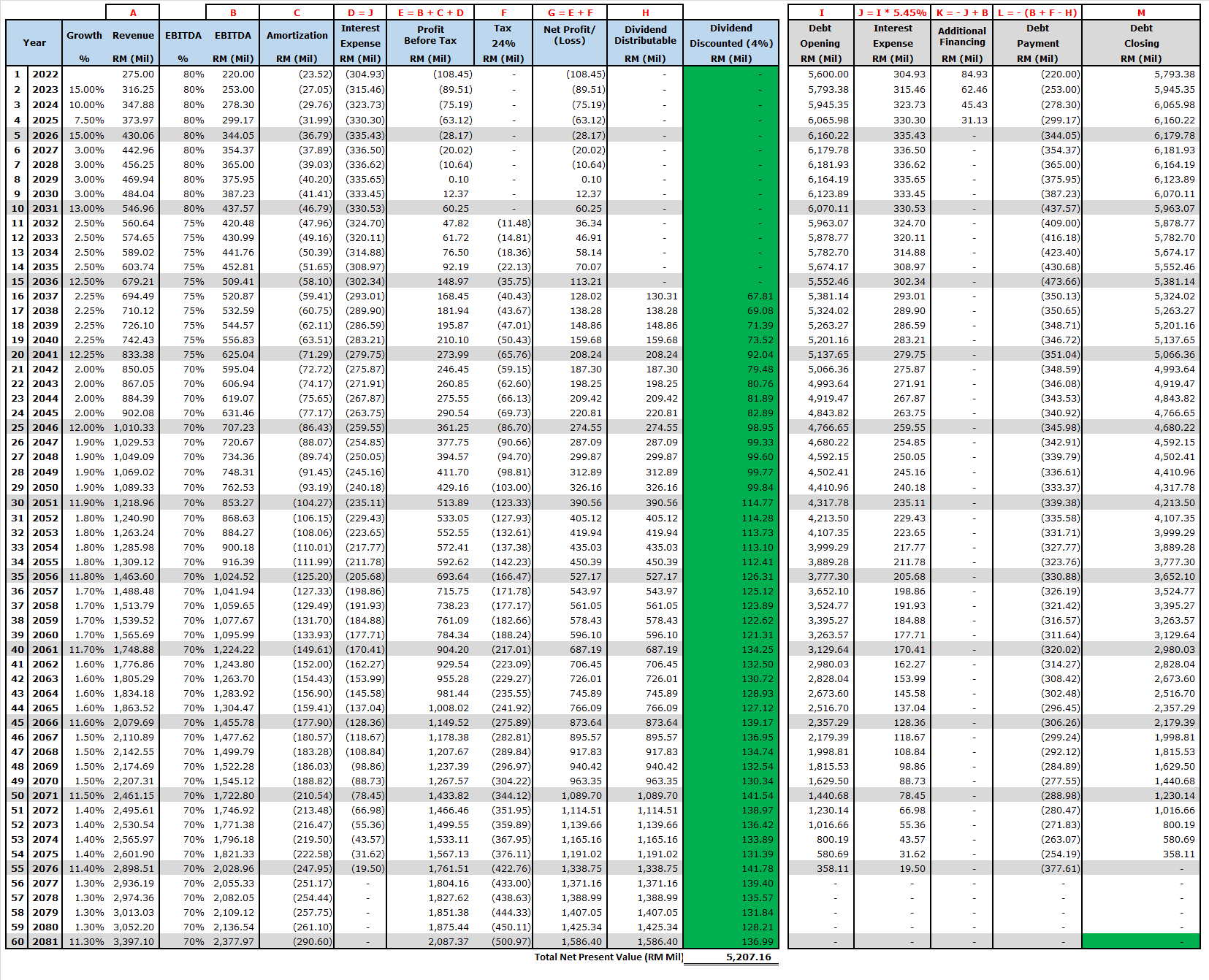

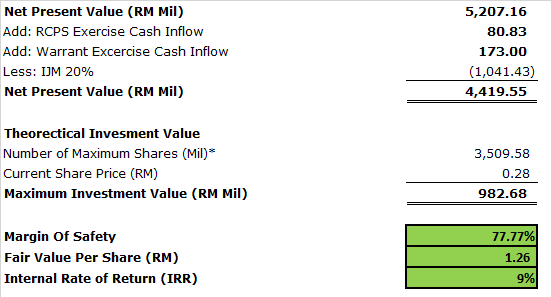

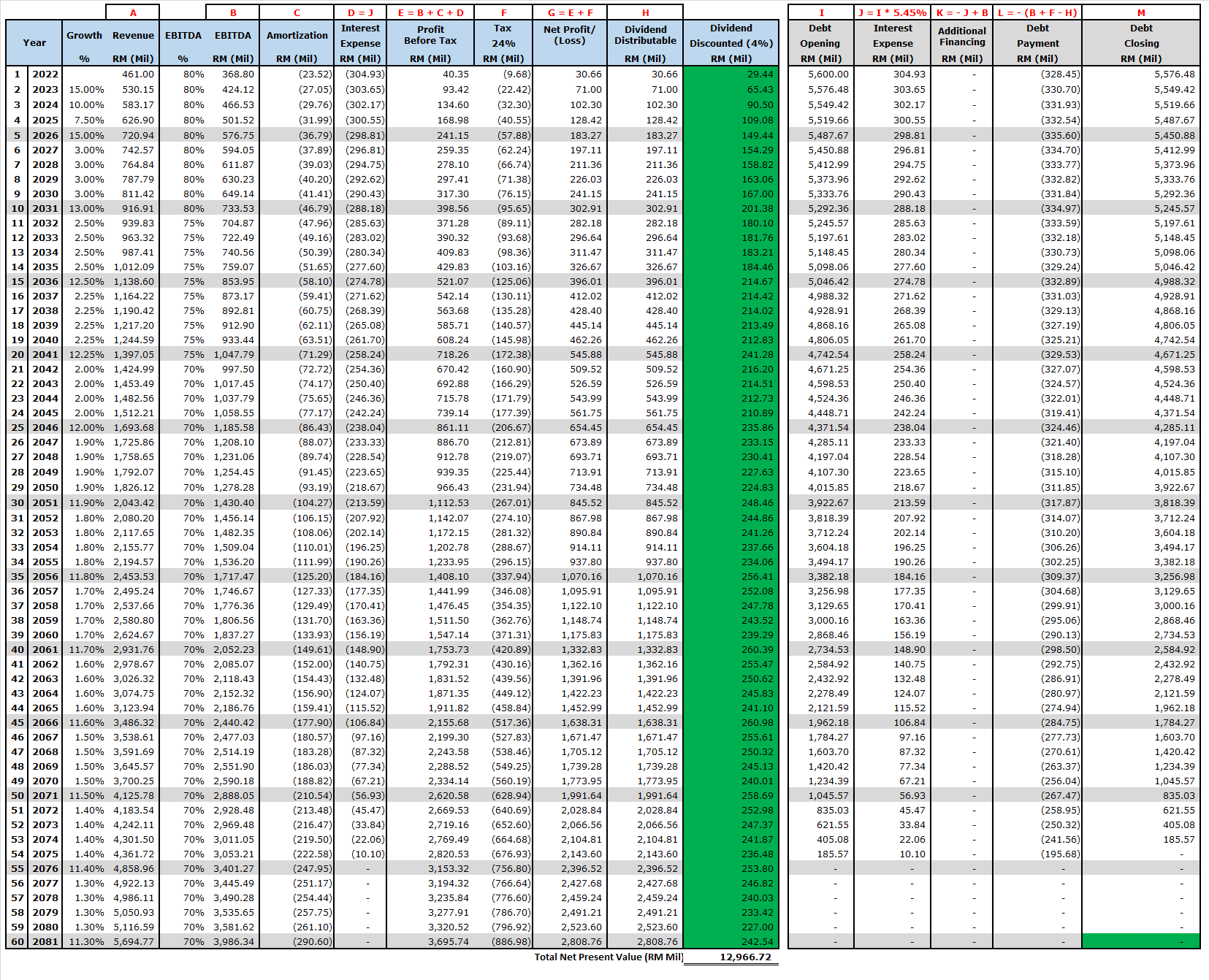

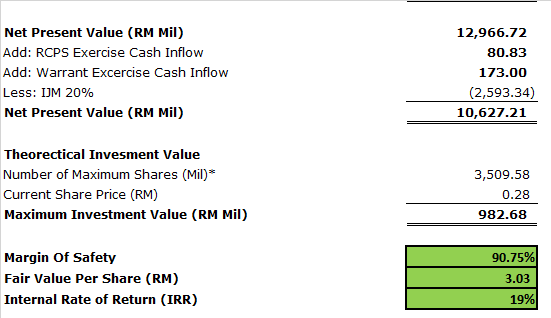

The detailed workings for (Appendix A – Worst Case), (Appendix B – Base Case) and (Appendix C – Best Case) can be found at the back of this document. Even under some of the most onerous assumptions, our worst-case scenario is still present a 103% upside to today’s prices.

If you were to read my previous article linked in the overview, I made another DCF then, where assumptions for traffic projections etc were so far below the reality for highways in similar areas and demographic, and despite that it was still valued at RM0.25 per share.

If there ever was an investment with an extremely asymmetric risk/reward in Malaysia, it is WCEHB.

At the absolute worst-case scenario, you would still make a decent amount of money, but if you were to make the base/best case scenario, you would make orders of magnitude more money.

If we were to look at it in a probabilistic way, I think there is,

- 20% chance for the Worst Case to occur;

- 60% chance for the Base Case to occur; and

- 20% chance for the Best Case to occur.

This gives us our long-term target price of RM1.57.

And, One Last Thing.

Is it priced in?

Other than the brief pop back in April-May 2020, which affected all stocks, it has only gone down since then and is way below its Dec 2020 closing price of RM0.375.

Back in 2017, before the delays due to land acquisition etc, the mere hint of the highway opening certain sections and fully reopen by 2020, had prices fly up from RM 0.915 to a high of RM1.68.

Today, despite the land acquisition matters being large solved, with 5 out of 11 sections having opened to-date, and another 4 sections to be opened in 2021. The share price is at a mere RM0.285.

In addition, let’s not forget the possibility of a highway trust, or the removal of 18% discount from PLUS Highways. Of which the decision will be announced by February 2021. It’s as if Mr Market forgot to read the news.

None of the facts I have written above have not been priced into the stock at all.

(Appendix A – Worst Case)

(Appendix B – Base Case)

(Appendix C – Best Case)

https://klse.i3investor.com/blogs/PilosopoCapital/2020-12-05-story-h1537420127-_CHOIVO_CAPITAL_WCE_3565_When_the_roads_align_562_Upside.jsp