JAKS (4723) JAKS RESOURCES BHD - The Most Reliable Earnings Guidance for JHDP

The most reliable earnings guidance from Vinh Tan 1 power plant

What makes the most reliable earnings forecast ?

Peer comparison is the most reliable and convincing method for making earnings forecast if the subject exhibits the following characteristics;

- high degree of earnings stability and foreseeability

- high degree of resemblance in operating terms and conditions

The higher the similarity between the subjects in comparison, the higher the accuracy of forecast.

Peer comparison evaluation method alleviates the need for making excessive adjustments, assumptions and projections which in most cases would cloud the integrity of the results derived. It is often derived from actual operation of businesses under terms and conditions which may not be well understood or considered by the evaluators of other methodologies. In other words, it is the most realistic forecast of earnings potential of a company operating under the same geographical roof.

Vinh Tan 1 Thermal Power Plant

It is located in Vietnam's southern province of Binh Thuan.

The coal-fired power plant includes two 620-MW super-critical generating units which is 55% owned by China Southern Power Grid, and constructed by CEEC. CEEC is the holding company of CPECC who is Jaks' partner in JHDP.

Vinh Tan achieved full commercial operation on 27th November 2018 (COD).

Why compare to Vinh Tan 1 ?

Hai Duong, Vinh Tan 1, and Mong Duong II are all 100% foreign owned power plants in Vietnam operating under 25 years BOT contracts with capacity around 1,200 MW. All their BOT contracts, power purchase agreements, coal supply agreements were signed around 2012.

Vinh Tan 1 is an extremely close model for Jaks Hai Duong power plant because;

- Both were awarded by the Vietnam Government around 2011

- Both BOT contracts were signed with the Ministry of Industry and Trade (MOIT).

- Both are Coal fired power plants costing around US$1.8b

- Both around 1,200MW capacity

- Both are 100% foreign owned and operated by Chinese corporations

- Both are adopting chinese technology

- Both under 25 years Build-Operate-Transfer (BOT) scheme

- Both are guaranteed by Vietnam Government

- Both Power purchase agreements signed with EVN

- Both coal supply agreements signed with Vinacomin

- Both under USD1.4b bank financing

- Both under max 18 years loan tenure allowed by Vietnam government

Therefore, Vinh Tan 1 and JHDP should exhibit extreme high resemblance, if not identical.

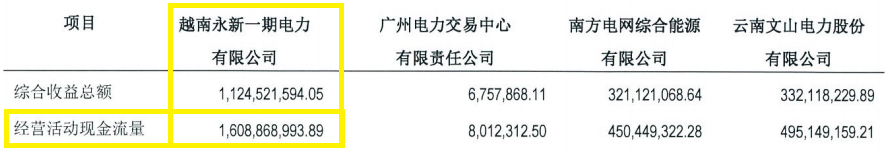

Extracted from the 2019 Annual Report of China Southern Power Grid Corporation

Profit attributable to minorities interest

Vinh Tan 1 = 越南永新一期电力有限公司

This is the first full year operation results of Vinh Tan 1 since commercial operation in November 2018

Net profit after tax for 2019 = RMB1,071m = RM652m (RM/RMB conversion rate of 1.64)

Hence, potential earnings attributable to Jaks

@30% = RM652m x 30% = RM196m = EPS RM0.30

@40% = RM652m x 40% = RM261m = EPS RM0.40

Free Cash Flow

Annual free cash flow = RMB1,609m = RM981m (RM/RMB conversion rate of 1.64)

Hence, potential free cash flow attributable to Jaks

@30% = RM981m x 30% = RM294m = RM0.45 per share

@40% = RM981m x 40% = RM392m = RM0.60 per share

Dividend Distribution

You may noticed that there was no distribution of dividend in 2019 despite healthy cash flow of RM981m. This is due to the need to build cash reserves requirements for bank installments, working capital, maintenance, coal inventory, and statutory reserves. Aggressive distribution policy is expected once the cash reserve requirements are met as evident in the case of Mong Duong II, another similar plant in Vietnam. Below is the distribution pattern of Mong duong II since commercial operation in April 2015. The amounts are converted to Malaysian Ringgit at 4.35 to USD.

| Year | Q1 | Q2 | Q3 | Q4 | Total |

| 2016 | 9m | 74m | 122m | 205m | |

| 2017 | 109m | 113m | 222m | ||

| 2018 | 117m | 78m | 195m | ||

| 2019 | 122m | 196m | 13m | 331m |

2018 dividend distribution was affected by the restructuring of long term project borrowings to reduce future interest costs. This has resulted in a one time restructuring cost of USD31m.

Note that first major dividend distribution by Mong Duong II started after 15 months of operation. By the end of 2019, Vinh Tan 1 has 13 months of operation. Hence, Vinh Tan 1 is expected to start dividend distribution in 2020.

Reservations

Vinh tan 1 has only provided one full year operating results for evaluation in this article. There is no information to whether there were any material extraordinary gains or losses included in the operating results. Nevertheless, the nature of the business of Vinh Tan 1 whch is stable and foreseeable with majority of its earnings derived from capacity payments mitigated such concern. Moreover, my previous studies provides further assurance of the results of Vinh Tan 1.

Vinh Tan 1 classifies its power plant as concession asset instead of loan receivable as required by the new international accounting standard. Adoption of old accounting treatment has resulted in lower total earnings of Mong Duong II by USD203m since operation with its 2018 earnings increased by USD40m after adoption of new accounting standard. Since continuing with old accounting treatment does not lead to overstatement in earnings of Vinh Tan 1, the higher earnings effect to JHDP is disregarded in this article on prudent grounds.

Conclusions

Earnings guidance provided by Vinh Tan 1 is by far the most straight forward and reliable estimate of JHDP's future earnings potential. Most evaluation methods require assumptions or management guidance and complicated computations. It is difficult for those without sufficient knowledge of those methodologies to express confidence.

Vinh Tan 1's earnings represents results from actual operation of a similar power plant in Vietnam which is also managed by a Chinese corporation.

Vinh Tan 1's earnings jibes with my previous estimates derived using various valuation methods.

This article concludes that JHDP is expected to deliver EPS of between RM0.30 to RM0.40 to Jaks. At PE of 10 to 15 times, Jaks is worth between RM3 to RM6.

I hope this article has raised your level of confidence in Jaks significantly.

Thank you and happy investing !

DK

Disclaimer : This

article is purely for information and opinion sharing purposes. You

should not make your decision based on the writing. You are strongly

advised to seek independent verification and advice.

Source from : https://klse.i3investor.com/blogs/Jaks%20resources/2020-05-01-story-h1506848575-Jaks_Resources_The_Most_Reliable_Earnings_Guidance_for_JHDP.jsp

https://klse.i3investor.com/blogs/jennylohsharing/2020-12-17-story-h1538277157-Jaks_Resources_The_Most_Reliable_Earnings_Guidance_for_JHDP.jsp