Hi all wonderful people,

As usual, I will share 1 counter every year before Chinese New Year for our fighters here to earn some new year angpow. I wish to recommend Mestron (0207) which is listed under ACE Market in 2021.

No fancy selling points bla bla bla. I will direct bring you through why I buy and what is the RISK factors.

Content:

- Introduction

- Financial Highlights

- Technical Analysis

- Expect the unexpected

- Risk based Investment plan

1. Introduction

Note:

Official website introduces Mestron as a

player of lighting contractor and they have ambitious plans to modernize

the urban district. Ask ourselves if the company does not has "special"

networking with ruling government (both ruling and opposition) how can

it grows steadily from 2017 (former Government) till present (Perikatan

Nasional). Netherless, their business expertises include street lighitng

pole, decorative pole, camera pole, mid hinge collapsable pole,

telecommunication, high mast, surveilance and oil and gas & mining

light pole. (for reference http://www.mestron.com.my/products/). Simple

business but promising profit margin!

The company also explores into internaltional markets to increase

profitability through their end-to-end manufacturing services.

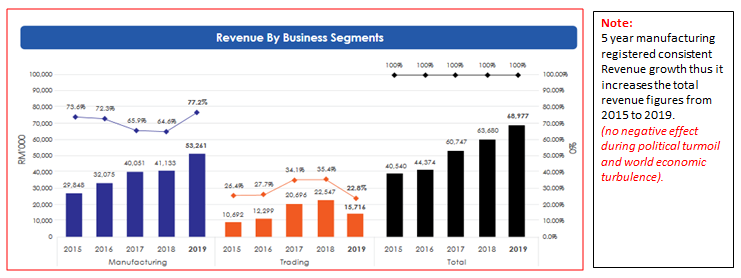

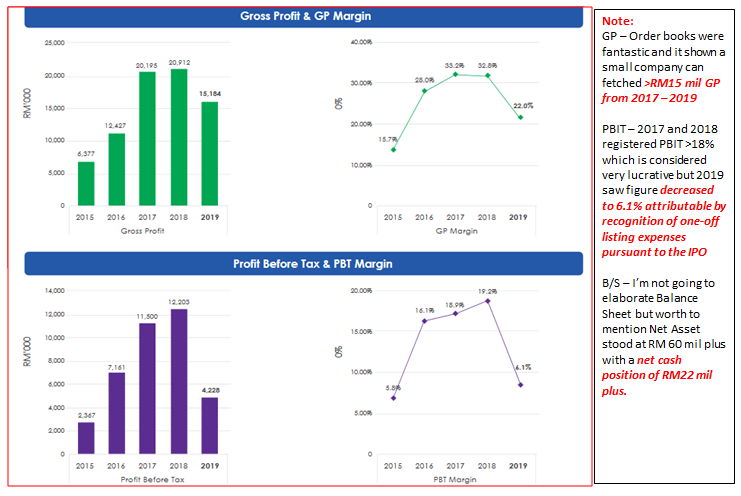

2. Financial Highlights

3. Technical Analysis

4.Expect the unexpected

Well. What can a net cash company does at this pandemic condition? Some wonder idea are as below.

- Venture into solar business and acquire 1-2 startup companies ??

- Aggresively penetrate oversea market and focus on their lighting pole/telecommunication/township surveillance system ?? Direct increase their P&L position? Invest now and harvest later?

- JV with logistic company and get ready with the economy recovery ?? Market saturated + NO techno know how?

- Venture into healthcare such as testing kits, vaccination and tracking business? Tag along with their "special" networking probably?

- e-payment and e-commence game? What is the competitiveness advantage compare to existing unicorn??

- Others (still in my mind)

5. Risk based Investment Plan

Risk Management is my Top priority in every transaction! I will suggest few options should you keen to explore this Chinese New Year Angpow opportunity.

Mid-term Investor:-(6 - 9 months)

Assume RM100k is your capital for this investment. You may allocate 40%

at RM0.185. If falls to RM0.175 add another 30% and last batch 30% at

RM0.155. In contrast, after 40% capital then the price up to RM0.195 you

may add 35% and that's it.

Short -term Investor:- (2 weeks- 2months)

Start with 60% at RM0.185 and when falls to RM0.175 add on the last

40%. Set cut loss at RM0.165 (10.8% from RM0.185). Examine your own risk

appetite and capacity before execute trading plan.

Feel free to share your inputs. I am looking forward to learning from everyone in my investment journey.

best wishes,

duitKWSPkita

https://klse.i3investor.com/blogs/duitMestronCNYangpow/2021-01-10-story-h1539260412.jsp