Hextar Global Berhad (Hextar) has just released its latest 4th quarter result of financial year 2020. Yet another solid performance by Hextar which saw its revenue and net profit to have soared by 21.7% and 47.4% respectively from a year ago.

As we know Hextar had a pivotal acquisition back in year 2019 which is proven to be such an effective and wise decision. Since the acquisition, the enlarged group Hextar has been performing excellently in every quarter, and the latest released quarter is no exception as well.

The company managed to achieve a revenue of RM100.8 million, which is an improvement of 21.7% from the equivalent quarter in last financial year. Agrochemical segment clearly is the main driver which contributes around 96% of the total revenue. To understand further on how Hextar has developed and improved from a year ago, you can refer back to my complete analysis here.

In this article we will be comparing the latest quarter result with its immediate previous quarter result to really understand how much Hextar has progressed from last quarter.

Revenue

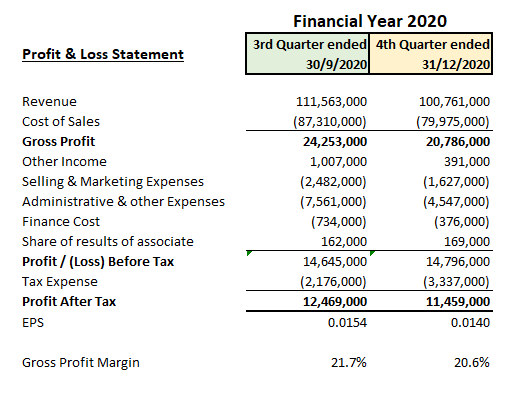

As we can see, the revenue in its latest quarter has slightly dropped 9.68% from RM111.56 million last quarter to RM100.76 million this quarter. I believe the slight drop in revenue is due to its exportation sale which was partly caused by the year end raining season in Indonesia. The application of agrochemical is usually done when there is no rain as the rain water will affect the effectiveness of agrochemical on the crops. Therefore, farmers might be discouraged to purchase and apply agrochemical on their crops during rainy season.

Gross Profit

The gross profit margin has slightly dropped as well from 21.7% last quarter to 20.6% this quarter. During the pandemic, the cost of chemical raw material has all increased due to supply constraint. This explains why the gross profit margin of its business has been decreasing since 2nd quarter this year. We should not worry too much because the decrease in margin at this point of time is very minimal, and the cost of raw material will be stabilized eventually.

Operating Expenses

Both Selling & Marketing expenses and Administration & Other expenses have dropped in a notable amount from last quarter. As mentioned by the management, there is a reversal of a provision for doubtful debts amounted to RM1.5 million due to improved debt collections. The company could also be spending less on marketing expense in the latest quarter due to the less effective marketing result during year end festive seasons worldwide.

Finance Cost

Finance cost have dropped by nearly 50% from last quarter. In fact, Hextar’s finance cost has been gradually decreasing since 2019. This shows that the company has been doing well in reducing its debts. This is coupled with the low interest rate environment by banks during the pandemic.

Cash and bank balances

As you can see from the table above, its cash and balances has decreased from RM26 million to RM17.3 million in this quarter. This is partly due to the acquisition of Hextar Biogas BEE Sdn Bhd (BBEE) for a total cash purchase consideration of RM7.75 million which was completed on the 30 November 2020, and also settlement of some of its borrowings.

Borrowing

Hextar also managed to reduce its total borrowing to RM58.9 million from RM71.7 million. This explains why its finance cost has been reduced as well. If this keeps up, Hextar will soon turn into a net cash company.

Current Ratio

Generally anything above 1.5 is acceptable, to have it above 2 is even better. Hextar managed to improve its current ratio from 2.29 to 2.49 amid the pandemic, which is really commendable. It shows the capability of the management.

Cash Flow

Since the pivotal acquisition in 2019, the company has been generating positive operating cash flow every quarter. Besides that, the company also managed to generate healthy free cash flow which can then be used for many other purposes in advantage to the company. As at the end of this quarter, the company has managed to generate a free cash flow of RM61.3 millions, which is RM24.6 million more than the same period last year.

Technical Analysis

The share price has been increasing in a steep manner recently until today, which dropped significantly after the release of its latest quarter result. As seen in the chart above, the stock price has entered into a new trend channel after it has broke through its initial trend channel on last Friday 19/2/2021.

The upper trend line of the initial trend channel should act as a price support line. If the upper trend line is broken, the share price will most probably behave in the same manner as the red arrows shown in the chart.

The share price might be undergoing a temporary correction / profit taking by investors since it has went up quite abit recently. The price level around RM1.075 should also serves as an important support level.

Conclusion

The latest quarter result of Hextar shows that the company is still performing well during the pandemic. On average, Hextar has always been performing the worst in its last quarter among the four quarters of its financial year. This could be due to year end festive seasons and also the rainy seasons in some of its export countries.

There will always be demand for Hextar’s goods and services due to the importance of food security to the world. As one of the market leaders in the agrochemical industry, Hextar is well positioned to benefit from the growing demand for crops around the world due to growing population. With further investment in R&D, Hextar will surely perform better in future.

Through the acquisition of BBEE, Hextar will then able to expand its revenue stream to complement its core business. With the palm oil industry expanding further in Malaysia and Indonesia, BBEE system will be well accepted as it will help in reducing environmental pollution and turn gaseous wastage into green energy for multi purpopses. Hence, the acquisition of BBEE will allow Hextar to provide solutions to its existing customer base (palm oil millers) under its agrochemical business. In return, this will provide Hextar a new stream of income which bodes well with the palm oil industry in Malaysia and Indonesia.

My initial target price was its previous all time high of RM1.104, (which has been surpassed on last Friday). With the share price trading above its previous all time high, the share price will be inclined to move higher. Did I sell off all my holdings when the share price reached my previous target price? The answer is yes and no. I have actually sold some of my holdings, and continue holding the rest as long as the business is still improving.

I believe every correction in its share price is an opportunity, as I believe there is still plenty of room for Hextar to improve in regards to its business. You can refer to my full analysis on Hextar to have a better idea on the company.

Invest at your own risk. Always do your own study and research before investing with your hard earn money.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

DISCLAIMER

This post is completely for education and discussion purpose only. The author of this post does not have the required licenses to provide any investment advice or induce any trade for the readers here. Therefore, it should not to be taken as investment advice or inducement to trade and the Author take no responsibility for any gains or losses as a result of reading the contents herein. Please invest at your own risk.

https://klse.i3investor.com/blogs/buycall/2021-02-22-story-h1541204452-HEXTAR_5151_Latest_Quarter_Result_4QFY20_Update.jsp