[10 Key reasons on why you should relook at MSC]

1. Even without the participation of institutional investors, MSC has

surged 230% with minimal selling pressure. When big insti funds starting

to notice MSC, potential gains might further be unleashed.

2. Straits Trading, the parent company of MSC (with 54% shareholdings in MSC) has gained more than 80% in less than 3 months.

3. MSC is also dual listed in Singapore. Current share price surged to 71sen. Arbitrage can be applied here.

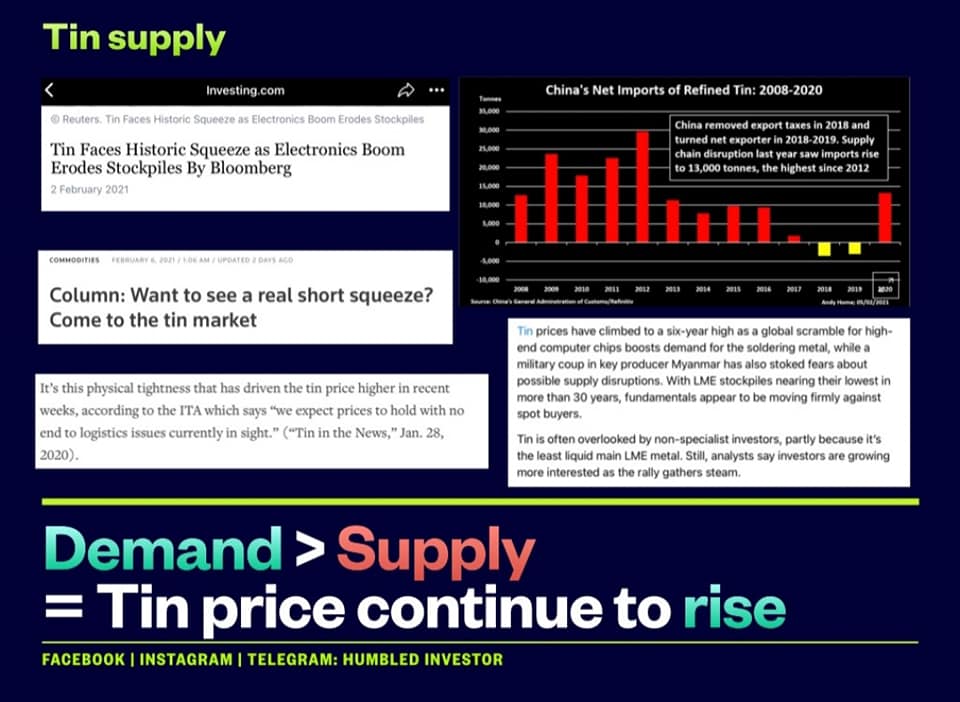

4. Production curb and output cuts by Top 1 and Top 2 refined tin

producers in the world (PT Timah and Yunnan Tin) back in 2019 and first

half of 2020 has successfully balanced out the oversupply situation in

2020. Smelters in Yunnan Tin have also taken maintenance downtime to

compensate for the shortfall of raw material.

5. Recently in 2021, Myanmar military coup + LME market dwindling tin

inventories might have just squeezed the tin supply even further and

resulted in tin shortage/deficit. Hence, tin prices could possibly stand

above 20k as supply is struggling to meet resurgent demand.

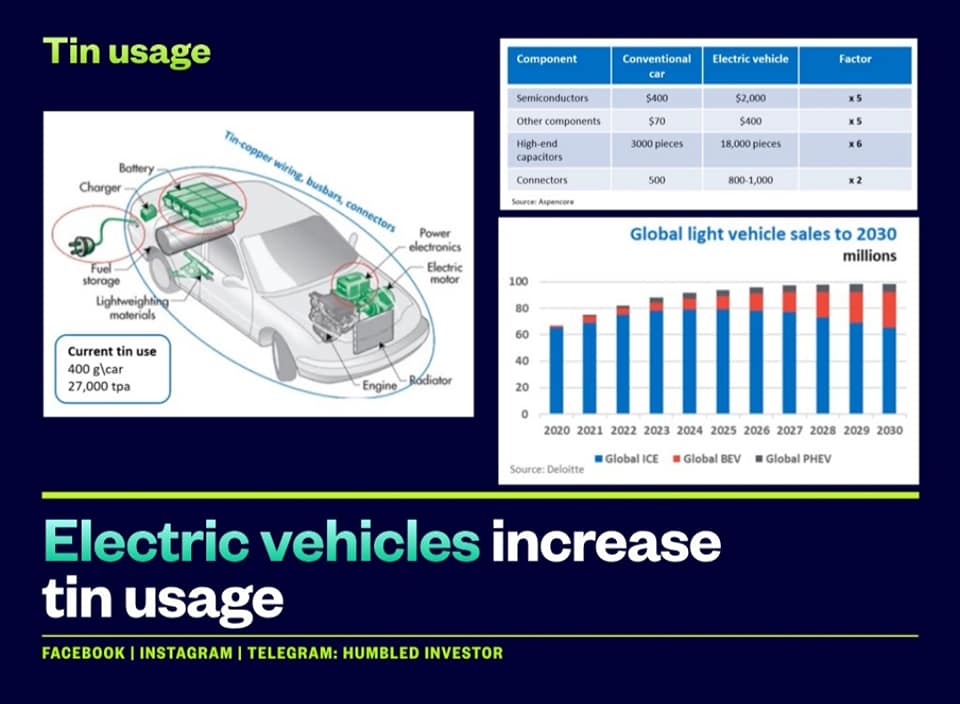

6. Global tin demand is recovering, due to the rising electronic sales

as more people stay at home due to the pandemic. With the rollout of 5G

networks and EV which require atleadt 25% more chips and hence demand

for tin soldering (which is the biggest use of tin) in order to connect

components.

7. China's internal supply dynamics seem to be struggling to keep up

with current demand, let alone finding sufficient mine resource to meet

future soldering demand.

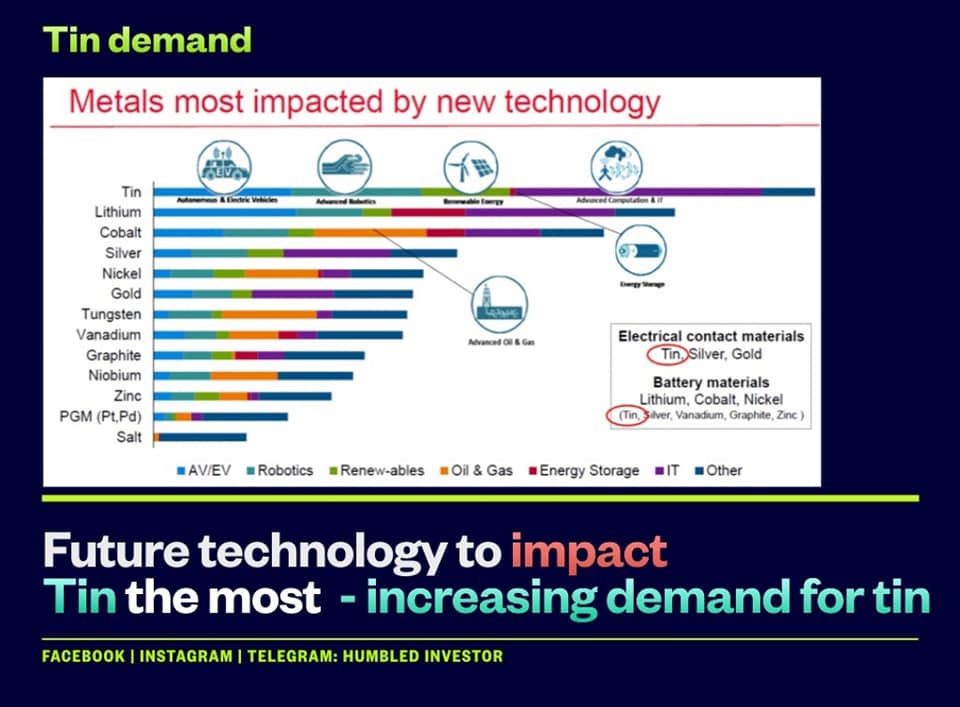

8. Tin remains as the metals most impacted by new technology with its

wide application and storage capability in terms of battery storage. Tin

improves conductivity and tin foils could be used instead of copper

anode in replacing lithium-ion batteries.

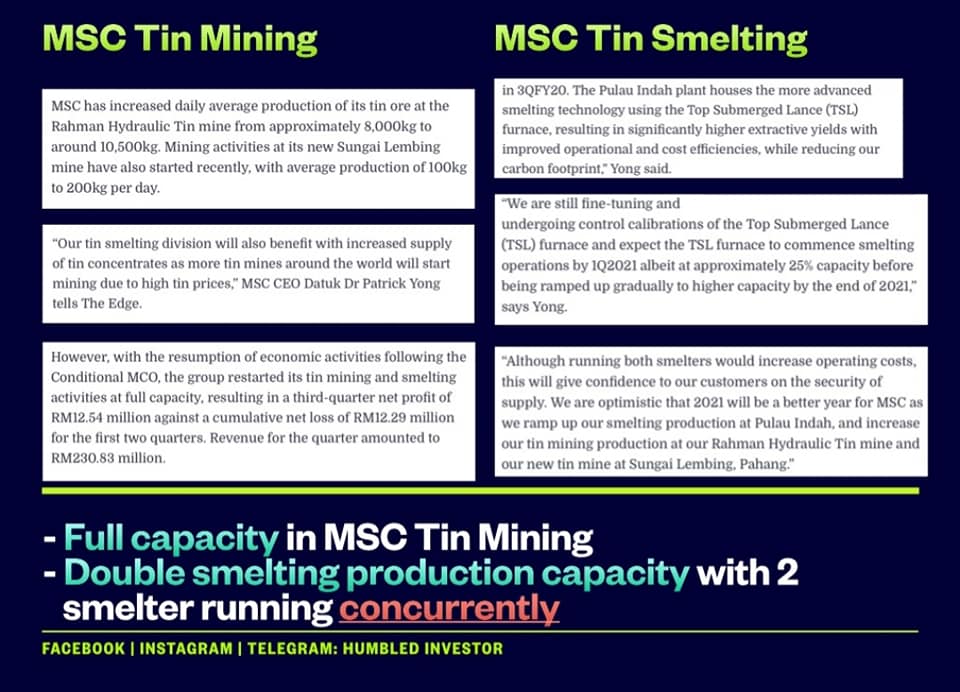

9. MSC Tin Mining segment is expected to contributed positively which

is attributed by its new mine at Sungai Lembing and increased daily

average production at existing mines. Both are currently operating at

full capacity.

10. Both Butterworth and Pulau Indah smelters of MSC are in operations

(albeit at 25% capacity for new smelter but refurbished with better

efficiency) which will increase refined tin output to meet current high

demand.

If you want to learn more, feel free to join us at:

_________________________________________________________________

All information provided here should be treated for informational

purposes only. It is solely reflecting author's personal views and the

author should not be held liable for any actions taken in reliance on

information contained herein.

No buy call. No sell call. No bullshit. Only content.

If you think the article / information is useful to you, you can

<SHARE> this article and support us by <LIKE> and

<FOLLOW> our Facebook page "Humbled Investor". Thank you so much

for supporting.

https://klse.i3investor.com/blogs/HumbledInvestor/2021-02-07-story-h1540990270-_Humbled_Investor_Malaysia_Smelting_Corporation_MSC.jsp