Koon Yew Yin 25 Feb 2021

Technical analysis take preference over Financial analysis.

Since the Covid 19 pandemic began about 1 year ago, the demand for gloves far exceeds supply. As a result, all the glove makers can eaily increase their selling prices to make more and more profit which should be reflected on their share prices. Initially all their share prices went up since the Covid 19 began. Unfortunately, for no good reason, their share prices have been dropping in the last 4 months. It defies investment logic. This phenomena is so ridiculous.

Supermax’s 1st quarter ending September EPS was 30.58 sen. Its 2ndquarter ending Dec was 41.14 sen, totalling 71.72 sen for 1st half year. Even if the company cannot increase its selling price, its 3rd quarter EPS will be 41.14 sen and 4th quarter EPS will be 41.14 sen. Its annual EPS will be Rm 1.54. Based on PE 10, Supermax should be selling Rm 15.40 per share. Among all the glove stocks, Supermax has the best profit growth rate.

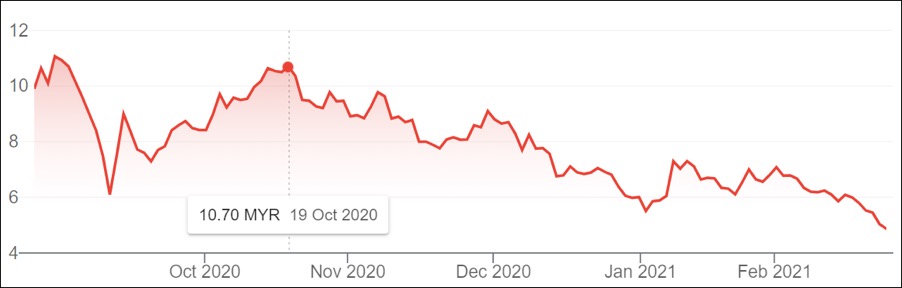

The above price chart for Supermax shows that it dropped from Rm 10.70 on 19 Oct to close at Rm 5.04, a drop more than 50% in the last 4 months despite its excellent profit growth rate.

Investors must remember that price chart takes preference over fundamantal analysis. You must sell as soon as the price chart is showing a down trend. Never buy a down trending stock even if its fundamental quality is excellent.

I learned a very expensive lesson. On hindsight, if I started to sell as soon as the price start to drop, I would have made a lot of money.

Beside Supermax all the share prices of the other glove stocks are also dropping.

http://koonyewyin.com/2021/02/26/ta-is-more-important-than-fa/