Hi to all fellow investors and traders !

Today I would like to share my thoughts the following counter:

PNE PCB BERHAD or PNEPCB (Code 6637, MAIN Market, Industrial Products & Services)

Some basic info on this company:

i. Number of shares float : 431.19 million

ii. Market Cap : RM 94.86 million

iii. Last closing price : 22 cents

iv. Website : https://pnepcb.com/

PNEPCB - THIS STOCK WILL BENEFIT FROM PICKUP DEMAND IN ELECTRONICS !!!

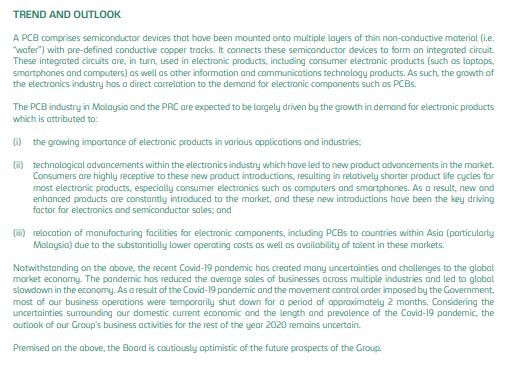

1. Positive Growth Outlook in PCB Sector

PNEPCB is a company which supplies Printed Circuit Boards. As the pandemic is getting near to its end, consumers buying power is starting to improve again.

Thefore, demand for elections products, which use PCB as a main component is starting to pickup.

The PCB industry in Malaysia and China (the biggest client of PNEPCB), is expected to be robust and attributed to :

i) growing importance of electronic products in various applications and industries

ii) technological enhancements in the electronics industry

iii) relocation of manufacturing facilities to within Asia to cut expenditure cost

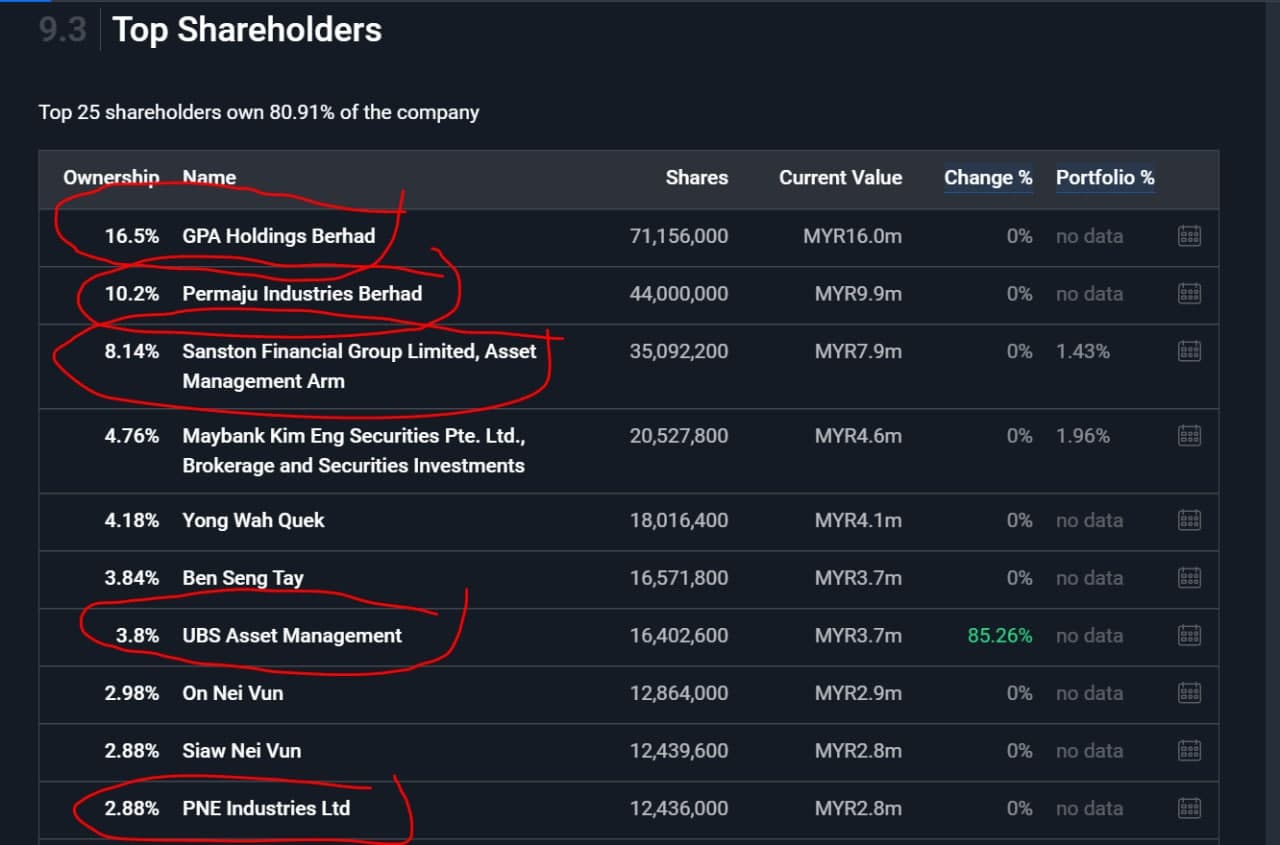

2. Strategic Shareholders - GPA & PERMAJU To Bring In Value to PNEPECB Business

Refer below the latest shareholdings for PNEPCB. We notice 2 public listed companies which recently bought into PNE PCB :

i) GPA - 71.156 mil shares (16.5%)

ii) PERMAJU - 44 mil shares (10.2%)

GPA (core business - battery suppplier) and PERMAJU (core business - property) are 2 companies with different expertise. Therefore, being a shareholder in PNEPCB, means that these companies would also need to add value thru cross referencing of people and expertise, and this would support in the long term growth of PNEPCB.

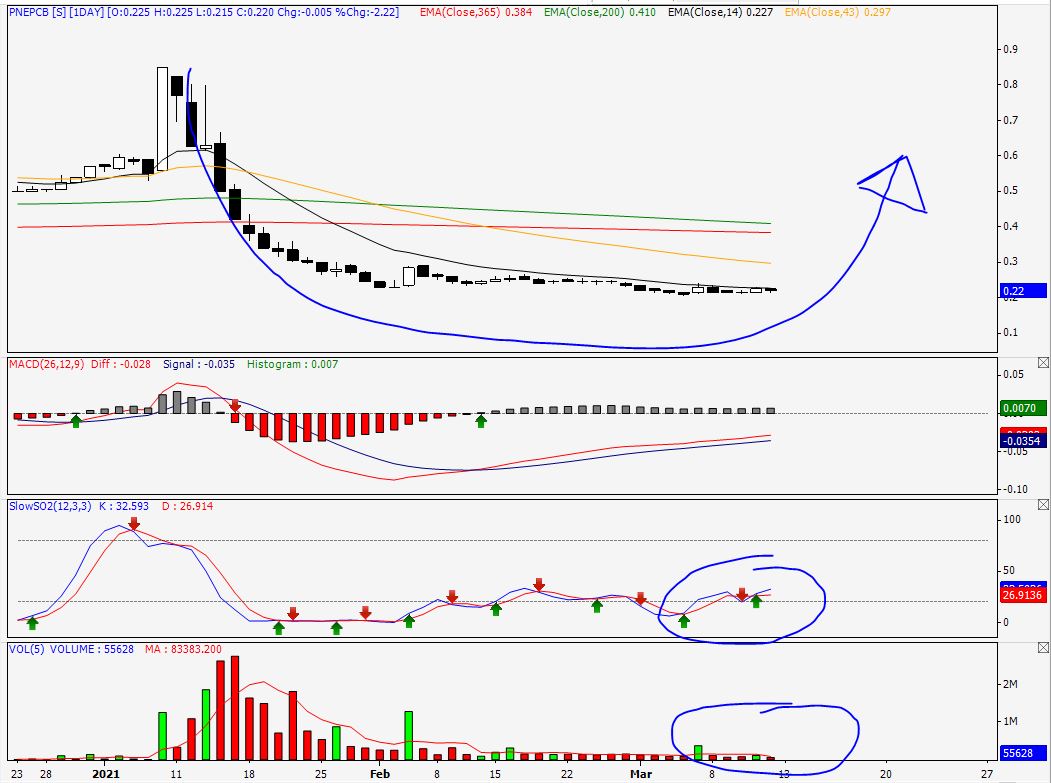

3. Technical Analysis - Forming A Rounding Bottom Pattern - Entry Near Bottom Support

Let's take a look at the daily chart of PNEPCB :

A few observations:

i. Overall the price is forming a rounding bottom pattern, where the bottom had been tested and buyers have supported the price strongly at 20-21c area

ii. Stochastics showing that the price is stil near the oversold region, hence a good entry for long term investors

iii. At the support, volume is seen small (not many weak sellers inside). and during an up day, volume is seen big (investors interested in picking up this stock). This might be a sign that the 20-21c price range is already a true bottom

iv. Should the price trend change, there is a lot more potential upside for this stock towards its strong resistance of 50c

CONCLUSION

Based on my opinion, PNEPCB should be given attention in coming weeks, based on below:

i. PCB sector growth outlook positive due to pickup in demand for electronic products

Thanks for reading and see you in the next post.

THE ABOVE IS NOT A BUY OR SELL CALL AND IS ONLY A PERSONAL OPINION ARTICLE AS A SHARING TO BSKL COMMUNITY MEMBERS.

Yours Truly,

INVESTHOR

https://klse.i3investor.com/blogs/InvesthorsHammer/2021-03-13-story-h1542156956-THIS_STOCK_WILL_BENEFIT_FROM_PICKUP_DEMAND_IN_ELECTRONICS.jsp