STEEL very underrated and possibly to FLY!

Dear Readers, welcome back to “The Huat Project”. In this article we would like to emphasize that STEEL Sectors are still very UNDERATED, and that its share prices are also very much UNDERVALUED.

Flat steel products are commonly known as steel sheet/coil and steel plate. These are categorised in various types including hot rolled coil (HRC), cold rolled coil (CRC), metallic coated steel, organic coated steel, coil plate and reversing mill plate. Flat steel products consist of sheets and plates. They are rolled from slabs, which are a semifinished steel product. These products are used in a wide range of industries such as automobile (ELECTRIC VEHICLE) , domestic appliances, shipbuilding, and construction. https://commodityinside.com/flat-steel-market/

For The Steel Sector, we would like to highlight this 3 High Possible Steel Stock, as these 3 Steel Companies focuse alot in Flat Steel Products - Hot Rolled Coil (HRC), Cold Rolled Coil (CRC).

1. YKGI (7020)

2. LIONIND (4235)

3. HIAPTEK (5072)

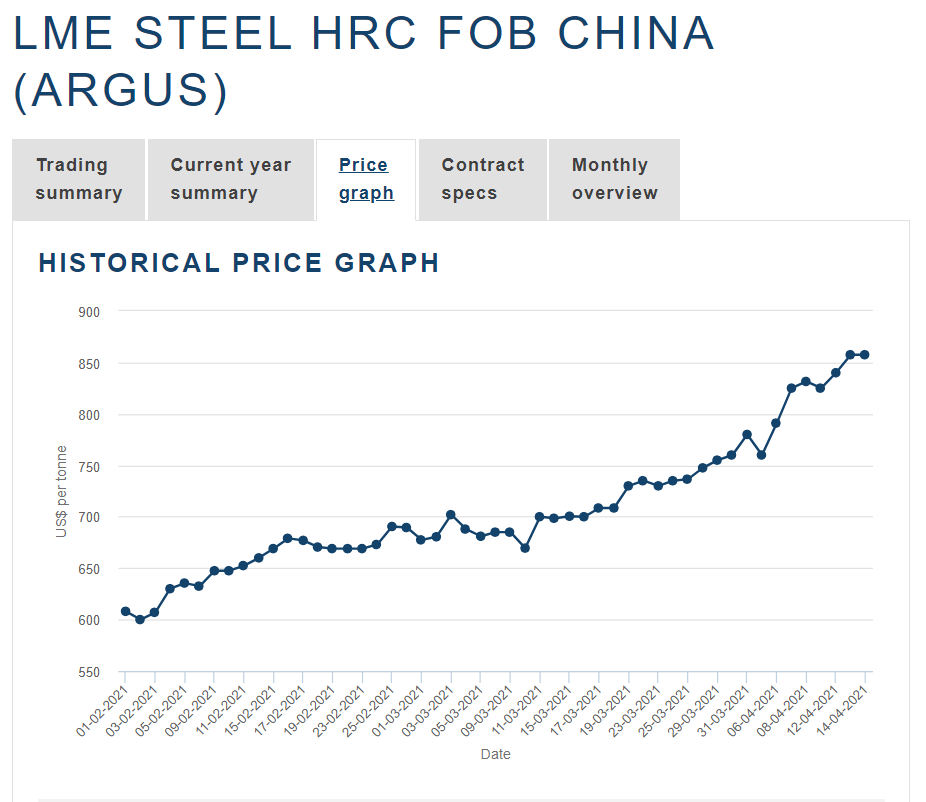

Flat Steel Prices Reference from London Metal Exchange (LME)

From the chart above, it is that the Flat Steel Prices are definitely on the uptrend and on the rise. It is all time high right now at $850/tonne ! !

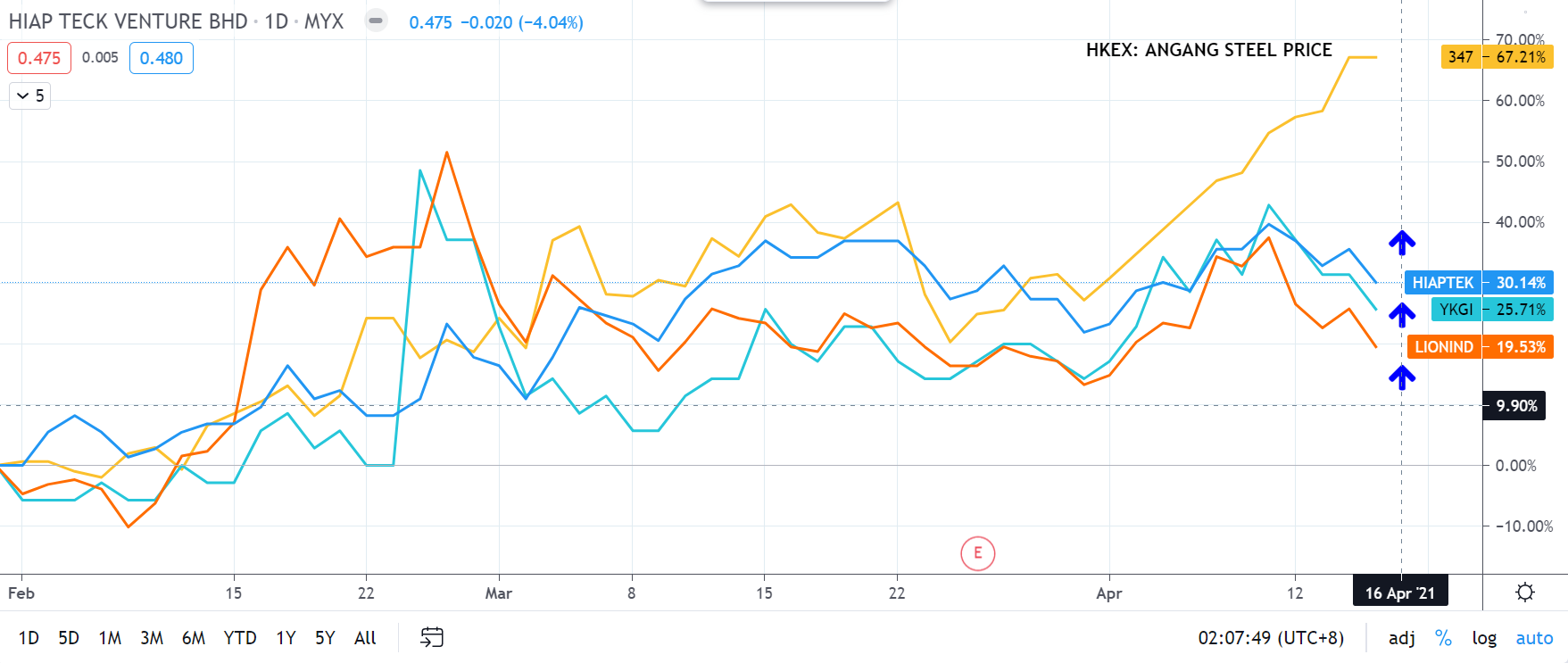

Peers Comparison Analysis

Lets compare the prices of the Leader in Hong Kong Steel, vs our 3 very prospective steel counters.

From the chart above, from February2021 to date, Angang Steel is up 67% while most of our steel counters are lagging and only up 19%-30%. Part of the reason is because of Foreign Fund has yet to notice the undervalue steel counters in Malaysia. We believe that the Steel Cartels in Malaysia are waiting for the right opportunity to whack the share prices up, especially after the BULLISH NEWS https://www.theedgemarkets.com/article/govt-review-antidumping-duties-cold-rolled-coil-imports-china-south-korea-vietnam

Through this, the Malaysia Steel Players <YKGI (7020) , LIONIND (4235), HIAPTEK(5072)> will be well protected and the company can continue to make money.

Technical Analysis

1. YKGI (7020)

On 24 February 2021, YKGI’s share price rallied bullishly. YKGI is on a uptrend. With RM0.215 as the support, there is a potential upside to retest its previous high of RM0.330, and its Reward:Risk ratio is 16 times.

2. LIONIND (4235)

LIONIND is has been on an uptrend and is currently “washing” weak holders as it is traded in the side ways. With RM0.740 as its support, a breakout from its immediate resistance of RM0.880, could possibly retest its Resistance of RM0.970. The Reward:Risk ratio is 7 times.

LIONIND is has been on an uptrend and is currently “washing” weak holders as it is traded in the side ways. With RM0.740 as its support, a breakout from its immediate resistance of RM0.880, could possibly retest its Resistance of RM0.970. The Reward:Risk ratio is 7 times.

3. HIAPTEK (5072)

HIAPTEK is on an uptrend. A breakout from its Cup & Handle resistance of RM0.535 would possibly bring the share price to retest the resistance of RM0.60. With RM0.465 as its support, it has a possible Reward:Risk Ratio of 12 times.

HIAPTEK is on an uptrend. A breakout from its Cup & Handle resistance of RM0.535 would possibly bring the share price to retest the resistance of RM0.60. With RM0.465 as its support, it has a possible Reward:Risk Ratio of 12 times.

Conclusion:

We believe that the STEEL SECTOR has alot of room to grow, especially for <YKGI (7020) , LIONIND (4235), HIAPTEK(5072)>. While the fundamental of increasing Flat Steel Prices are beneficial to <YKGI (7020) , LIONIND (4235), HIAPTEK(5072)> its Technical Analysis are promising as well as the Reward:Risk Ratio of YKGI (7020) is 16 times, LIONIND (4235) 7 times, HIAPTEK (7020) 12 times.

Also with the anti-dumping news, we strongly believe that the share price of these companies would soon take off !

What will you do?

DISCLAIMER: This post serves as an educational analysis and is never meant to be a buy/sell call or recommendation. Investors must always do their own due diligence before making any investment decisions. The author of this post is not liable in any way for any decisions made by any individual.

https://klse.i3investor.com/blogs/THP/2021-04-16-story-h1563360277-STEEL_very_underrated_and_possibly_to_FLY.jsp