The share prices of US listed gaming companies have diverged: -

Chart: Comparison of US listed casinos (MGM, CZR, BYD, LVS, WYNN)

*Note: all chart comparison are against 2 January 2020 share price(s)

This divergence can be explained as a result of the difference in the Geographic Segments in which they operate

The share price of US-listed gaming companies whose revenues are majority (or almost exclusively) derived from the United States ("Las Vegas" and "Regional") are at record highs and far outpaces those that are focused in Macau ("China") or International regions

US-based:

- MGM Resorts International (NYSE:MGM)

- Caesars Entertainmend (NASDAQ:CZR)

- Boyd Gaming (NYSE:BYD)

Macau-based:

- Las Vegas Sands (NTSE:LVS)

- Wynn Resorts (NASDAQ:WYNN)

As can be seen from the chart, those companines that are purely US-based (BOYD) have seen the greatest outperformance in terms of sharer price, while those that derive the most revenue/profits from Macau/outside the US has performed the worse, with those that are in between/mix between US and non-US are in the middle (e.g. MGM)

MORE IMPORTANTLY, THE SHARE PRICE OF US-BASED GAMING COMPANIES ARE AT RECORD HIGHS:

As stated in an earlier article, the Las Vegas Strip is seeing a revival with the possibility of it even exceeding pre-Covid numbers.

If you didn't already know this bodes well for Genting Berhad's 100%-owned US $4.3 billion Resorts World Las Vegas (RWLV) which is set to open on 24 June 2021! (3 days to go!)

Compared to these US-based gaming companies, the share price Genting (3182) has thus far not accounted for Resorts World Las Vegas' impact (gaming co's are valued on an EBITDA basis and RWLV is expected to have an EBITDA of US$82 million in 2022 here) and is in fact still far below pre-covid levels of c. RM6 (approx 15% lower)

Chart: Comparison of Genting vs US based casinos (MGM, CZR and BYD)

*Note: all chart comparison are against 2 January 2020 share price(s)

For these reasons, Genting (3182) represents not only a direct entry to the Las Vegas revival via RWLV, but also an undervalued exposure to the Gaming sector in general

TLDR GENTING (3182) TO THE SKIES AND BEYOND ![]()

Disclaimer: The information and opinions expressed here are for educational purposes only and the contents of this report should not be considered financial advice and does not constitute a buy or sell call. Consult your investment advisor before making any investment decision.

Appendix

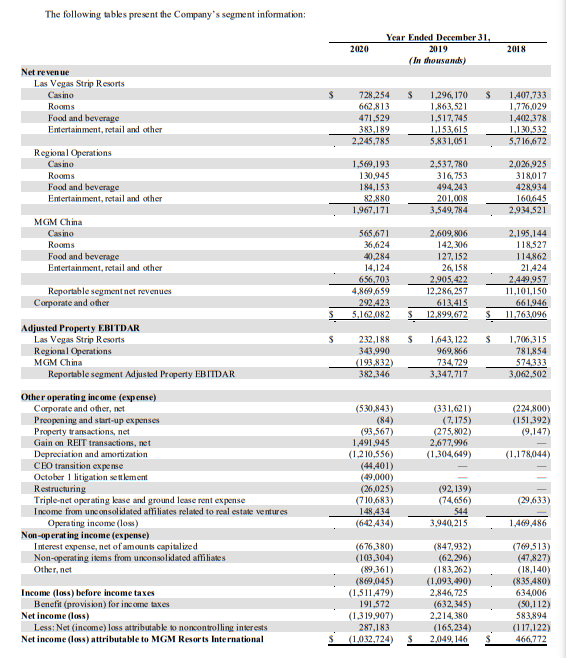

Geographic exposure: -

1) MGM Resorts International

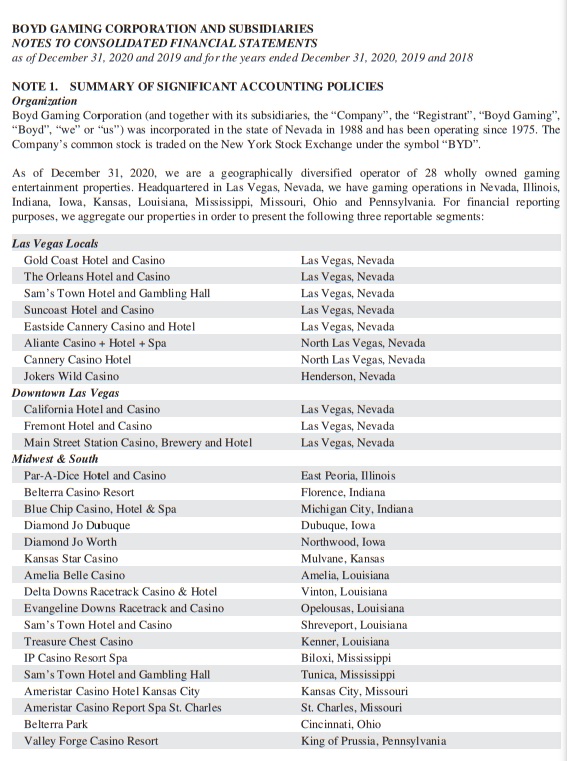

2) Boyd Gaming (purely US)

https://klse.i3investor.com/blogs/emsvsi/2021-06-22-story-h1566967034-BREAKING_The_share_price_of_US_based_gaming_companies_are_at_record_hig.jsp