FREIGHT (7210) FREIGHT MANAGEMENT HOLDINGS BHD - How far would it goes?

After sharing our insights on PMBTECH & CEKD, today we want to share you another GEM in Logistics Industry.

FREIGHT MANAGEMENT HOLDINGS BERHAD (7210)

So what FREIGHT does in it's business?

https://www.fmgloballogistics.com/about-us/

As one of the top freight services provider in the region, FM Global Logistics is a leader in enabling manufacturers and brands to significantly enhance their logistics operations.

They are providing the logistic solutions in the quickest and most cost-efficient manner possible.

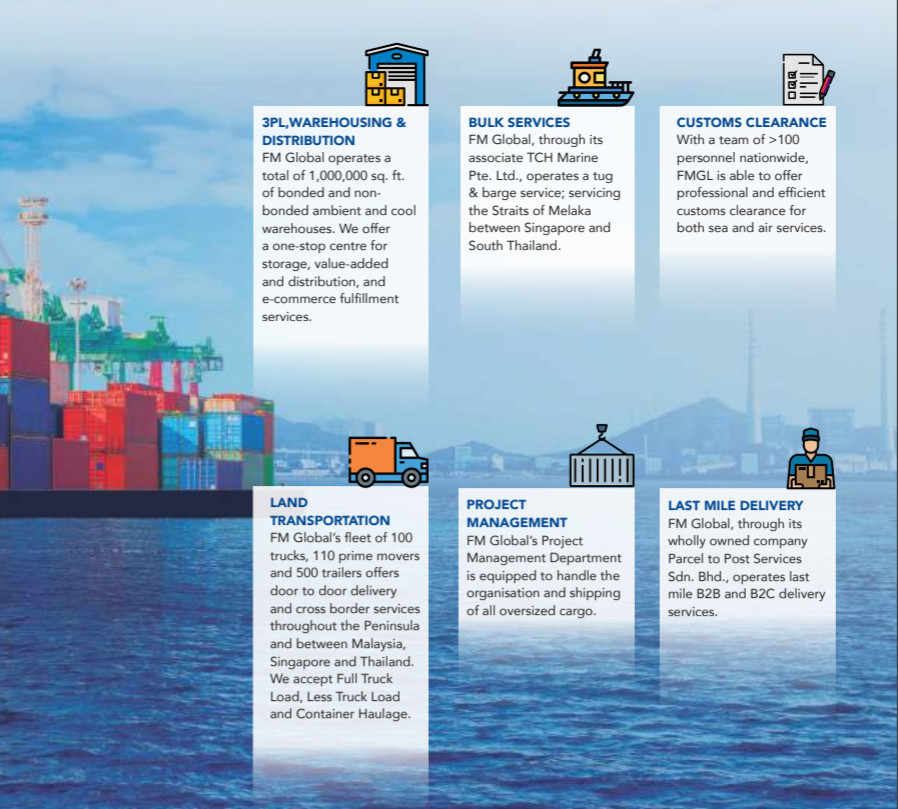

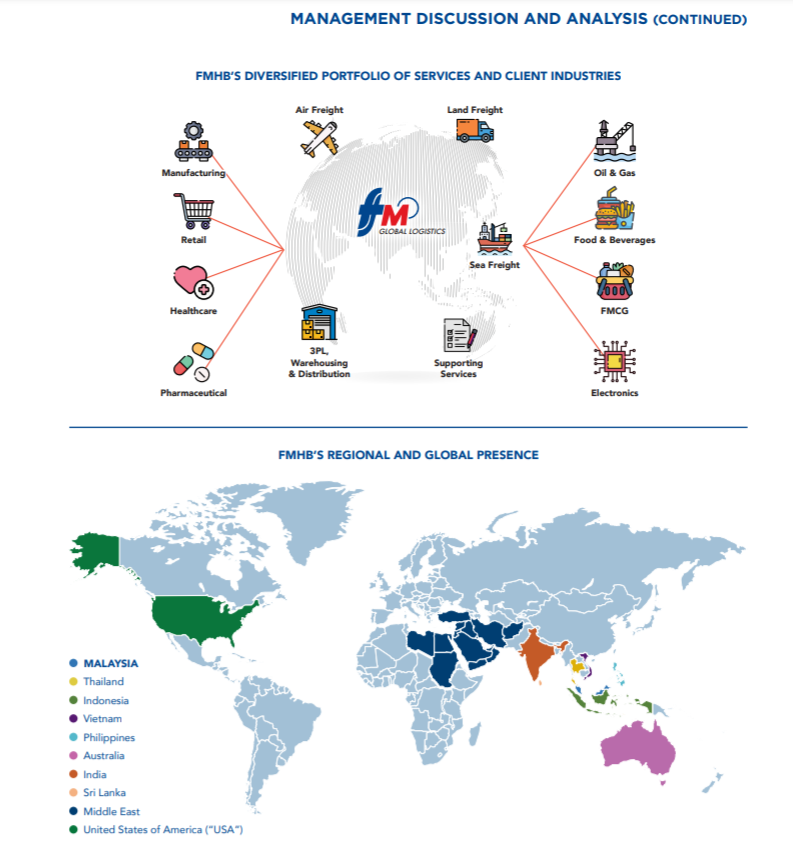

FM GLOBAL LOGISTICS is one of the leading logistic solution providers in the Asia Pacific region. They are able to offer innovative supply chain solutions that include sea, land, air, tug & barge, and warehousing services.

From the above clarification, we can know FREIGHT is a LEADER in this freight services provider industry.

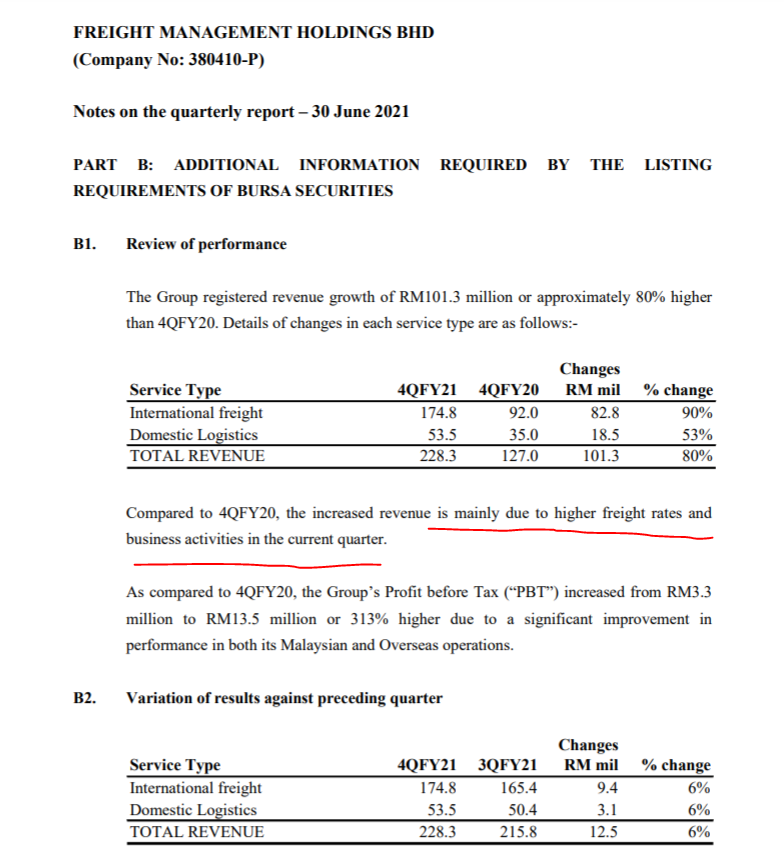

From the Latest QR, in Review of Performance, The increased revenue is mainly due to HIGHER FREIGHT RATES and business activities.

The Profit Before Tax (PBT) increased from RM 3.3 million to RM 13.5 million or 313% higher due to Improvement in both Malaysia and Overseas Operations.

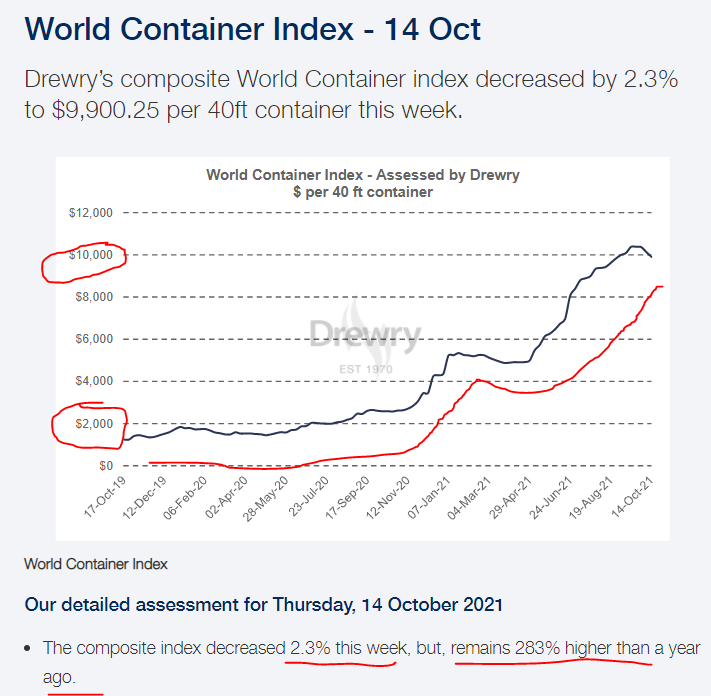

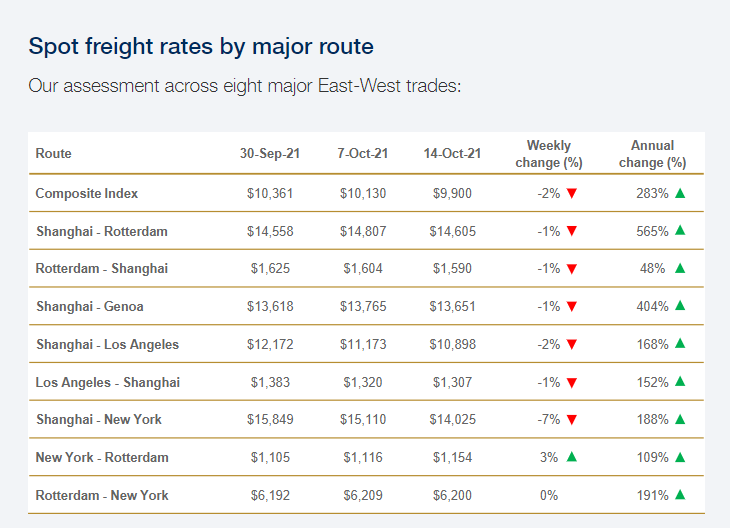

Here is the super bullish trend of FREIGHT RATES:

You also can check the SCHEDULES here on a MONTHLY BASIS. You can know how busy they are.

https://www.fmgloballogistics.com/schedules/

By end of OCTOBER, they will complete the Expansion into US MARKET.

Freight Management Holdings Bhd is buying three US-based freight forwarding services companies for a combined US$2.2 million (approximately RM9.2 million), as part of the group's expansion initiatives into selective international markets.

The acquisition is expected to be completed within 30 days from 4 OCTOBER 2021.

"With the acquisition, the group would be able to immediately leverage the existing customer base and resources of IOS Companies, which have an established freight forwarding business and valid customs brokerage licence in the US. The IOS Companies will also serve as a gateway to the vast US market via its base in Los Angeles. As the group develops its presence in the US, the group will also explore other logistics-related opportunities such as e-commerce fulfilment services," Freight Management added.

Ref: https://www.theedgemarkets.com/article/freight-management-expands-us-market-acquisitions-three-usbased-firms?type=malaysia

TARGET PRICE RM 1.27 by CGS-CIMB Research

KUALA LUMPUR (Aug 20): CGS-CIMB Research has maintained its “Add” rating Freight Management Holdings Bhd (FMH) at 73.5 sen with a higher target price (TP) of RM1.27 (from RM1.20) and said FMH’s FY6/21 core net profit of RM32 million (+90.6% y-o-y) beat expectations,thanks to higher-than-expected freight volumes in 4QFY6/21.

In a note Aug 19, the research house said that going forward, FMH should post stronger earnings, driven by a recovery in global trade, expansion of service offerings and better cost efficiencies.

“We lift FY22-23F EPS to reflect higher demand for freight services and higher economies of scale, and introduce FY24F EPS.

“Reiterate Add, with a higher TP of RM1.27 (20x CY22F P/E),” it said.

Ref:https://www.theedgemarkets.com/article/cgscimb-raises-target-price-freight-management-rm127

The above Target Price is NOT YET including with the Revenue & Profit that will be accounted in the Q2 FY2022 due to the acquisition of US 3 companies (Inter-Orient Services, Inter-Orient Corp and Noble Shipping Corp (IOS Companies))

Ref: https://klse.i3investor.com/blogs/sinchew_company_story/2021-10-11-story-h1591997273.jsp

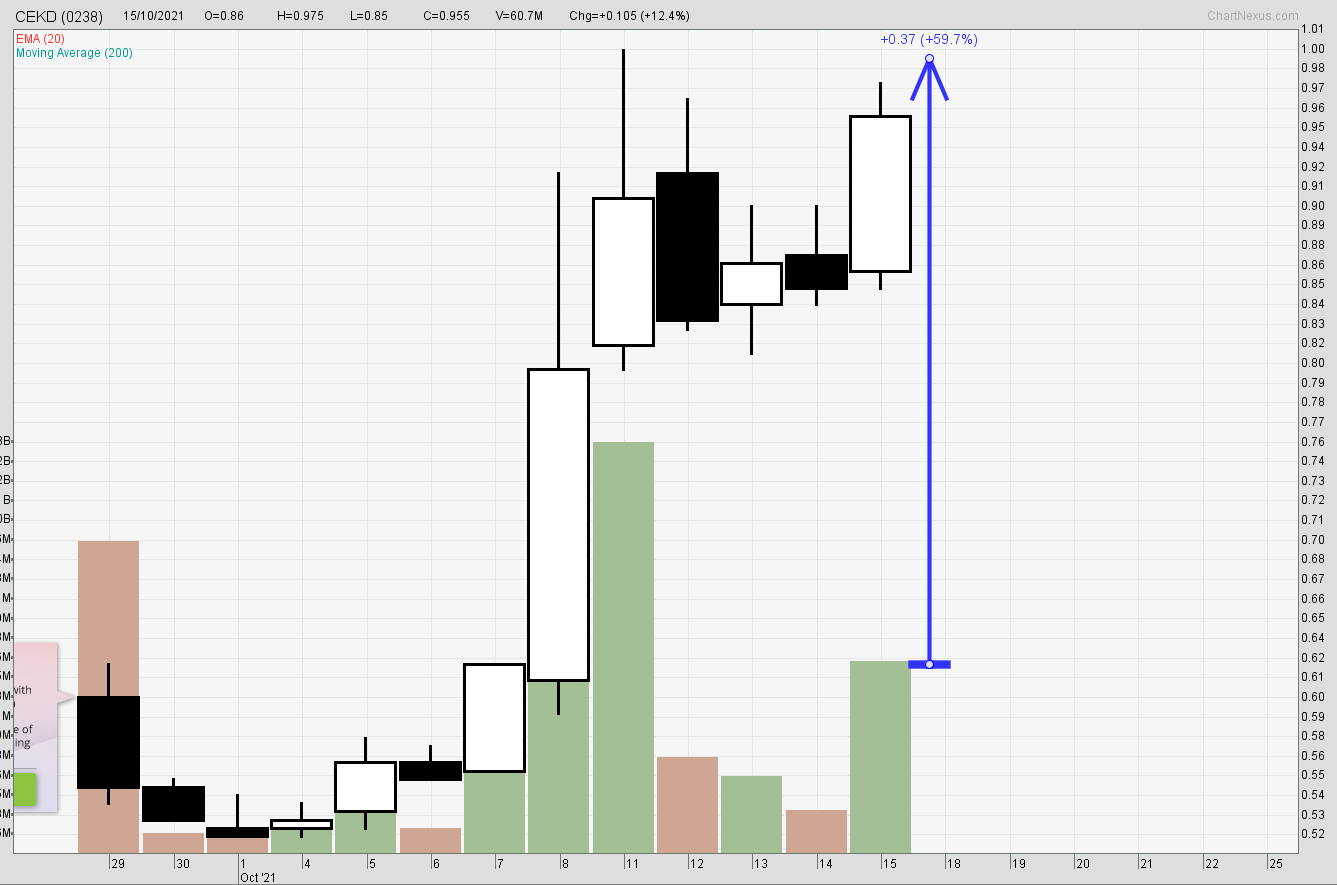

Here is our Technical Chart Overview:

On 8 OCTOBER 2021, the share price break RM 0.88 with the most HIGHEST VOLUME in the history. The share price under retracement with small volume now.

We can see the latest Resistance Level at RM 1.15 and Support Level at RM 0.925 ~ RM 0.965.

The Technical Chart showing a retracement shall done soon in the near term.

(Near 40% gain based on the support zone in order to reach the Target Price)

Apart from Glove Investors are losing lot of money, there are a lot of investors lose money in KPOWER, SCIB & SERBADK.

Hopefully our stock insights will allow you to earn back your losses from Glove Counters and above counters.

Simple and Easy Quote for Investors:

"Never go against the Market and Never Buy Downtrend Stocks."

To be reminded,

1st Post: PMBTECH rose about 36% after we share our insight here.

2nd Post: CEKD rose about 56% after we share our insight here.

Disclaimer: You should only refer your Dealer/Remisier for any Buy/Sell

suggestions. It is neither a trading advice nor an invitation to trade.

Any action that you take as a result of information, analysis or

commentary on the contents is ultimately your responsibility.

https://klse.i3investor.com/blogs/EagleEyed/2021-10-15-story-h1592712258-FREIGHT_How_far_would_it_goes.jsp